Bank Of The James Cd Rates

In an era defined by economic uncertainty and fluctuating interest rates, savers are increasingly seeking secure havens for their capital. Bank of the James, a regional institution with deep roots in the communities it serves, is under scrutiny for its Certificate of Deposit (CD) rates, as customers weigh the potential for growth against the backdrop of market volatility.

This article delves into the intricacies of Bank of the James' CD offerings, examining their competitiveness within the current financial landscape. It will explore the factors influencing these rates, providing readers with a comprehensive understanding to inform their investment decisions, all while considering expert analysis and the bank's strategic position.

Understanding CD Rates at Bank of the James

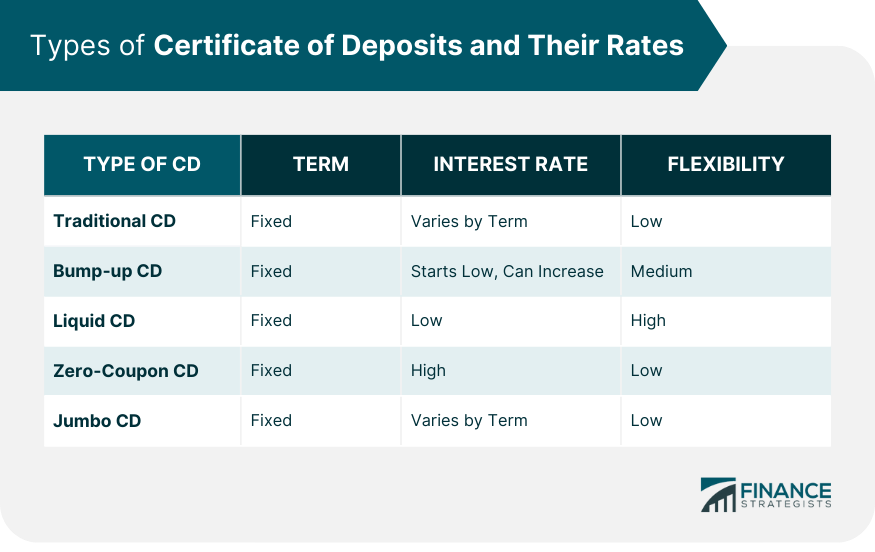

CDs, or Certificates of Deposit, are a type of savings account that holds a fixed amount of money for a fixed period of time, and in return, the bank pays a fixed interest rate. This makes them a relatively safe investment option, particularly attractive in times of market turbulence. Understanding the specifics of Bank of the James' CD rates requires looking at various term lengths and comparing them with those of competitors.

