Is Spruce Bank A Prepaid Bank

The financial landscape is constantly evolving, leading consumers and businesses alike to seek clarity on the nature and operations of various financial institutions. One such institution currently under scrutiny is Spruce Bank. Questions have arisen regarding whether Spruce Bank operates as a traditional bank or a prepaid bank, a distinction with significant implications for its customers.

This article aims to provide a neutral and objective analysis of Spruce Bank's operational model. It will delve into its services, regulatory oversight, and official statements to determine whether it functions as a prepaid bank or a different type of financial institution. Understanding Spruce Bank's classification is crucial for consumers making informed decisions about where to entrust their funds.

Defining Prepaid Banks

Before examining Spruce Bank specifically, it's essential to understand what constitutes a prepaid bank. Prepaid banks typically operate by providing prepaid cards or accounts that customers can load with funds and use for purchases. These institutions generally don't offer traditional banking services like loans or lines of credit.

Unlike traditional banks, prepaid banks may not be subject to the same stringent regulatory requirements, particularly regarding deposit insurance. This distinction significantly impacts consumer protection and the security of deposited funds.

Spruce Bank's Services and Operations

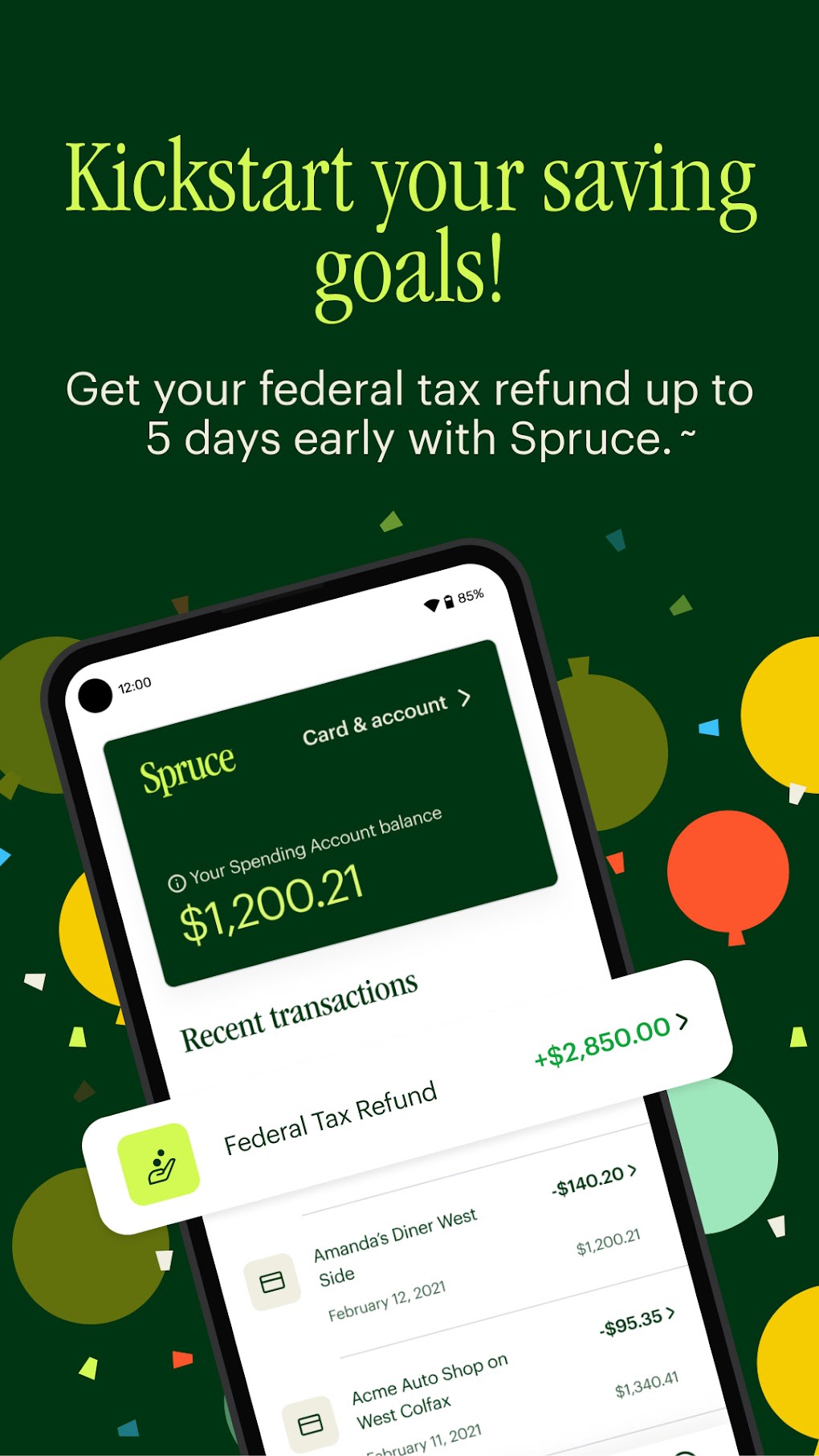

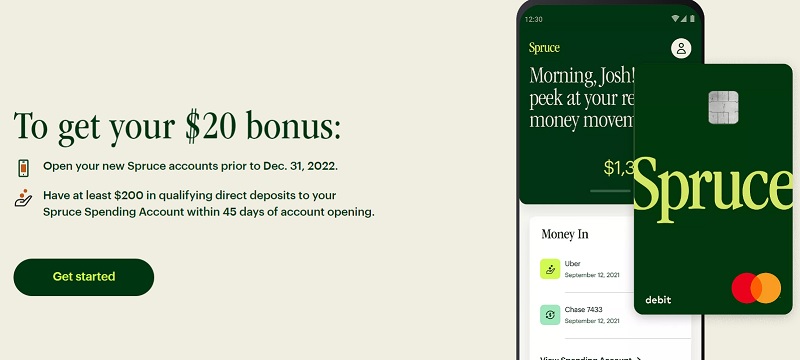

Spruce Bank offers a range of financial services to its customers. These services include checking accounts, savings accounts, and prepaid debit cards. It is important to examine whether the core functions align with typical prepaid bank activities.

According to Spruce Bank's official website, the institution is chartered as a state-chartered bank. This detail places it under the supervision of the appropriate state banking regulator. The significance of this is the regulator oversight of the bank.

Regulatory Oversight and Deposit Insurance

One of the key differences between traditional and prepaid banks lies in the extent of regulatory oversight. Traditional banks, especially those insured by the Federal Deposit Insurance Corporation (FDIC), are subject to rigorous examinations and compliance requirements.

