How To Know When To Close A Business

Businesses nationwide are facing unprecedented pressures. Deciding when to close shop is the hardest decision an entrepreneur will make, but delaying it can lead to devastating financial consequences.

This article provides critical indicators and expert advice to help business owners assess their situation and make informed decisions about the future of their ventures, focusing on recognizing the signs that point towards closure.

Key Indicators Signaling Potential Closure

Sustained Losses: Consistent net losses over several quarters, despite efforts to cut costs and increase revenue, are a major red flag. This persistent negative trend indicates a fundamental flaw in the business model or market viability.

Cash Flow Crisis: Inability to meet short-term obligations, such as payroll, rent, and supplier payments, signifies a cash flow problem. According to a 2023 study by the Small Business Administration (SBA), cash flow issues contribute to over 82% of business failures.

Debt Accumulation: Mounting debt that cannot be serviced by current revenue streams is unsustainable. High debt-to-equity ratios can indicate severe financial distress.

Declining Market Share: A consistent decrease in market share, coupled with increasing competition, suggests a loss of competitive advantage. Adaptability is key; failure to innovate can accelerate decline.

Legal Issues: Major lawsuits, regulatory violations, or other legal battles can severely impact a business's finances and reputation. Such issues can often be difficult or impossible to recover from.

Seeking Expert Advice

Contact your accountant and financial advisor immediately. Their insights into your financial statements and market conditions are crucial for making informed decisions. Request a frank assessment of your business's viability.

Consider consulting a business turnaround specialist. These experts can identify opportunities for restructuring, cost reduction, or strategic pivots that might save the business. However, their services come at a cost, so weigh the investment carefully.

Assessing Personal Impact

Closing a business impacts more than just the bottom line. It's essential to consider the emotional and personal toll it will take.

