How To Shutdown A Business Checklist

Businesses closing their doors need a meticulous plan to avoid legal pitfalls and ensure a smooth wind-down. This checklist outlines the critical steps for a responsible business shutdown.

Navigating the complexities of closing a business requires attention to detail and legal compliance. Ignoring necessary procedures can result in significant financial and legal repercussions.

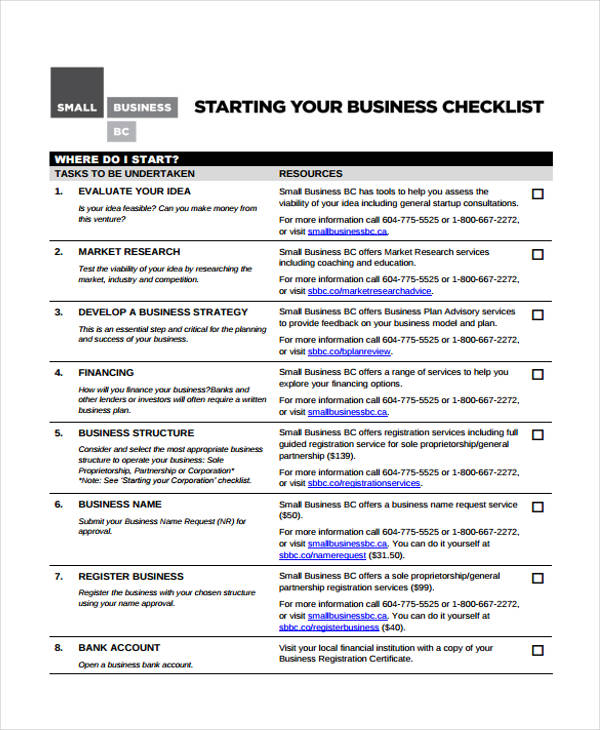

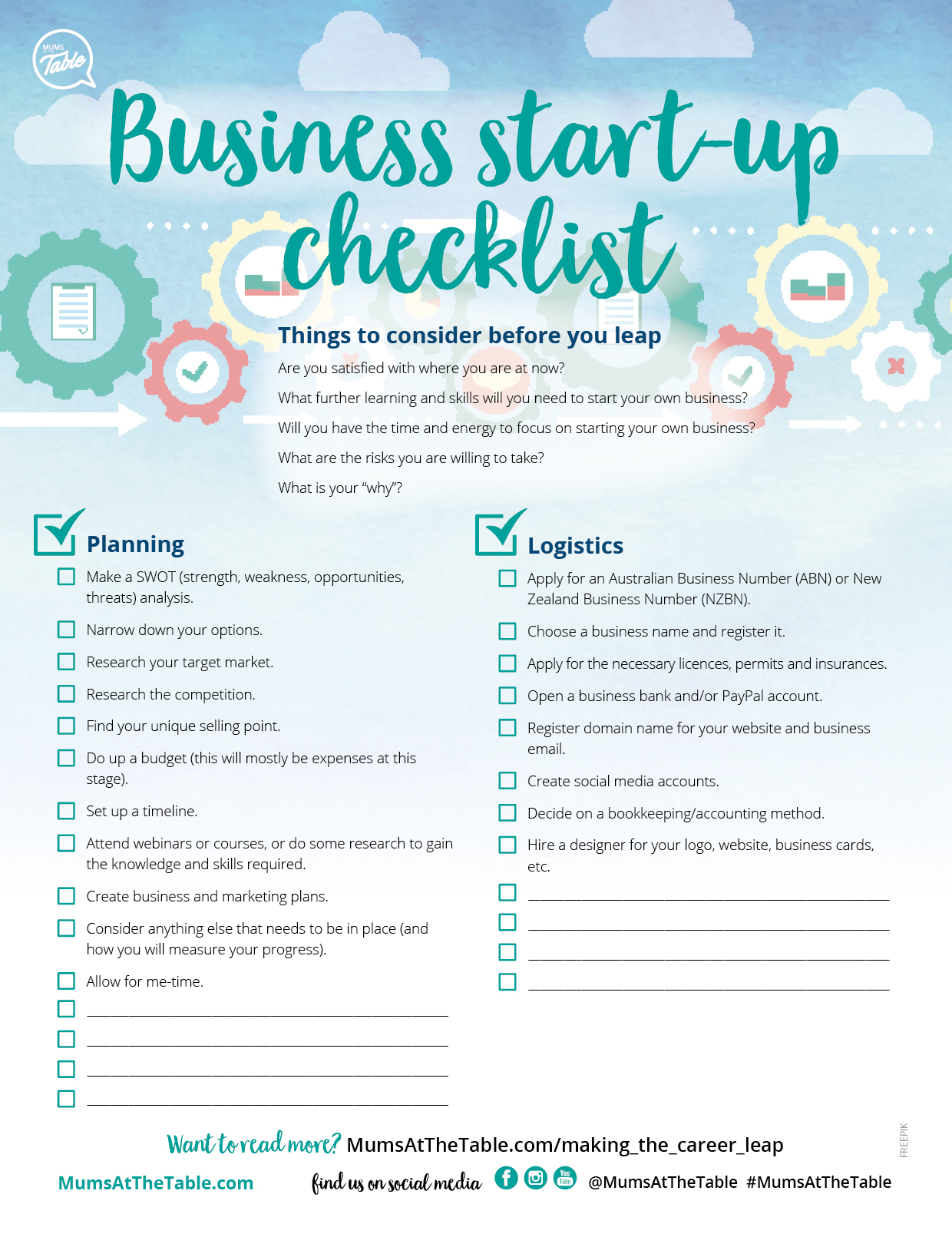

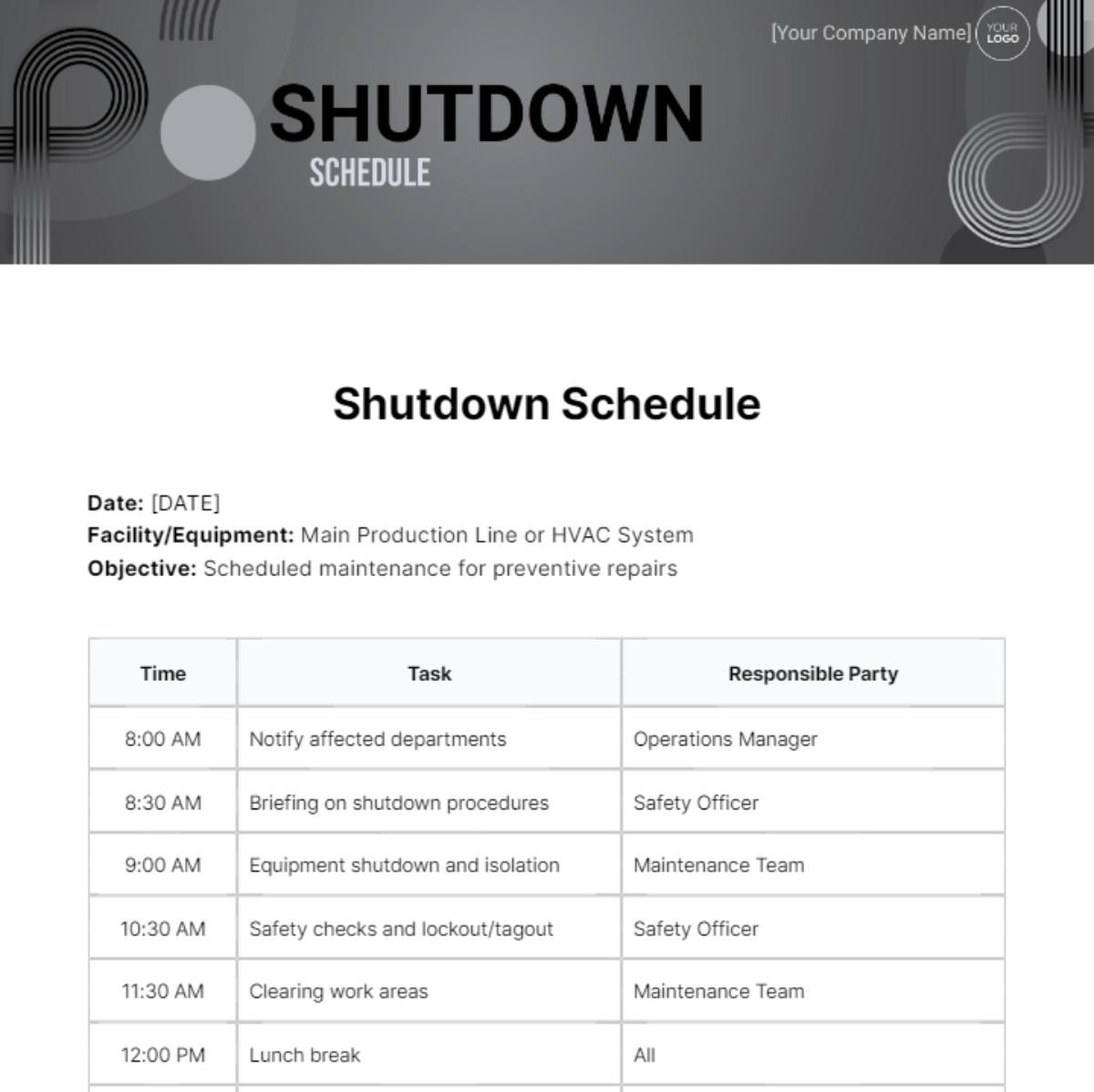

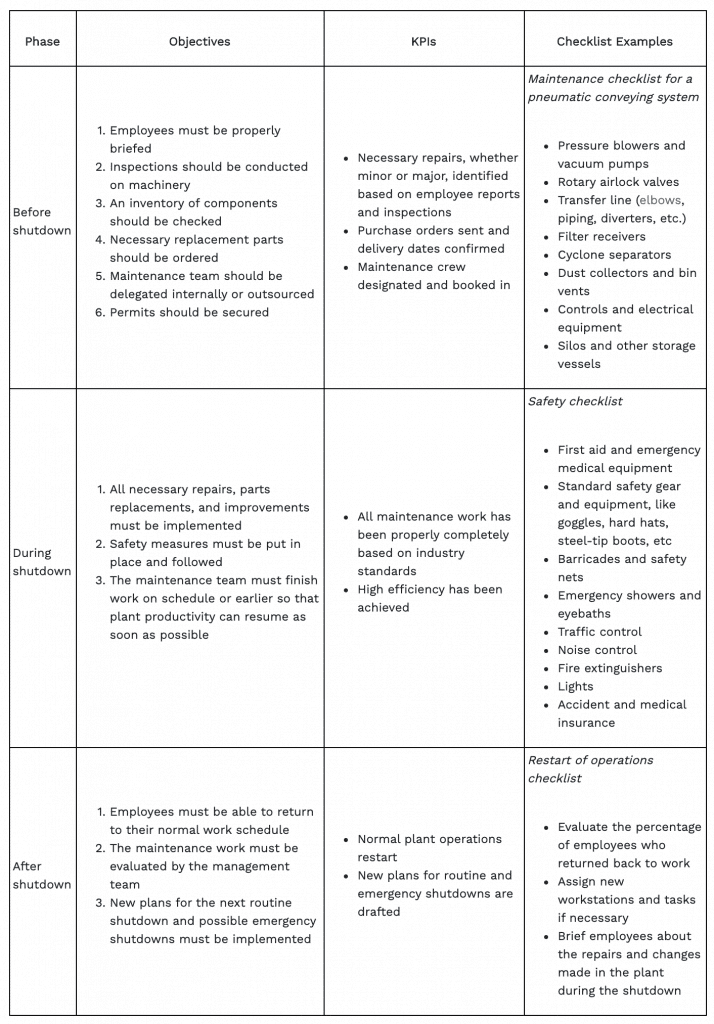

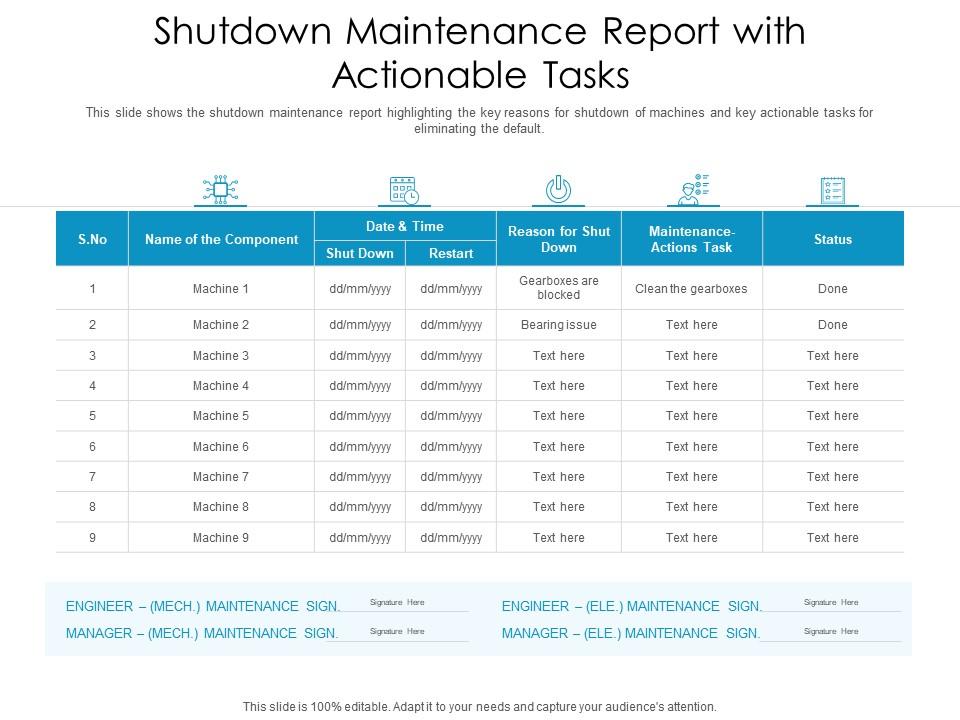

Phase 1: Initial Assessment & Planning

First, assess your financial standing. Understand your debts, assets, and available resources to formulate a realistic closure strategy.

