In A Purely Competitive Industry Each Firm

The agricultural sector is often cited as a prime example of a purely competitive industry. This market structure, characterized by numerous small firms, standardized products, and free entry and exit, dictates specific economic realities for businesses operating within it. For these firms, navigating the market demands strategic decision-making centered on cost minimization and efficiency.

Understanding how individual firms function in this environment is crucial for comprehending the dynamics of the broader agricultural landscape, and also has implications for policymakers and consumers alike. The actions and constraints faced by each firm have ripple effects that impact production levels, market prices, and the overall health of the industry.

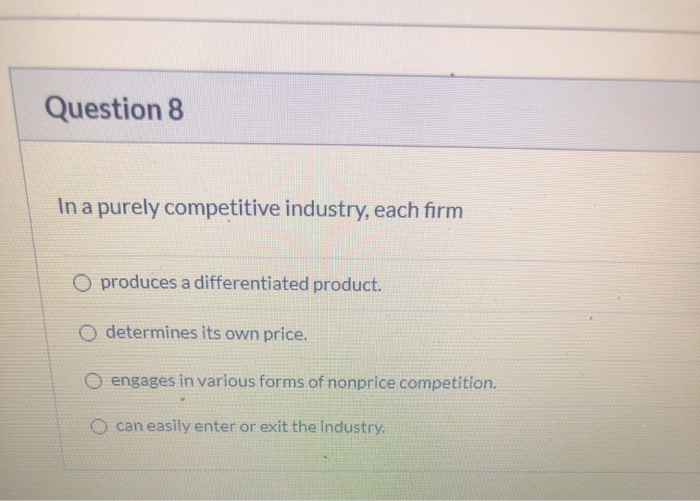

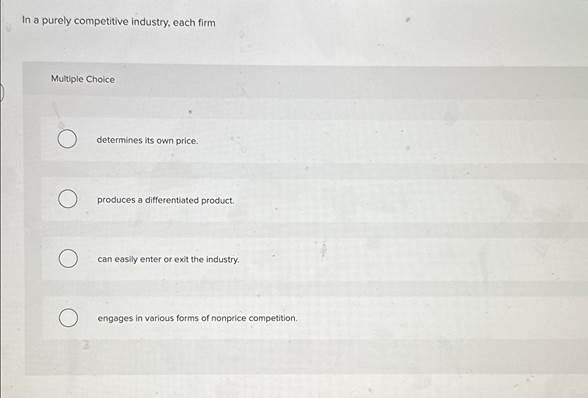

Key Characteristics of Purely Competitive Firms

In a purely competitive industry, firms are price takers. This means they have no power to influence the market price of their product. They must accept the prevailing market price determined by the forces of supply and demand.

The individual firm's demand curve is perfectly elastic. This means that a firm can sell as much as it wants at the market price, but it cannot sell anything above that price.

Because of this, the marginal revenue (MR) for a purely competitive firm is equal to the market price (P). This equality, P=MR, is a defining characteristic of firms in this market structure.

