How To Separate A Business Partnership

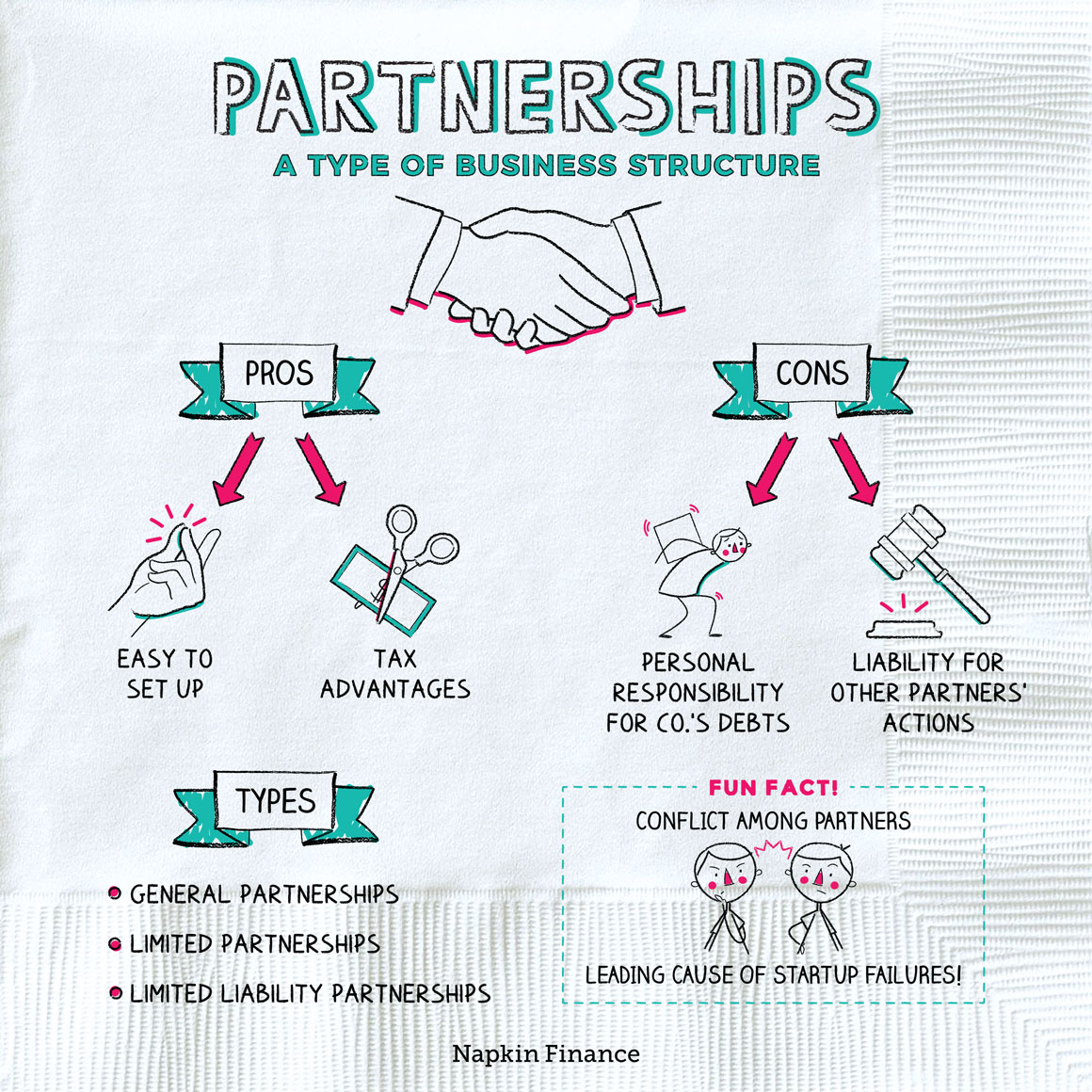

Business partnerships, once the cornerstone of entrepreneurial dreams, can sometimes fracture. Navigating a partnership dissolution requires immediate action and meticulous planning to protect your assets and future.

The Inevitable Split: Preparing for a Business Divorce

The decision to dissolve a business partnership is rarely easy, yet often necessary. Understanding the legal and financial implications is crucial for a smooth transition.

Reviewing the Partnership Agreement: The Foundation

The first step is a thorough review of your partnership agreement. This document outlines the procedures for dissolution, asset division, and handling liabilities.

Without one, state law will dictate the process, potentially leading to unfavorable outcomes. Seek legal counsel immediately to understand your rights and obligations.

