How To Raise Capital For A Startup

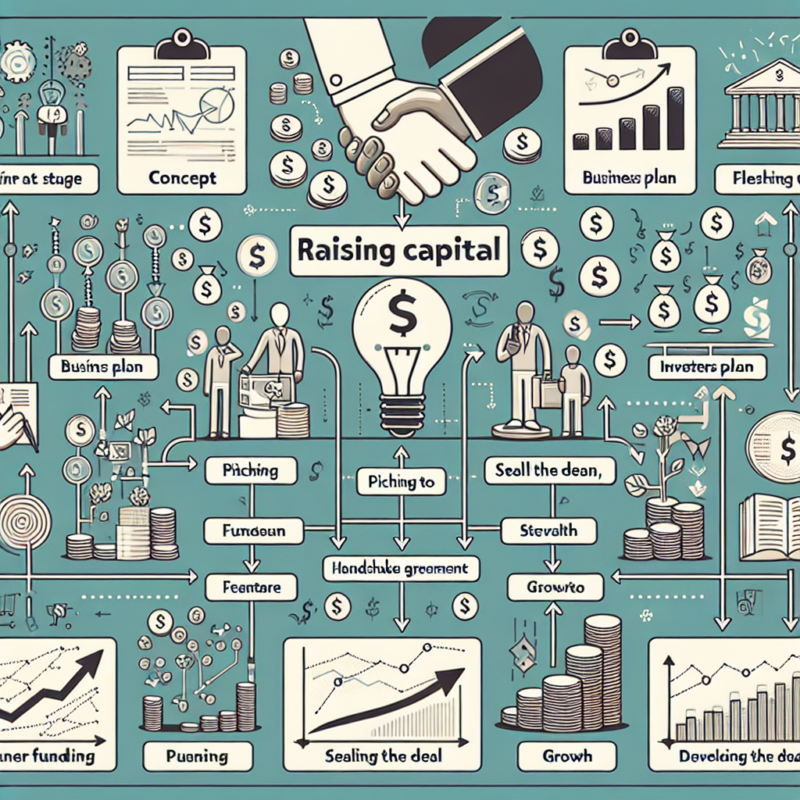

In the high-stakes world of startups, securing funding is often the critical difference between transformative success and premature failure. The path to raising capital is fraught with challenges, requiring founders to navigate a complex landscape of investors, market conditions, and evolving financial strategies.

Understanding the intricacies of fundraising is paramount for any aspiring entrepreneur. This article breaks down the essential steps and strategies for startups seeking capital, from bootstrapping to venture capital, offering a comprehensive guide for navigating this crucial process. We will explore different funding avenues and provide practical advice, ensuring a higher chance of success.

Bootstrapping and Early-Stage Funding

Many startups begin with bootstrapping, using personal savings or revenue from early sales to fund operations. This approach demands extreme frugality and resourcefulness. It also grants founders complete control and avoids early dilution of equity.

Another common initial step is seeking support from friends and family. While potentially easier to secure, these investments require clear communication and defined repayment terms to avoid damaging personal relationships.

Angel investors represent a significant step up from personal networks. These high-net-worth individuals provide capital in exchange for equity. They often bring valuable industry experience and mentorship, increasing the startup's odds of succeeding.

Venture Capital and Later-Stage Funding

Venture capital (VC) is typically sought when startups require substantial funding for scaling operations. VC firms invest large sums in exchange for a significant equity stake. This often involves a rigorous due diligence process.

According to the National Venture Capital Association (NVCA), venture capital investments reached record levels in recent years. However, funding trends are constantly fluctuating, requiring startups to be adaptable and prepared for intense competition.

Different VC firms specialize in various industries and stages of development. Thorough research is essential to identify investors whose expertise aligns with the startup's needs and goals.

Alternative Funding Options

Crowdfunding platforms like Kickstarter and Indiegogo offer an alternative way to raise capital. These platforms allow startups to solicit small contributions from a large number of individuals in exchange for rewards or equity.

Government grants and loans are another potential source of funding. Programs like the Small Business Innovation Research (SBIR) grant provide non-dilutive funding for innovative research and development projects. Eligibility criteria can be stringent.

Debt financing, such as bank loans, can also be used to raise capital. However, this option requires a strong credit history and a well-defined repayment plan, which is not always feasible for early-stage startups.

Crafting a Compelling Pitch

A well-crafted pitch deck is crucial for attracting investors. This presentation should clearly articulate the problem the startup is solving, the proposed solution, the market opportunity, and the team's capabilities.

Financial projections are another essential component of the pitch. These projections should demonstrate the startup's potential for growth and profitability, based on realistic assumptions. Overly optimistic forecasts can damage credibility.

The entrepreneur's passion and vision are also key factors that influence investor decisions. A confident and articulate presentation can convey the startup's potential and inspire confidence in the team's ability to execute.

Due Diligence and Legal Considerations

"Before investing, investors will conduct thorough due diligence, scrutinizing the startup's financials, legal structure, and market position."

This process can be lengthy and demanding. Founders must be prepared to provide detailed information and answer challenging questions.

Legal considerations are paramount throughout the fundraising process. Engaging experienced legal counsel is crucial to ensure compliance with securities laws and to protect the startup's interests.

Term sheets outline the key terms of the investment. Understanding these terms is essential before signing any agreement, as they can have a significant impact on the startup's future.

Looking Ahead: The Future of Startup Funding

The landscape of startup funding is constantly evolving. New technologies, such as blockchain and artificial intelligence, are creating innovative funding models and disrupting traditional approaches.

The rise of impact investing is also shaping the future of startup funding. Investors are increasingly seeking ventures that generate both financial returns and positive social or environmental impact.

Successfully raising capital requires a combination of strategic planning, financial acumen, and unwavering determination. By understanding the different funding options, crafting a compelling pitch, and navigating the legal and due diligence processes, startups can significantly increase their chances of securing the resources needed to achieve their vision and build a successful business.