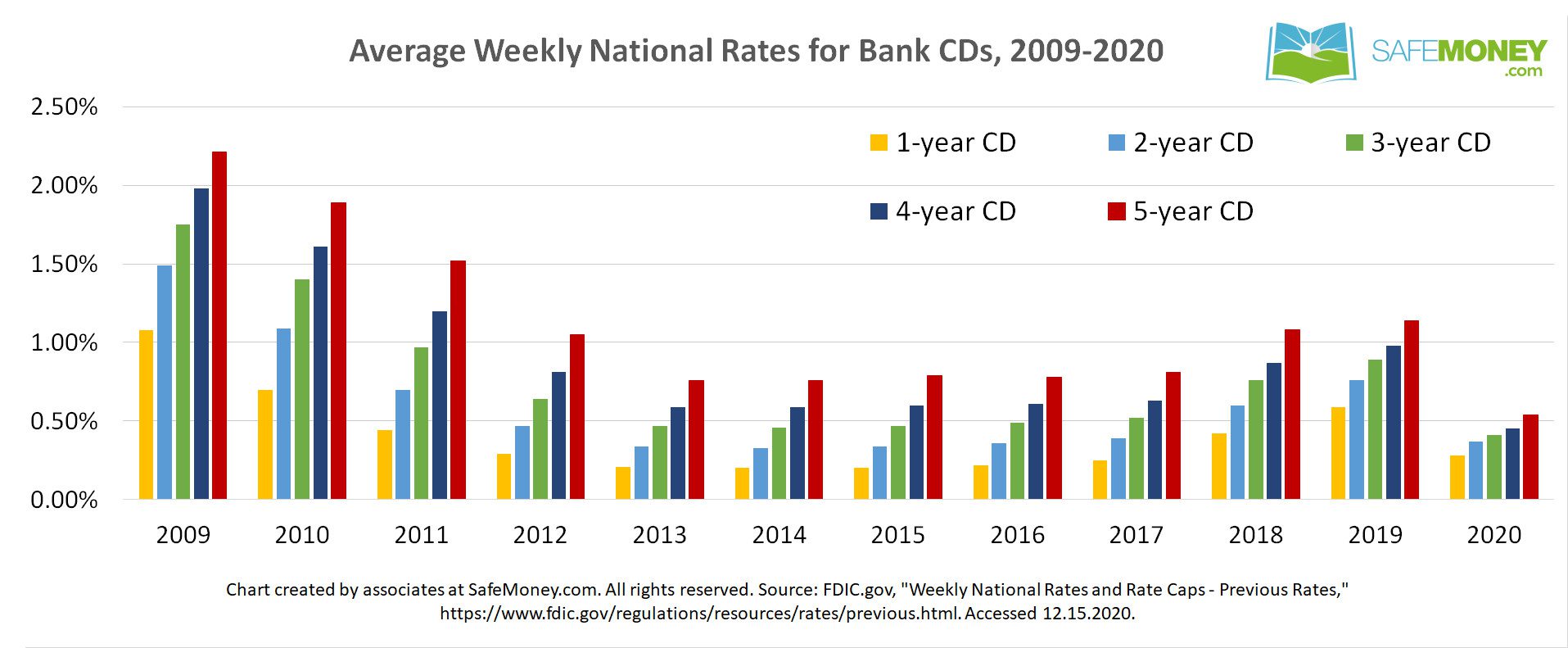

Currently, Bank of the James offers CDs with terms ranging from a few months to several years. The Annual Percentage Yield (APY) varies depending on the term, with longer terms generally offering higher rates to compensate for the longer lock-in period.

Competitive Analysis: How Bank of the James Stacks Up

Benchmarking Bank of the James' CD rates against national averages and other regional banks is crucial for potential investors. According to recent data from Bankrate and DepositAccounts.com, the average national CD rate for a 1-year term is around 5.00% as of late 2024. Bank of the James, at the time of this writing, offers a 1-year CD at an APY that is slightly below this national average.

However, the bank frequently runs promotional offers that can temporarily boost their rates above the average for specific terms. It's always advisable to check the bank's website or speak with a representative for the most up-to-date information.

The difference might seem small, but it could significantly impact the overall returns. Understanding these comparisons allows for a more informed choice when choosing to save.

