How To Prepare Statement Of Stockholders Equity

Urgent guidance for businesses: Correctly preparing your Statement of Stockholders' Equity is critical for compliance and transparency. Follow these steps to avoid errors and ensure accurate financial reporting.

This document outlines the essential components and calculations required to produce a compliant Statement of Stockholders' Equity. Mastering this process is essential for CFOs, accountants, and anyone involved in financial reporting.

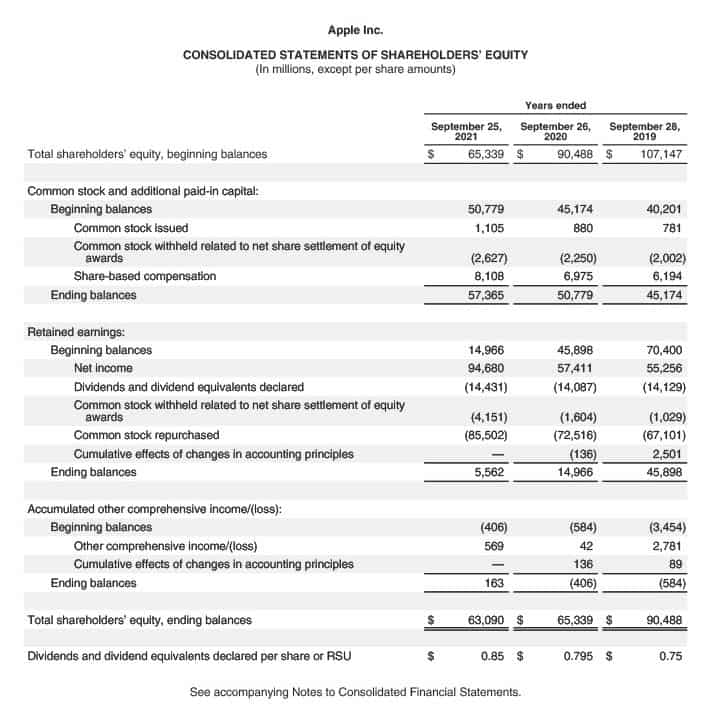

Understanding the Core Components

The Statement of Stockholders' Equity details the changes in a company's equity accounts over a specific period. It includes key accounts such as Common Stock, Preferred Stock, Retained Earnings, and Additional Paid-In Capital.

Each element requires careful attention to ensure accuracy and completeness. Neglecting any single component can lead to material misstatements.

Gathering Necessary Data

Begin by collecting all relevant financial data. This includes the beginning balances for each equity account from the previous period's balance sheet.

You also need records of all transactions affecting equity during the current period. Common transactions include issuing stock, repurchasing stock, net income, and dividend payments.

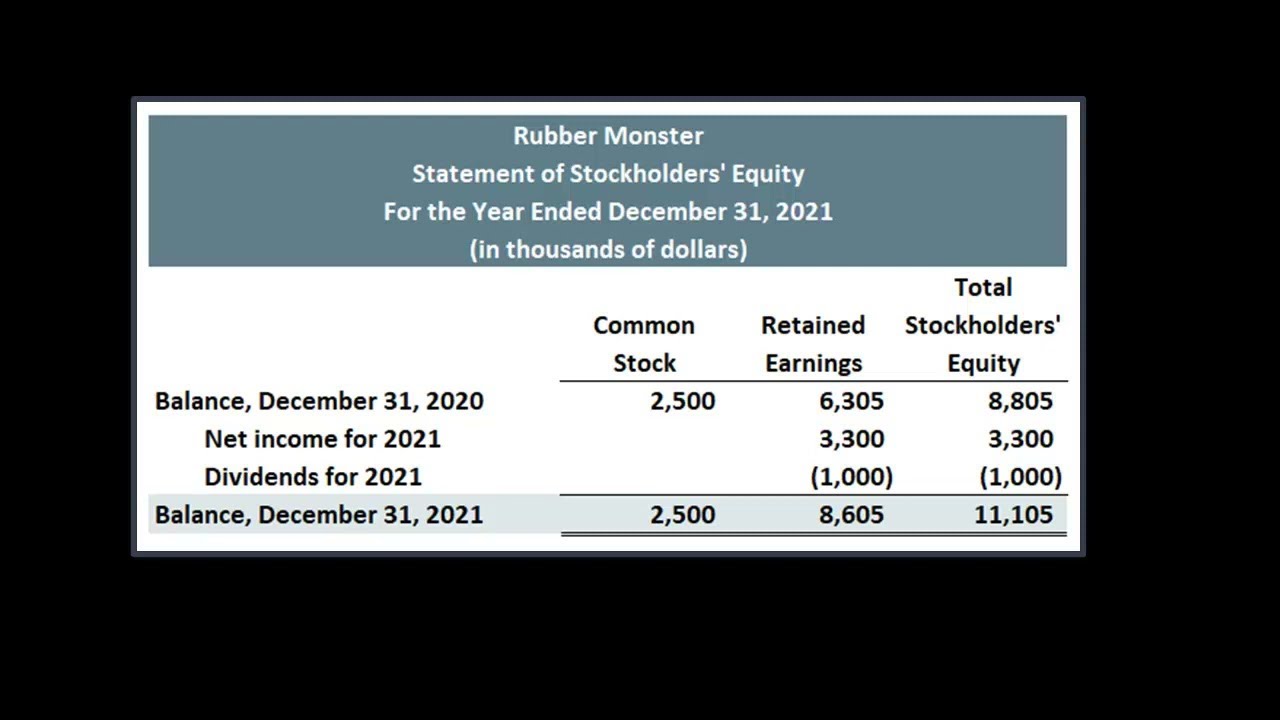

Calculating Changes in Common Stock

Changes in Common Stock typically result from issuing new shares. Record the number of shares issued and the corresponding value received.