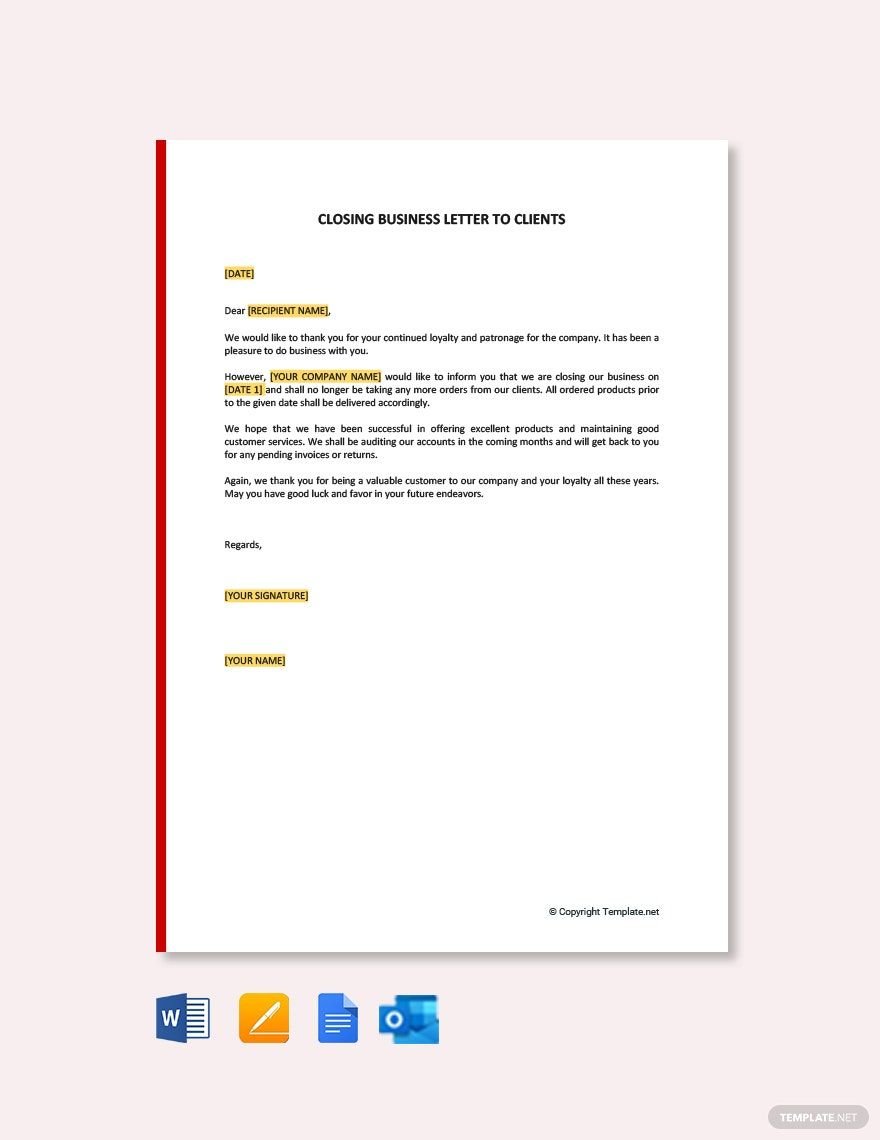

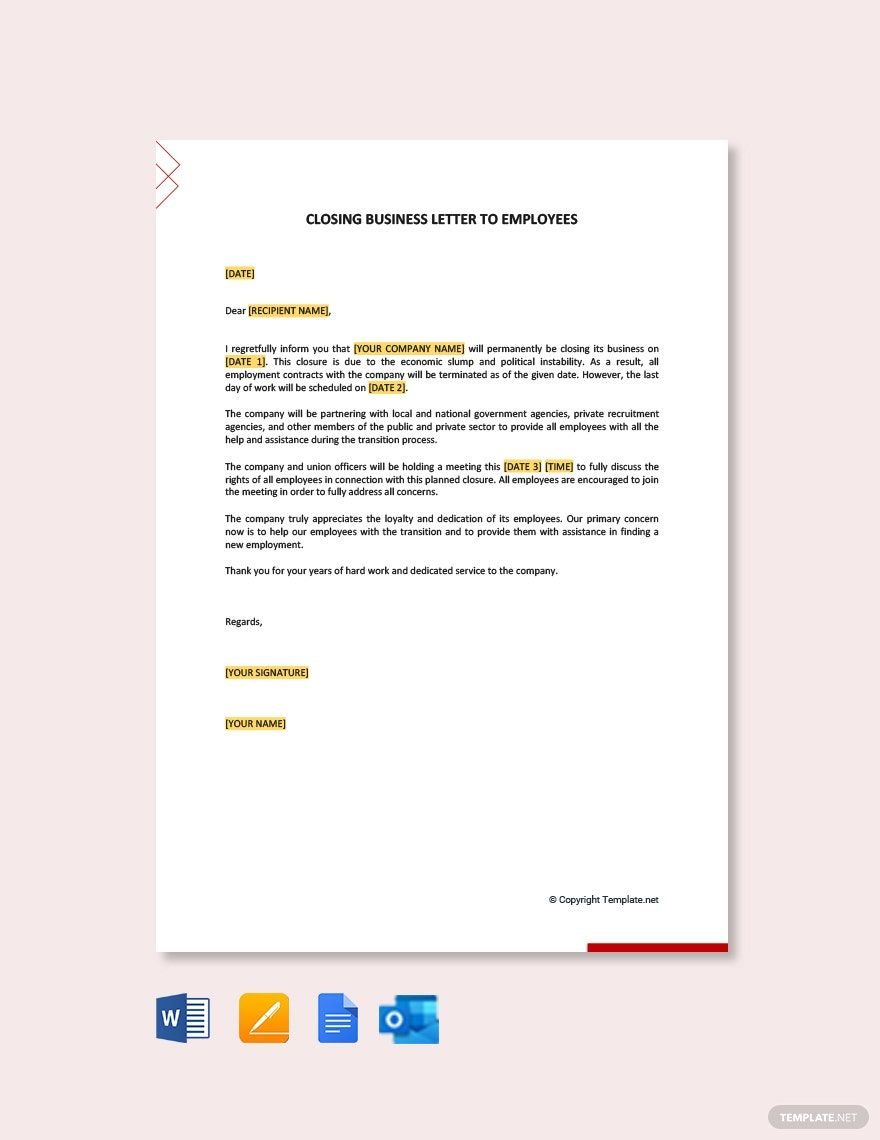

Think about the impact on employees, suppliers, and customers. Open communication and transparent decision-making are crucial during this difficult time. This helps to minimize the negative effects on all parties involved.

Examine personal finances and future career prospects. Having a plan for what comes next can ease the transition and minimize stress.