Factors Influencing CD Rates

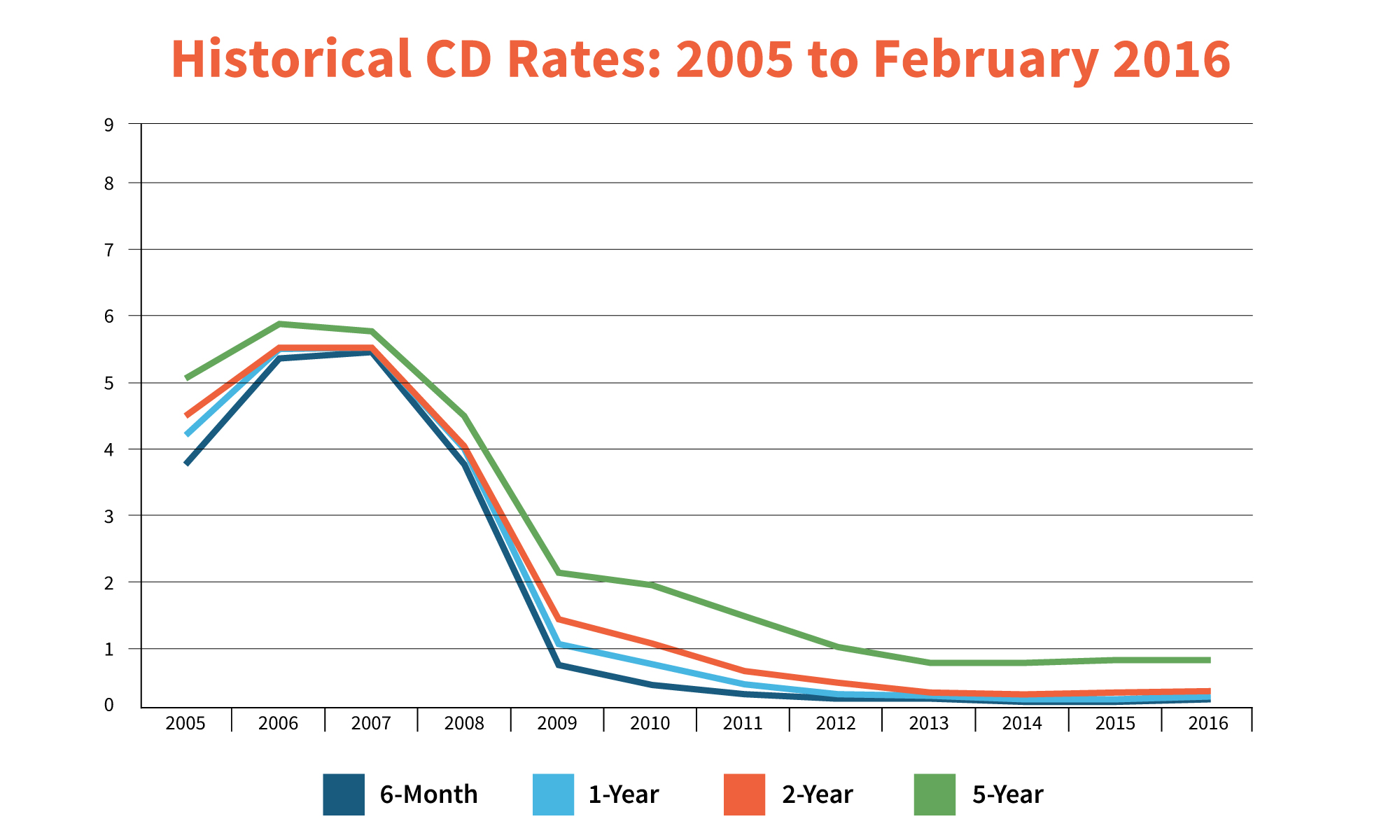

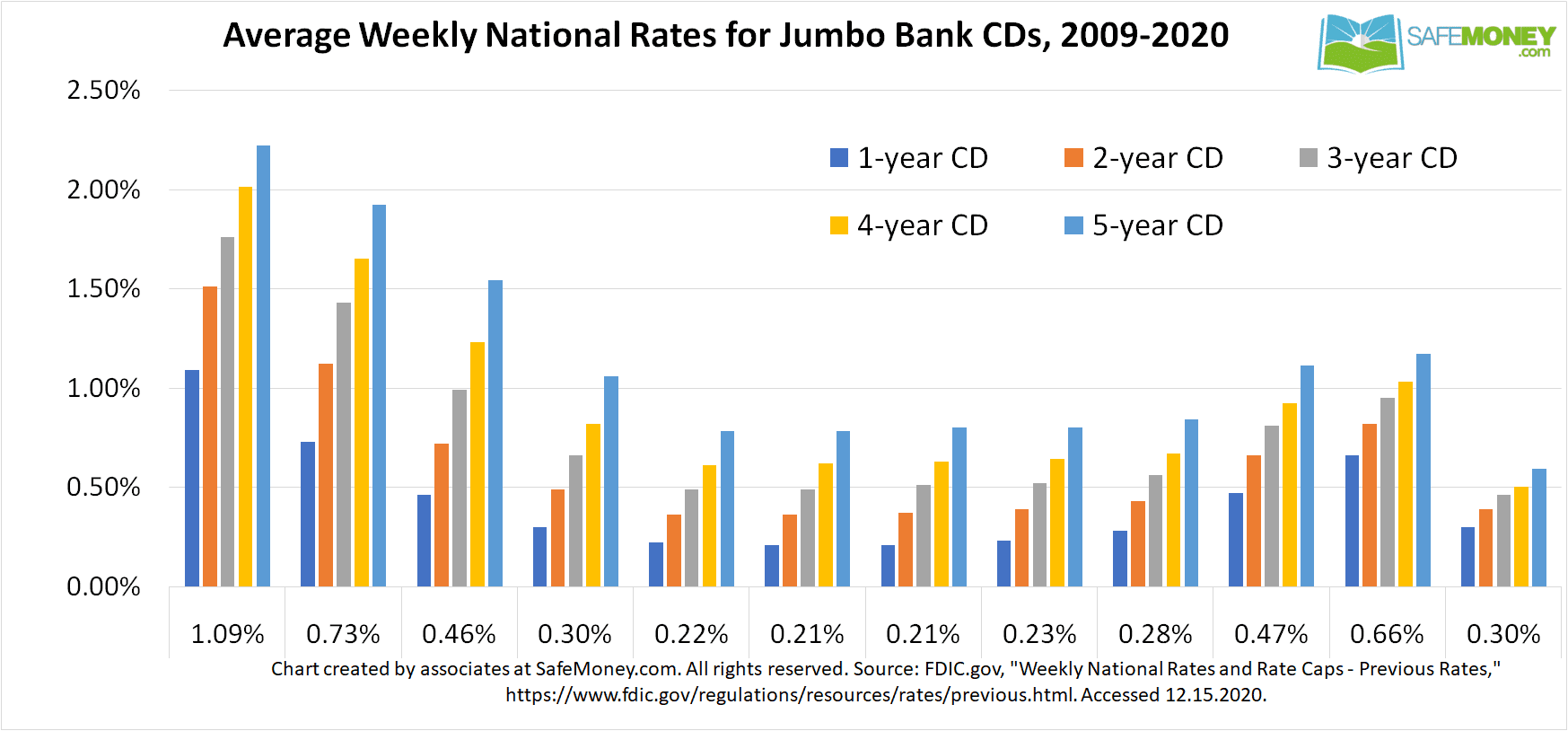

Several factors determine the CD rates offered by Bank of the James. The most prominent is the Federal Reserve's monetary policy.

