How To Pay Yourself When You Own A Business

Business owners often grapple with a critical question: How do I pay myself? Navigating the complexities of owner compensation is crucial for both personal financial stability and the long-term health of your company.

Understanding the different methods available and choosing the right one is essential. This guide provides a concise overview of how to pay yourself as a business owner, ensuring compliance and optimizing your financial strategy.

Sole Proprietorships and Partnerships: Owner's Draw

For sole proprietorships and partnerships, the primary method is an owner's draw. This involves taking money out of the business for personal use.

There's no employment tax implications with an owner's draw; you're simply withdrawing your share of the profits. Keep meticulous records of all withdrawals.

These withdrawals are not considered salary or wages. Instead, you'll pay self-employment taxes on your profits when filing your annual tax return.

S Corporations: Salary and Distributions

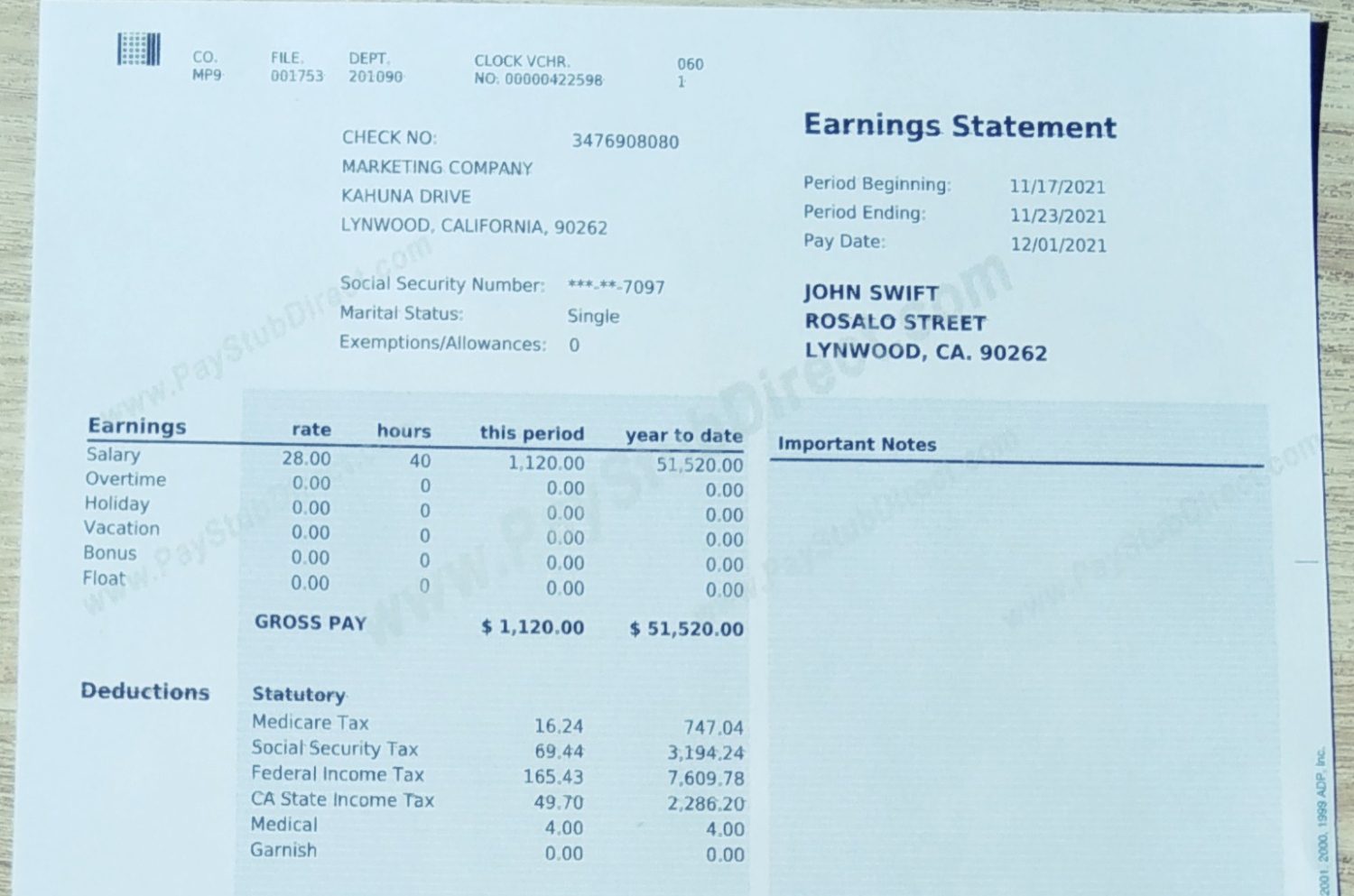

S corporations offer a more structured approach: a combination of salary and distributions. As an employee of your S corp, you must pay yourself a reasonable salary.

The IRS mandates that this salary be commensurate with your skills, experience, and the work you perform for the business. Failing to pay a reasonable salary can trigger an audit.

After paying yourself a reasonable salary, you can then take distributions of profits. Distributions are not subject to employment taxes, providing a potential tax advantage.

C Corporations: Salary and Dividends

C corporations also use a combination approach: salary and dividends. Similar to S corps, you must pay yourself a salary subject to employment taxes.

Any remaining profits can be distributed to shareholders as dividends. However, dividends are subject to double taxation: once at the corporate level and again at the individual level.

Choosing between an S corp and a C corp structure depends on your specific circumstances and tax planning goals. Seek professional advice before making this decision.

LLCs: Choosing Your Tax Structure

Limited Liability Companies (LLCs) offer flexibility in how they're taxed. An LLC can be taxed as a sole proprietorship, partnership, S corporation, or C corporation.

The choice depends on factors such as your ownership structure, profit levels, and tax planning strategy. If taxed as a sole proprietorship or partnership, you'll use the owner's draw method.

If taxed as an S corporation or C corporation, you'll follow the salary and distributions/dividends model. Consult with a tax professional to determine the optimal tax classification for your LLC.

Payroll and Record Keeping: Critical Steps

Regardless of your business structure, maintaining accurate records is paramount. Implement a system for tracking all income, expenses, and owner compensation.

If paying yourself a salary, utilize payroll software or hire a payroll service to ensure timely and accurate tax withholdings and filings. Compliance with payroll regulations is non-negotiable.

Keep detailed documentation of all draws, distributions, and dividends, including dates, amounts, and purposes. This documentation will be essential for tax preparation and potential audits.

Estimated Taxes: Avoid Penalties

As a business owner, you're responsible for paying estimated taxes throughout the year. This applies to both self-employment taxes (for sole proprietorships and partnerships) and income taxes.

The IRS provides guidelines for calculating and paying estimated taxes. Failure to pay estimated taxes can result in penalties.

Work with a tax advisor to determine your estimated tax obligations and ensure timely payments. Utilize IRS resources like Form 1040-ES.

Seek Professional Advice

Navigating owner compensation can be complex, and the optimal strategy depends on your unique circumstances. Don't hesitate to seek professional advice from a qualified accountant or tax advisor.

A professional can help you choose the right business structure, optimize your compensation strategy, and ensure compliance with all applicable tax laws. Investing in professional guidance can save you time, money, and potential headaches down the road.

Take the next step: consult with a financial professional to create a tailored compensation plan for your business. Delaying could lead to missed opportunities or costly mistakes.