How To Manage Small Business Finances

Imagine stepping into a sun-drenched bakery, the aroma of warm bread and sweet pastries filling the air. Flour dusts the counter, and the gentle hum of the espresso machine creates a symphony of small-business life. But behind the scenes, beyond the inviting atmosphere, lies a crucial component: managing the finances to ensure that the sweet scent of success continues to waft through the doors for years to come.

For many small business owners, juggling passion and profit can feel like a tightrope walk. Mastering your finances is not just about balancing the books; it's about building a sustainable future and realizing your entrepreneurial dream. This article provides practical strategies to help you confidently navigate the financial landscape of your small business.

The Foundation: Understanding Your Cash Flow

Cash flow is the lifeblood of any small business. Think of it as the circulatory system that keeps everything running smoothly. A consistent and positive cash flow ensures you can cover expenses, invest in growth, and weather any unexpected storms.

Start by meticulously tracking every penny that comes in and goes out. Using accounting software like QuickBooks or Xero can automate much of this process, providing real-time insights into your financial health. Regularly review your cash flow statement to identify trends, predict potential shortfalls, and make informed decisions.

Budgeting: Your Roadmap to Financial Success

A well-crafted budget acts as your roadmap, guiding your financial journey. It allows you to allocate resources effectively, set realistic goals, and monitor your progress.

Begin by estimating your revenue based on historical data, market trends, and sales projections. Next, outline your fixed expenses (rent, salaries, insurance) and variable costs (materials, marketing, utilities). Compare your projected revenue against your expenses. This will help you identify areas where you can cut costs or increase revenue, ensuring that your business operates within its means.

Separating Business and Personal Finances

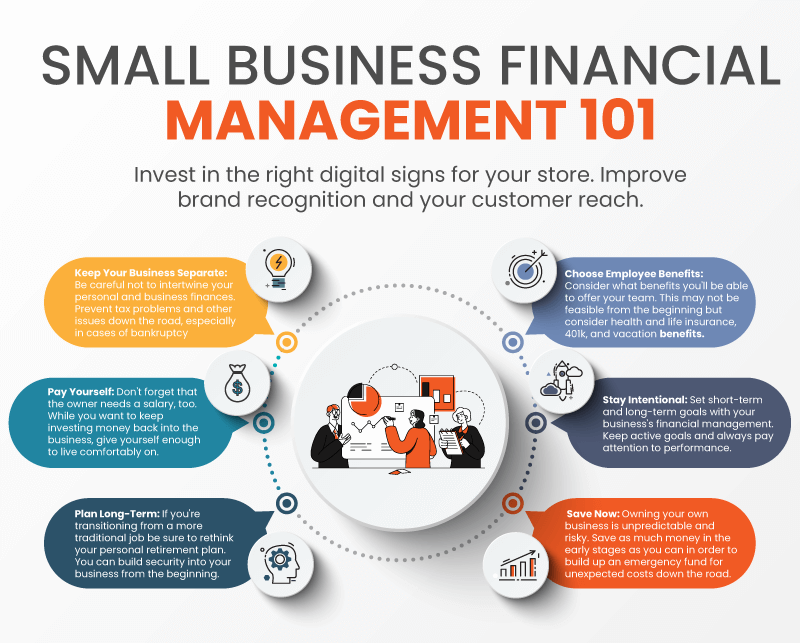

One of the most crucial steps for small business owners is separating their personal and business finances. This practice not only simplifies bookkeeping but also provides clarity when assessing your business's financial performance.

Open a dedicated business bank account and obtain a business credit card. Pay all business expenses from the business account and use the business credit card for business purchases only. This separation streamlines tax preparation, protects your personal assets, and creates a professional image for your company.

Managing Debt Wisely

Debt can be a valuable tool for growth when managed responsibly. However, excessive or poorly managed debt can quickly cripple a small business.

Carefully evaluate the terms and conditions of any loan before taking it out. Consider the interest rate, repayment schedule, and any associated fees. Prioritize paying down high-interest debt to reduce your overall financial burden. According to the Small Business Administration (SBA), a good debt-to-equity ratio is crucial for securing future funding.

Embrace Technology for Efficiency

Technology has revolutionized small business finance, offering tools that streamline operations and provide valuable insights. Accounting software automates bookkeeping, invoicing, and financial reporting.

Payment processing systems allow you to accept payments online and in person. Consider implementing a CRM (Customer Relationship Management) system to track customer interactions and sales. Investing in technology can save time, reduce errors, and provide data-driven insights that inform your decision-making process.

Seek Professional Advice

Navigating the complexities of small business finance can be daunting, especially for those without a financial background. Don't hesitate to seek professional advice from accountants, financial advisors, or business consultants.

These experts can provide tailored guidance on tax planning, financial forecasting, and business strategy. They can also help you identify opportunities for improvement and ensure you comply with all relevant regulations. A trusted advisor can be an invaluable asset, helping you make informed decisions and achieve your financial goals.

"Investing in professional financial advice is an investment in the long-term success of your business," says John Smith, a certified financial planner specializing in small business consulting.

Looking Ahead: Financial Planning for the Future

Managing small business finances is not a one-time task; it's an ongoing process that requires vigilance and adaptability. As your business evolves, your financial strategies must evolve with it.

Continuously monitor your performance, analyze trends, and adjust your budget as needed. Consider building a financial cushion to protect against unforeseen circumstances and invest in long-term growth opportunities. By proactively managing your finances, you can ensure that your small business thrives for years to come.

As you lock the door to your bakery each evening, the scent of success lingering in the air, remember that financial prudence is the secret ingredient. By mastering your finances, you're not just balancing books; you're crafting a recipe for lasting success, one delicious financial decision at a time.