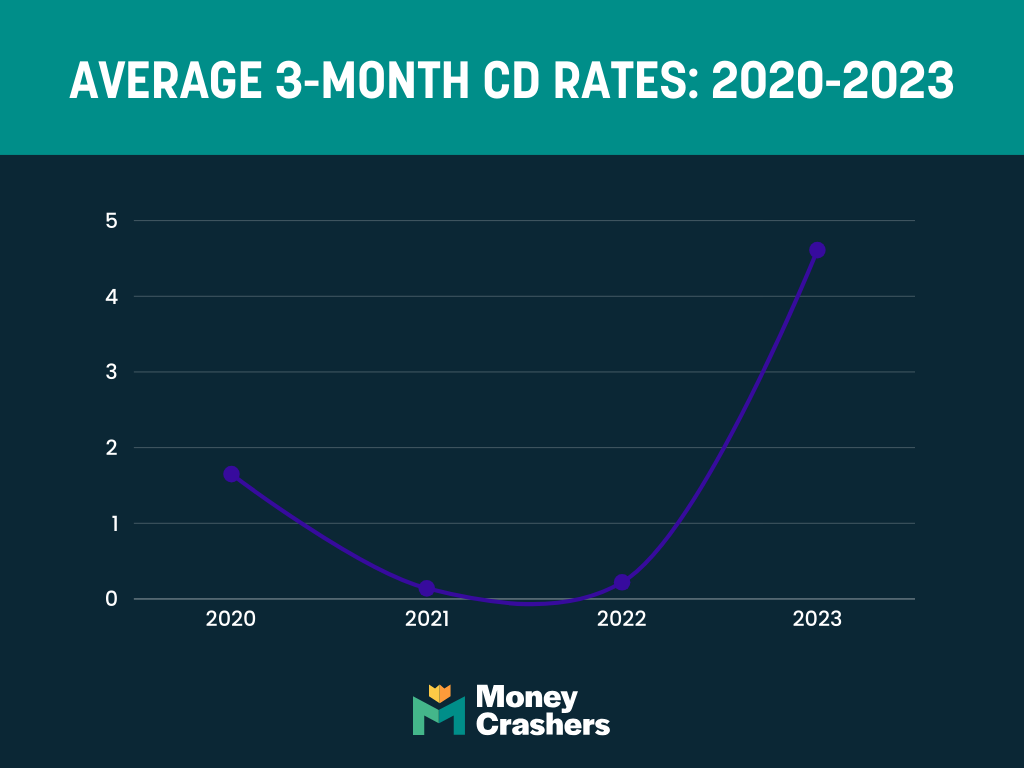

When the Fed raises interest rates, banks generally follow suit to attract deposits. Conversely, when the Fed lowers rates, CD rates tend to decrease as well. The current environment of high, but potentially stabilizing, interest rates makes it a particularly dynamic time for CD offerings.

Competition from other banks and credit unions also plays a role. Bank of the James must remain competitive to attract and retain customers. Finally, the bank's internal financial goals and asset-liability management strategy also influence rate decisions.

"We constantly monitor market conditions and adjust our rates to provide competitive returns for our customers while maintaining the bank's financial stability," said a representative from Bank of the James in a prepared statement.

Potential Benefits and Risks

Investing in CDs at Bank of the James, like any financial decision, comes with both potential benefits and risks. The primary benefit is the security of a fixed interest rate over a defined period.

This provides certainty in a volatile market and allows savers to plan their finances more effectively. Furthermore, Bank of the James is FDIC-insured, meaning deposits are protected up to $250,000 per depositor, per insured bank.

The primary risk is the potential for inflation to outpace the CD's interest rate. If inflation rises faster than the APY, the real return on the investment could be negative. Another risk is the illiquidity of CDs.

Withdrawing funds before the maturity date typically incurs a penalty, which can erode the earned interest. Therefore, it's crucial to choose a CD term that aligns with your financial needs and timeline.

Strategies for Maximizing Returns

Several strategies can help maximize returns on CDs at Bank of the James. One common approach is CD laddering.

This involves dividing your investment across CDs with varying maturity dates. As each CD matures, you can reinvest the principal and interest into a new CD, potentially capturing higher rates and maintaining liquidity. Another strategy is to take advantage of promotional offers and special rates that Bank of the James may occasionally offer. Always compare rates and terms carefully before making a decision.

Finally, consider the tax implications of CD interest. Interest earned on CDs is generally taxable as ordinary income. Consult with a financial advisor to determine the best tax strategy for your individual circumstances.

Looking Ahead: The Future of CD Rates at Bank of the James

The future of CD rates at Bank of the James is closely tied to the overall economic outlook and the Federal Reserve's policy decisions. Experts predict that interest rates may remain relatively high in the near term, but the long-term trajectory is uncertain.

As inflation cools down, the Fed may begin to lower rates, which would likely lead to a decrease in CD yields. Monitoring economic indicators, such as inflation data and unemployment rates, can provide valuable insights into the potential direction of interest rates.

Bank of the James will likely continue to adapt its CD offerings to remain competitive and meet the needs of its customers. Savers should stay informed, compare rates, and consider their individual financial goals when making investment decisions.

By carefully evaluating the options available and understanding the underlying factors influencing CD rates, investors can make informed choices that align with their risk tolerance and financial objectives. The role of Bank of the James in the local economic ecosystem depends on them successfully navigating the shifting economic trends.