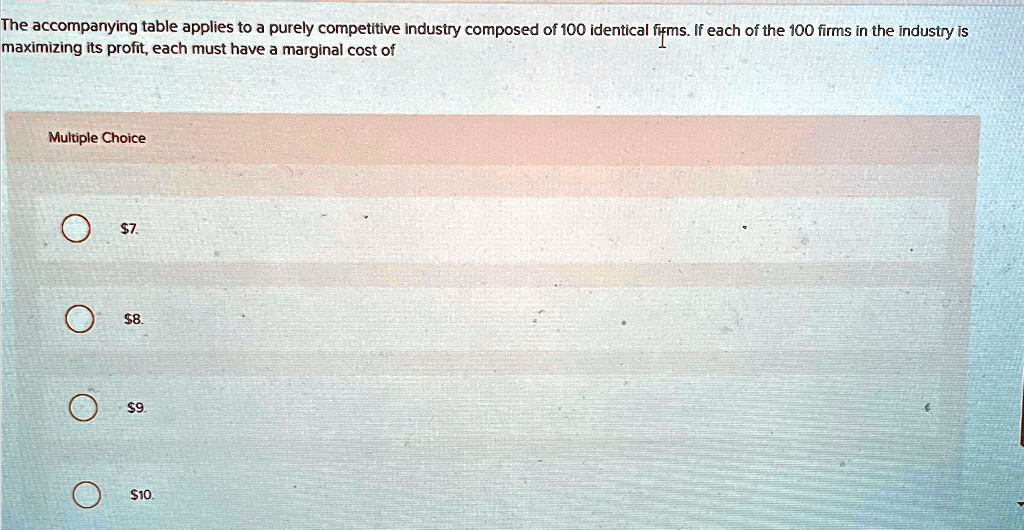

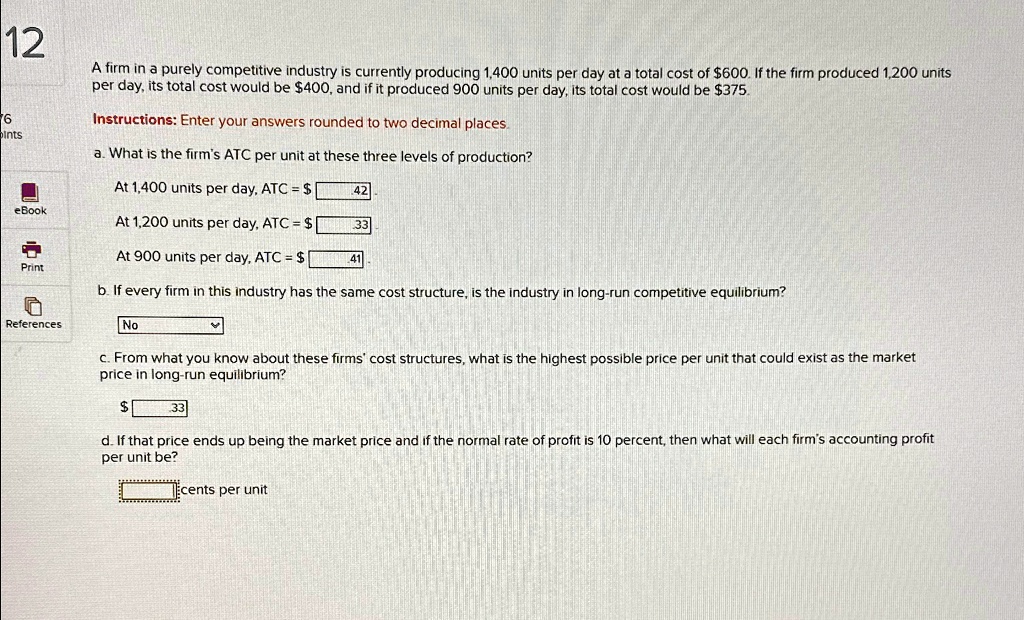

Profit Maximization

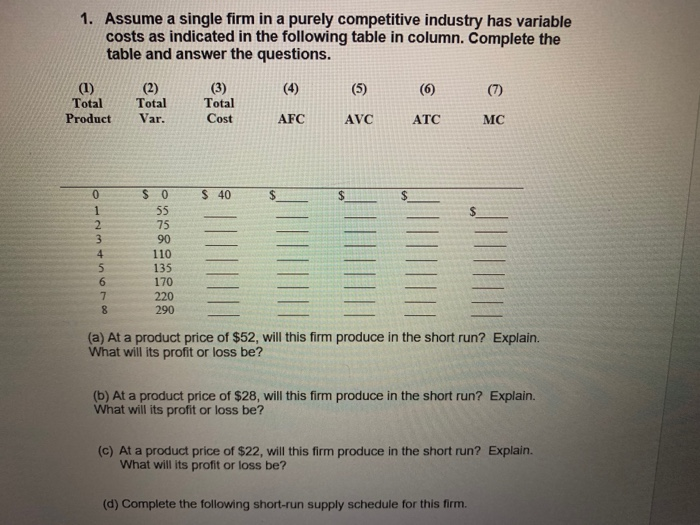

The primary goal of any firm is to maximize profit. In a purely competitive industry, firms achieve this by producing at the output level where marginal cost (MC) equals marginal revenue (MR).

Since P=MR in perfect competition, the profit-maximizing condition is where MC=P. If MC is less than P, the firm can increase profits by producing more. Conversely, if MC is greater than P, the firm can increase profits by producing less.

This focus on equating marginal cost with price leads to efficient resource allocation within the industry. Resources are directed towards the production of goods that consumers value most, as reflected in the market price.

