Line Of Credit For Bad Credit Direct Lender

Imagine a single parent, Sarah, juggling bills, rent, and the ever-present need to provide for her children. A sudden car repair threatens to derail everything. Banks turn her down due to a less-than-perfect credit history, leaving her feeling trapped. This is the reality for millions, but a new solution is emerging, offering a lifeline where traditional lenders fear to tread.

This article explores the rise of direct lenders offering lines of credit specifically for individuals with bad credit. These lenders represent a significant shift in the financial landscape, providing access to much-needed funds for those often overlooked by mainstream institutions.

The Credit Conundrum: A Barrier to Opportunity

A low credit score can feel like a life sentence, barring access to loans, mortgages, and even employment opportunities. Traditional banks often have strict lending criteria, leaving individuals with blemishes on their credit reports with limited options.

This creates a vicious cycle: those who need financial assistance the most are often denied it, perpetuating their financial struggles.

The Rise of Alternative Lending

Over the past decade, the financial technology (fintech) sector has exploded, giving rise to a plethora of alternative lending platforms. These platforms utilize advanced algorithms and alternative data sources to assess risk, allowing them to serve a broader range of borrowers.

This includes individuals with bad credit who might otherwise be deemed too risky by traditional banks.

Direct Lenders: Cutting Out the Middleman

Within the alternative lending space, direct lenders occupy a unique position. Unlike loan marketplaces that connect borrowers with various lenders, direct lenders fund loans directly from their own capital.

This streamlined process can result in faster approval times and potentially more flexible terms.

What Makes Them Different?

Direct lenders specializing in bad credit lines of credit often focus on factors beyond a borrower's credit score. They may consider income stability, employment history, and other indicators of repayment ability.

Some utilize innovative risk assessment models that incorporate alternative data sources, such as bank account activity and bill payment history.

