Love And Trust Format For Client

The financial advisory world is experiencing a seismic shift. Long-held assumptions about client engagement are being challenged as a new model, dubbed the "Love and Trust Format" (LTF), gains traction. Early adopters are reporting significant improvements in client retention and satisfaction, but industry veterans remain skeptical, questioning its sustainability and scalability.

At its core, LTF prioritizes building deep, emotionally resonant relationships with clients, emphasizing empathy and understanding over purely transactional interactions. This approach, while seemingly intuitive, represents a radical departure from traditional, data-driven methodologies, and its long-term efficacy is still being debated.

The Rise of the Love and Trust Format

The genesis of LTF can be traced back to the increasing demand for personalized financial advice. In an era of automated investment platforms and robo-advisors, clients are seeking more than just portfolio management. They crave a human connection and a financial advisor who genuinely understands their aspirations and anxieties.

According to a recent study by Cerulli Associates, "Clients increasingly value advisors who can provide emotional support and guidance during periods of market volatility." This sentiment is fueling the adoption of LTF among a growing number of firms.

One of the pioneers of LTF is Sarah Chen, founder of Bloom Financial, a boutique advisory firm based in San Francisco. "We realized that our clients weren't just looking for investment advice," Chen explains. "They were looking for someone to partner with them on their life journey, someone who could help them navigate complex financial decisions with empathy and understanding."

Bloom Financial implements LTF by dedicating significantly more time to client interactions. Initial consultations delve beyond financial statements to explore clients' values, goals, and fears. Regular check-ins focus on emotional well-being as much as portfolio performance.

Key Components of LTF

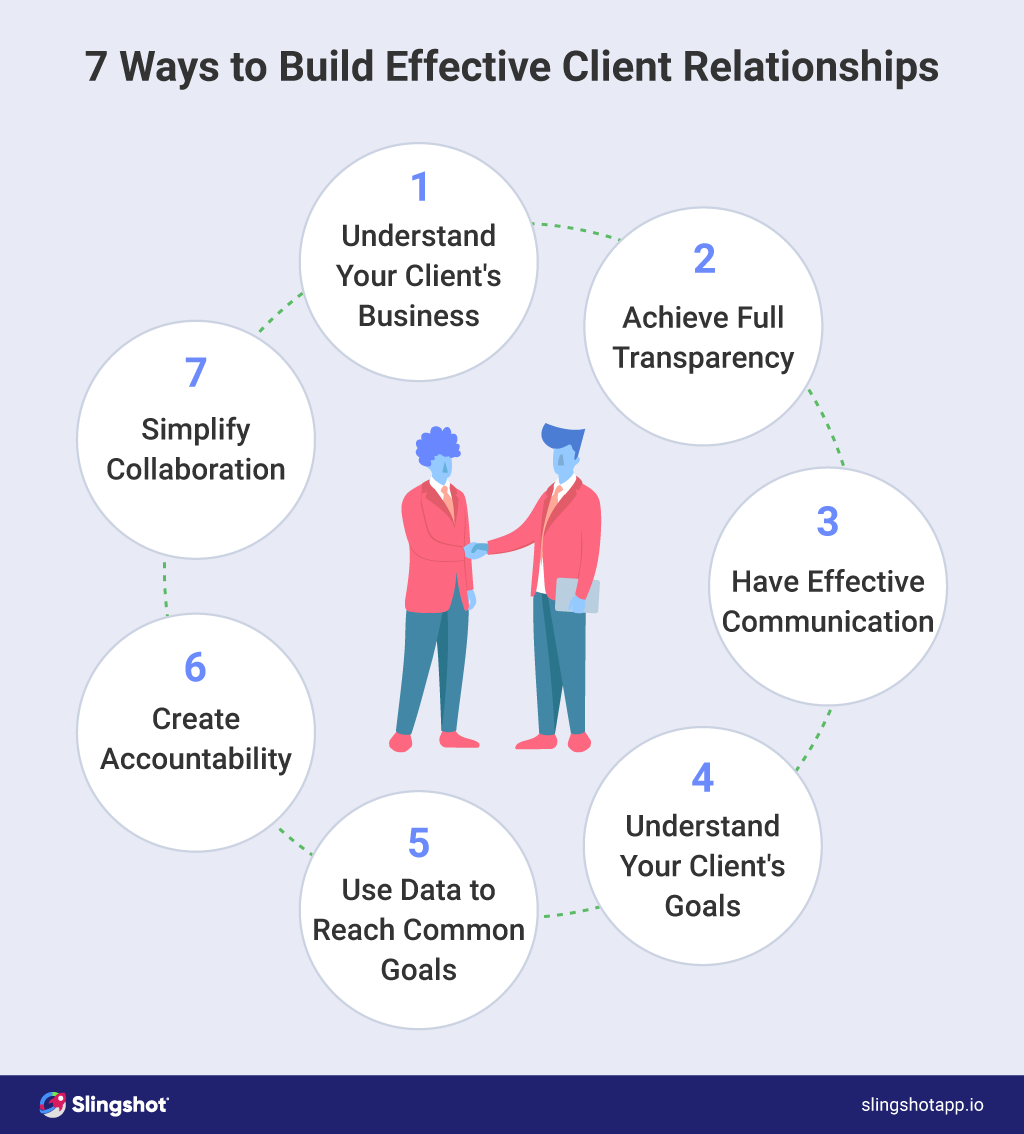

Several key components define the Love and Trust Format:

- Empathy-Driven Communication: Active listening and validation of client emotions are paramount.

