How To Succeed Financially In Life

Achieving financial success is a goal shared by many, yet the path to get there can seem complex and daunting. While luck undoubtedly plays a role for some, a strategic and disciplined approach significantly increases the odds of long-term financial well-being. This article explores key principles and practical steps individuals can take to improve their financial standing.

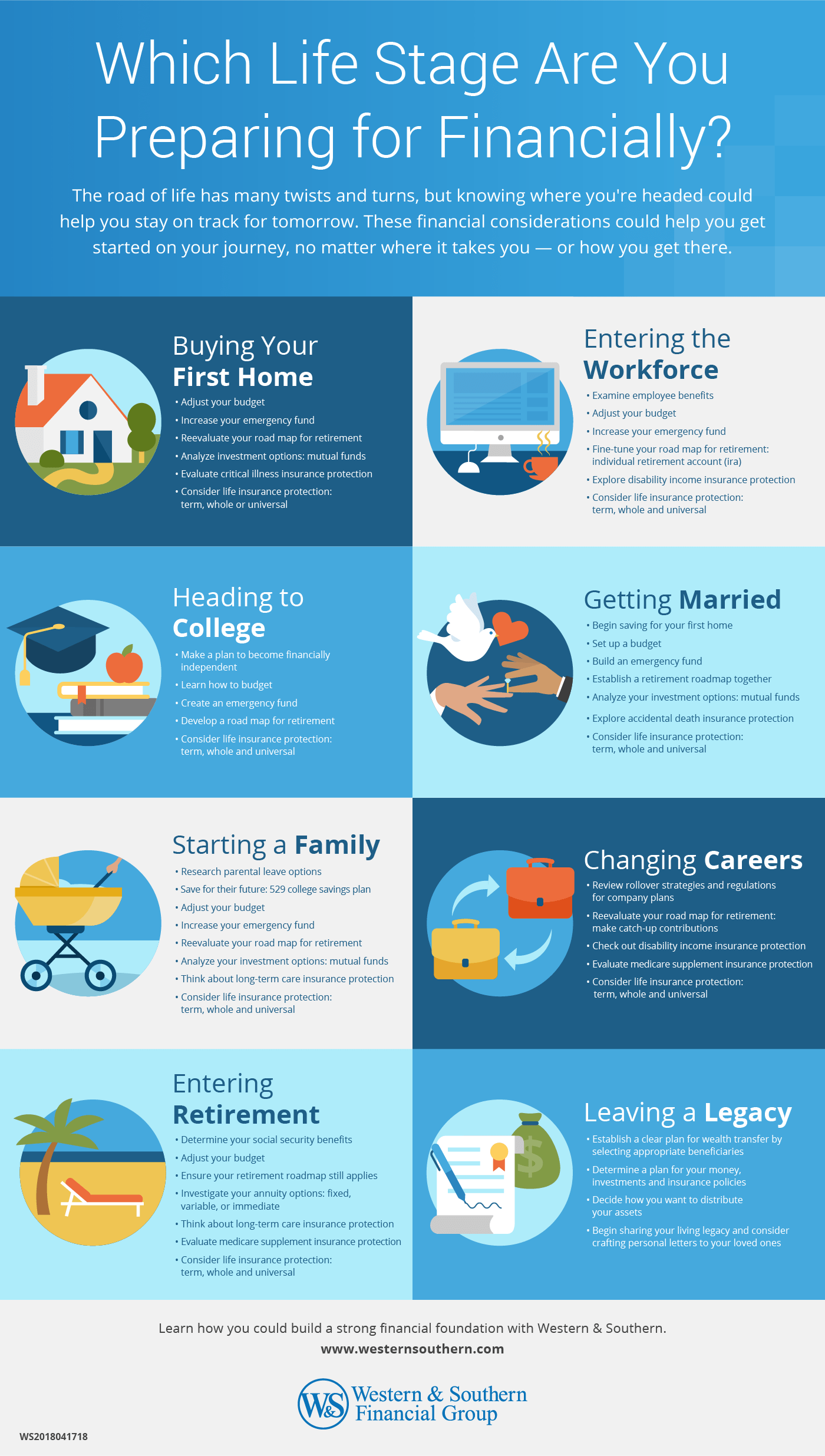

The core of financial success lies in understanding and mastering several fundamental areas: budgeting, saving, investing, and managing debt. Each element contributes to a holistic financial strategy designed to build wealth and security over time. A lack of attention to even one area can undermine otherwise strong financial habits.

Budgeting and Saving: Laying the Foundation

Effective budgeting is the cornerstone of financial stability. It involves tracking income and expenses to understand where money is going. This awareness allows individuals to identify areas where they can cut back spending and increase savings.

Several budgeting methods exist, from traditional spreadsheets to mobile apps. Finding a method that suits one's individual needs and preferences is key. Mint, YNAB (You Need A Budget), and personal spreadsheets are popular options.

Saving consistently, even small amounts, is crucial. Experts often recommend the 50/30/20 rule: allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Automating savings through direct deposit can make saving easier.

Investing: Growing Your Wealth

Investing allows your money to grow over time. The stock market, bonds, and real estate are common investment avenues. Understanding your risk tolerance is vital before investing. It is always advised to speak with a Financial Advisor before investing.

Diversification is key to mitigating risk. Spreading investments across different asset classes reduces the impact of any single investment performing poorly. Index funds and ETFs offer diversification at a low cost.

Time is your greatest ally in investing. The earlier you start, the more time your investments have to grow through the power of compounding. Compound interest is when the interest you earn also starts to earn interest.

Managing Debt: Avoiding Pitfalls

Debt can be a significant obstacle to financial success. High-interest debt, such as credit card debt, should be prioritized for repayment. The avalanche method (paying off the highest-interest debt first) and the snowball method (paying off the smallest debt first) are two popular strategies.

Avoiding unnecessary debt is crucial. Before making a purchase, consider whether it's a need or a want. Weigh the long-term financial implications of taking on debt.

Student loan debt can be a burden, but options like income-driven repayment plans and loan forgiveness programs exist. Researching and utilizing these programs can provide relief. A financial advisor can help you learn more about how to pay off debt.

Financial Education: Empowering Yourself

Continuous financial education is essential. The financial landscape is constantly evolving, so staying informed is crucial. Numerous resources are available, including books, websites, and online courses.

The Financial Planning Association (FPA) and the Certified Financial Planner Board of Standards offer valuable resources and information. Seeking advice from a qualified financial advisor can also be beneficial.

The Human Element: Perseverance and Patience

Financial success is not just about numbers; it's also about mindset. Cultivating a positive relationship with money and developing good financial habits are crucial. It’s important to remember that a person’s financial life can go up and down, so the important thing is to maintain the habits that will eventually lead to success.

Set realistic goals and celebrate milestones along the way. Building wealth takes time and effort. Patience and perseverance are key to achieving long-term financial security.

Ultimately, financial success is a journey, not a destination. By embracing sound financial principles, continuously learning, and staying disciplined, individuals can significantly improve their chances of achieving their financial goals. A consistent focus on budgeting, saving, investing, and managing debt provides the foundation for a secure and prosperous future.