How To Invest In Reliance Share Market

Reliance Industries, a behemoth in the Indian market, offers diverse investment avenues. Understanding the intricacies is crucial for potential investors aiming to capitalize on its growth.

This guide offers a focused breakdown of how to invest in Reliance shares, outlining essential steps and considerations for informed decision-making.

Understanding Reliance Industries & Share Basics

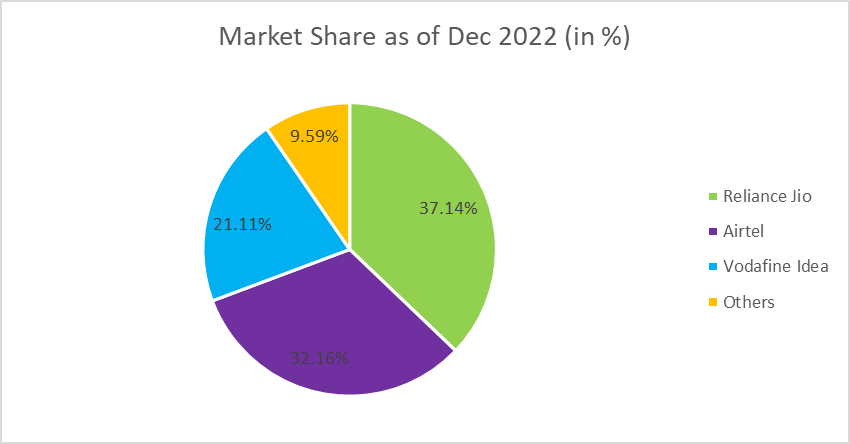

Reliance Industries Limited (RIL), traded on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), is a key player in sectors like petrochemicals, refining, telecom (Jio), and retail.

Its shares represent ownership in the company. Buying these shares means you become a part-owner and are entitled to a portion of the company’s profits (dividends) and growth.

Who Can Invest?

Any individual or institution with a Demat and trading account can invest in Reliance shares. This includes Indian residents, NRIs (Non-Resident Indians), and foreign institutional investors (FIIs).

Opening a Demat account is a mandatory first step.

When to Invest?

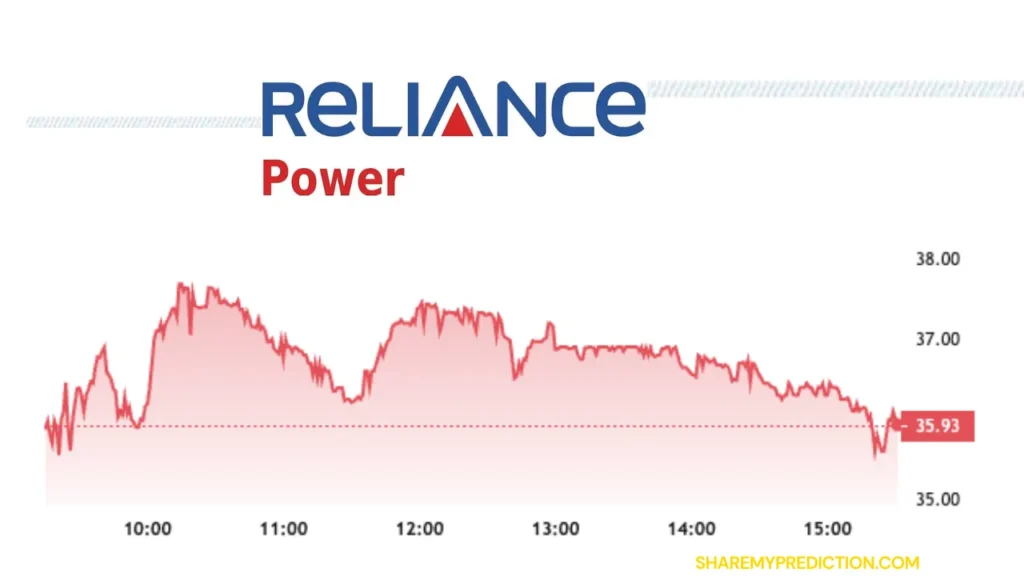

Market timing is critical, but fundamentally difficult to predict precisely. Monitor Reliance's financial performance (quarterly results, annual reports), industry trends, and overall market sentiment before investing.

Consider a long-term investment horizon for potentially better returns.

Steps to Invest in Reliance Shares

The primary method is through a Demat and trading account.

These accounts can be opened with a brokerage firm, either online or offline. Several reputed brokers such as Zerodha, Upstox, ICICI Direct, and HDFC Securities offer these services.

1. Open a Demat & Trading Account

Choose a reputable broker and complete the KYC (Know Your Customer) process. This usually involves submitting identity and address proof documents online or in person.

Verify all the filled in details.

2. Fund Your Account

Once the account is active, transfer funds from your bank account to your trading account. Most brokers offer various online payment options like UPI, net banking, and IMPS.

Be aware of the transaction fees.

3. Place Your Order

Log in to your trading platform and search for Reliance Industries using its stock symbol (RELIANCE). Specify the number of shares you want to buy and the price you are willing to pay.

You can place either a market order (executed immediately at the current market price) or a limit order (executed only when the stock reaches your specified price).

4. Monitor Your Investment

Regularly track the performance of your Reliance shares. Stay informed about company news, industry developments, and market trends that may affect the stock price.

Re-evaluate your investment strategy periodically.

Alternative Investment Options

Besides direct equity investment, consider investing in Reliance through Mutual Funds. Many equity mutual funds hold Reliance shares as part of their portfolio.

This provides diversification and professional management.

Key Considerations & Risks

Investing in the stock market carries inherent risks. The value of your investment can fluctuate based on market conditions and company performance.

Thorough research is paramount before investing.

Diversification is key to mitigate risk. Don't put all your eggs in one basket.

Consider consulting a financial advisor for personalized investment advice. They can assess your risk tolerance and investment goals to recommend a suitable strategy.

Stay Informed & Adapt

Continuously monitor Reliance's performance, market dynamics, and regulatory changes. This helps you make informed decisions and adjust your investment strategy as needed.

Review your portfolio regularly. Keep abreast of all the news.

![How To Invest In Reliance Share Market RELIANCE SHARE PRICE - Analysis, Target & Forecast [2022]](https://subhmantra.com/wp-content/uploads/2021/01/20210314_005204_0000.png)