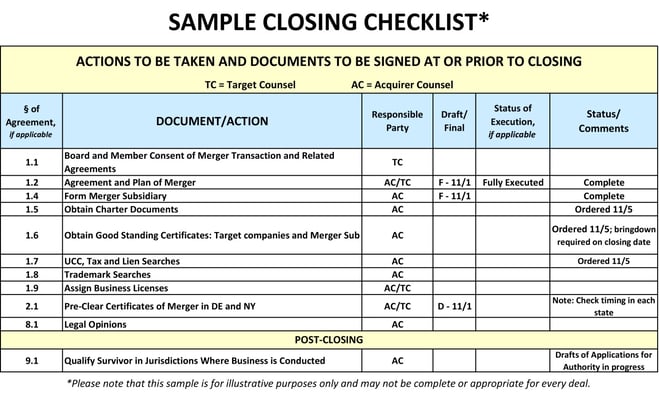

Next, review all relevant legal documents. This includes partnership agreements, shareholder agreements, and loan documents, identifying any specific obligations related to closure.

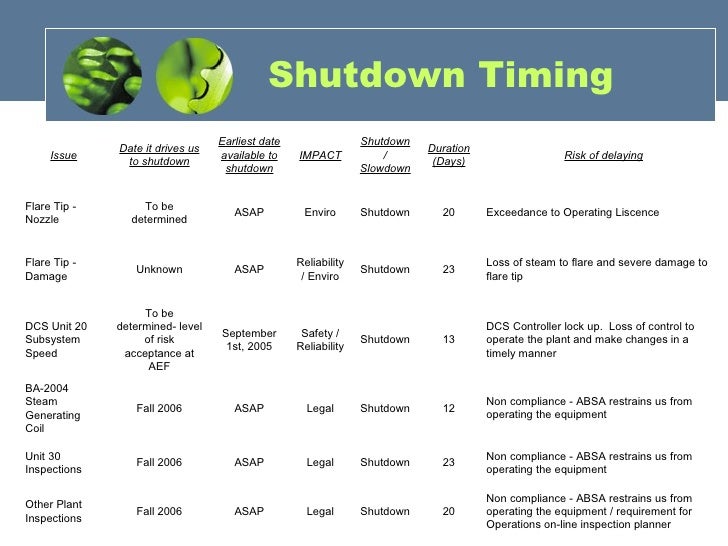

Then, create a detailed timeline for the shutdown process. This will help you stay organized and ensure all deadlines are met.

Phase 2: Legal & Regulatory Compliance

Inform relevant government agencies of your closure. Contact the IRS, state tax agencies, and any other regulatory bodies that oversee your operations.

Settle all outstanding tax obligations. Ensure all federal, state, and local taxes are paid to avoid future penalties.

Address any outstanding permits and licenses. Officially cancel or transfer these as required by local regulations.