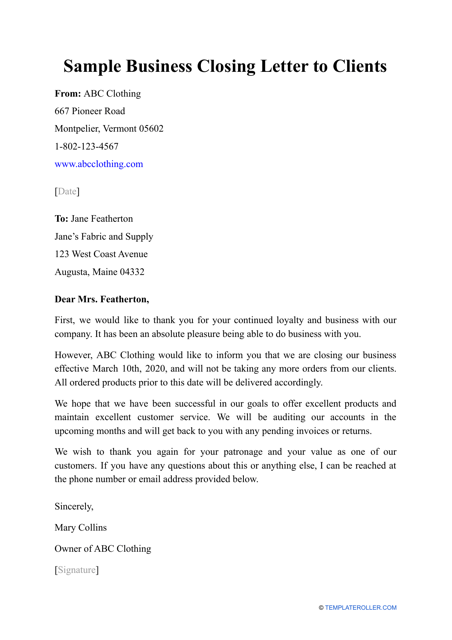

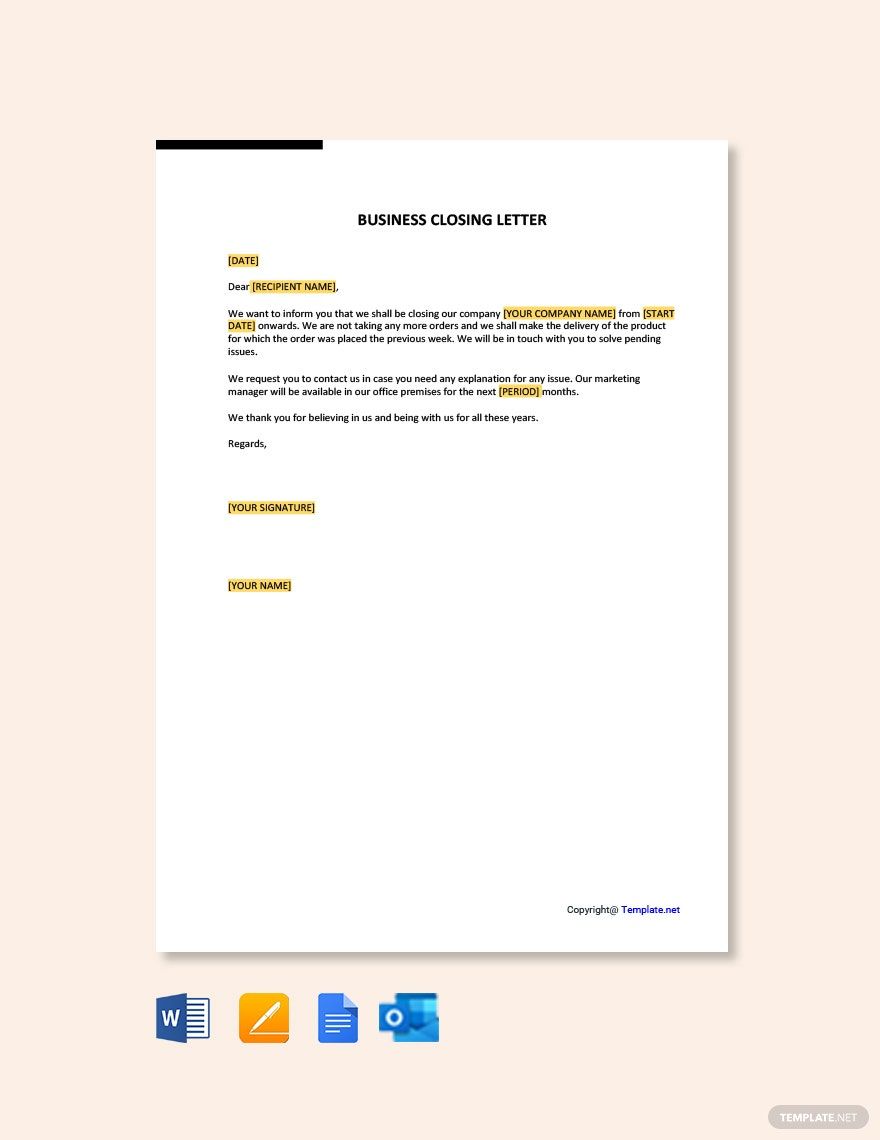

Steps to Take When Closing

Develop a detailed closure plan. This should include notifying employees, settling debts, selling assets, and fulfilling legal obligations. Failure to do so can create more problems in the long run.

Communicate honestly with all stakeholders. Transparency builds trust and can help to mitigate negative reactions. Remember your reputation matters even after the business is gone.

Explore options for asset liquidation. Consult with professionals to maximize the value of remaining assets. Unsold assets can become liabilities if left unattended.

Consider bankruptcy as a last resort. It can provide legal protection and a structured process for settling debts. Consult a bankruptcy attorney to understand the implications.

Closing a business is a difficult but sometimes necessary decision. Recognizing the signs early and taking proactive steps can minimize the damage and pave the way for future endeavors. It's crucial to seek professional advice and develop a comprehensive plan to navigate the closure process effectively.

![How To Know When To Close A Business How to Close a Business Checking Account in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2023/02/How-to-close-a-business-checking-account-screenshot.jpg)