How To Set Up Multiple Streams Of Income

In an era defined by economic uncertainty and evolving job markets, the concept of establishing multiple streams of income has moved from a niche strategy to a mainstream financial goal. Individuals are increasingly seeking ways to diversify their earnings beyond a single job, aiming for greater financial security and independence.

This approach involves generating income from various sources, reducing reliance on any one particular avenue. The "how" of building these income streams varies significantly, depending on individual skills, resources, and risk tolerance.

Identifying Potential Income Streams

The first step in setting up multiple income streams is identifying potential sources that align with your skills and interests. These can be broadly categorized into active and passive income.

Active Income Streams

Active income requires direct effort and time investment. This includes freelancing, consulting, part-time jobs, and creating and selling services.

Platforms like Upwork and Fiverr facilitate connections between freelancers and clients needing specific skills. Teaching online courses or tutoring can also generate a consistent income stream, leveraging existing expertise.

For example, a marketing professional might offer freelance social media management services, while a software developer could build and sell custom applications.

Passive Income Streams

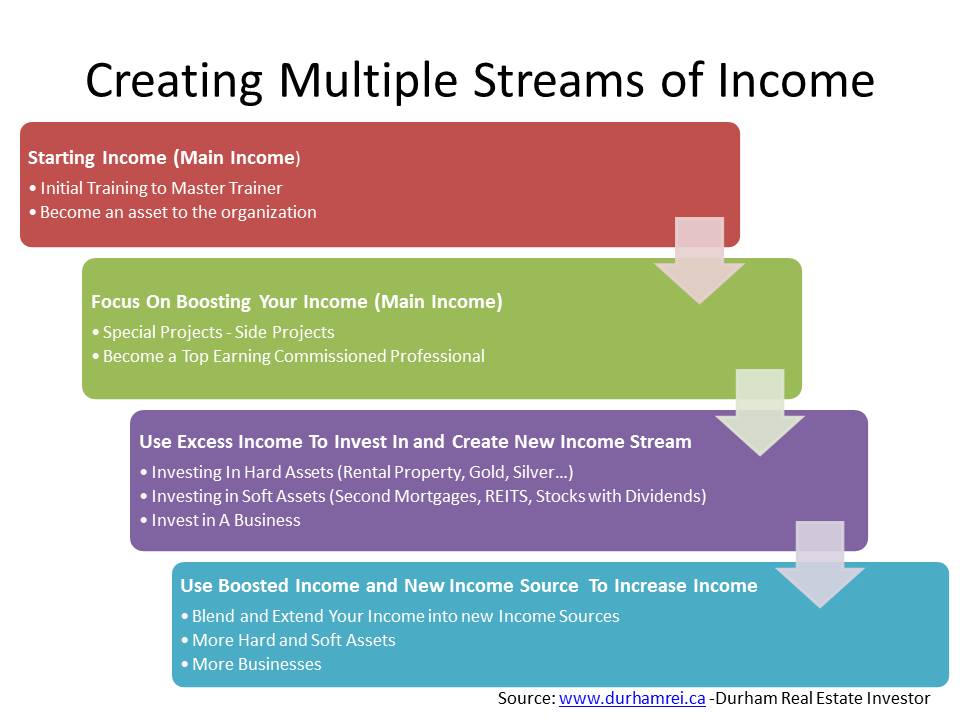

Passive income, while requiring initial effort to set up, generates revenue with minimal ongoing involvement. Common examples include investing in dividend-paying stocks, creating and selling digital products like e-books or online courses, and affiliate marketing.

Real estate investing, through rental properties or REITs (Real Estate Investment Trusts), can provide a stream of passive income. However, it also requires significant capital and due diligence.

Creating and selling online courses requires initial effort in content creation, but can generate recurring revenue over time. Affiliate marketing involves promoting other companies' products and earning a commission on sales.

Building and Managing Your Streams

Once you've identified potential income streams, the next step is to build and manage them effectively. This involves careful planning, time management, and ongoing monitoring.

Start with one or two streams and gradually expand as you gain experience and confidence. Prioritize those that align with your existing skills and require minimal upfront investment.

Time management is crucial. Dedicate specific blocks of time to each income stream to ensure consistent progress. Using tools like calendars, to-do lists, and project management software can improve efficiency.

Considerations and Risks

While multiple income streams offer numerous benefits, it's important to be aware of potential challenges. These include increased workload, potential burnout, and financial risks associated with different investments.

It is important to consult with a financial advisor before investing in any income-generating assets. Tax implications also need careful consideration.

Building multiple income streams takes time and effort. It is not a get-rich-quick scheme. Patience and persistence are key.

The Impact on Financial Security

The primary benefit of establishing multiple income streams is increased financial security. Diversifying income reduces the risk of financial hardship if one source is disrupted.

Multiple income streams can accelerate debt repayment, build savings, and achieve financial goals more quickly. They provide a buffer against unexpected expenses and job loss.

Ultimately, the pursuit of multiple income streams empowers individuals to take control of their financial destinies. It fosters a sense of security and provides greater opportunities for personal and professional growth.

![How To Set Up Multiple Streams Of Income How to Create Multiple Streams of Income [7 Proven Methods]](https://themillennialmoneywoman.com/wp-content/uploads/2022/02/How-to-Create-Multiple-Streams-of-Income.webp)