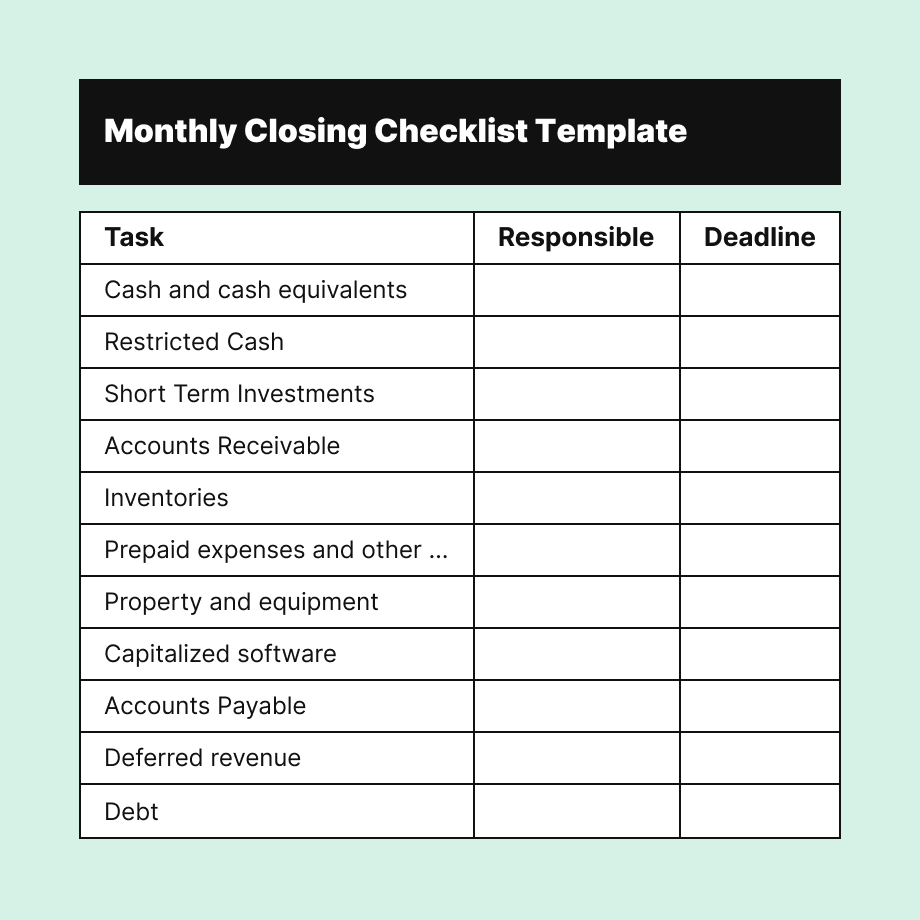

Phase 3: Financial Obligations & Asset Liquidation

Prioritize paying off debts. Focus on secured creditors first, followed by unsecured creditors, adhering to legal guidelines for liquidation.

Liquidate remaining assets. Consider selling equipment, inventory, and other assets to generate funds for debt repayment.

Close business bank accounts. Ensure all final transactions are processed before closing the accounts to avoid complications.