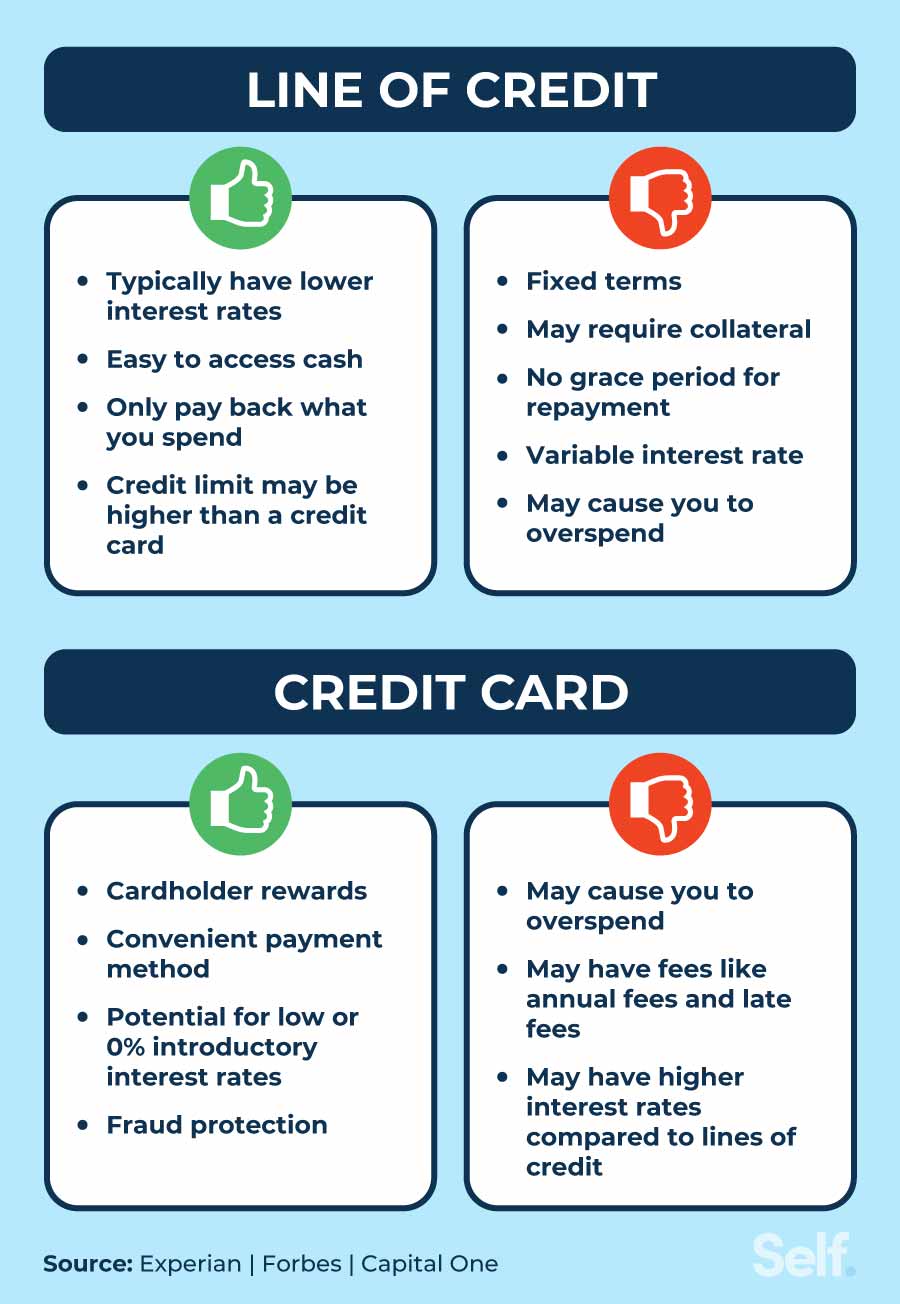

The Benefits of a Line of Credit

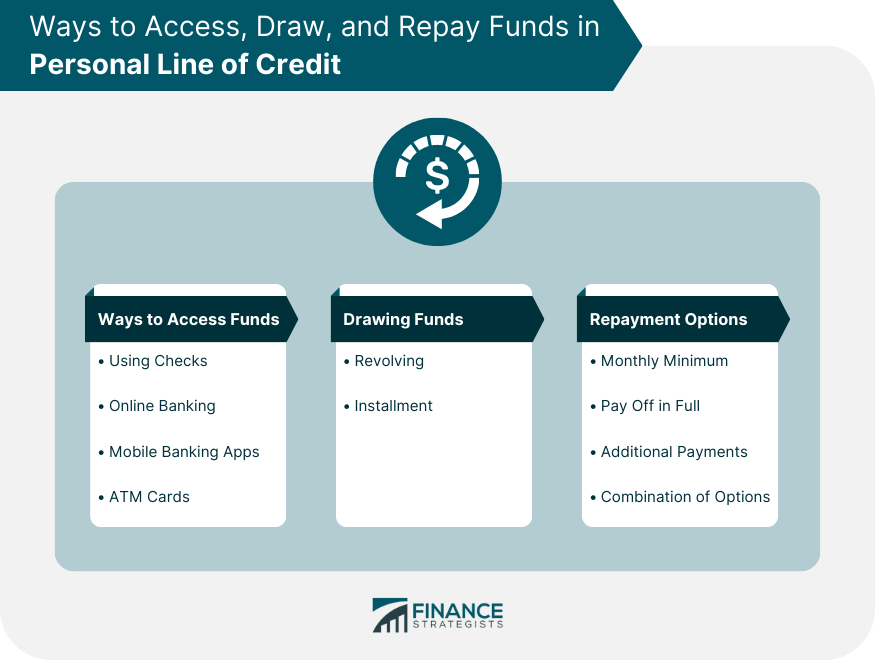

A line of credit offers borrowers a flexible way to access funds as needed, up to a pre-approved limit. Unlike a traditional loan, where the entire amount is disbursed upfront, a line of credit allows borrowers to draw funds only when necessary and pay interest only on the amount borrowed.

This can be particularly beneficial for managing unexpected expenses or bridging income gaps.

Why Choose a Line of Credit over a Loan?

For individuals with bad credit, a line of credit can be a more manageable option than a lump-sum loan. It provides a safety net without the pressure of repaying a large principal amount all at once.

