Im Behind On My Credit Card Payments

The weight of unpaid bills presses down on millions of Americans, a silent epidemic of financial distress. Credit card debt, once a tool for convenience and opportunity, is now a source of anxiety and hardship for a growing number of households. Many are finding themselves trapped in a cycle of missed payments, escalating interest rates, and a diminishing sense of control.

This article delves into the increasingly prevalent issue of delinquent credit card payments. It examines the underlying causes, explores the immediate and long-term consequences for individuals and families. Furthermore, it offers practical guidance and resources for those struggling to stay afloat, and analyzes potential systemic solutions to address this growing financial crisis. This is according to data analyzed from the Federal Reserve and various credit counseling agencies.

The Rising Tide of Delinquency

Data from the Federal Reserve indicates a worrying trend: credit card delinquency rates are on the rise. The percentage of credit card balances transitioning into delinquency (defined as being 30 or more days late) has been steadily increasing. This signals a potential weakening in consumers' ability to manage their debt obligations.

Economists at organizations like the Consumer Financial Protection Bureau (CFPB) are closely monitoring this trend. They are trying to determine if this is a temporary blip or the start of a more sustained period of financial strain.

Contributing Factors

Several factors are contributing to this rise in credit card delinquencies. Inflation, which has increased the cost of essential goods and services, is a primary driver. Stagnant wages, despite a tight labor market, are not keeping pace with rising living expenses.

Unexpected medical bills or job loss can quickly derail even the most carefully planned budgets. These events often force individuals to rely on credit cards to cover immediate needs. This leads to debt accumulation and increased vulnerability to delinquency.

The Consequences of Missed Payments

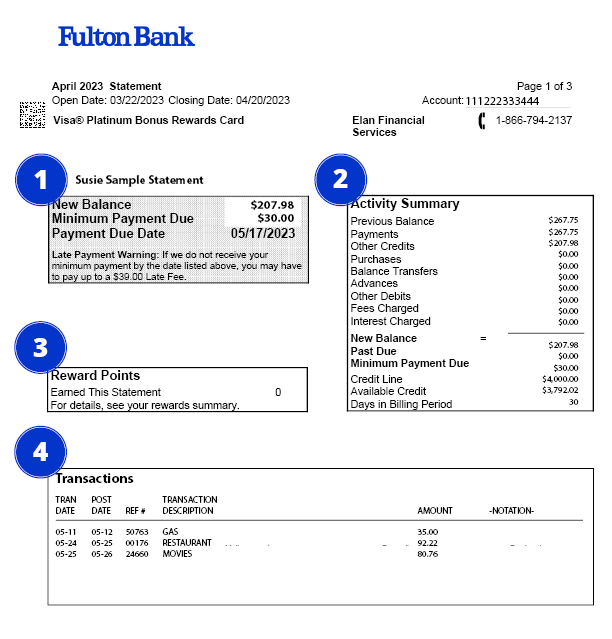

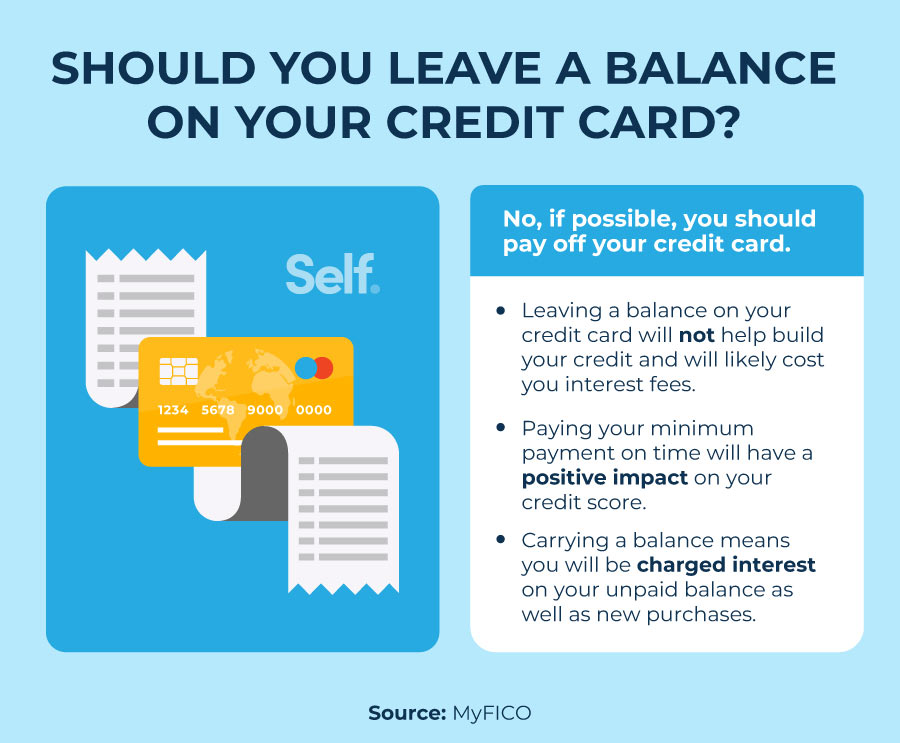

The consequences of falling behind on credit card payments can be severe and far-reaching. A single missed payment can trigger late fees, which further increase the outstanding balance. This pushes borrowers deeper into debt.

Delinquency negatively impacts a borrower's credit score. This makes it more difficult and expensive to obtain future loans, mortgages, or even rent an apartment.

In the long term, chronic delinquency can lead to legal action, including lawsuits and wage garnishment. This can create a cycle of poverty and financial instability.

"The stress and anxiety associated with debt can also take a significant toll on mental and physical health,"according to a report from the National Foundation for Credit Counseling (NFCC).

Seeking Help and Exploring Options

For those struggling with credit card debt, seeking help is crucial. Credit counseling agencies, such as the NFCC and Money Management International (MMI), offer free or low-cost counseling services.

These agencies can help individuals create a budget, negotiate with creditors to lower interest rates or establish payment plans, and explore debt management programs (DMPs).

Another option is debt consolidation, which involves taking out a new loan to pay off existing credit card debt. This could potentially offer a lower interest rate and a more manageable monthly payment. However, it's important to carefully consider the terms and conditions of any debt consolidation loan.

Addressing the Systemic Issues

While individual solutions are important, addressing the systemic issues that contribute to credit card debt is also necessary. Some advocate for stronger regulations on credit card interest rates and fees. Others propose expanding access to financial education and counseling services.

Government initiatives and non-profit programs aimed at promoting financial literacy are critical. This includes empowering individuals to make informed decisions about credit and debt.

"We need to create a system that supports financial well-being, rather than one that profits from financial distress," says Dr. Susan Harkness, a leading economist specializing in consumer debt.

Looking Ahead

The rise in credit card delinquencies is a serious concern. It highlights the growing financial vulnerability of many American households. It demands a multi-faceted approach that combines individual responsibility with systemic reforms.

By addressing the underlying causes of debt and providing access to resources and support, we can help individuals regain control of their finances and build a more secure future. Continued monitoring of credit card delinquency rates and proactive intervention are essential to prevent a full-blown financial crisis.

Ultimately, fostering a culture of financial literacy and responsible borrowing is key to creating a more resilient and equitable economic landscape.