How To Set Up A Payroll Deduction In Quickbooks Desktop

Imagine the satisfaction of streamlining your business finances, knowing every deduction is accurately accounted for, effortlessly managed within your QuickBooks Desktop. The relief of avoiding manual errors and staying compliant with ever-changing regulations is palpable. This feeling is attainable, and we're here to guide you through the process.

This article provides a step-by-step guide on how to set up payroll deductions in QuickBooks Desktop. Mastering this process not only simplifies your payroll but also ensures accuracy and compliance.

Understanding Payroll Deductions

Payroll deductions are amounts withheld from an employee's gross pay for various reasons. These can include taxes, insurance premiums, retirement contributions, and other voluntary deductions.

Properly managing these deductions is crucial for maintaining accurate financial records and avoiding legal issues.

Common Types of Deductions

Deductions broadly fall into two categories: mandatory and voluntary. Mandatory deductions include federal, state, and local taxes, as well as social security and Medicare contributions.

Voluntary deductions encompass items like health insurance premiums, retirement plan contributions (401(k)s), and charitable donations.

Understanding the specific types relevant to your employees is the first step in proper setup.

Setting Up a New Deduction Item in QuickBooks Desktop

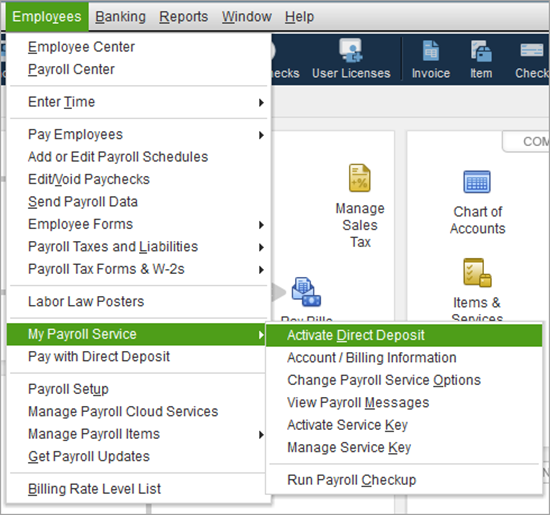

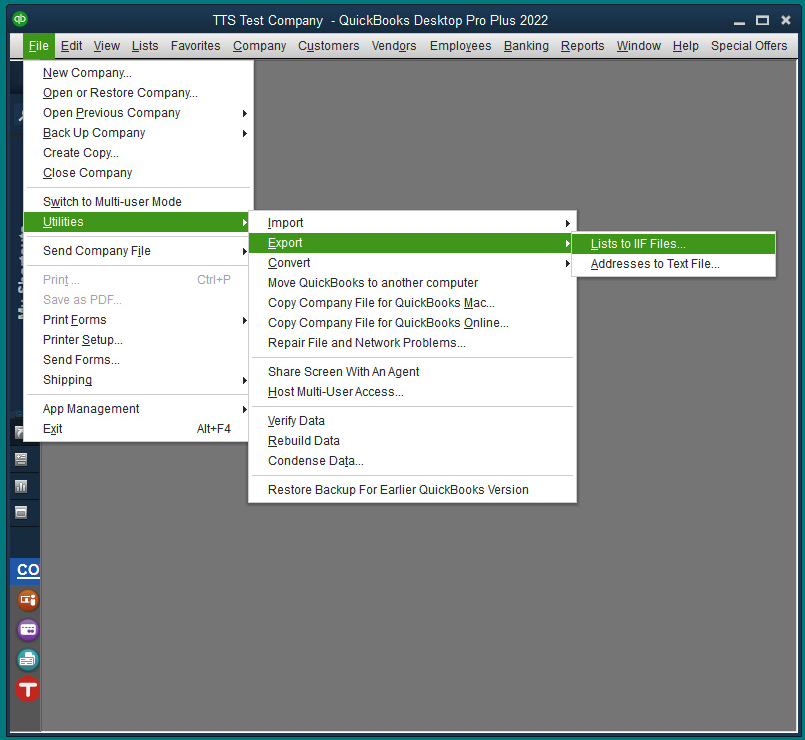

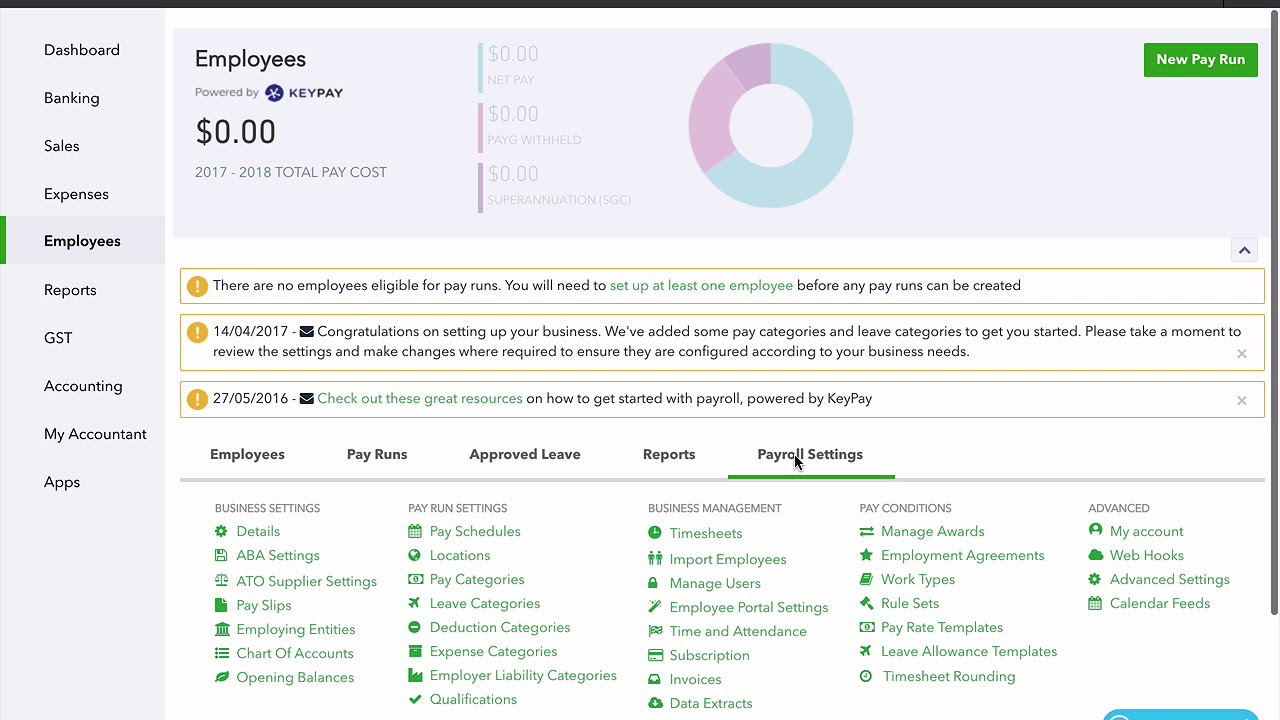

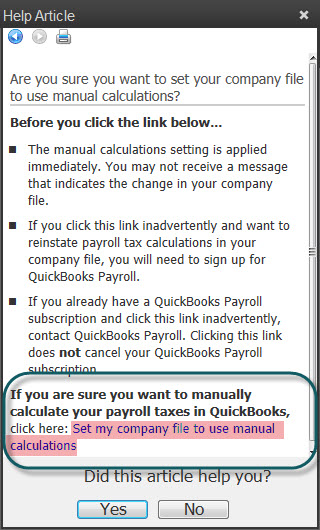

First, navigate to the "Lists" menu and select "Payroll Item List." This is where you'll manage all your payroll-related items.

Next, click the "Payroll Item" button at the bottom left and choose "New." This starts the process of creating a new deduction item.

Choosing the Deduction Type

QuickBooks Desktop will ask you to choose the type of payroll item. Select "Deduction" and click "Next."

You’ll then be prompted to select a deduction name; use a clear, descriptive name (e.g., "Health Insurance Premium"). Next, assign a number for easy identification.

Selecting the Agency and Liability Account

Identify the agency to which the deduction is paid, if applicable (e.g., the insurance company). This will likely be different based on the deduction being set up.

Then, choose the liability account where the deducted funds will be tracked until they are paid to the agency.

This ensures accurate accounting of your payroll liabilities.

Calculating the Deduction

Select the calculation method for the deduction: percentage, fixed amount, or amount per hour. Input all the information needed to complete the setup.

