How To Withdraw From A Business Partnership

Imagine a bustling café, the aroma of freshly brewed coffee mingling with the lively chatter of patrons. Two partners, once brimming with shared dreams, now stand at a crossroads. Their paths, once intertwined, are diverging. How does one gracefully navigate the delicate process of separating a business partnership, ensuring fairness and preserving relationships as much as possible?

Exiting a business partnership requires careful planning, open communication, and a thorough understanding of the legal and financial implications. This article provides a roadmap for navigating this complex process, focusing on practical steps to ensure a smooth and equitable transition for all parties involved.

Understanding the Partnership Agreement

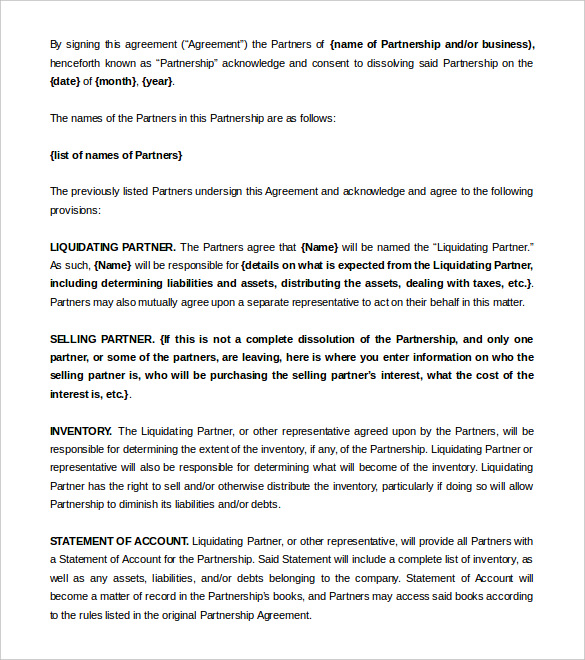

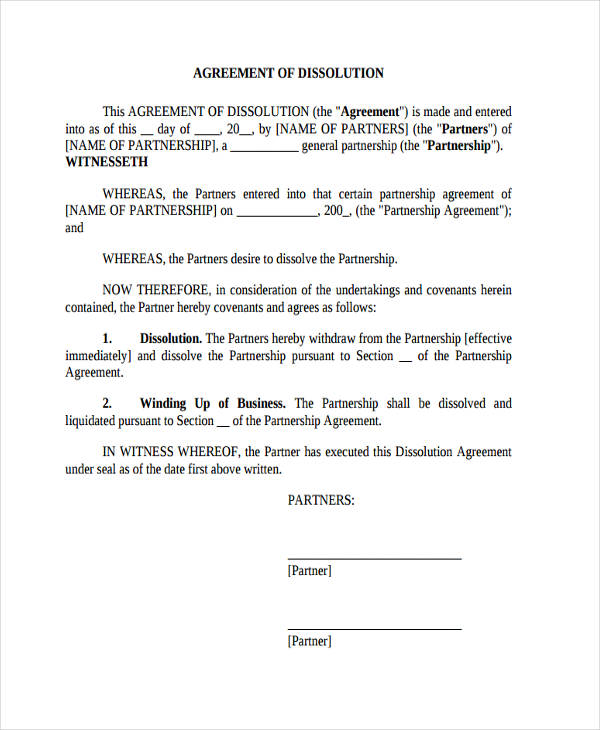

The cornerstone of any partnership dissolution is the partnership agreement. This document outlines the terms of the partnership, including capital contributions, profit and loss sharing, and, crucially, the procedures for withdrawal or dissolution.

Before taking any steps, meticulously review the agreement. Pay close attention to clauses addressing buy-out options, valuation methods, and dispute resolution mechanisms.

Initiating the Conversation

Open and honest communication is paramount. Schedule a meeting with your partner(s) to discuss your intention to withdraw.

Approach the conversation with transparency, clearly explaining your reasons for leaving while remaining respectful of your partners' perspectives.

Document this meeting, noting the date, attendees, and key discussion points.

Valuation and Buy-Out Options

Determining the fair value of the departing partner's share is a critical step. Several methods can be used, including book value, market value, or an independent appraisal.

Consider engaging a qualified business appraiser to provide an unbiased valuation. This can help minimize disputes and ensure a fair outcome.

The partnership agreement may specify a preferred valuation method. If not, discuss and agree on a mutually acceptable approach with your remaining partners.

Legal and Financial Considerations

Consult with legal and financial professionals to understand the tax implications of the withdrawal. This includes capital gains taxes, transfer taxes, and any other relevant tax liabilities.

