How To Raise Money To Start A Business

Imagine the scent of freshly brewed coffee mingling with the excitement in the air. Picture a bustling co-working space where dreams are being built, one line of code, one marketing strategy, one handcrafted product at a time. But behind every successful startup is a crucial first step: securing the initial funding.

This article explores the multifaceted landscape of raising capital to launch your business, offering practical advice and insights to help you navigate the challenges and unlock the opportunities that await. From bootstrapping to venture capital, we'll break down the key strategies and resources available to aspiring entrepreneurs.

Understanding Your Funding Needs

Before diving into the various funding options, it's essential to clearly define your financial needs. A well-defined budget will help you avoid overspending.

Consider all aspects of your business. These considerations are including initial inventory, marketing expenses, and operational costs.

Bootstrapping: The Self-Funded Path

Bootstrapping, also known as self-funding, involves using your personal savings, revenue from early sales, or even selling assets to finance your business. This approach offers maximum control and avoids the pressure of external investors. However, it can be financially risky and limit growth potential.

Many successful entrepreneurs start with bootstrapping. This method includes Sara Blakely, the founder of SPANX.

She famously invested her $5,000 in savings to launch her hosiery empire.

Friends, Family, and Fools: A Helping Hand

Seeking financial support from your inner circle – friends, family, and even "fools" (individuals with a high risk tolerance) – can be a viable option. Be mindful to approach this with caution.

Treat these investments as formal loans. Consider the possibility of the loss of both money and relationship.

Small Business Loans: Traditional Financing

Small business loans are a traditional financing option offered by banks and credit unions. These loans typically require a solid business plan, good credit history, and collateral.

The Small Business Administration (SBA) offers various loan programs. These programs can help small businesses access funding with favorable terms.

Crowdfunding: Harnessing the Power of the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise funds from a large number of people, often in exchange for rewards or equity. This approach is particularly effective for businesses with innovative products or services that resonate with a specific community.

Crowdfunding campaigns require significant marketing effort and a compelling story to capture the attention of potential backers.

Angel Investors: Early-Stage Funding

Angel investors are high-net-worth individuals who invest their personal capital in early-stage businesses. They often provide not only funding but also valuable mentorship and industry connections.

Finding the right angel investor who aligns with your vision and values is crucial for a successful partnership.

Venture Capital: Fueling Rapid Growth

Venture capital (VC) firms invest in high-growth potential businesses in exchange for equity. VC funding is typically larger than angel investments and is often used to scale up operations and expand into new markets.

Securing VC funding is a competitive process that requires a compelling business plan, a strong team, and a proven track record. Sequoia Capital and Andreessen Horowitz are examples of well-known VC firms.

Crafting a Compelling Pitch

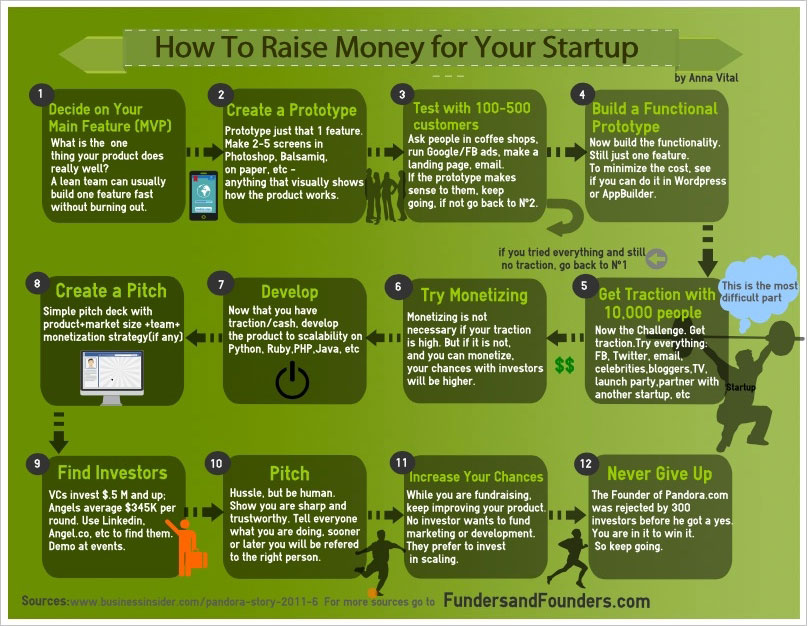

Regardless of the funding source you pursue, a well-crafted pitch is essential. Your pitch is your opportunity to captivate potential investors and demonstrate the value of your business.

Highlight the problem you're solving, your unique solution, your target market, your competitive advantage, and your financial projections.

Raising capital for a startup is undoubtedly a challenging endeavor, but with careful planning, perseverance, and a compelling vision, it is achievable. Remember to thoroughly research your options, build a strong network, and never lose sight of your passion for your business.

The journey of entrepreneurship is filled with its ups and downs, the ability to secure initial funding often paves the way for innovation and success.