How To Manage Money In A Small Business

Running a small business is a challenging yet rewarding endeavor. One of the biggest hurdles entrepreneurs face is effectively managing their finances. Poor financial management can cripple even the most promising businesses, while smart strategies can fuel growth and ensure long-term stability.

This article delves into essential strategies for small business owners to effectively manage their money, covering key areas from budgeting to cash flow management and long-term financial planning.

Budgeting: The Foundation of Financial Control

Creating a budget is the first step towards taking control of your business's finances. A budget is a roadmap that outlines your expected income and expenses over a specific period, typically a month, quarter, or year.

Start with forecasting. Analyze past sales data, industry trends, and anticipated changes in the market to project your revenue. Next, list all your fixed expenses like rent, salaries, and insurance premiums.

Don't forget variable costs such as inventory, marketing, and utilities, which fluctuate with sales volume. Regularly compare your actual performance against your budget to identify areas where you're overspending or falling short of revenue goals.

Cash Flow Management: Keeping the Lifeblood Flowing

Effective cash flow management is critical for the survival of any small business. Many businesses fail not because they are unprofitable, but because they run out of cash.

Closely monitor your accounts receivable. Invoice customers promptly and consider offering early payment discounts. Negotiate favorable payment terms with your suppliers to extend your payment deadlines.

Maintain a cash flow forecast to anticipate potential shortfalls and plan accordingly. Consider establishing a line of credit as a safety net to cover unexpected expenses or seasonal dips in revenue, according to the Small Business Administration.

Controlling Expenses: Every Penny Counts

Controlling expenses is a continuous effort that can significantly impact your bottom line. Regularly review all your business expenses and identify areas where you can cut costs without compromising quality.

Explore opportunities to negotiate better deals with suppliers, reduce energy consumption, and streamline operations. Consider outsourcing non-core functions such as accounting or IT to reduce overhead costs, as suggested by financial experts at Forbes.

Implement a system for tracking and approving all expenses to prevent unauthorized spending. Encourage employees to be mindful of costs and suggest cost-saving ideas.

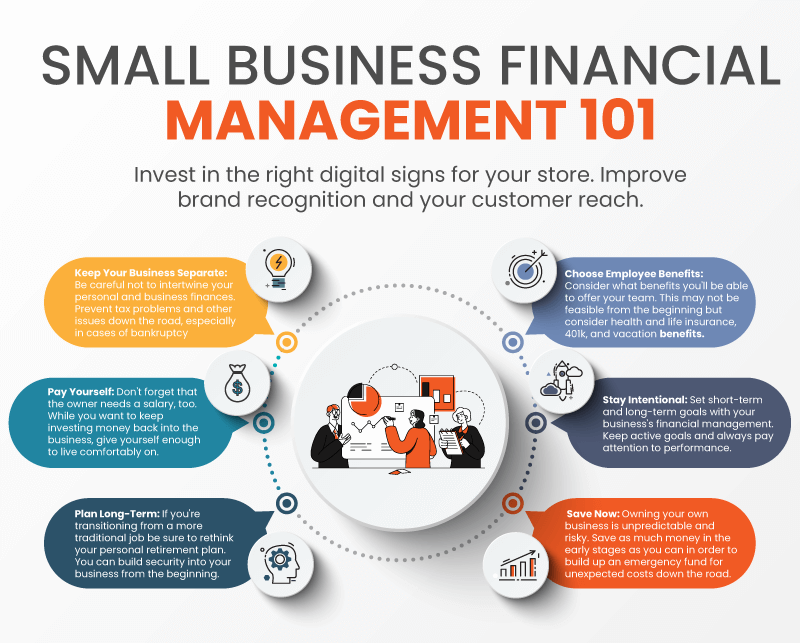

Investing in the Future: Long-Term Financial Planning

Beyond day-to-day financial management, it's crucial to plan for the future. Consider setting financial goals such as expanding your business, investing in new equipment, or building a retirement fund.

Work with a financial advisor to develop a long-term financial plan that aligns with your business goals and risk tolerance. Diversify your investments to reduce risk and maximize returns.

Regularly review and update your financial plan to reflect changes in your business and the market. Remember, consistent financial planning is key to building a sustainable and successful business.

Leveraging Technology: Streamlining Financial Processes

Technology can play a significant role in simplifying and automating financial management. Numerous software solutions are available to help with accounting, budgeting, invoicing, and cash flow management.

Consider using cloud-based accounting software such as QuickBooks or Xero, which offer real-time financial data and reporting. These tools can help you track your income, expenses, and cash flow more efficiently.

Utilize online payment platforms to streamline invoicing and payment collection. Embrace data analytics to gain insights into your business's financial performance and identify areas for improvement.

Seeking Professional Advice: When to Call for Help

While many small business owners manage their own finances, it's often beneficial to seek professional advice from an accountant or financial advisor. A professional can provide expert guidance on tax planning, financial analysis, and investment strategies.

Consider hiring a certified public accountant (CPA) to help with tax preparation and compliance. A financial advisor can assist with long-term financial planning and investment decisions.

Don't hesitate to seek professional help when you're facing complex financial challenges or need assistance with strategic decision-making. The investment in professional advice can pay off in the long run by helping you make informed financial decisions and avoid costly mistakes.

Effective money management is the cornerstone of a thriving small business. By implementing a solid budget, managing cash flow diligently, controlling expenses, investing in the future, leveraging technology, and seeking professional advice when needed, small business owners can significantly improve their financial stability and pave the way for long-term success.

.jpg)