Irs Not Taking Money From Bank Accounts

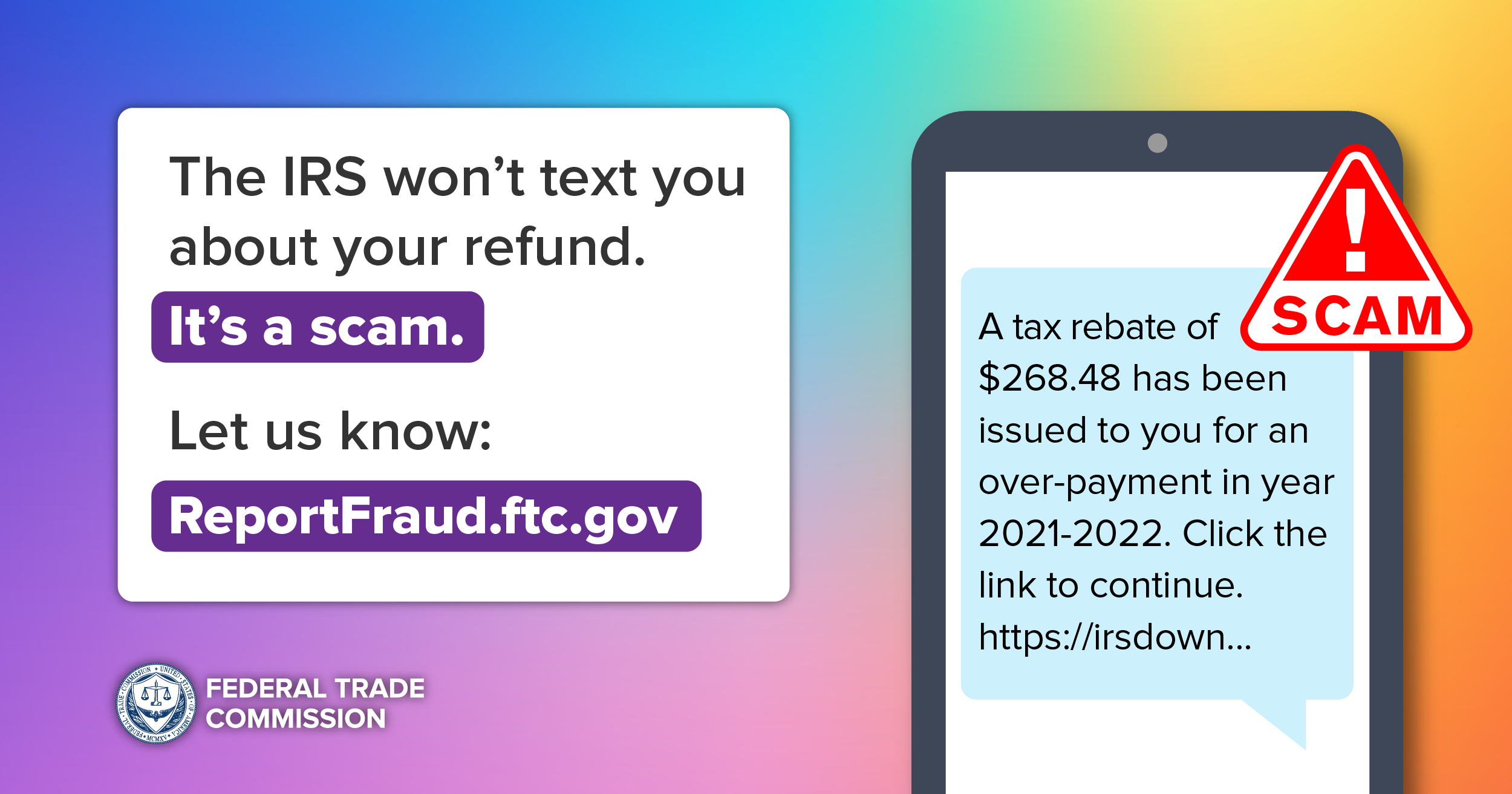

A wave of alarm surged through the nation as rumors spread that the Internal Revenue Service (IRS) was directly seizing funds from taxpayers' bank accounts without proper notification. These claims, fueled by social media and amplified by certain news outlets, triggered widespread anxiety and distrust, prompting immediate responses from both the IRS and concerned lawmakers.

However, the core message is clear: the IRS is not unilaterally seizing funds from bank accounts. While the IRS does possess the authority to levy bank accounts under specific circumstances, these actions are governed by strict legal protocols designed to protect taxpayers' rights. This article clarifies the IRS's procedures regarding levies, separates fact from fiction, and outlines the safeguards in place to prevent unwarranted seizures.