If the stock was issued at a price above its par value, the excess is recorded as Additional Paid-In Capital.

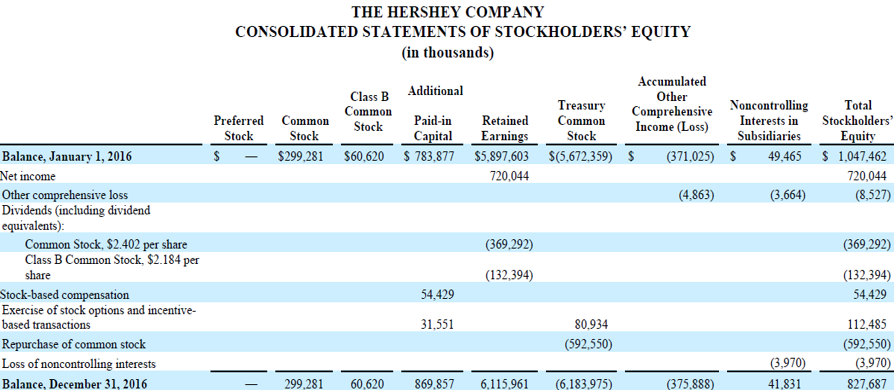

Analyzing Preferred Stock Activity

Similar to common stock, changes in Preferred Stock involve issuances or repurchases. Track the number of shares and associated values meticulously.

Be aware of any dividend obligations specific to the preferred stock. These payments impact retained earnings.

Determining Net Income's Impact

Net Income, derived from the income statement, increases retained earnings. This is a crucial link between the two financial statements.

Ensure the net income figure is accurate and reflects all revenues and expenses for the period.

Accounting for Dividend Payments

Dividend Payments decrease retained earnings. Record the total amount of dividends declared and paid to shareholders.

Distinguish between cash dividends and stock dividends, as their accounting treatments differ.

Adjusting for Treasury Stock

Treasury Stock represents shares repurchased by the company. The repurchase decreases stockholders' equity.

Subsequent reissuance of treasury stock increases stockholders' equity, potentially affecting additional paid-in capital.

Addressing Other Comprehensive Income (OCI)

Other Comprehensive Income (OCI) includes items like unrealized gains or losses on certain investments. These items bypass the income statement directly affect equity.

Carefully categorize and report each component of OCI. Common items include foreign currency translation adjustments and pension adjustments.

Preparing the Statement

Organize the data into a clear, understandable format. Typically, the statement starts with the beginning balances for each equity account.

Then, add or subtract the changes that occurred during the period. Summing these changes results in the ending balances for each account.

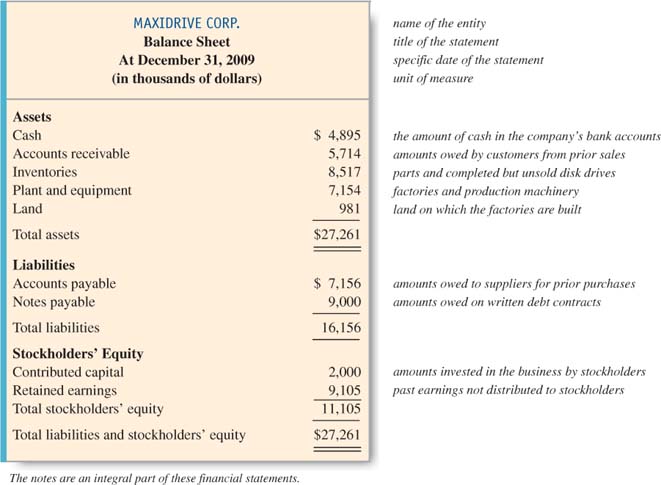

Review and Verification

Thoroughly review the statement for errors. Cross-reference figures with other financial statements and supporting documentation.

Ensure the ending balances of equity accounts on the statement match the equity section of the balance sheet. Discrepancies must be investigated and resolved.

Seek Expert Assistance

If unsure about any aspect of the preparation process, consult with a qualified accountant. Misstatements can have serious consequences.

Consider using accounting software to automate the process. Software can reduce errors and improve efficiency.

Common Pitfalls to Avoid

Failing to properly account for stock options and warrants is a common error. These instruments can dilute existing shareholders' equity.

Incorrectly classifying transactions can also lead to problems. For example, treating a stock dividend as a cash dividend is a serious mistake.

Another common error is overlooking the impact of retrospective adjustments. Prior period adjustments require careful restatement of equity balances.

Next Steps

Review your company's current processes for preparing the Statement of Stockholders' Equity. Identify areas for improvement and implement corrective actions.

Stay updated on changes to accounting standards. The Financial Accounting Standards Board (FASB) frequently issues new guidance that affects financial reporting.

Regular training for accounting staff is crucial. Ensure they have the knowledge and skills to prepare accurate and compliant statements.