Enter any applicable limits or thresholds for the deduction, especially for retirement plan contributions.

Review all settings carefully before clicking "Finish."

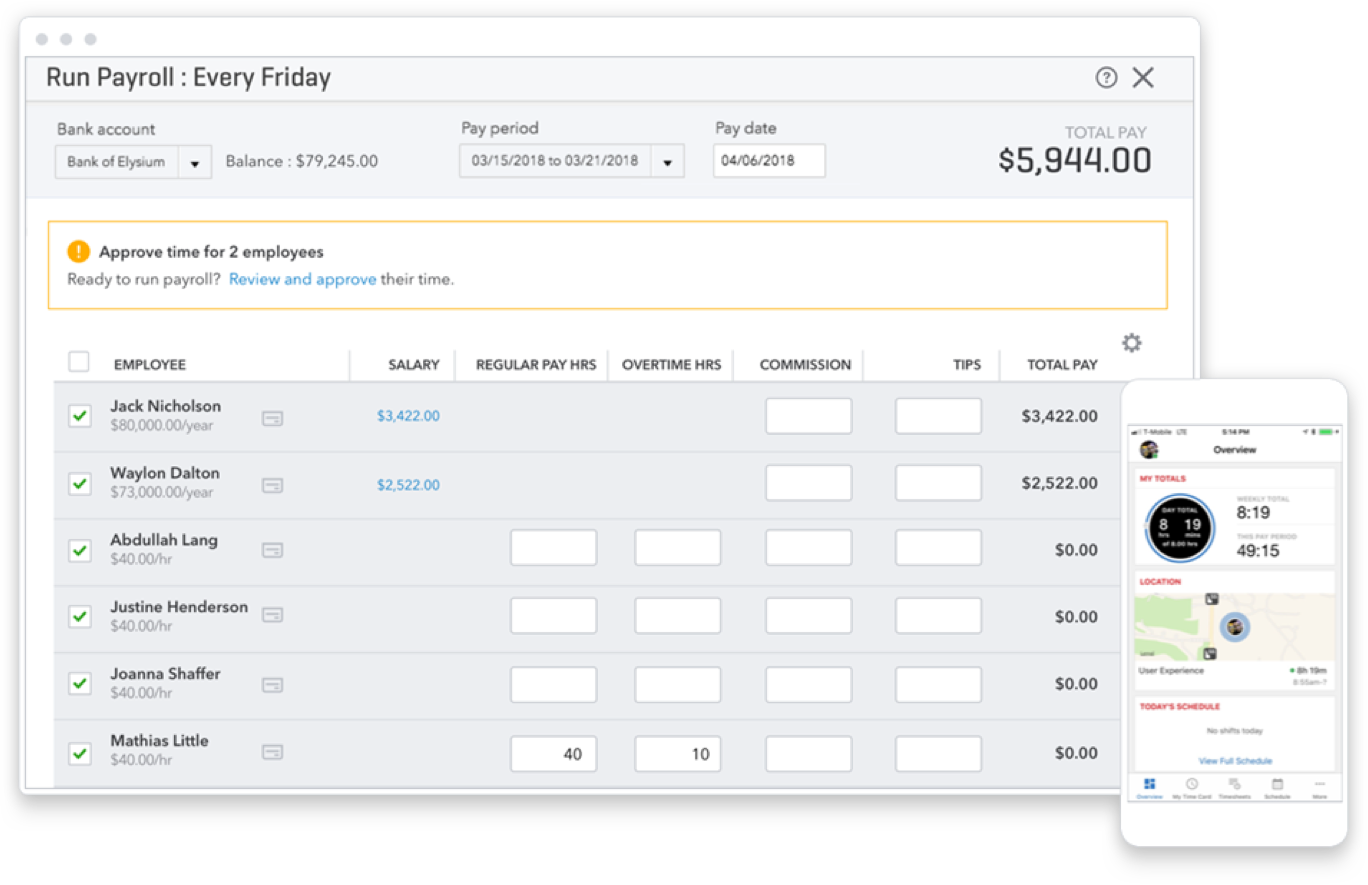

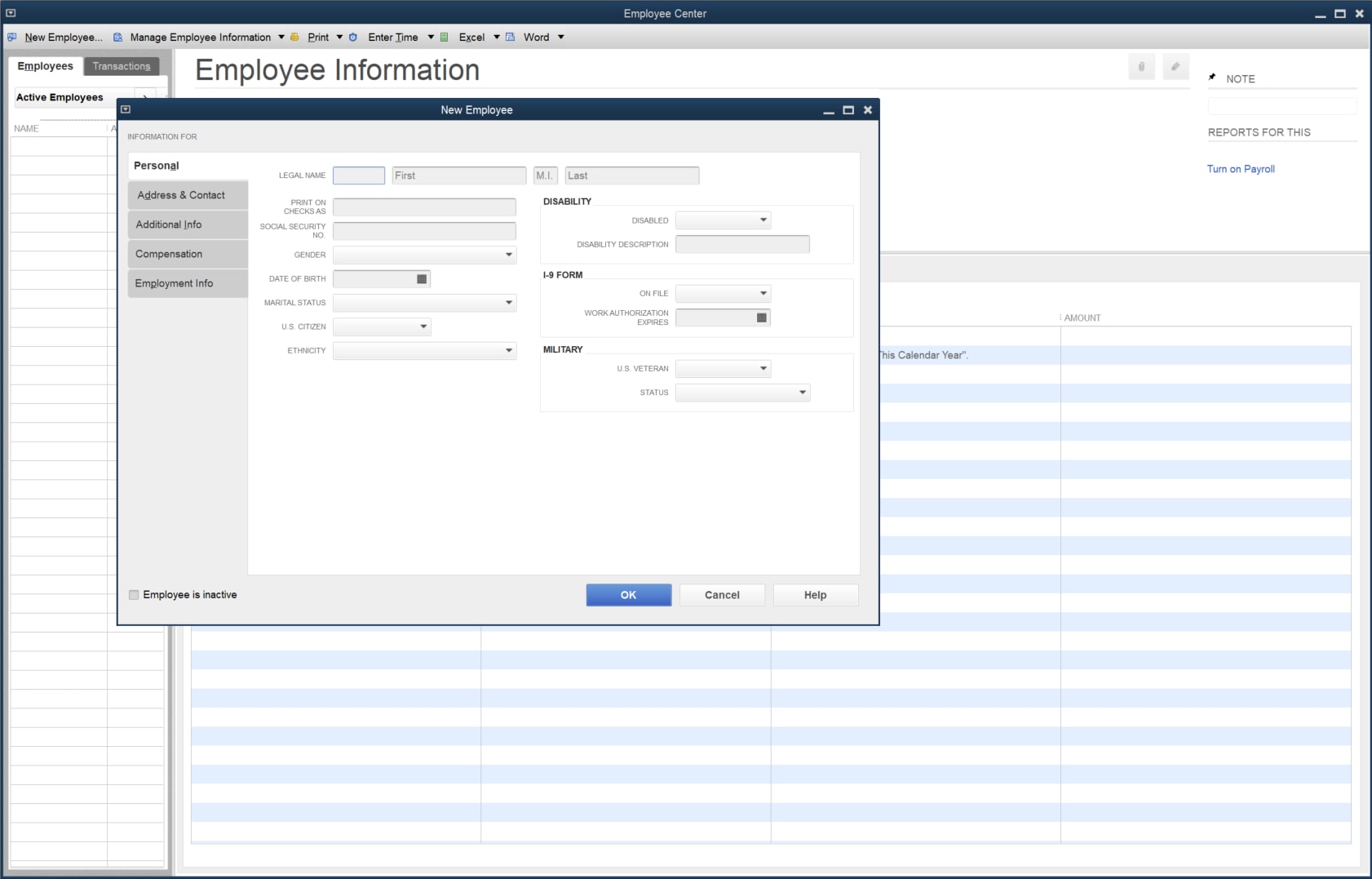

Assigning the Deduction to Employees

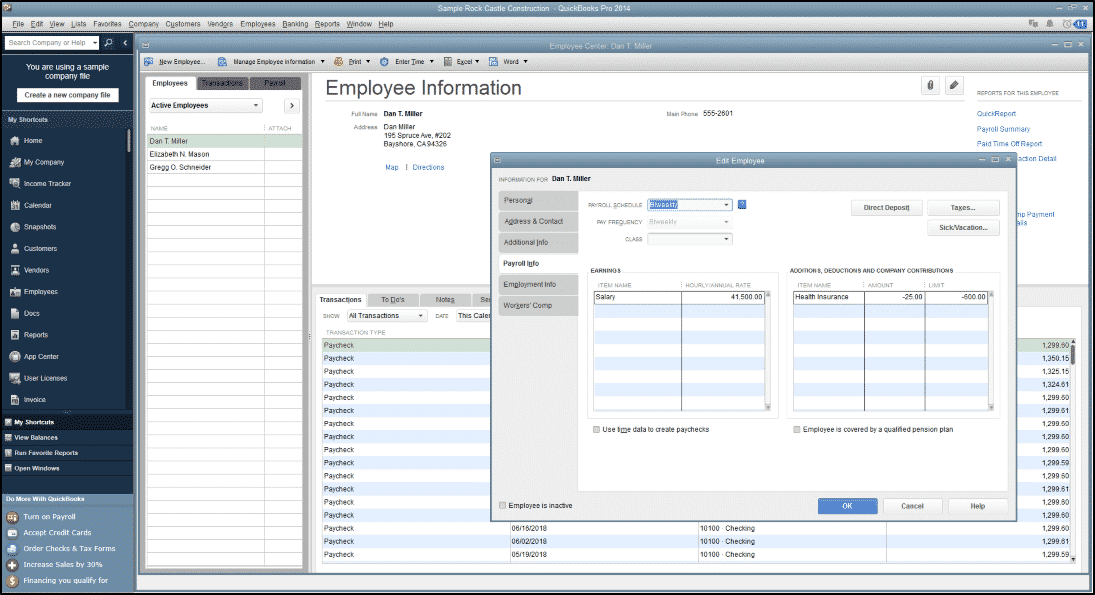

Once the deduction item is set up, you must assign it to the appropriate employees. To do this, open the "Employee Center" and select the relevant employee.

Click on the "Payroll Info" tab and then "Additions, Deductions, and Contributions." Select the newly created deduction item from the dropdown menu.

Enter the deduction amount or percentage for that employee, which is essential for accurate withholding.

