Is There A Class Action Lawsuit Against Experian

Imagine receiving a letter in the mail, not a friendly greeting or an anticipated bill, but a notice about a data breach that could expose your most sensitive financial information. The anxiety of that moment, the feeling of vulnerability, is something millions have experienced, and it often leads to the question: Is there anything we can do?

This article delves into the landscape of legal actions against Experian, one of the three major credit reporting agencies. Specifically, we'll explore whether there are active class action lawsuits targeting the company, what these lawsuits allege, and what recourse consumers may have if their data has been compromised.

The Role of Experian and Data Security

Experian, along with Equifax and TransUnion, plays a crucial role in the financial ecosystem.

These agencies collect and maintain credit information on millions of consumers, data that is used by lenders to assess creditworthiness.

This information includes names, addresses, Social Security numbers, credit card details, and payment histories, making them prime targets for cybercriminals.

Data Breaches: A Recurring Threat

The threat of data breaches is a constant concern for consumers and businesses alike.

Large-scale breaches can expose the personal information of millions, leading to identity theft, financial fraud, and significant emotional distress.

Credit reporting agencies, holding vast amounts of sensitive data, are particularly vulnerable and have been targeted in several high-profile incidents.

Class Action Lawsuits: A Collective Response

When a data breach occurs, individuals often feel powerless to take on a large corporation like Experian.

This is where class action lawsuits come into play, allowing a group of people with similar grievances to collectively sue a company.

These lawsuits can seek compensation for damages resulting from the breach, such as financial losses, credit monitoring costs, and emotional distress.

Exploring Existing Lawsuits Against Experian

The legal landscape surrounding data breaches and Experian is complex and ever-evolving.

There have been numerous instances where Experian has faced scrutiny and legal action related to data security incidents.

It's important to investigate whether there are currently active class action lawsuits targeting Experian related to a specific breach or security lapse.

To determine if a class action lawsuit exists, one should check with law firms specializing in data breach litigation.

Websites that track class action lawsuits, like ClassAction.org or Top Class Actions, are also valuable resources.

Court records and legal databases can provide information on filed cases and their current status.

Note: It is crucial to understand that the existence and details of active lawsuits can change rapidly. The information provided here is for general informational purposes only and should not be considered legal advice.

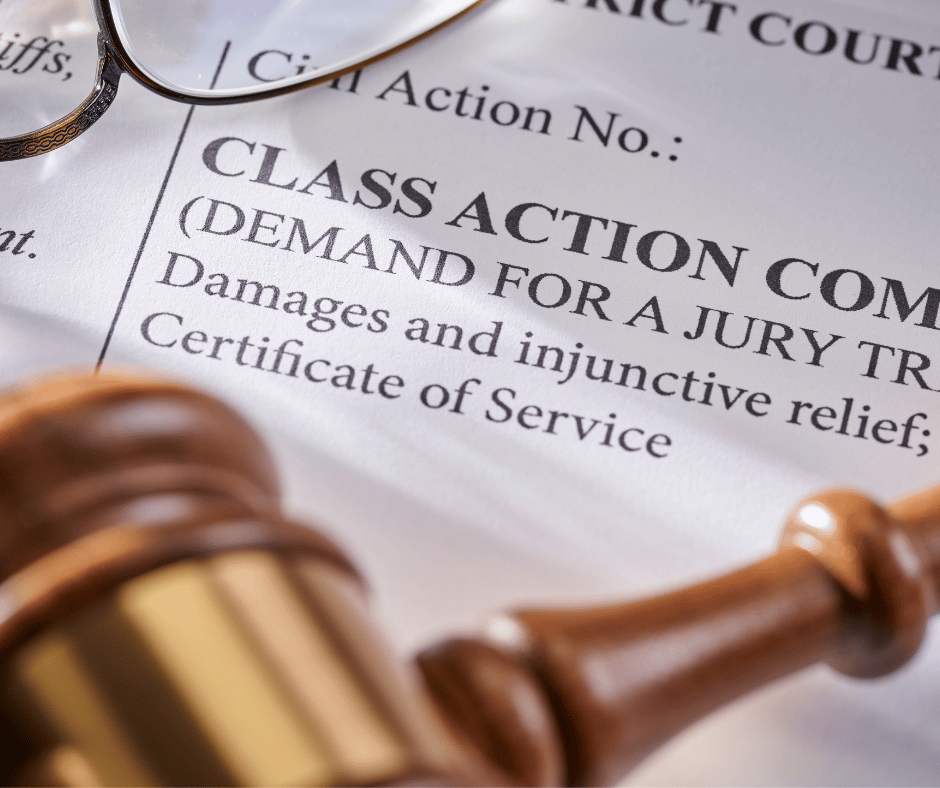

Potential Allegations in a Class Action

If a class action lawsuit is filed against Experian following a data breach, the allegations typically center around the company's failure to adequately protect consumer data.

Plaintiffs might argue that Experian did not implement reasonable security measures, failed to promptly notify affected individuals, or misrepresented its data security practices.

The legal claims often include negligence, breach of contract, and violations of consumer protection laws.

"Companies that collect and store sensitive consumer data have a legal and ethical obligation to protect that information from unauthorized access," says a privacy lawyer, who requested anonymity due to ongoing litigation. "When they fail to do so, they can be held liable for the resulting harm."

Consumer Rights and Recourse

Regardless of whether a class action lawsuit is underway, consumers affected by a data breach have certain rights and recourse options.

These include the right to receive notification of the breach, to obtain a free copy of their credit report, and to place a fraud alert or security freeze on their credit file.

Individuals can also file complaints with the Federal Trade Commission (FTC) and their state's Attorney General.

Steps to Take After a Data Breach

If you receive a notice that your information has been compromised in a data breach, take immediate action to protect yourself.

First, carefully review the notice and understand the type of information that was exposed.

Next, change your passwords on all online accounts, especially those that use the same username and password combination.

Consider placing a fraud alert on your credit report, which requires creditors to verify your identity before opening new accounts.

You can also place a security freeze on your credit file, which prevents access to your credit report and makes it more difficult for identity thieves to open accounts in your name.

Regularly monitor your credit reports and financial accounts for any unauthorized activity and report any suspicious transactions immediately.

The Broader Impact and Lessons Learned

Data breaches have far-reaching consequences, not just for individuals but for the entire economy.

They erode consumer trust, damage business reputations, and can lead to significant financial losses.

These incidents highlight the importance of robust data security practices and the need for companies to prioritize the protection of consumer information.

Experian and other credit reporting agencies have a responsibility to invest in state-of-the-art security technologies and to implement comprehensive data protection policies.

They must also be transparent with consumers about data security incidents and provide timely and effective support to those affected.

This proactive approach can help mitigate the risks of future breaches and build stronger relationships with consumers.

Moving Forward with Awareness and Vigilance

Staying informed is the best defense in the face of data security threats.

Consumers should remain vigilant about their online security practices, regularly monitor their credit reports, and be aware of the risks associated with sharing personal information online.

By working together, consumers, businesses, and policymakers can create a more secure and trustworthy digital environment.

While the legal battles may continue to unfold, the power to protect our personal information ultimately lies with each of us.

Staying informed, being proactive, and demanding accountability from those who hold our data are essential steps in safeguarding our financial well-being.

The journey toward greater data security is ongoing, but with awareness and vigilance, we can navigate the challenges and build a future where personal information is treated with the respect and care it deserves.