- Personalized Financial Planning: Advice is tailored to individual circumstances and values, not just risk tolerance.

- Transparency and Honesty: Open communication about fees, potential risks, and limitations of advice is essential.

- Ongoing Education and Support: Clients are empowered to make informed decisions through educational resources and proactive guidance.

These components are not entirely new to the financial advisory world. However, LTF elevates them to the forefront, making them the foundation of the client-advisor relationship.

Industry Skepticism and Challenges

Despite its growing popularity, the Love and Trust Format faces significant skepticism from some corners of the financial industry. Concerns revolve around scalability, objectivity, and the potential for emotional bias. Critics argue that focusing too heavily on emotions can cloud judgment and lead to suboptimal investment decisions.

"While building strong client relationships is undoubtedly important," says David Miller, a senior analyst at Morningstar, "the primary goal of a financial advisor should still be to generate optimal returns for their clients. The LTF runs the risk of prioritizing emotional comfort over financial performance."

Another concern is the potential for LTF to be exploited. Unscrupulous advisors could manipulate clients' emotions for personal gain. Ensuring ethical conduct and maintaining objectivity are crucial challenges for firms adopting this approach.

Furthermore, scaling LTF can be difficult. Building deep, personal relationships requires significant time and resources. Firms may struggle to maintain the same level of personalized service as they grow.

The question of measuring the success of the LTF also arises. Traditional metrics like portfolio performance and client retention may not fully capture its impact. Developing new metrics that assess emotional well-being and client satisfaction will be crucial for evaluating its long-term effectiveness.

Regulatory Considerations

The increasing emphasis on emotional intelligence in financial advice also raises regulatory considerations. Current regulations primarily focus on ensuring advisors provide suitable investment recommendations based on clients' financial circumstances and risk tolerance. Whether these regulations adequately address the potential risks associated with emotionally-driven advice remains an open question.

The Securities and Exchange Commission (SEC) has yet to issue specific guidance on the use of emotional intelligence in financial advice. However, industry experts anticipate that regulators will be closely monitoring the adoption of LTF and its potential impact on investor protection.

Ensuring that advisors are properly trained to handle sensitive client emotions and avoid conflicts of interest will be crucial for maintaining regulatory compliance.

The Future of Financial Advice

The Love and Trust Format represents a significant evolution in the financial advisory landscape. While its long-term success remains uncertain, it highlights the growing importance of emotional intelligence and personalized service in a rapidly changing world.

As technology continues to disrupt the industry, human connection and empathy will become increasingly valuable assets for financial advisors. Firms that can effectively blend data-driven analysis with emotional understanding will be best positioned to thrive in the future.

The debate surrounding LTF is likely to continue as more firms experiment with different approaches to client engagement. Ultimately, the most successful models will be those that prioritize both financial performance and client well-being.

Looking ahead, the financial advisory world may see a hybrid approach emerge, blending the best aspects of traditional methodologies with the emotional intelligence principles of LTF. This could involve leveraging technology to automate routine tasks, freeing up advisors to focus on building deeper relationships with their clients.

The key will be to strike a balance between efficiency and empathy, ensuring that clients receive both sound financial advice and the emotional support they need to navigate the complexities of life.

The future of financial advice is not just about numbers. It’s about people and understanding that money touches lives at a deep and emotional level. The evolution in progress is moving to acknowledging that and to help people from a place of caring.

![Love And Trust Format For Client Updated Trust Format for Client 2025 [Sample Messages]](https://smartlazyhustlers.com/wp-content/uploads/2021/08/trust-format-for-client-blog-post-1024x576.jpg)

![Love And Trust Format For Client Love Format For Client to Fall in Love 2023 [Download PDF]](https://smartlazyhustlers.com/wp-content/uploads/2022/08/love-format-for-client.webp)

![Love And Trust Format For Client 130+ Trust Format Message For Client [New Best Sample Messages] | Gopius](https://gopius.com/wp-content/uploads/2023/12/Client-1.jpg)

![Love And Trust Format For Client [2024] 60 Love And Trust Format For Client To Fall In Love](https://tipsquoteswishes.com/wp-content/uploads/2023/06/Romantic-Good-Afternoon-Messages-for-him-768x514.jpg)

![Love And Trust Format For Client 130+ Trust Format Message For Client [New Best Sample Messages] | Gopius](https://gopius.com/wp-content/uploads/2024/01/How-to-Create-a-Facebook-Dating-Account-and-Access-the-Facebook-Dating-Site-for-Free-in-2024-768x402.png)

![Love And Trust Format For Client [2025] 60 Love And Trust Format For Client To Fall In Love](https://tipsquoteswishes.com/wp-content/uploads/2023/05/500-love-messages-768x512.webp)