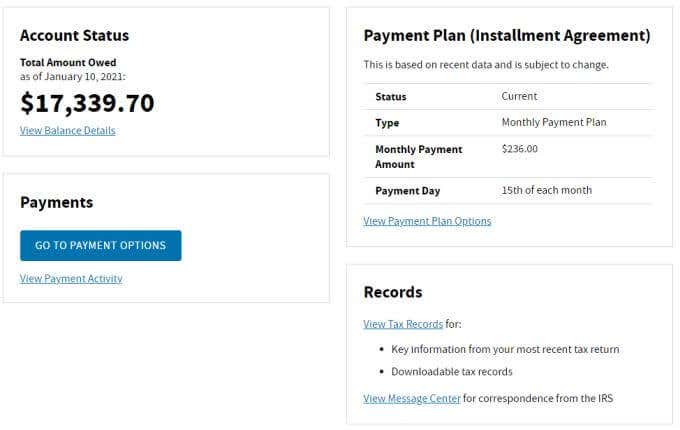

Understanding IRS Levies

An IRS levy is a legal seizure of property to satisfy a tax debt. This is not the first step in the collection process. It typically occurs only after the IRS has assessed the tax, sent multiple notices and demands for payment, and given the taxpayer an opportunity to appeal.

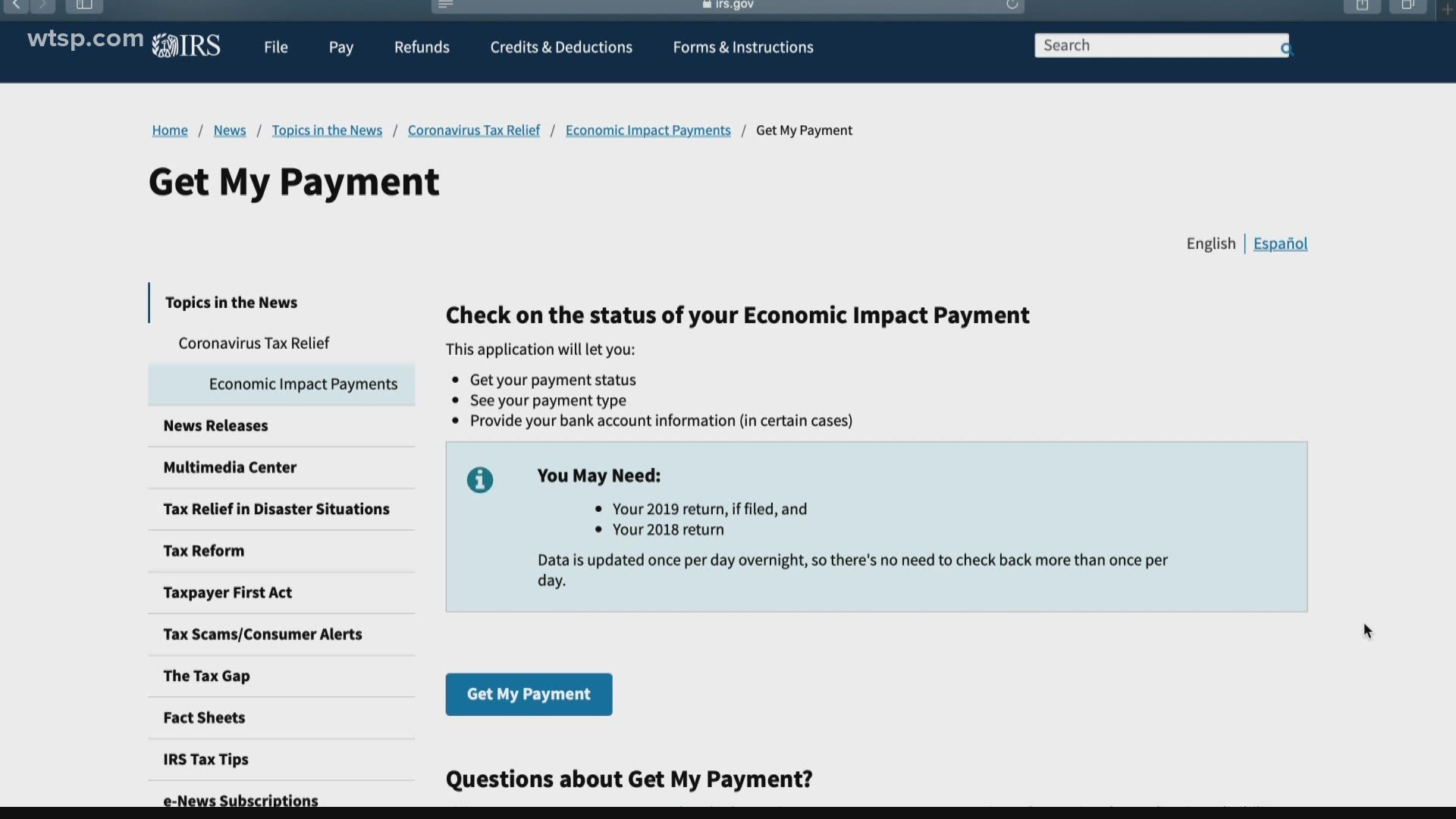

According to the IRS website and official statements, a levy is only considered after all other attempts to resolve the tax debt have failed. This includes payment plans, offers in compromise, and other resolution methods.