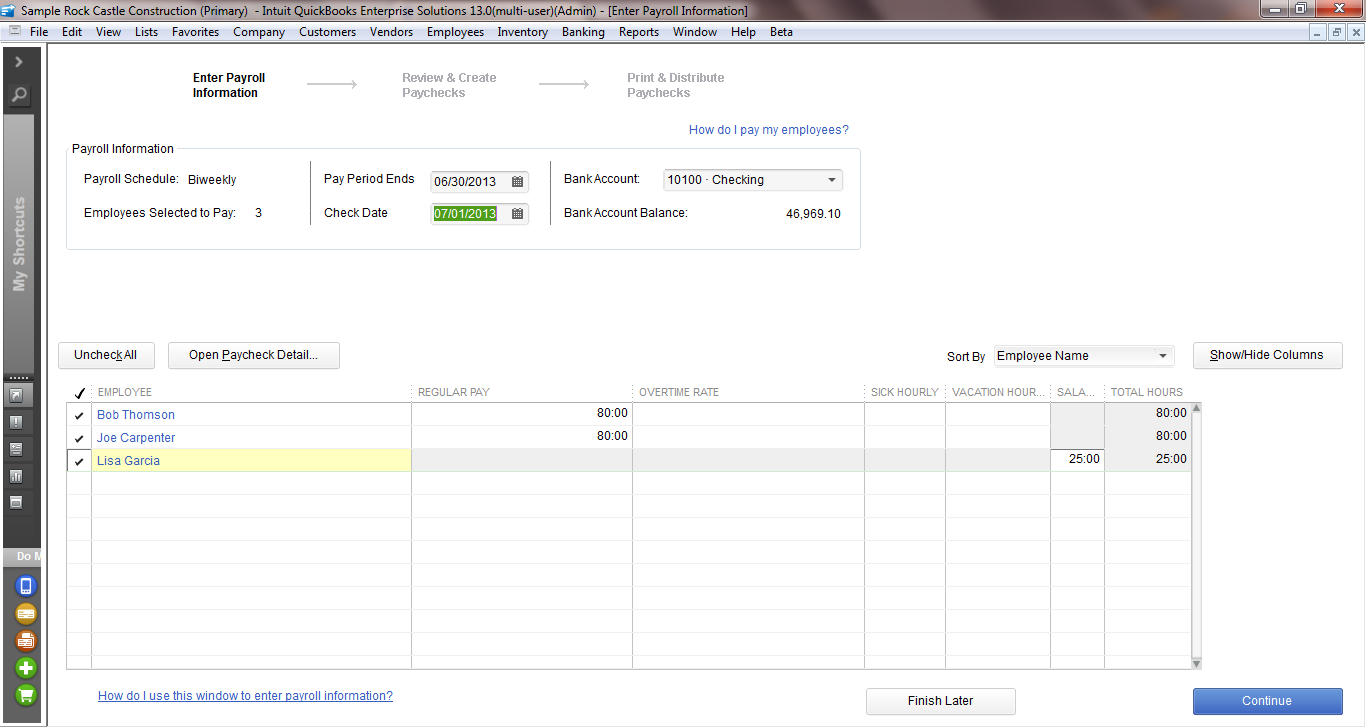

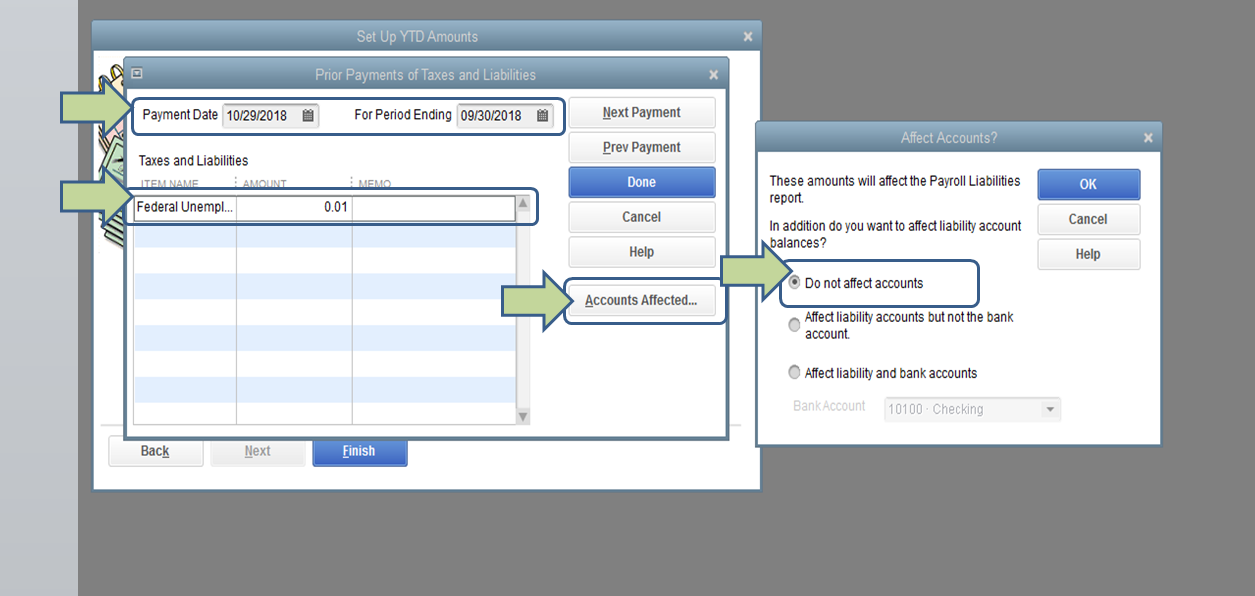

Verifying the Setup

Run a test payroll to verify that the deduction is being calculated correctly. Review the employee's paycheck to ensure the deduction is accurate.

Double-check your liability reports to confirm that the deducted amounts are being tracked correctly. This ensures accuracy in your financial reporting.

Staying Compliant

Payroll regulations are constantly evolving, so stay informed about changes in tax laws and deduction rules. Consult with a payroll professional or tax advisor to ensure compliance.

Regularly review your payroll setup to identify and address any potential issues. Proactive monitoring is key to maintaining accurate and compliant payroll.

Setting up payroll deductions in QuickBooks Desktop may seem daunting at first, but with careful attention to detail and a systematic approach, you can streamline your payroll process and ensure compliance. Embracing these steps brings peace of mind, knowing your business is operating efficiently and accurately. Remember, you are building a stronger foundation for your business's financial future, one deduction at a time.