How To Raise Money For A Business Without A Loan

Imagine a bustling farmers market, overflowing with vibrant produce and the aroma of freshly baked bread. A young entrepreneur, Sarah, stands behind her stall, showcasing her handcrafted jams and jellies. Her dream? To expand her small operation into a full-fledged local food business. But like many aspiring business owners, Sarah faces a common hurdle: funding.

Securing capital is often the biggest challenge for new ventures. While traditional bank loans remain a popular option, they're not always accessible or desirable. This article explores alternative strategies for raising money for your business without relying on loans, offering a roadmap for entrepreneurs like Sarah to achieve their goals through creativity and resourcefulness.

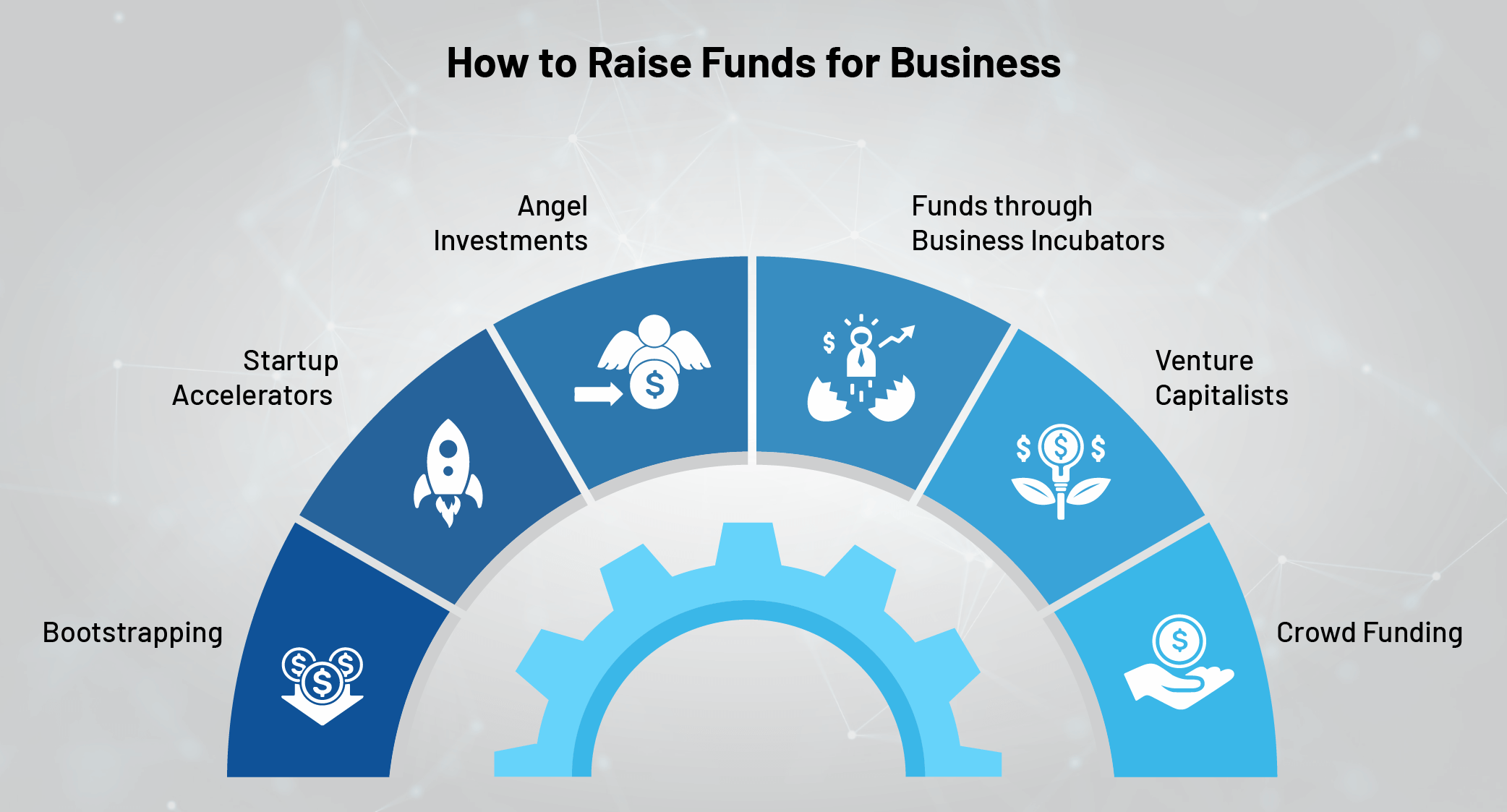

Bootstrapping: The Power of Self-Funding

Bootstrapping, or self-funding, is a cornerstone of many successful startups. It involves using your own savings, personal resources, and early revenue to finance your business. This method emphasizes frugality and resource optimization, forcing you to make every dollar count.

For Sarah, bootstrapping meant using her part-time job earnings to purchase ingredients and equipment. It also involved trading her goods at the farmer's market in exchange for services like website design, significantly reducing her initial costs. Bootstrapping allows you to maintain full control and avoid debt, fostering a strong sense of ownership and resilience.

Friends, Family, and Fools: The Personal Network

Turning to your personal network is another avenue for raising capital. Often referred to as "friends, family, and fools," this group may be willing to invest in your business based on their belief in you and your idea.

Approaching loved ones requires careful consideration. Formalize the investment with clear terms, including interest rates and repayment schedules. These terms will keep relationships healthy while respecting the investment.

Crowdfunding: Tapping into Collective Support

Crowdfunding platforms like Kickstarter and Indiegogo have revolutionized fundraising. These platforms allow you to solicit small contributions from a large online audience in exchange for rewards or equity.

Sarah used crowdfunding to raise funds for a new commercial kitchen. She offered donors early access to her products and personalized thank-you notes. Crowdfunding not only provided capital but also generated buzz and pre-sales for her business.

Grants and Competitions: Seeking External Funding

Government agencies and private organizations often offer grants and business plan competitions. These opportunities can provide significant funding without requiring repayment.

