Investing With Fidelity For Beginners

Fidelity Investments offers a wide array of investment options for both seasoned traders and complete beginners. Navigating the platform can seem daunting, but understanding the basics will empower you to start building your financial future today.

Getting Started: Your Fidelity Account

First, head to Fidelity.com and click "Open an Account". You'll need your Social Security number, driver's license, and employer information.

Choose the account type that fits your needs: a brokerage account for general investing, a Roth IRA or Traditional IRA for retirement, or a 529 plan for education savings.

Funding your account is simple. You can link your bank account for electronic transfers or even deposit checks through the Fidelity app.

Investment Options: What Can You Buy?

Fidelity provides access to stocks, bonds, mutual funds, ETFs (Exchange Traded Funds), and more.

Mutual funds pool money from multiple investors to buy a diversified portfolio, managed by professionals.

ETFs are similar to mutual funds but trade like stocks, offering flexibility and often lower fees.

Individual stocks allow you to invest in specific companies you believe in, but require more research.

Bonds are essentially loans to governments or corporations, offering a fixed income stream.

Research is Key: Making Informed Decisions

Fidelity offers extensive research tools to help you analyze potential investments.

Utilize their stock screeners to filter companies based on criteria like market cap, dividend yield, and P/E ratio.

Read analyst reports and company filings to gain deeper insights. Fidelity provides resources from Morningstar and other reputable sources.

Don't forget to research the expense ratios of mutual funds and ETFs, as these fees can impact your returns.

Placing Your First Trade: Step-by-Step

Once you've chosen your investment, click the "Trade" button.

Enter the ticker symbol (e.g., AAPL for Apple), the quantity of shares you want to buy, and the order type (market or limit order).

A market order executes your trade immediately at the current market price. A limit order allows you to specify the price you're willing to pay.

Review your order carefully before submitting. Be aware of potential commissions, although Fidelity offers commission-free trading for many stocks and ETFs.

Important Considerations: Managing Risk and Time Horizon

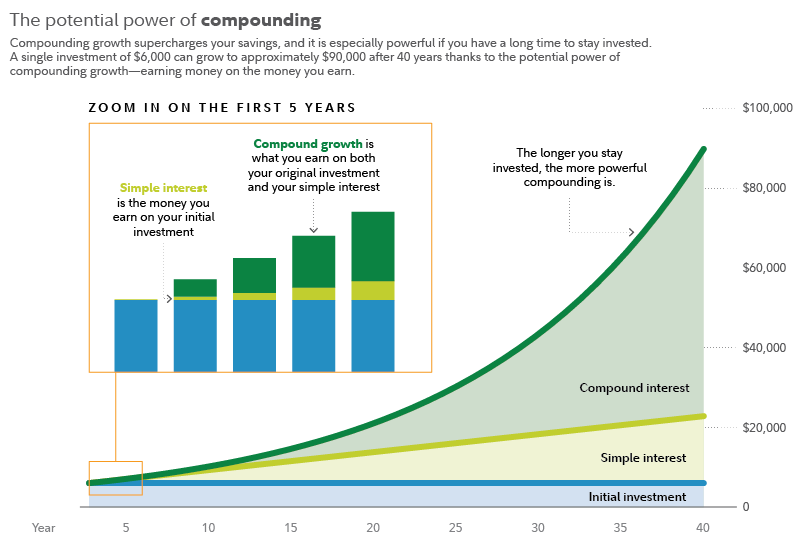

Diversification is crucial to managing risk. Don't put all your eggs in one basket!

Consider your risk tolerance and time horizon when making investment decisions. Younger investors with a longer time horizon can generally tolerate more risk.

Regularly review your portfolio and rebalance as needed to maintain your desired asset allocation.

Fees and Minimums: What to Expect

Fidelity offers commission-free online trading for stocks, ETFs, and options.

Some mutual funds may have transaction fees or minimum investment requirements, so be sure to read the prospectus carefully.

Fidelity also offers managed account options, such as Fidelity Go, which may charge advisory fees.

Need Help? Fidelity's Resources

Fidelity provides a wealth of educational resources, including articles, videos, and webinars.

Their customer service team is available 24/7 via phone, chat, and email.

Consider attending a local Fidelity branch for in-person assistance.

Next Steps: Start Investing Today

Don't wait to start building your financial future. Open a Fidelity account, fund it, and begin exploring your investment options.

Remember to research thoroughly, diversify your portfolio, and seek professional advice if needed.

Investing involves risk, but with careful planning and informed decision-making, you can achieve your financial goals.