The flexibility of a line of credit also allows borrowers to better control their debt and avoid unnecessary interest charges.

Navigating the Landscape: What to Look For

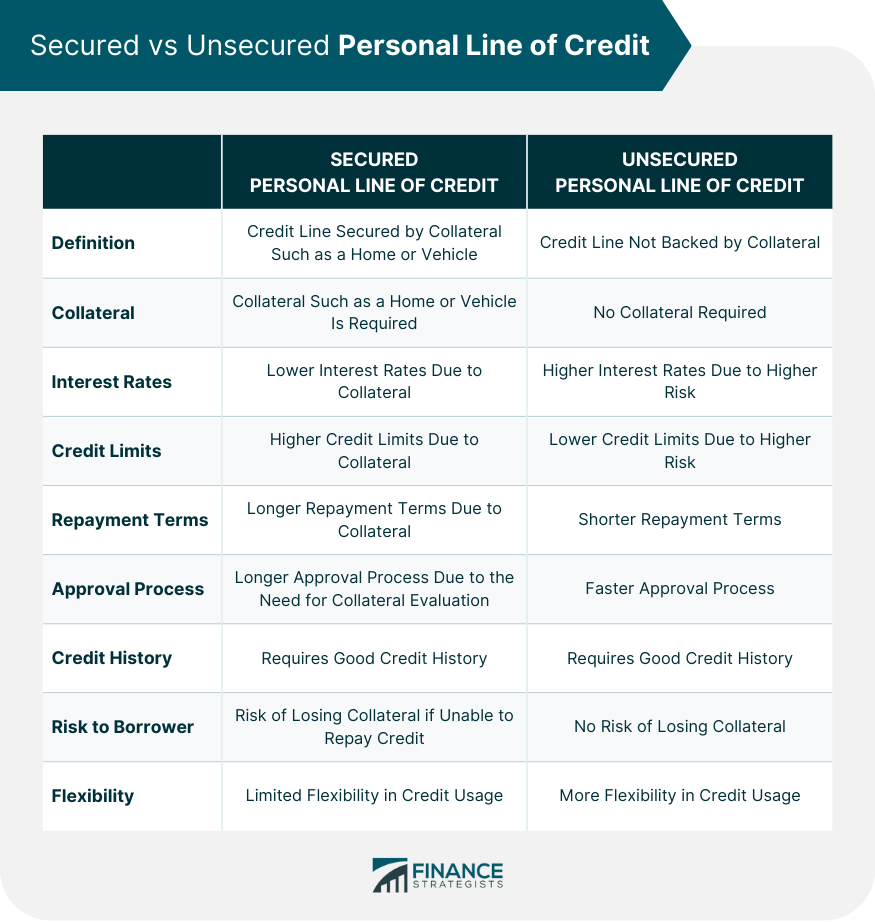

While direct lenders offering bad credit lines of credit can be a valuable resource, it's crucial to approach them with caution. Not all lenders are created equal, and some may charge exorbitant fees or engage in predatory lending practices.