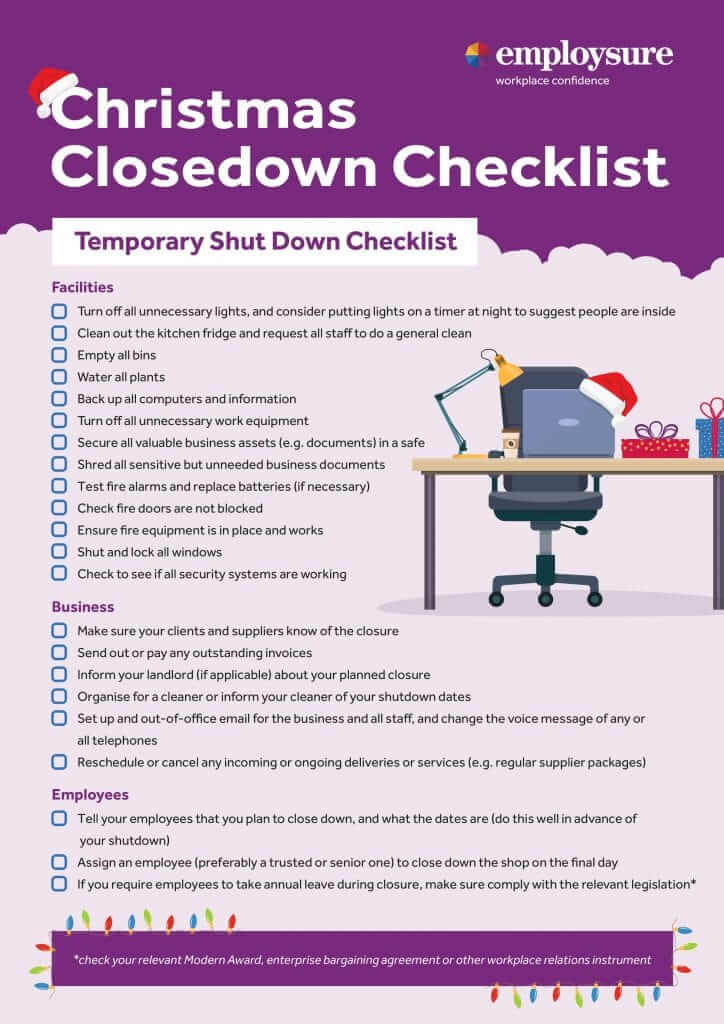

Phase 4: Employee Considerations

Communicate the closure to employees with ample notice. Provide as much advance warning as possible, adhering to the Worker Adjustment and Retraining Notification (WARN) Act if applicable.

Fulfill all final payroll obligations. Ensure employees receive their final wages, accrued vacation time, and any severance pay they are entitled to.

Provide information about unemployment benefits. Assist employees in understanding their eligibility and the application process.

Phase 5: Customer & Vendor Communication

Notify customers of the closure. Inform them of any changes to services or product availability, and provide alternative solutions where possible.

Settle accounts with vendors and suppliers. Ensure all outstanding invoices are paid and contracts are properly terminated.

Handle customer data responsibly. Comply with privacy laws regarding the storage and disposal of customer information.

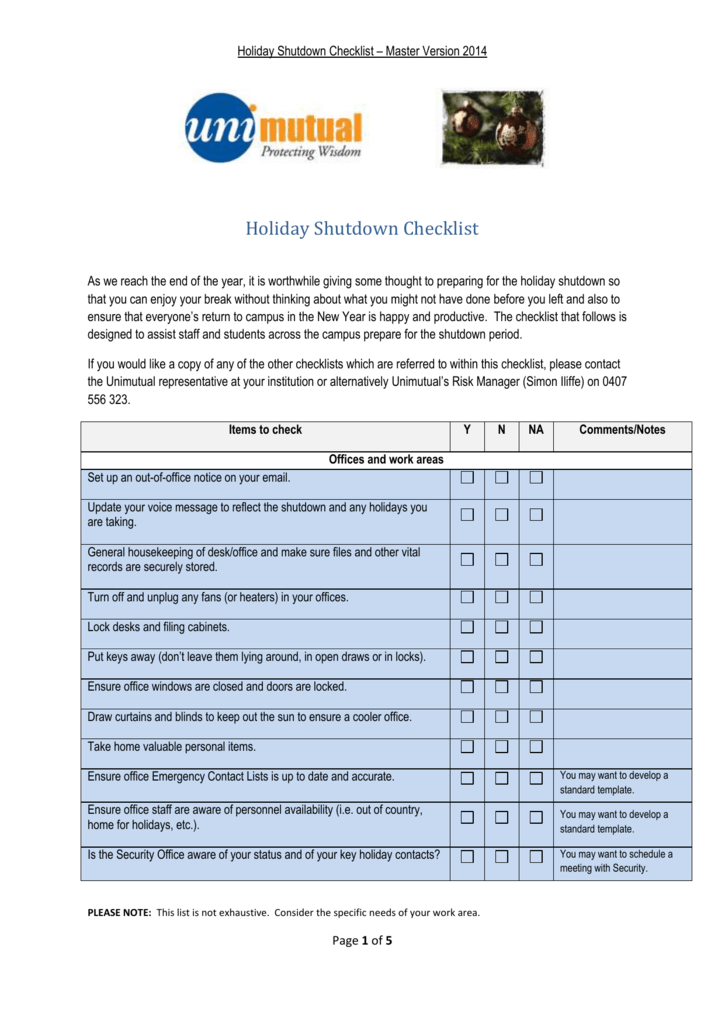

Phase 6: Documentation & Record Keeping

Maintain accurate records of all transactions. Keep records of all financial transactions, legal documents, and communications related to the closure.