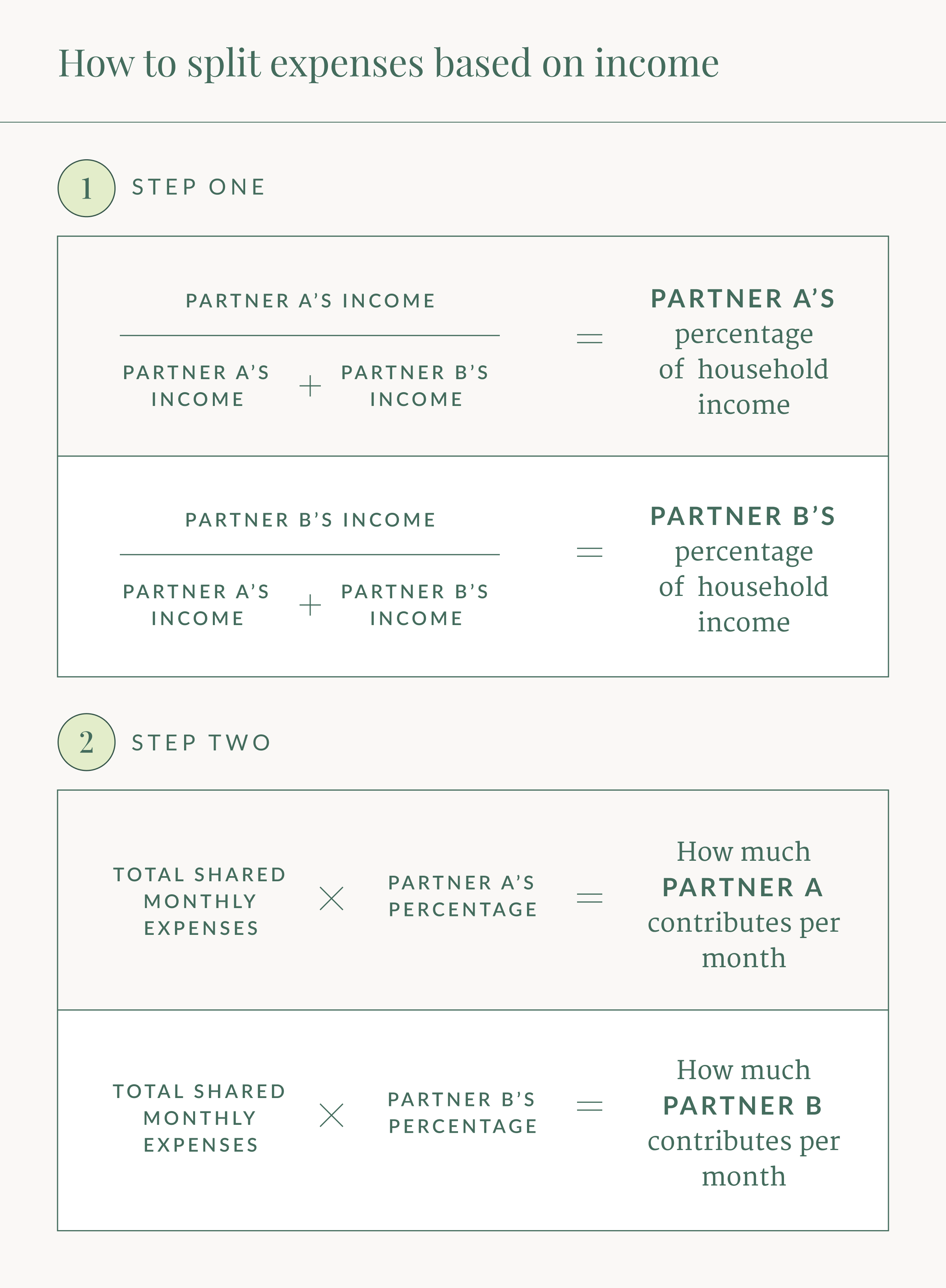

Valuation and Asset Division: Determining Fair Shares

Accurately valuing the business is critical. Employ a qualified appraiser to determine the fair market value of the company's assets, including tangible property, intellectual property, and goodwill.

Negotiate asset division based on the partnership agreement or, in its absence, through mediation or arbitration. Disputes over valuation can significantly delay the process.

Debt and Liability Allocation: Who Pays What?

Clearly define how existing debts and liabilities will be handled. Joint and several liability means each partner is responsible for the entire debt, regardless of the agreed-upon split.

Secure releases from creditors and update loan agreements to reflect the new ownership structure. Failure to address liabilities can result in personal financial ruin.

Legal Documentation: Formalizing the Dissolution

A formal dissolution agreement is essential. This legally binding document outlines the terms of the separation, including asset distribution, liability allocation, and non-compete clauses.

File the necessary paperwork with state and local authorities to officially dissolve the partnership. Consult with an attorney to ensure all legal requirements are met.

Tax Implications: Minimizing the Burden

Dissolving a partnership has significant tax consequences. Consult with a tax professional to understand the tax implications of asset distribution and debt forgiveness.

Plan strategically to minimize your tax burden and avoid costly penalties. Ignoring tax implications can lead to audits and legal troubles.

Communication: Keeping Stakeholders Informed

Inform clients, vendors, and employees about the partnership dissolution. Transparency is crucial to maintaining trust and minimizing disruption to the business.

Develop a communication plan to address concerns and ensure a smooth transition for all stakeholders. Failure to communicate effectively can damage your reputation.

Alternatives to Dissolution: Exploring Other Options

Consider alternatives to dissolution, such as buying out a partner or restructuring the business. Mediation can help facilitate these discussions.

Explore all options before committing to dissolution to ensure it's the best course of action. Dissolution is often irreversible, so consider all angles.

The Urgency of Action: Protecting Your Future

Separating from a business partner requires immediate and decisive action. Protect your assets, reputation, and future by seeking professional guidance and acting swiftly.

Ignoring the complexities of partnership dissolution can lead to protracted legal battles and financial hardship. Don't delay, act now.

Next steps involve gathering all relevant documents, scheduling a consultation with a business attorney, and developing a comprehensive plan for dissolution. The future of your business depends on it.