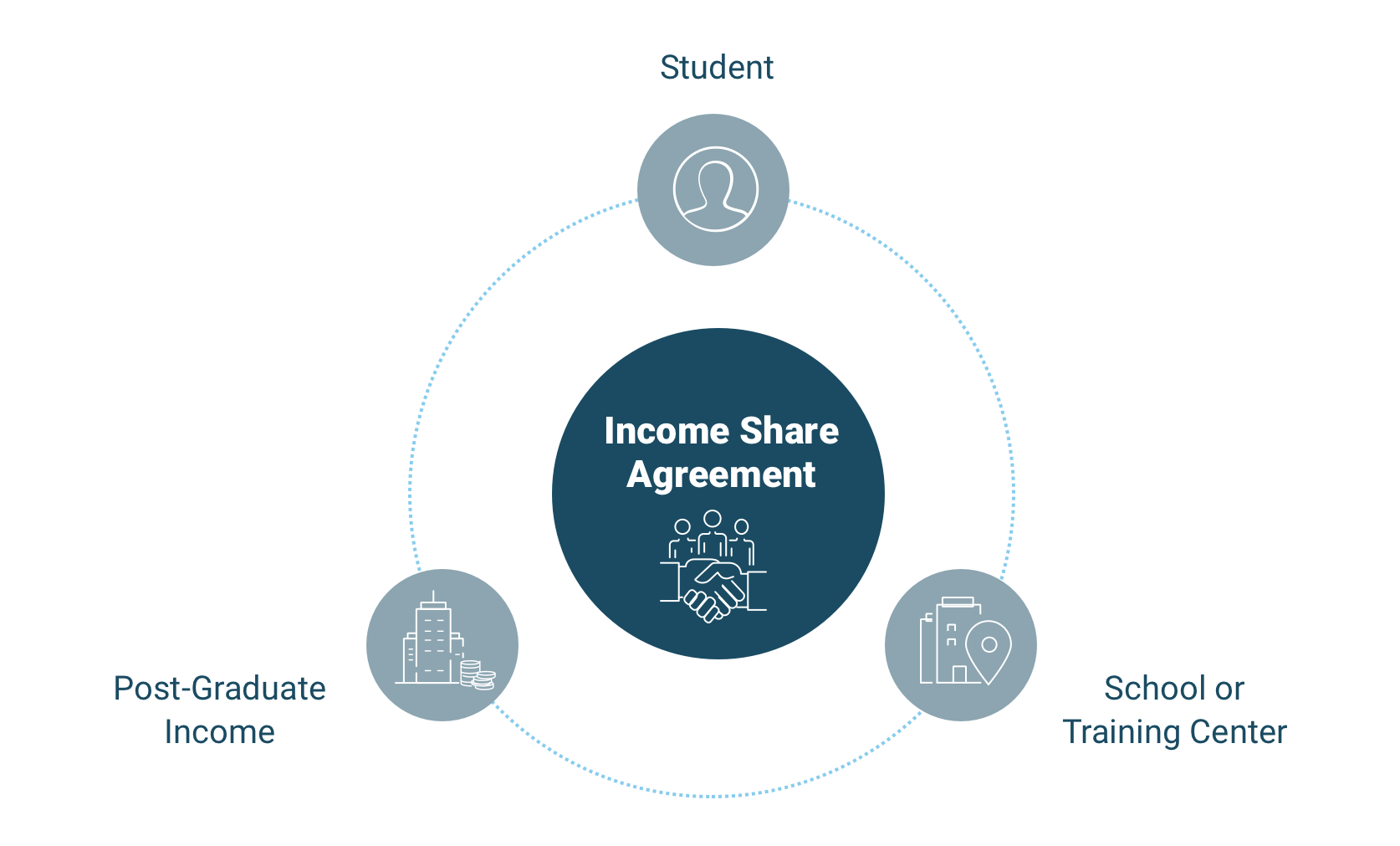

Income Share Agreement Student By Yelofunding

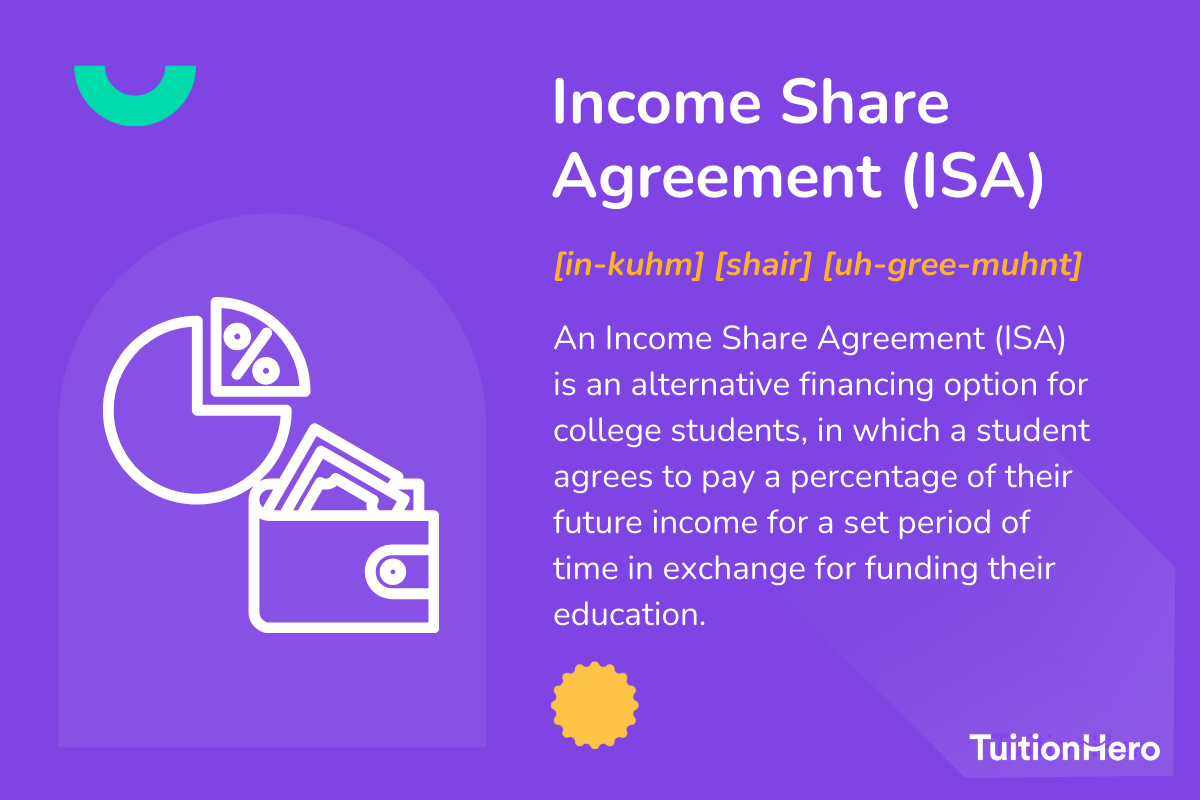

Yelofunding, a prominent Income Share Agreement (ISA) provider, faces mounting scrutiny amid allegations of misleading practices and unsustainable financial models. Students report crippling debt burdens despite low post-graduation incomes, sparking legal challenges and calls for regulatory intervention.

The unfolding crisis surrounding Yelofunding and its ISAs underscores the potential pitfalls of alternative financing models in higher education. Many question the long-term viability and ethical implications of these agreements, urging students to exercise extreme caution.

Mounting Student Debt and Disputed Terms

Reports are flooding in from former Yelofunding clients struggling to meet their ISA obligations. Students claim they were pressured into signing agreements without fully understanding the repayment terms and potential financial risks.