Researching and applying for grants requires time and effort. Focus on opportunities that align with your business's mission and values. Sarah secured a small business grant from her local economic development agency, which helped her purchase energy-efficient equipment.

Bartering and Trade: Leveraging Existing Assets

Bartering and trade involve exchanging goods or services instead of money. This strategy can be particularly useful in the early stages of your business when cash flow is tight.

Sarah bartered her jams and jellies with a local coffee shop in exchange for marketing services. This arrangement benefited both businesses, reducing marketing expenses for Sarah and providing the coffee shop with unique product offerings.

Strategic Partnerships: Collaborating for Growth

Forming strategic partnerships with other businesses can provide access to resources and capital. Collaborative ventures can help you share costs, expand your reach, and access new markets.

Sarah partnered with a local farm to source organic ingredients, reducing her input costs and supporting local agriculture. This mutually beneficial relationship strengthened her brand and increased customer loyalty.

Venture Capital and Angel Investors: A Path for High-Growth Startups

Venture capital and angel investors are individuals or firms that invest in early-stage companies with high growth potential. These investors typically provide significant capital in exchange for equity in the business.

This option is more suitable for businesses with a clear path to scalability and profitability. It requires a compelling business plan and a willingness to share ownership and decision-making.

Conclusion

Raising money for a business without a loan requires creativity, perseverance, and a willingness to explore various options. While the journey may present challenges, the rewards of maintaining control and building a debt-free business are substantial.

Like Sarah, who successfully expanded her jam and jelly business using a combination of bootstrapping, crowdfunding, and strategic partnerships, entrepreneurs can achieve their dreams with resourcefulness and determination. Remember to carefully evaluate each option, tailor your approach to your specific needs, and never underestimate the power of your own passion and drive. The path to entrepreneurial success may not always be easy, but it’s certainly attainable.

![How To Raise Money For A Business Without A Loan How To Raise Money For Your Startup [Infographic] | Bit Rebels](http://www.bitrebels.com/wp-content/uploads/2012/06/How-To-Raise-Startup-Money.jpg)