Store records securely. Ensure records are stored in a safe and accessible location for the required retention period.

Consult with legal and financial professionals. Seek expert advice to ensure compliance with all applicable laws and regulations throughout the closure process.

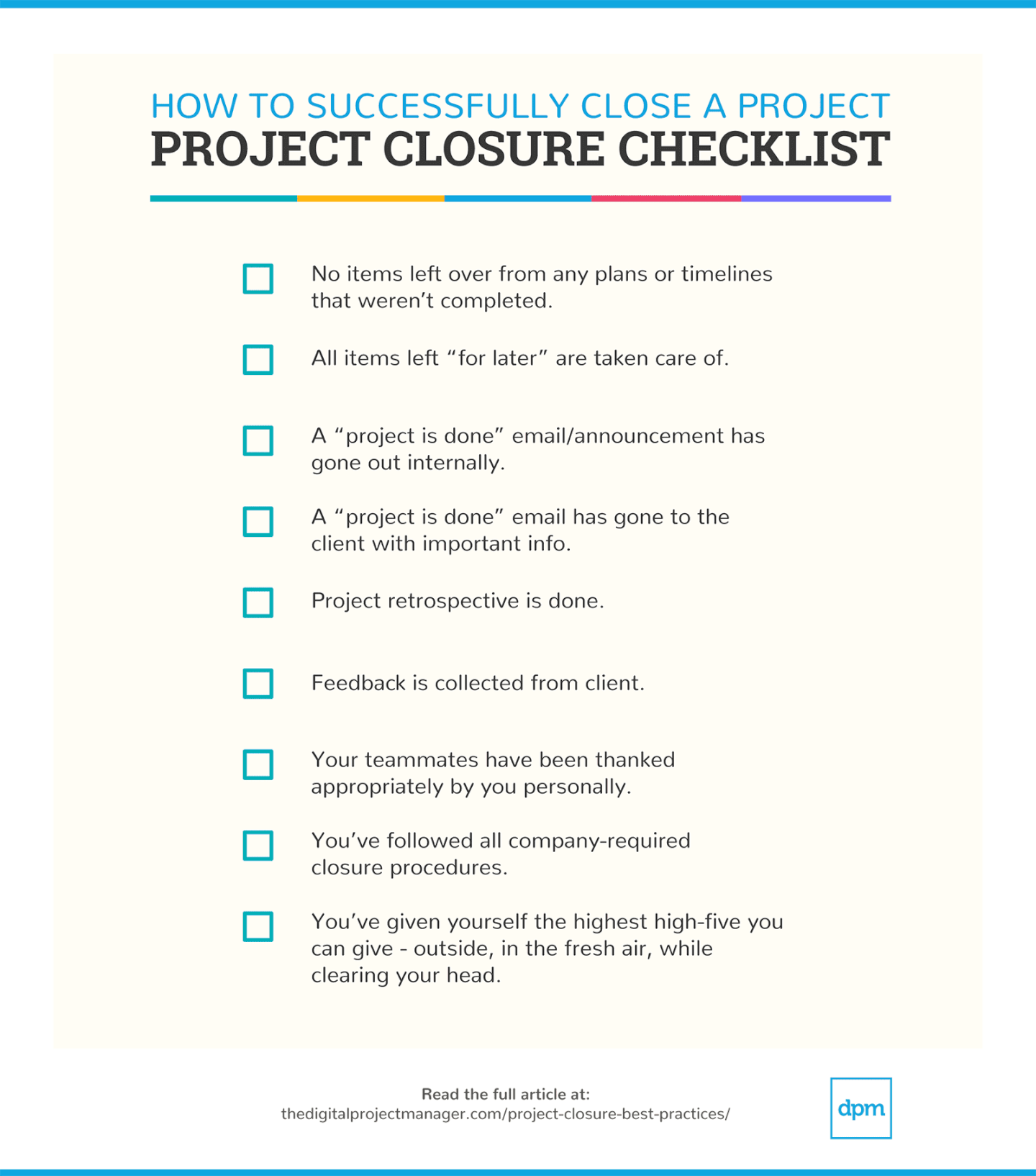

Failure to follow this checklist can lead to legal and financial complications. Business owners should immediately consult with legal and financial advisors to navigate the process.

The information provided serves as a guide and is not a substitute for professional advice from qualified legal and financial experts.