One former Yelofunding client, Sarah Miller, described the experience as "predatory". She stated that the projected salary used by Yelofunding to calculate her payment was unrealistic.

“They painted a picture of guaranteed success,” she explained, adding that her current salary falls far short of that projection, making the ISA payments a significant burden.

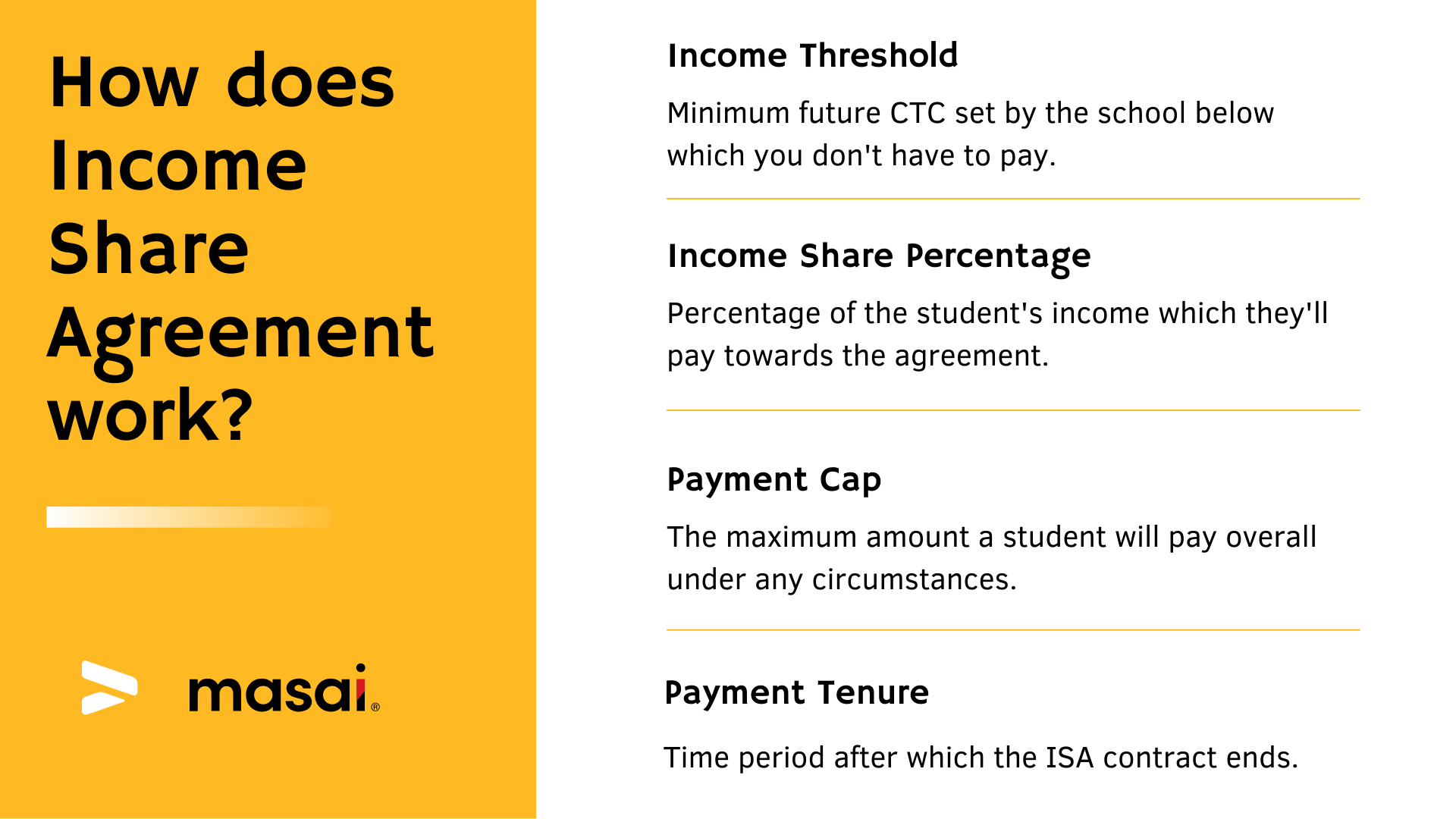

The average ISA contract with Yelofunding reportedly lasts between 5 to 10 years. Total repayment can sometimes exceed the original tuition amount, especially for students with higher incomes after graduation.