Due Process and Taxpayer Rights

The IRS is bound by stringent regulations ensuring taxpayers receive due process. Before a levy can be issued, the IRS must provide the taxpayer with a final notice of intent to levy, which includes information about their rights to appeal the decision.

This notice is generally sent via certified mail, providing documented proof that the taxpayer was informed of the impending action. Taxpayers have the right to challenge the levy if they believe it is unwarranted or if they disagree with the tax assessment.

There are several avenues for disputing a levy. Taxpayers can request a Collection Due Process (CDP) hearing with the IRS's Independent Office of Appeals, or they can seek assistance from the Taxpayer Advocate Service (TAS), an independent organization within the IRS that helps taxpayers resolve problems with the agency.

Debunking the Misinformation

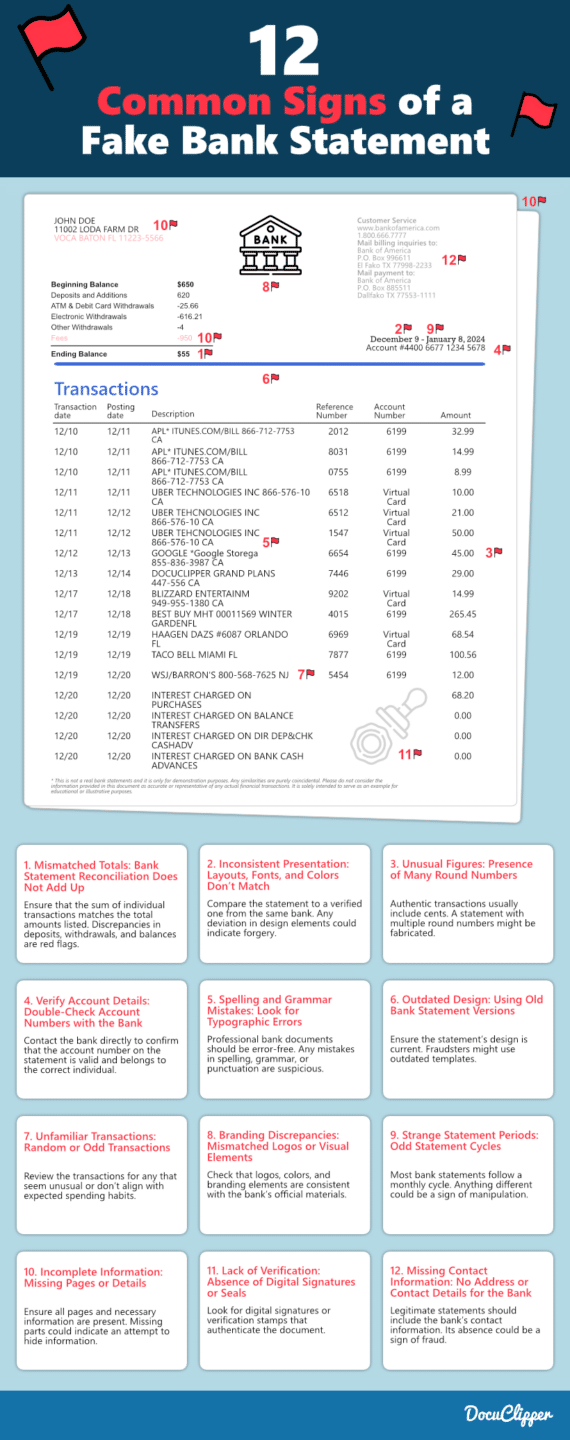

The recent surge of misinformation appears to stem from a misunderstanding of standard IRS procedures and isolated incidents amplified through social media. Some reports have conflated legitimate levy actions with unsubstantiated claims of widespread, unwarranted seizures.

Treasury Inspector General for Tax Administration (TIGTA) reports, which oversee the IRS, consistently emphasize the importance of adhering to due process and taxpayer rights. These reports are crucial in identifying areas where the IRS needs to improve its procedures and communication with taxpayers.

Experts emphasize the importance of verifying information from unofficial sources. Always cross-reference information with official IRS publications and consult with a qualified tax professional if you have concerns.

Safeguards and Protections

Several safeguards are in place to protect taxpayers from wrongful levies. These include internal review processes within the IRS and external oversight from organizations like TIGTA and the Taxpayer Advocate Service.

The IRS has implemented procedures to ensure that levies are only issued as a last resort. These procedures require multiple levels of approval and review before a levy can be enforced.

Taxpayers can also take proactive steps to protect themselves. This includes keeping accurate records, filing tax returns on time, and responding promptly to IRS notices.

Looking Ahead

While the current claims of widespread, unwarranted seizures appear to be unfounded, they underscore the importance of clear communication and transparency from the IRS. The agency must continue to improve its outreach efforts to educate taxpayers about their rights and the collection process.

Moving forward, it is crucial for the IRS to address the underlying anxieties that fueled these rumors. This includes simplifying the tax code, improving customer service, and ensuring that all taxpayers are treated fairly and with respect.

By fostering trust and transparency, the IRS can mitigate future misinformation and maintain public confidence in the tax system. It is in everyone's interest to ensure fairness and equity in tax collection.