How To Send Money Through Caribe Express

Sending money to loved ones, or conducting international business, requires reliable and secure transfer methods. Caribe Express, a well-established financial services company, offers several options for individuals looking to send money. This article provides a comprehensive guide on how to send money through Caribe Express, outlining the available methods, fees, and processes.

Caribe Express facilitates money transfers through its extensive network of locations and online platforms. This allows users to choose the most convenient method for their needs. Understanding the steps involved ensures a smooth and efficient transfer process.

Methods for Sending Money

Caribe Express offers three primary methods for sending money: in-person at an agent location, online via their website, and through their mobile app. Each method caters to different user preferences and technological access.

In-Person Transfers

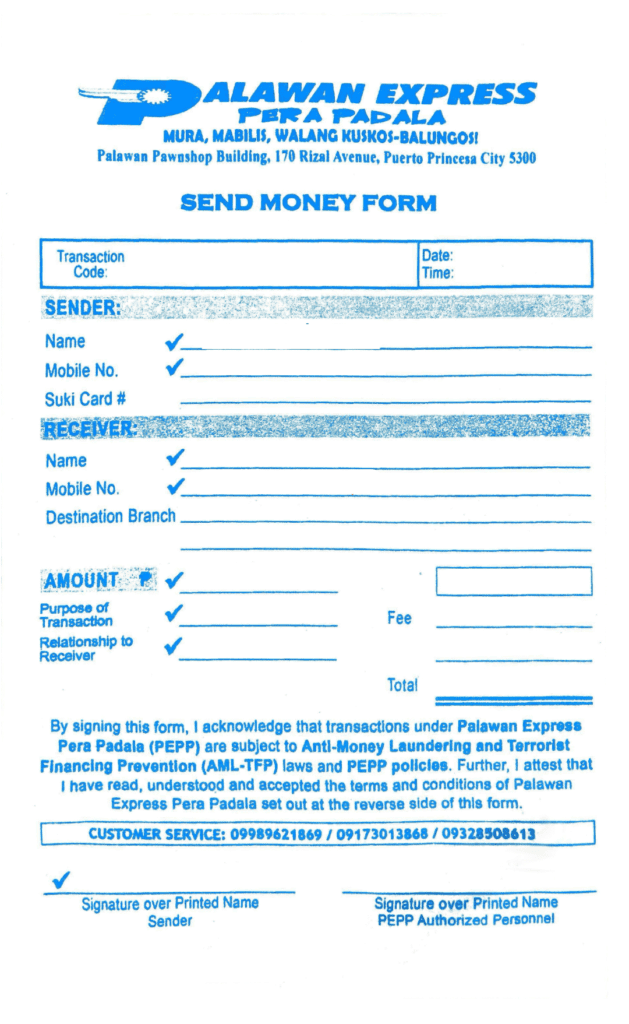

Sending money in person requires visiting an authorized Caribe Express agent location. Customers will need to provide the recipient's full name, address, and other relevant identification details. Accepted forms of payment typically include cash and debit cards, but policies can vary by location.

The agent will process the transaction, collect the payment, and provide a receipt with a transaction number. The recipient can then collect the funds from a Caribe Express location in their country by presenting valid identification and the transaction number.

Online Transfers

Caribe Express offers the convenience of sending money online through its website. Users will need to create an account or log in to an existing one, providing personal information and verifying their identity.

After logging in, users can initiate a transfer by entering the recipient's details, the amount to be sent, and the preferred payment method. Payment options typically include credit cards, debit cards, and bank transfers. Once the transaction is confirmed, the recipient can collect the funds at a designated Caribe Express location.

Mobile App Transfers

The Caribe Express mobile app provides a similar functionality to the online platform, but with the added convenience of managing transfers on a smartphone or tablet. Users can download the app from app stores and log in with their existing account credentials or create a new account.

The app allows users to initiate transfers, track transaction statuses, and access their transfer history. Payment options are generally the same as those available on the website. Recipients collect their money as they would with the other options.

Fees and Exchange Rates

Caribe Express charges fees for its money transfer services, which vary depending on the amount being sent, the destination country, and the payment method used. Exchange rates also fluctuate, so it's important to compare rates and fees before initiating a transfer.

Users can typically find information on fees and exchange rates on the Caribe Express website, mobile app, or by contacting customer service. Understanding these costs ensures transparency and helps users make informed decisions.

Security and Regulations

Caribe Express implements security measures to protect user data and prevent fraudulent activities. These measures may include encryption technology, identity verification processes, and transaction monitoring systems.

As a financial institution, Caribe Express must also comply with regulatory requirements, such as anti-money laundering (AML) laws and know your customer (KYC) guidelines. These regulations help ensure the integrity of the financial system and prevent illicit activities.

Conclusion

Sending money through Caribe Express offers a variety of options to suit different needs and preferences. Whether through in-person transactions, online platforms, or mobile apps, users can transfer funds securely and efficiently. By understanding the processes, fees, and security measures involved, individuals can make informed decisions and ensure a seamless money transfer experience.