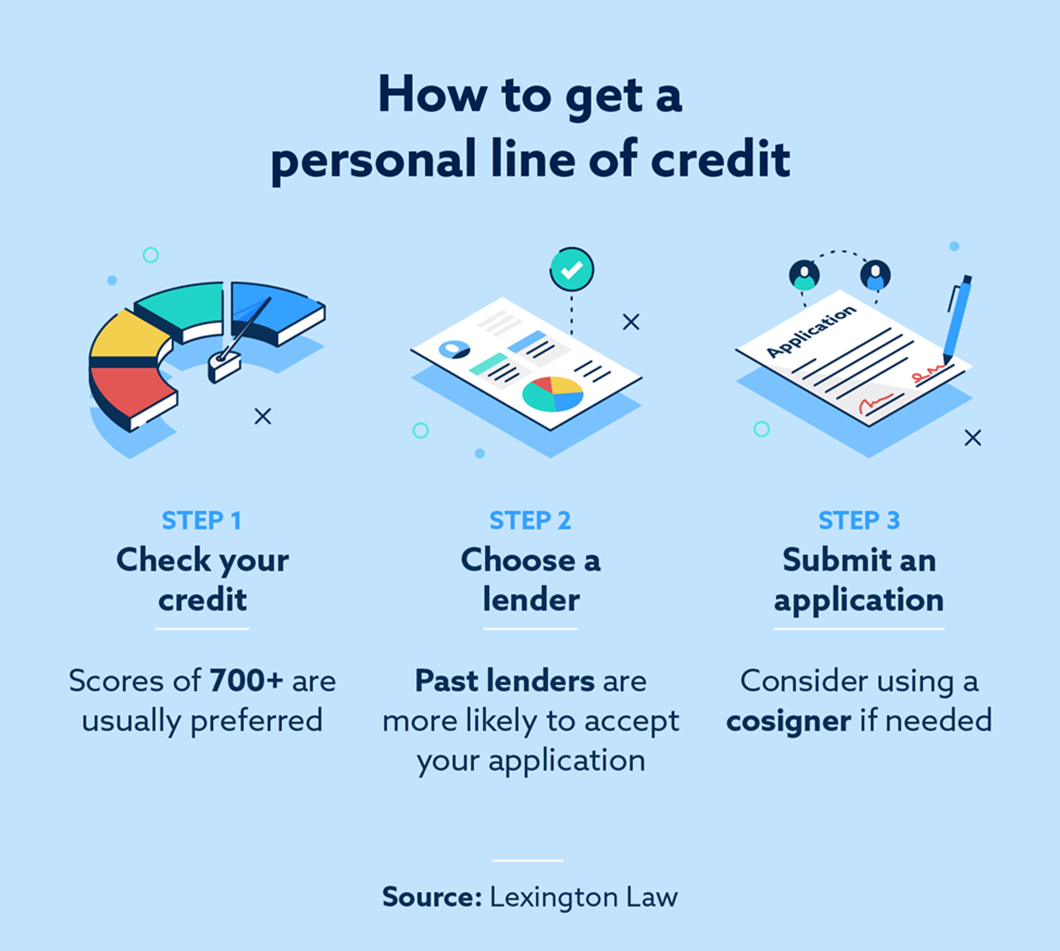

Borrowers should carefully research lenders, compare interest rates and fees, and read online reviews before applying for a line of credit.

Key Considerations:

Interest Rates and Fees: Understand the annual percentage rate (APR) and any associated fees, such as origination fees or late payment fees. Compare rates from multiple lenders to ensure you're getting a fair deal.

Repayment Terms: Review the repayment schedule and ensure you can comfortably afford the monthly payments. Look for lenders that offer flexible repayment options.

Transparency: Choose lenders that are transparent about their terms and conditions. Avoid lenders that are vague or evasive about their fees.

Customer Service: Research the lender's customer service reputation. Look for lenders that are responsive and helpful.

Potential Pitfalls and Responsible Borrowing

While a line of credit can be a valuable tool, it's essential to use it responsibly. Overspending or failing to make timely payments can lead to increased debt and damage your credit score.

Borrowers should only use a line of credit for essential expenses and should prioritize making on-time payments.

Building Credit with a Line of Credit

Used responsibly, a bad credit line of credit can actually help improve your credit score. By making on-time payments, you can demonstrate to lenders that you are a reliable borrower.

Over time, this can lead to better credit terms and access to a wider range of financial products.

The Future of Lending: Accessibility and Inclusion

The rise of direct lenders offering lines of credit for individuals with bad credit represents a positive step towards greater financial inclusion. These lenders are helping to level the playing field and provide opportunities for individuals who have been traditionally underserved by the financial system.

As technology continues to evolve, we can expect to see even more innovative lending solutions emerge, further expanding access to credit for all.

"The key is responsible lending and borrowing. These lines of credit can be a lifeline for those struggling, but it's crucial to understand the terms and manage the debt effectively," explains financial advisor, Emily Carter.

While the road to financial stability may still be challenging for many, the emergence of these specialized lending options offers a glimmer of hope. They signify a shift towards a more inclusive and understanding financial system, one that recognizes the potential in every individual, regardless of their past credit mistakes. It's about providing a second chance, a hand up, and the opportunity to rebuild and thrive.