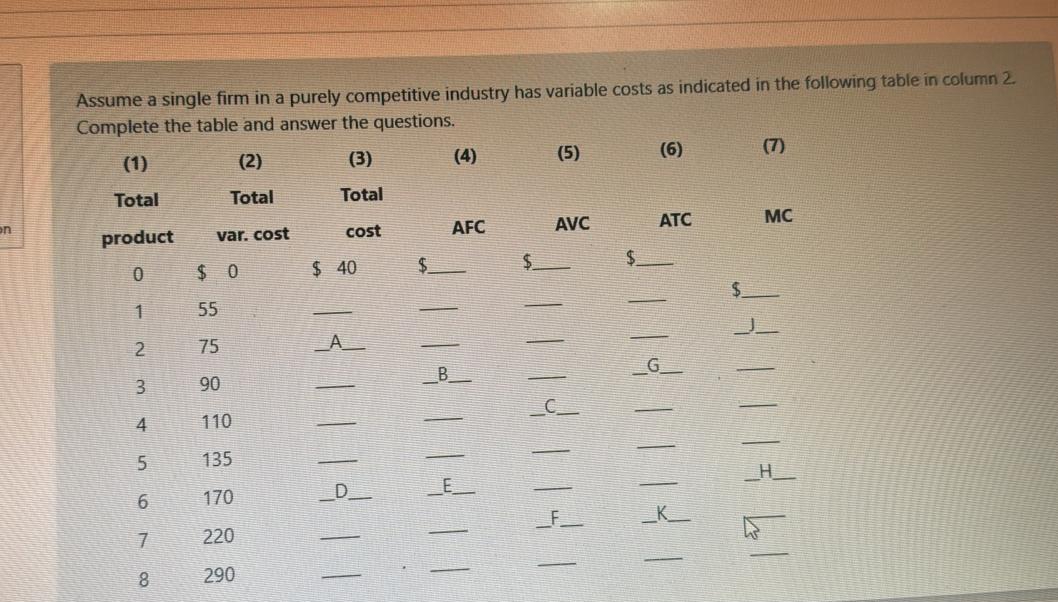

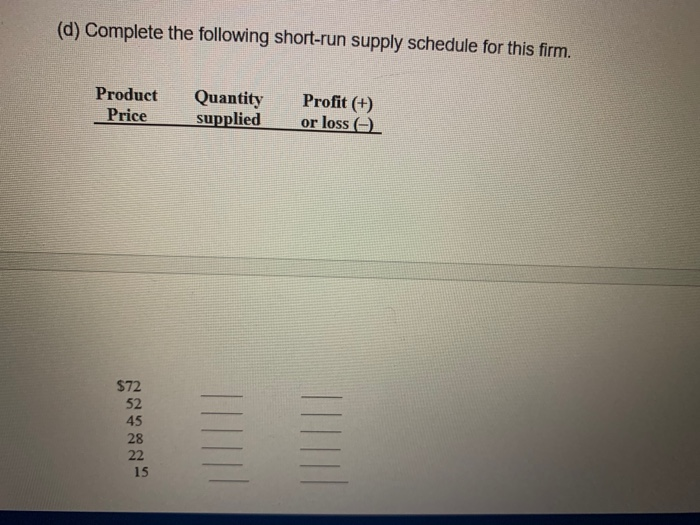

Cost Structure and Supply

A firm's cost structure is crucial in determining its supply behavior. The marginal cost curve represents the firm's supply curve in the short run, above the average variable cost (AVC).

This means that a firm will only produce if the market price is high enough to cover its variable costs. If the price falls below the AVC, the firm will shut down production in the short run.

