Is Allstate Car Insurance Expensive

The question of affordability is paramount for drivers shopping for car insurance. Allstate, a major player in the industry, often finds itself under scrutiny regarding its pricing. A comprehensive look reveals a complex picture influenced by individual driver profiles and market fluctuations.

At the heart of this discussion lies the need to determine whether Allstate car insurance is, in fact, expensive. The answer isn't a simple yes or no; rather, it's a nuanced assessment based on factors such as coverage options, driving history, location, and demographics.

Factors Influencing Allstate Premiums

Several elements contribute to the overall cost of Allstate car insurance. Understanding these factors is key to gauging affordability.

Driving Record: A clean driving record invariably translates to lower premiums. Accidents, traffic violations, and DUIs can significantly increase the cost of insurance.

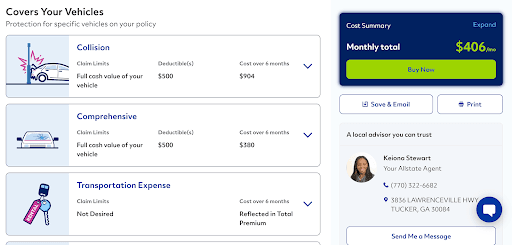

Coverage Options: The level of coverage chosen profoundly impacts the price. Opting for comprehensive and collision coverage will raise premiums compared to basic liability coverage.

Location: Urban areas with higher traffic density and accident rates typically have higher insurance costs than rural areas.

Vehicle Type: The make and model of the car influence insurance rates. High-performance vehicles or those with higher repair costs generally result in more expensive premiums.

Demographics: Age, gender, and marital status can affect insurance rates. Younger drivers and single individuals are often considered higher-risk and may face steeper premiums.

Comparing Allstate to Competitors

To determine Allstate's competitiveness, it's crucial to compare its rates with those of other major insurers. Such comparisons often reveal that Allstate's pricing falls within a comparable range, though variations exist depending on individual circumstances.

Industry data, such as reports from the National Association of Insurance Commissioners (NAIC), provides a broader perspective on market averages. These reports offer benchmarks for evaluating insurance costs across different companies and regions.

"Insurance rates are a reflection of risk, and companies use sophisticated algorithms to assess that risk," explains Jane Doe, a financial analyst specializing in the insurance industry.

Discounts and Savings Opportunities

Allstate offers a variety of discounts that can help lower premiums. Exploring these options is essential for finding affordable coverage.

Common discounts include those for safe driving, bundling multiple policies (e.g., auto and home), student drivers with good grades, and vehicle safety features. Taking advantage of these discounts can significantly reduce the overall cost.

Allstate Drivewise: This program tracks driving behavior and rewards safe driving habits with discounts.

Multi-Policy Discount: Bundling home and auto insurance with Allstate can lead to substantial savings.

The Impact of Recent Rate Increases

Recent years have seen rising insurance rates across the board, driven by factors such as increased accident frequency, higher repair costs, and inflation. Allstate, like other insurers, has adjusted its rates accordingly.

These increases have sparked debate about affordability and access to insurance, particularly for low-income individuals and those living in high-risk areas. Consumer advocacy groups have called for greater transparency in rate-setting practices.

Despite the rate hikes, Allstate maintains that it strives to offer competitive pricing and value to its customers. The company encourages consumers to explore all available discounts and coverage options to find a policy that fits their budget.

Conclusion

Whether Allstate car insurance is "expensive" is subjective and depends heavily on individual circumstances. While some drivers may find Allstate's rates higher than other insurers, others may find them competitive, especially when factoring in available discounts and coverage options.

The key to finding affordable car insurance, regardless of the provider, lies in researching different options, comparing quotes, and understanding the factors that influence premiums. By taking a proactive approach, drivers can make informed decisions and secure the coverage they need at a price they can afford.

![Is Allstate Car Insurance Expensive Allstate Car Insurance Guide [Best and Cheapest Rates + More]](https://www.insurantly.com/wp-content/uploads/2019/09/181aa9c4-2019-website-allstate-car-insurance-page-scrolled-down-small-e1578681758142.png)

![Is Allstate Car Insurance Expensive Allstate Car Insurance Guide [Best and Cheapest Rates + More]](https://www.insurantly.com/wp-content/uploads/2019/09/99f4a265-2019-website-allstate-auto-insurance-page-small.png)