Interactive Brokers Non Us Residents

The global investment landscape has become increasingly accessible, yet navigating the complexities of international brokerage accounts remains a significant hurdle for non-U.S. residents. Interactive Brokers, a prominent online brokerage firm, offers its services worldwide, but the specific experiences and regulations governing non-U.S. account holders warrant careful examination. Understanding these nuances is critical for individuals seeking to leverage Interactive Brokers' platform for international investing.

This article delves into the intricacies of using Interactive Brokers as a non-U.S. resident. It explores account opening procedures, regulatory considerations, tax implications, and available investment options. This information is gathered from Interactive Brokers' official statements, regulatory guidelines, and expert opinions to provide a comprehensive overview of the platform's accessibility and limitations for international investors. We aim to shed light on the key factors that non-U.S. residents must consider when deciding whether Interactive Brokers is the right choice for their investment needs.

Account Opening and Eligibility

Interactive Brokers generally welcomes non-U.S. residents to open accounts, subject to certain conditions and restrictions. The specific requirements vary based on the applicant's country of residence and citizenship. Factors such as local regulations, anti-money laundering (AML) compliance, and tax treaties play a crucial role in determining eligibility.

Applicants typically need to provide proof of identity (passport, government-issued ID), proof of address (utility bill, bank statement), and potentially additional documentation depending on their jurisdiction. Interactive Brokers employs a rigorous verification process to ensure compliance with international regulations.

Some countries might be subject to specific limitations or outright restrictions due to regulatory constraints or geopolitical considerations. Prospective clients are advised to carefully review Interactive Brokers' website or contact their customer service to ascertain their eligibility before initiating the account opening process.

Regulatory and Tax Implications

Non-U.S. residents trading through Interactive Brokers are subject to the regulatory frameworks of both the United States and their country of residence. This dual compliance requirement adds complexity to their investment activities. Understanding these regulations is essential to avoid potential legal or financial repercussions.

The U.S. Internal Revenue Service (IRS) has specific rules for taxing non-resident aliens (NRAs) on income derived from U.S. sources. These rules often involve withholding taxes on dividends and interest earned from U.S. securities.

Furthermore, non-U.S. residents must comply with the tax laws of their home country, which may require reporting and paying taxes on global income, including profits earned through Interactive Brokers. Seeking advice from a qualified tax professional is highly recommended to navigate these complex tax obligations.