Legal Challenges and Regulatory Scrutiny

A class-action lawsuit has been filed against Yelofunding, alleging deceptive marketing practices and breach of contract. The suit, filed in the U.S. District Court for the Southern District of New York, claims that Yelofunding misrepresented the true cost of their ISAs.

The suit further alleges that Yelofunding failed to adequately disclose the potential impact of low post-graduation income on repayment obligations. It suggests this lack of transparency constitutes a violation of consumer protection laws.

The Consumer Financial Protection Bureau (CFPB) has also launched an investigation into Yelofunding's lending practices. The CFPB is examining whether Yelofunding engaged in unfair, deceptive, or abusive acts or practices.

Yelofunding's Response

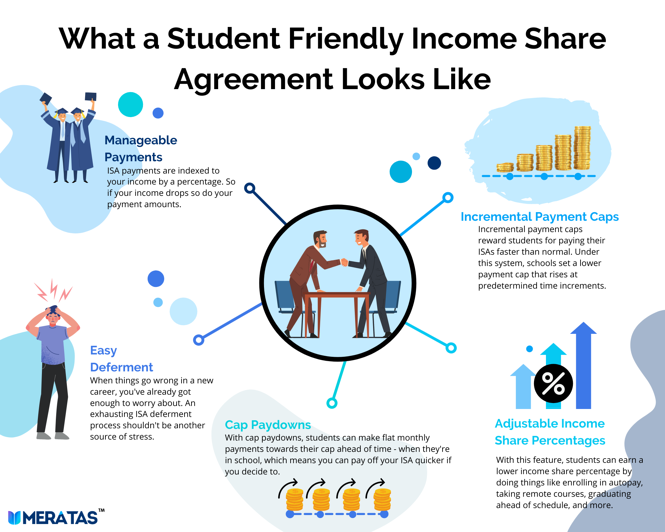

Yelofunding has vehemently denied all allegations of wrongdoing. In a statement released last week, the company asserted that its ISAs are a valuable alternative to traditional student loans.

The statement claimed that Yelofunding provides students with the resources they need to make informed decisions. It also said that the company's repayment terms are fair and flexible.

“We are committed to providing accessible and affordable education financing,” the statement reads. “We believe our ISAs offer a responsible alternative to traditional student loans, especially for students pursuing high-demand fields.”

The Future of Income Share Agreements

The Yelofunding controversy raises critical questions about the regulation and oversight of ISAs. Experts warn that the lack of standardized regulations creates opportunities for predatory lending practices.

“ISAs can be a viable option for students, but only if they are structured and regulated properly,” said Dr. Emily Carter, a professor of financial economics at Columbia University. “Transparency and consumer protection are paramount.”

Some lawmakers are calling for federal legislation to establish clear guidelines for ISAs. The goal is to protect students from unfair lending practices and ensure that ISAs are a truly viable and ethical financing option.

Urgent Action Needed

Students currently enrolled in Yelofunding ISAs should carefully review their contracts and seek independent financial advice. Consider exploring alternative financing options, such as federal student loans, which may offer more favorable terms and protections.

Those who believe they have been victims of deceptive lending practices should consider joining the class-action lawsuit. They should also file complaints with the CFPB and other regulatory agencies.

The ongoing investigation and legal challenges surrounding Yelofunding are expected to continue in the coming months. Stay informed about developments and be vigilant about protecting your financial interests.