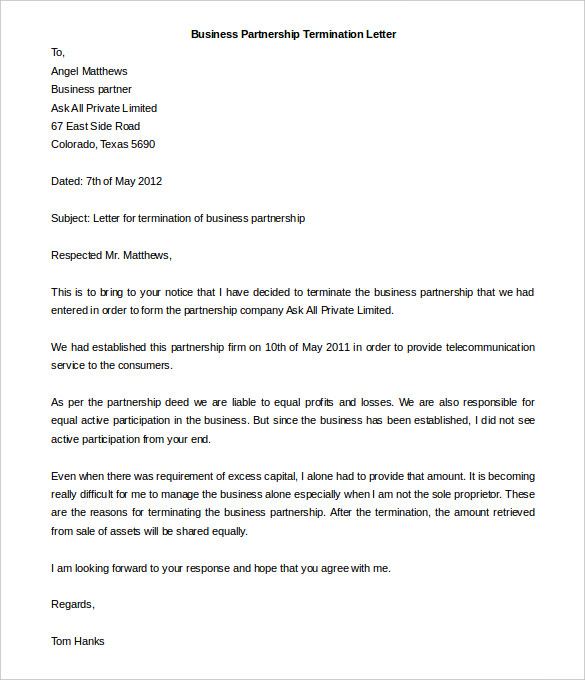

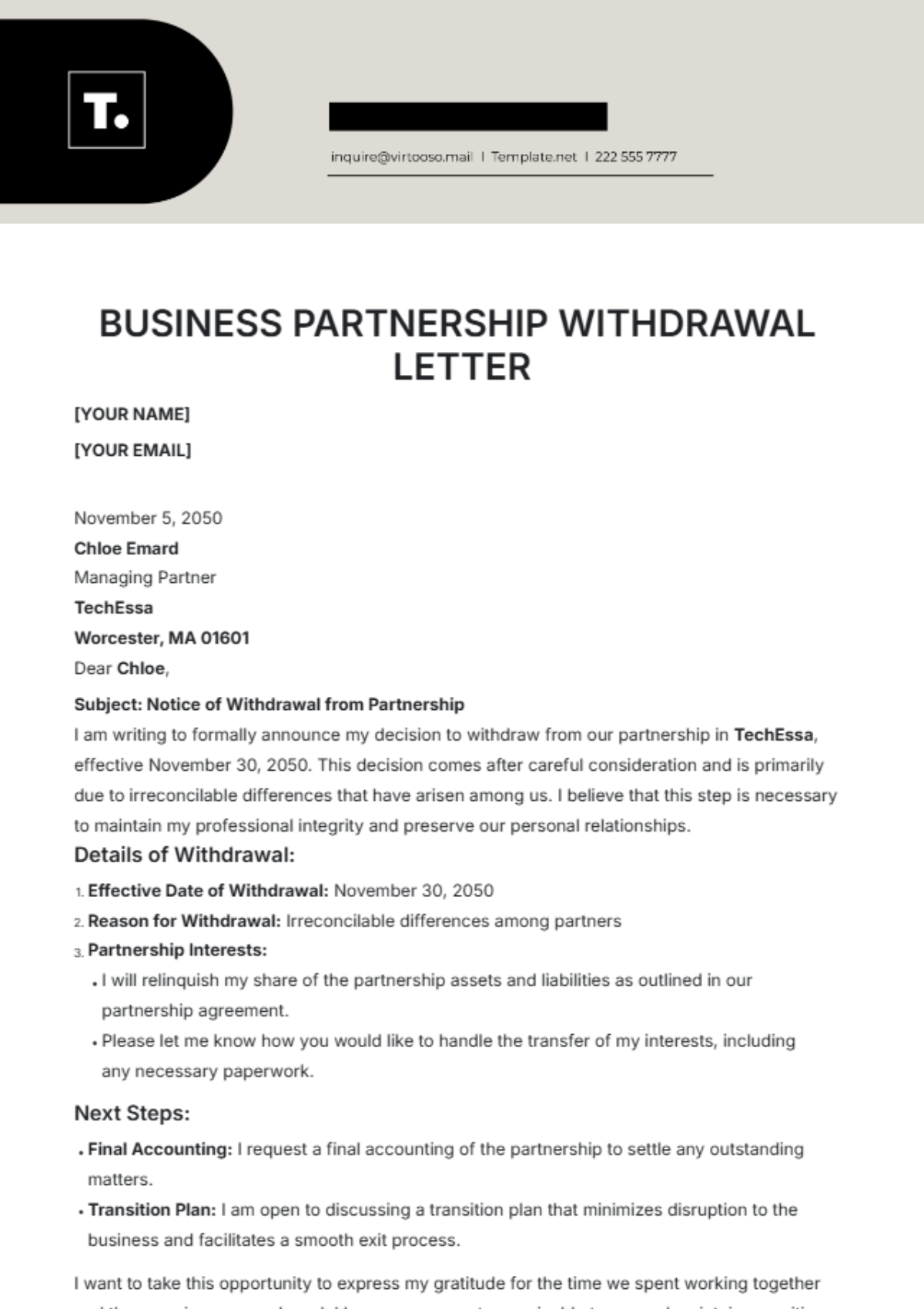

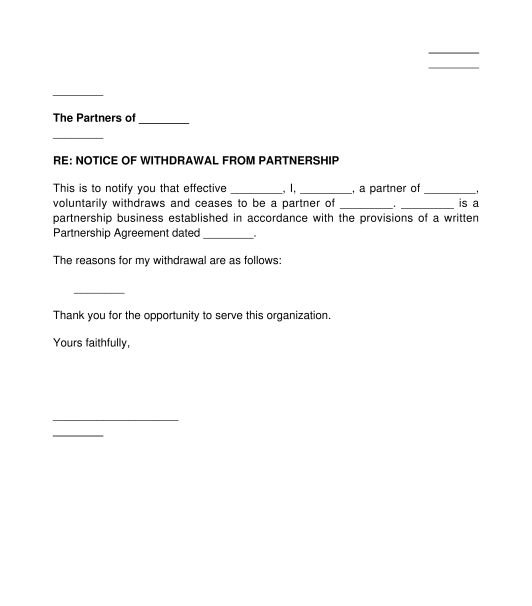

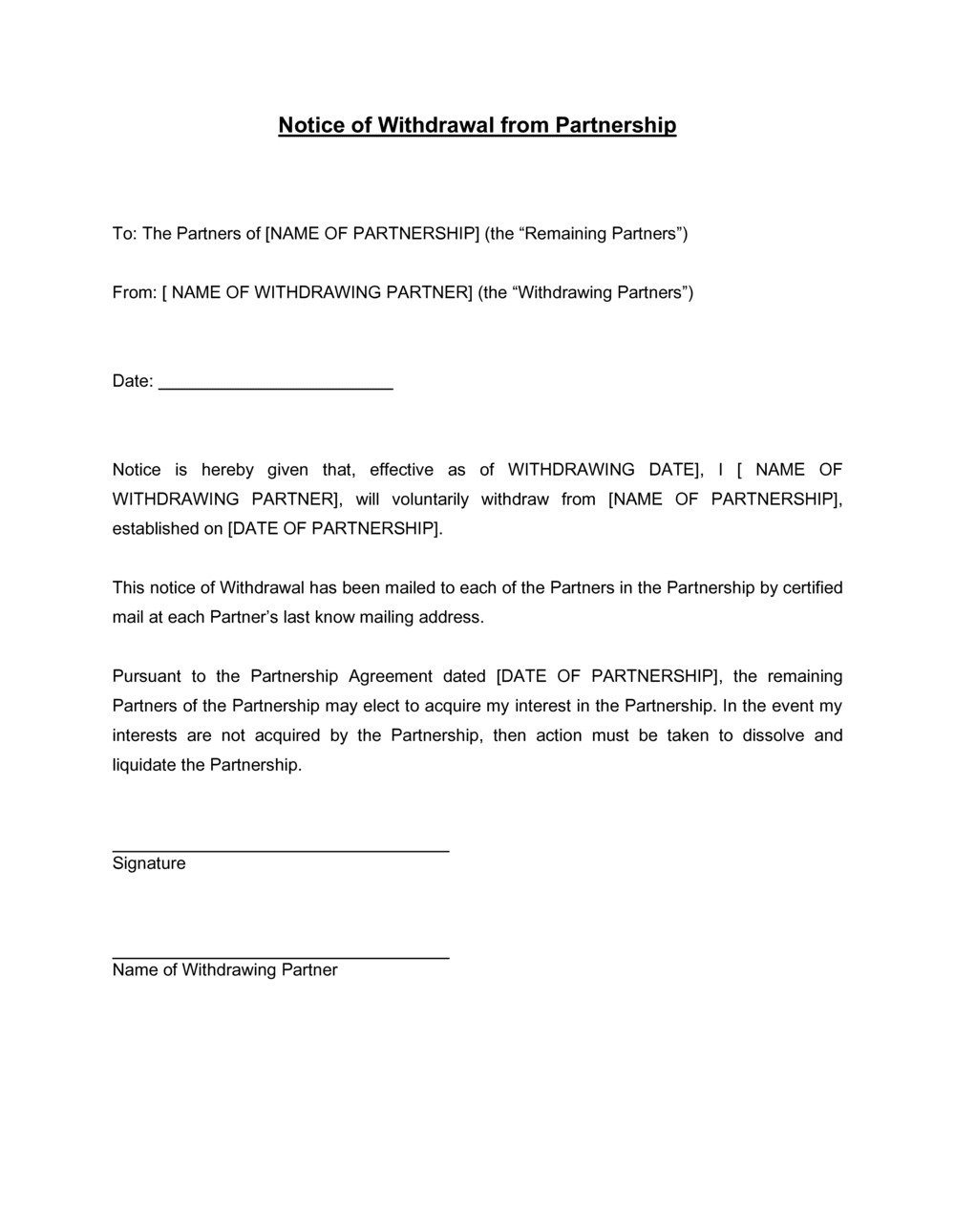

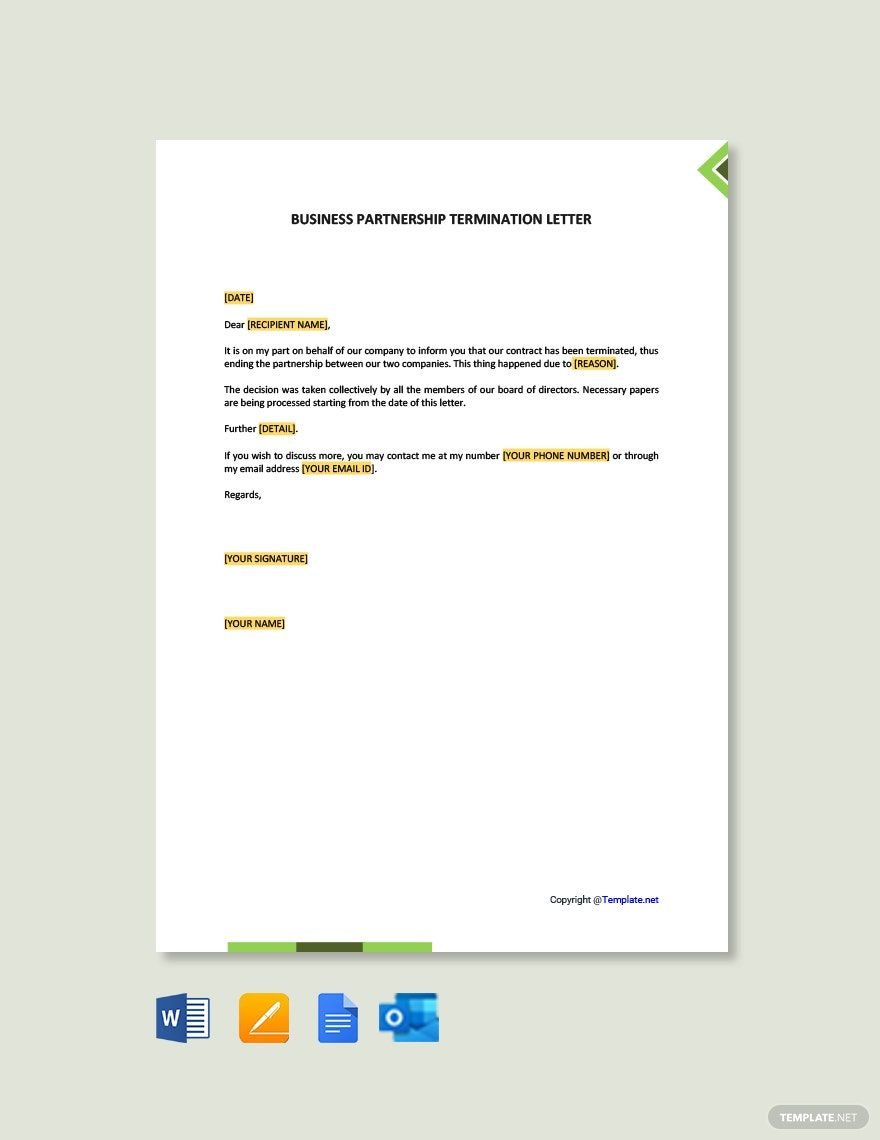

Work with an attorney to draft a formal withdrawal agreement. This document should outline the terms of the buy-out, including the purchase price, payment schedule, and any ongoing obligations or restrictions.

Ensure all necessary legal documents are properly executed and filed with the appropriate authorities.

Transitioning Responsibilities

Develop a plan for transferring your responsibilities to the remaining partners. This might involve training staff, documenting processes, and providing ongoing support during the transition period.

Consider creating a timeline for the handover to ensure a smooth and efficient transfer of duties.

Communicate the changes to clients, customers, and vendors to maintain business continuity. Transparency can help ease concerns and maintain positive relationships.

Update all relevant business documents, such as bank accounts, licenses, and permits, to reflect the change in ownership.

Formally notify any relevant agencies, such as the IRS or the state's business registration office, of your withdrawal from the partnership.

According to the Small Business Administration (SBA), clear communication and legal documentation are crucial for a successful business transition.

Withdrawing from a business partnership can be a challenging but ultimately rewarding experience. By approaching the process with careful planning, open communication, and a commitment to fairness, you can ensure a smooth transition and preserve valuable relationships.