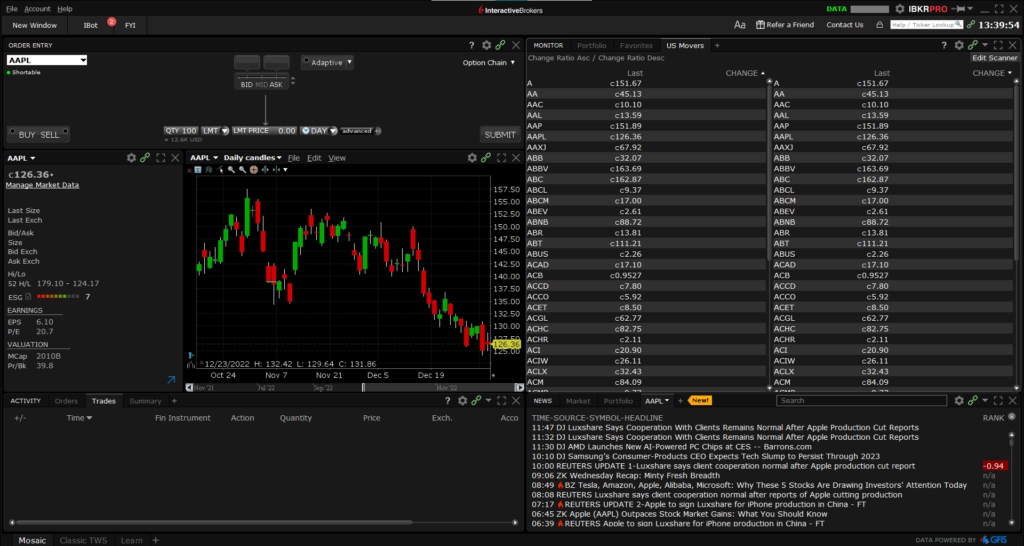

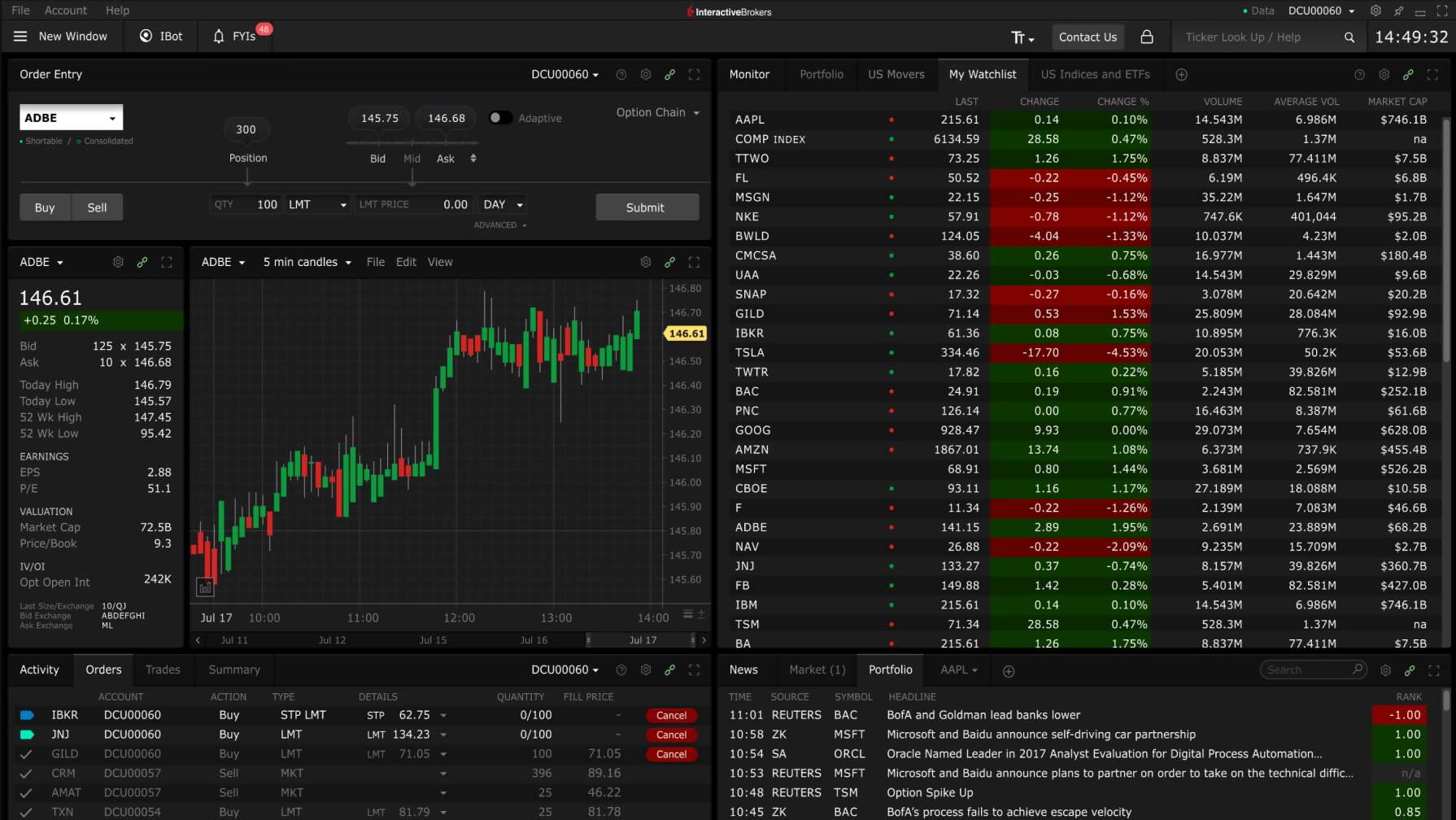

Investment Options and Platform Access

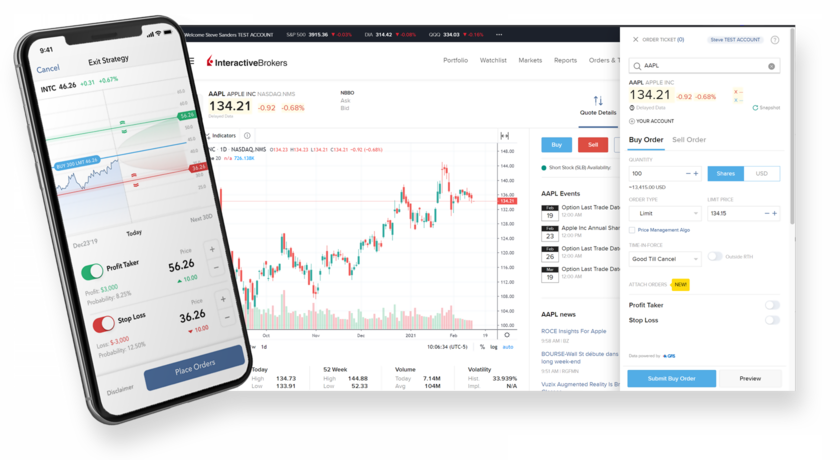

Interactive Brokers offers a wide range of investment options to non-U.S. residents, including stocks, bonds, options, futures, forex, and mutual funds. The availability of specific instruments might vary depending on regulatory restrictions in the investor's country of residence.

The platform's sophisticated trading tools and global market access can be advantageous for experienced investors seeking to diversify their portfolios internationally. However, the complexity of the platform can also be overwhelming for beginners.

It's crucial for non-U.S. residents to familiarize themselves with the specific risks associated with international investing, such as currency fluctuations and geopolitical instability. Proper due diligence and risk management are paramount.

Fees and Currency Conversion

Interactive Brokers generally has a competitive fee structure. However, non-U.S. residents need to consider the potential costs associated with currency conversion. Converting funds between different currencies can incur fees and expose investors to exchange rate risk.

Understanding the margin rates and potential borrowing costs is also essential, particularly for investors engaging in leveraged trading. Carefully evaluating the fee schedule and currency conversion policies is crucial to minimize transaction costs.

It is important to check for any hidden fees that may be applicable to non-US residents.

Customer Support and Language Barriers

Interactive Brokers provides customer support in multiple languages, which can be beneficial for non-U.S. residents who are not fluent in English. However, the quality and availability of support might vary depending on the region and language.

Accessing timely and accurate customer support is crucial for resolving issues and navigating the complexities of the platform. Investors should familiarize themselves with the available support channels and response times.

Language barriers may complicate communication and understanding, so it's important to utilize the available language support resources.

Forward-Looking Considerations

The regulatory landscape for international brokerage accounts is constantly evolving. Non-U.S. residents using Interactive Brokers should stay informed about changes in regulations, tax laws, and platform policies that may affect their investment activities.

Continuous monitoring of account statements, tax implications, and market conditions is crucial for managing risk and maximizing returns. Proactive communication with Interactive Brokers and seeking professional advice are essential for navigating the complexities of international investing.

The rise of globalization and digital finance will likely lead to further integration of global markets and increased access for international investors. Staying informed and adapting to these changes will be key to success.