Spruce Bank prominently displays the FDIC logo on its website. This indicates that deposits are insured up to the standard FDIC limit, which is currently $250,000 per depositor, per insured bank. This insurance provides a crucial safety net for customers.

Official Statements and Public Records

To further clarify Spruce Bank's status, it's important to review official statements and public records. Press releases and regulatory filings can offer valuable insights into the institution's operational model and its relationships with regulatory bodies.

A search of regulatory databases reveals that Spruce Bank is listed as a state-chartered bank supervised by the state's Department of Financial Institutions. There are no indications that its primary business involves solely prepaid cards or accounts. This reinforces the assessment that the bank's main function is not a prepaid bank.

Comparison with Traditional Banking Models

While Spruce Bank offers prepaid debit cards, this offering doesn't automatically classify it as a prepaid bank. Many traditional banks offer prepaid cards as one of their products, alongside checking accounts, savings accounts, and other financial services.

Spruce Bank's provision of a broad array of banking products, coupled with its regulatory oversight as a state-chartered bank, more closely aligns it with a traditional banking model. The focus is more expansive that of a prepaid bank model.

Impact on Consumers

The classification of Spruce Bank has direct implications for consumers. Understanding the extent of deposit insurance and regulatory oversight is crucial for making informed decisions about where to deposit funds.

Because Spruce Bank is insured by the FDIC, the consumers' funds are protected up to $250,000. This insurance level makes it similar to other traditional banking organizations.

Conclusion

Based on available information, including Spruce Bank's official statements, regulatory filings, and the services it offers, it is not classified as a prepaid bank. The bank operates as a state-chartered bank with deposit insurance from the FDIC. It offers a wider range of financial services beyond just prepaid cards.

Consumers should always conduct their own due diligence when choosing a financial institution. Understanding the regulatory framework and deposit insurance coverage is paramount for ensuring the safety and security of their funds. Spruce Bank's operations, as currently understood, fall within the established structure of a state-chartered and FDIC-insured bank.