How To Send Money To Someone In Dominican Republic

Sending money to loved ones in the Dominican Republic is a common practice for many, and a variety of methods are available, each with its own set of benefits and considerations.

This article provides a comprehensive overview of how to send money to the Dominican Republic, outlining the different options, their associated fees, and potential impacts for both senders and recipients.

Options for Sending Money

Several established methods exist for transferring funds internationally to the Dominican Republic. These include traditional money transfer services, online platforms, bank transfers, and mobile wallets.

Money Transfer Services

Companies like Western Union and MoneyGram are widely recognized for their global reach. They offer convenient options for sending money, often with quick transfer times.

Recipients can typically collect the funds in person at a local agent location. Fees and exchange rates can vary, so it's important to compare offers before initiating a transfer.

Online Platforms

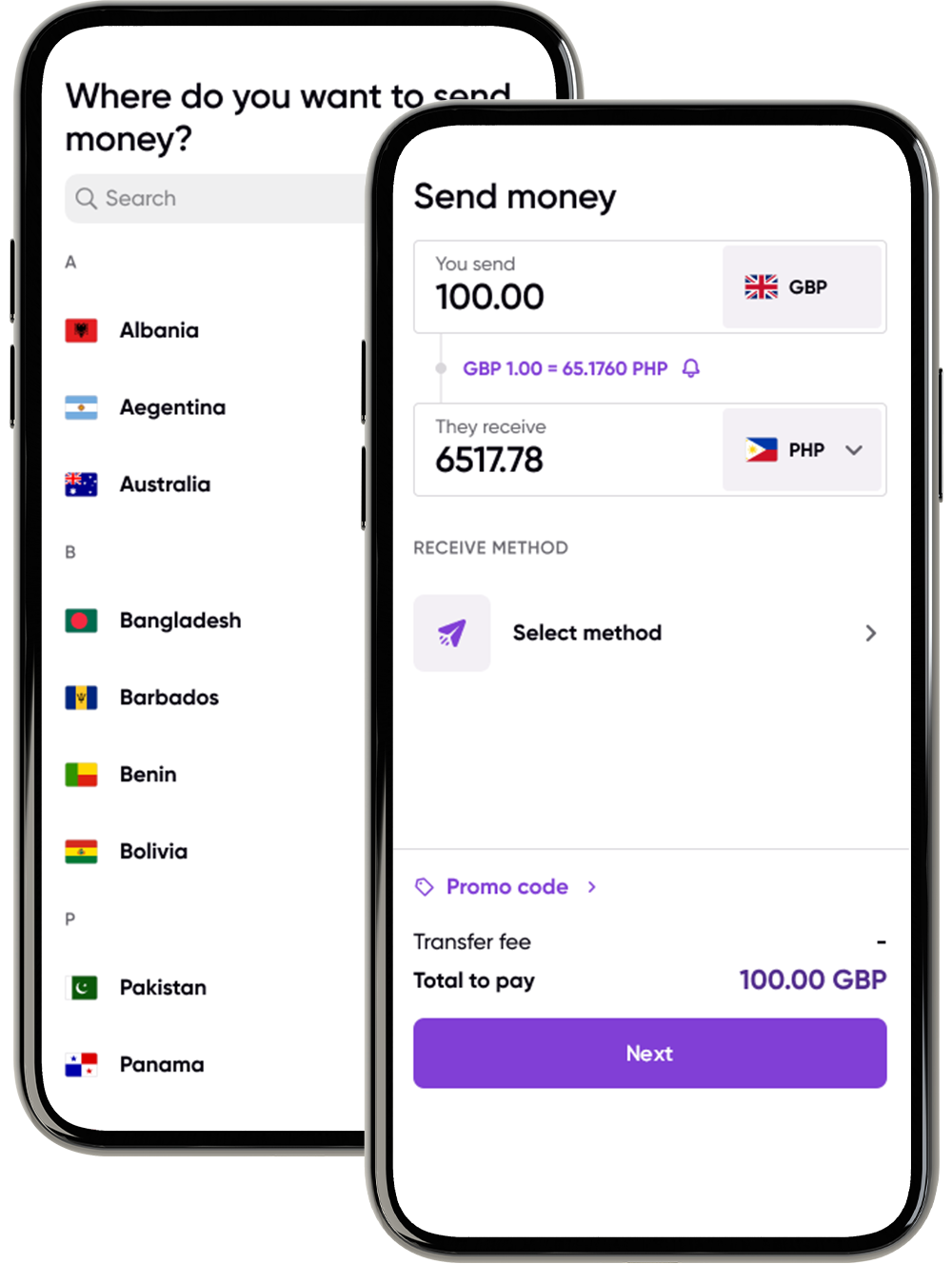

Online platforms such as Remitly, Xoom (a PayPal service), and WorldRemit have gained popularity due to their ease of use and competitive pricing. These platforms allow senders to initiate transfers from their computers or mobile devices.

Recipients may have options to receive funds directly into their bank accounts, mobile wallets, or at designated pickup locations. Users should carefully examine the exchange rates and fees associated with each transaction.

Bank Transfers

Traditional bank-to-bank transfers remain a reliable option, particularly for larger sums of money. However, these transfers often involve higher fees and can take longer to process compared to other methods.

The sender will need the recipient's bank name, account number, and SWIFT/BIC code. It's advisable to confirm these details with the recipient to avoid delays or complications.

Mobile Wallets

Mobile wallets are gaining traction in the Dominican Republic, presenting another avenue for receiving funds. Services like PayPal and others that operate in the region may allow for international transfers.

Both the sender and recipient need to have accounts with the same mobile wallet provider. Fees and availability can vary depending on the specific service.

Factors to Consider

When choosing a method for sending money, several factors should be taken into account. These include transfer fees, exchange rates, transfer speed, convenience, and security.

Exchange rates can fluctuate, impacting the amount the recipient ultimately receives. It's wise to compare rates from different providers before making a decision.

Transfer fees can also vary significantly. Some services may offer lower fees for larger transfers or for specific payment methods.

The speed of the transfer is another important consideration, especially if the recipient needs the funds urgently. Some services offer near-instant transfers, while others may take several business days.

Convenience plays a role as well. Senders should consider the ease of initiating the transfer and the recipient's access to receive the funds.

Security is paramount. Always use reputable and licensed money transfer services to protect against fraud. Before sending money, verify the recipient's details to avoid sending funds to the wrong person.

Impact on the Dominican Republic

Remittances play a significant role in the Dominican Republic's economy. According to the Central Bank of the Dominican Republic, remittances contribute substantially to the country's GDP and support many households.

These funds are often used for essential needs such as food, education, and healthcare. They also contribute to local businesses and overall economic growth.

The availability of various money transfer options helps to ensure that these vital funds reach those who need them most. Increased competition among providers can lead to lower fees and more favorable exchange rates, benefiting both senders and recipients.

Conclusion

Sending money to the Dominican Republic can be accomplished through a range of methods, each offering its own advantages. By carefully considering the factors discussed above, senders can choose the option that best meets their needs and ensures that their loved ones receive the funds they need in a timely and secure manner.

Staying informed about the latest developments in the money transfer industry can help individuals make informed decisions and maximize the impact of their remittances.