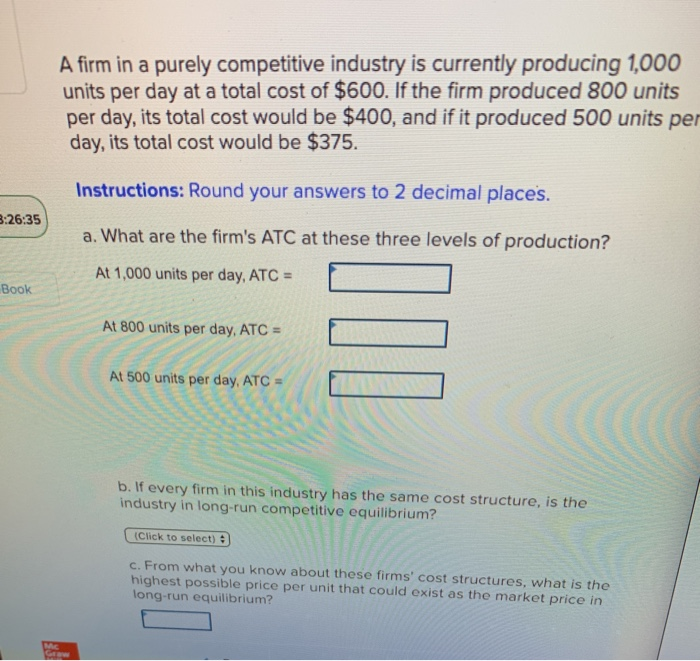

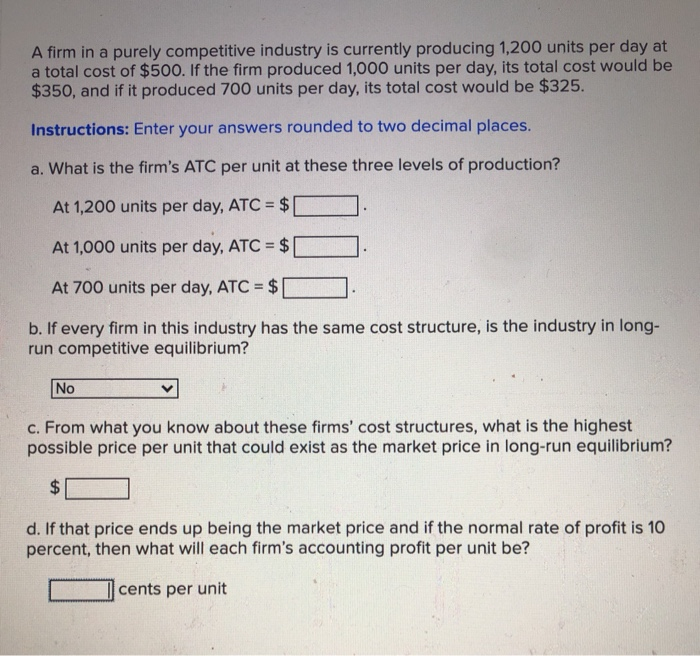

In the long run, firms must also cover their fixed costs. If the price is not high enough to cover all costs, the firm will eventually exit the industry.

Entry and Exit

The free entry and exit of firms is a defining feature of purely competitive industries. This characteristic ensures that the market remains competitive and that profits are driven towards a normal level.

If firms are earning economic profits (profits above and beyond what is required to keep them in business), new firms will enter the industry. This increases supply, driving down the market price until economic profits are eliminated.

Conversely, if firms are experiencing losses, some firms will exit the industry. This decreases supply, driving up the market price until losses are eliminated. This dynamic adjustment ensures that resources are efficiently allocated in the long run.

Implications for Farmers and Consumers

The model of a purely competitive firm offers valuable insights into the realities faced by many farmers. They operate in a market where they have little control over prices and must constantly strive to improve efficiency and reduce costs.

Technological advancements and improved farming practices can lower production costs, allowing farmers to increase profits or remain competitive in a challenging market. Farmers often rely on government subsidies and support programs to mitigate the risks associated with fluctuating market prices and weather-related challenges.

Consumers benefit from the competitive pressure in the industry. Because firms are price takers, consumers receive products at the lowest possible price. The efficiency of the market also ensures that resources are allocated in a way that maximizes consumer welfare.

Challenges and Criticisms

While the model of pure competition provides a useful framework for understanding certain industries, it is an idealized representation. Few industries perfectly meet all the assumptions of the model.

In reality, some firms may have a slight degree of market power due to brand recognition or product differentiation. Government regulations and market imperfections can also limit entry and exit, distorting the competitive landscape.

Nevertheless, the purely competitive model remains a valuable benchmark for evaluating market performance and designing policies that promote competition and efficiency. Understanding the characteristics of a firm in this type of industry is fundamental to analyzing the broader economic dynamics of many essential sectors.

+by+new+(or+existing)+firms..jpg)

![In A Purely Competitive Industry Each Firm [ 4.1 ] Pure Competition. - ppt download](https://slideplayer.com/slide/12775285/77/images/7/Price%2C+Output%2C+and+Purely+Competitive+Markets.jpg)