How To Prepare For A Economic Depression

The shadow of economic uncertainty looms large, prompting many to ponder a question that was once relegated to history books: How to prepare for a potential economic depression? While economists debate the likelihood and severity of future downturns, individual preparedness remains a prudent strategy.

This article examines actionable steps individuals and families can take to mitigate the potential impact of a severe economic downturn. It focuses on building financial resilience, securing essential resources, and adapting to a changing economic landscape, drawing upon expert advice and historical precedent to offer a practical guide for navigating uncertain times.

Understanding the Landscape

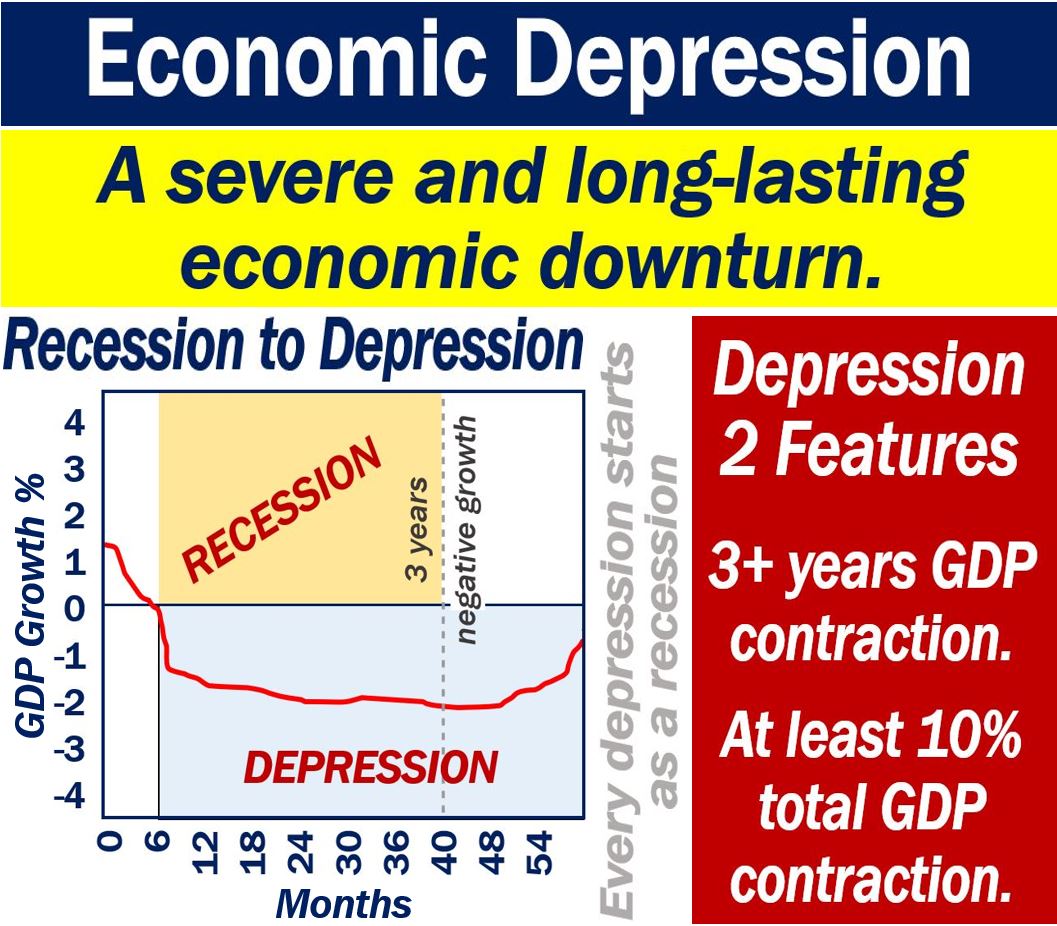

Before taking action, understanding the characteristics of an economic depression is crucial. A depression is a prolonged and severe economic downturn characterized by a significant decline in GDP, high unemployment, and widespread business failures. This differs from a recession, which is a shorter and less severe contraction.

Historical examples, such as the Great Depression of the 1930s, serve as stark reminders of the devastating consequences. Understanding the potential impact on employment, investments, and overall quality of life informs effective preparedness strategies.

Building Financial Resilience

Emergency Fund Essentials

A robust emergency fund is the cornerstone of financial preparedness. Experts generally recommend having 3-6 months' worth of living expenses readily accessible in a high-yield savings account. This fund acts as a buffer against job loss, unexpected medical bills, or other financial emergencies.

Increasing your emergency fund beyond the minimum recommended amount can provide additional security in a prolonged downturn. Consider using online tools and calculators to determine your specific needs.

Debt Reduction Strategies

High debt levels can be particularly vulnerable during economic depressions. Prioritize paying down high-interest debt, such as credit card balances, to reduce your monthly obligations. Consider strategies like debt consolidation or balance transfers to lower interest rates.

Avoiding new debt is equally important. Delay large purchases and carefully evaluate any new financial commitments.

Diversifying Income Streams

Relying solely on one income stream can be risky during periods of economic instability. Explore opportunities to diversify your income, such as freelancing, starting a side business, or investing in income-generating assets. The more diverse your income sources, the better equipped you will be to weather economic storms.

Securing Essential Resources

Stockpiling Strategically

Building a stockpile of essential supplies is a practical step in preparing for potential disruptions to supply chains. Focus on non-perishable food items, water, medications, and hygiene products. Aim for a supply that can last for several weeks or months.

Rotation is key to prevent spoilage. Regularly check expiration dates and use older items first.

Essential Skills and Knowledge

Developing essential skills can increase your self-reliance and employability during challenging times. Consider learning skills such as gardening, basic home repair, cooking from scratch, or first aid. Knowledge can be as valuable as physical resources.

Community involvement and networking can also prove invaluable. Building relationships with neighbors and other community members can provide support and resources during times of need.

Adapting to a Changing Landscape

Rethinking Investments

Review your investment portfolio and consider adjusting your asset allocation to reduce risk. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate potential losses. Consider consulting with a financial advisor to determine the best strategy for your individual circumstances.

Remember that panic selling during market downturns can often lock in losses. A long-term perspective is crucial.

Budgeting and Frugality

Embrace a more frugal lifestyle by cutting unnecessary expenses and prioritizing needs over wants. Create a detailed budget and track your spending to identify areas where you can save money. This approach can help you conserve resources and build financial resilience.

Consider bartering and trading goods and services with others in your community. This can help you reduce your reliance on cash and build stronger relationships.

Looking Ahead

Preparing for an economic depression is not about predicting the future, but about building resilience and adaptability. By taking proactive steps to strengthen your finances, secure essential resources, and develop valuable skills, you can better navigate potential economic challenges. While the future remains uncertain, preparedness can provide a sense of control and security in an increasingly complex world. Continued vigilance and adaptation are key to successfully weathering any economic storm. Stay informed from credible sources and adjust your strategies as needed to reflect the evolving economic landscape.

![How To Prepare For A Economic Depression [Economics] What is Economic Depression? - Class 12 Teachoo](https://d1avenlh0i1xmr.cloudfront.net/b627c738-a0db-444d-acf8-0db6aeb5e54c/slide12.jpg)