Is There A Way To Cash A Check Online

In an era defined by digital convenience, the archaic ritual of physically cashing a check can feel like a frustrating anachronism. Many consumers, accustomed to managing their finances online, are asking: is there a truly seamless and reliable way to cash a check without stepping foot in a bank or check-cashing store?

The promise of cashing checks online has tantalized consumers for years. This article explores the landscape of online check cashing, examining the available options, associated risks, and the overall viability of this increasingly sought-after service. It delves into the technology, the regulatory framework, and the real-world experiences of users navigating this evolving financial frontier.

Mobile Check Deposit: A Ubiquitous Solution

For many, mobile check deposit, offered through their bank's mobile app, has become the standard. This method involves taking a picture of the front and back of the check and submitting it electronically to the bank for deposit.

Most major banks now offer this feature, and it's generally considered a safe and convenient option for existing bank customers. However, it requires having a bank account, which immediately excludes a significant portion of the population.

Third-Party Check Cashing Apps: An Alternative Route

A growing number of third-party apps promise to cash checks online, often targeting the unbanked or underbanked population. These apps, such as Ingo Money, PayPal, and Brink's Money Prepaid, offer check cashing services for a fee.

The convenience of these apps comes at a cost, with fees typically ranging from 1% to 5% of the check amount. These fees can quickly add up, especially for those cashing larger checks regularly.

Weighing the Risks and Rewards

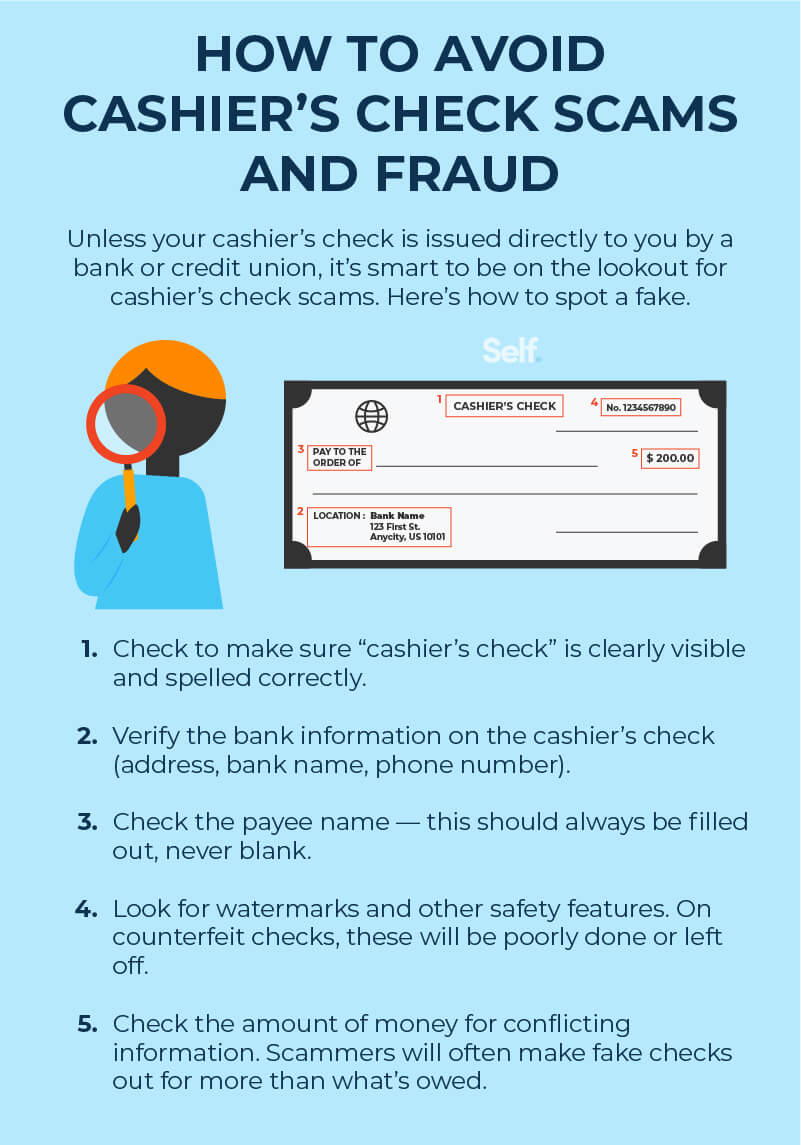

While these apps offer a lifeline for some, users must be vigilant about potential risks. Data security is a paramount concern, as these apps require users to share sensitive financial information, including bank account details and social security numbers.

Moreover, app users are vulnerable to scams and fraudulent checks. A check may appear valid but be returned unpaid days or weeks later, leaving the user responsible for the funds.

One significant risk is the possibility of identity theft or data breaches. Always verify the legitimacy of any app before sharing personal or financial details.

Regulatory Landscape and Consumer Protection

The online check cashing industry is subject to a complex web of regulations, varying from state to state. The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) play a role in overseeing these services and protecting consumers from unfair or deceptive practices.

However, enforcement can be challenging, and consumers need to be aware of their rights and responsibilities. Always read the fine print and understand the fees, terms, and conditions before using any online check cashing service.

According to the CFPB, consumers should carefully review the fee schedule and understand the app's policies regarding returned checks and dispute resolution.

The Future of Check Cashing: A Cashless Society?

The reliance on physical checks is gradually declining as electronic payment methods become more prevalent. Direct deposit, debit cards, and mobile payment platforms are increasingly replacing traditional checks.

However, checks are still used for various purposes, particularly by businesses and individuals who prefer the paper trail or lack access to digital payment options. As technology evolves, online check cashing is likely to become more sophisticated and integrated with other financial services.

Innovation will continue to drive changes in the check-cashing industry. Whether online check cashing will ever fully replace the traditional methods remains to be seen.

"While digital check cashing offers convenience, consumers must prioritize security and understand the associated costs." - Financial Security Advocate

Ultimately, the decision of whether to cash a check online hinges on individual circumstances, risk tolerance, and access to alternative financial services. By understanding the available options, potential risks, and regulatory landscape, consumers can make informed choices and navigate the evolving world of online check cashing.