Meta Pay Charge On Debit Card

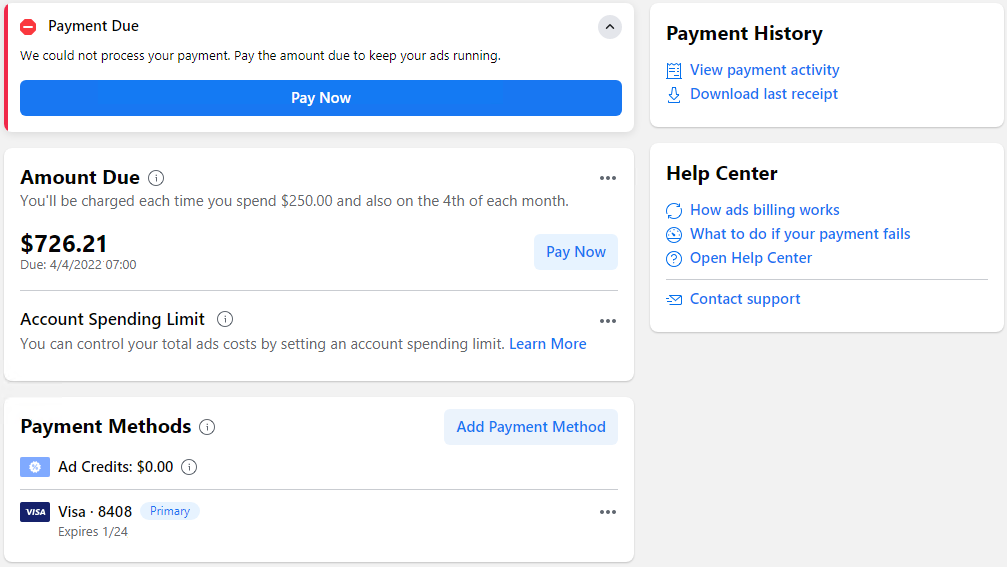

A wave of unease is sweeping through Meta users as reports of unexpected charges, labeled "Meta Pay," begin appearing on debit card statements. These unauthorized debits, often ranging from small amounts to substantial sums, have left countless individuals scrambling to understand the source and disputing the charges with their banks. The situation has sparked widespread confusion, fueled by a lack of clear communication from Meta regarding the potential causes and preventative measures.

The unexplained Meta Pay debit card charges represent a significant breach of consumer trust and raise serious questions about the security protocols surrounding Meta's payment platform. This article delves into the growing problem, examining the potential causes, the impact on affected users, Meta's response (or lack thereof), and what steps individuals can take to protect themselves from becoming victims of this concerning trend. We will also explore potential legal ramifications if Meta fails to adequately address this issue.

Understanding the Meta Pay Charge Mystery

The root cause of these unauthorized charges remains shrouded in mystery. Some users speculate that their accounts may have been compromised, leading to fraudulent transactions initiated through Meta Pay. Others suggest potential glitches within Meta's payment system itself, causing erroneous charges to be levied against debit cards.

A third theory points to potential vulnerabilities in third-party applications or websites integrated with Meta Pay, where malicious actors could exploit weaknesses to initiate unauthorized payments. It is important to note that these are just speculations, as Meta has yet to provide a definitive explanation.

The Impact on Affected Users

The impact of these unauthorized charges extends far beyond the financial burden. Many users report feeling vulnerable and violated, their sense of security shattered by the intrusion. The time and effort required to dispute these charges with banks and credit card companies can be considerable, adding to the stress and frustration.

For some, the unexpected debit can lead to overdraft fees or missed payments on other essential bills. This financial strain, coupled with the emotional distress, can have a significant and lasting impact on affected individuals and families.

Meta's Response: A Cause for Concern

The most concerning aspect of this situation is the perceived lack of a proactive and transparent response from Meta. Many users complain that their inquiries to Meta's customer support have gone unanswered or resulted in generic responses that fail to address the specific issues. This silence has fueled speculation and exacerbated the anxiety among affected users.

A comprehensive investigation into the root cause of these unauthorized charges is crucial. Furthermore, clear and timely communication with users is paramount to rebuilding trust and providing reassurance that their financial information is being protected.

What Can Users Do? Taking Proactive Steps

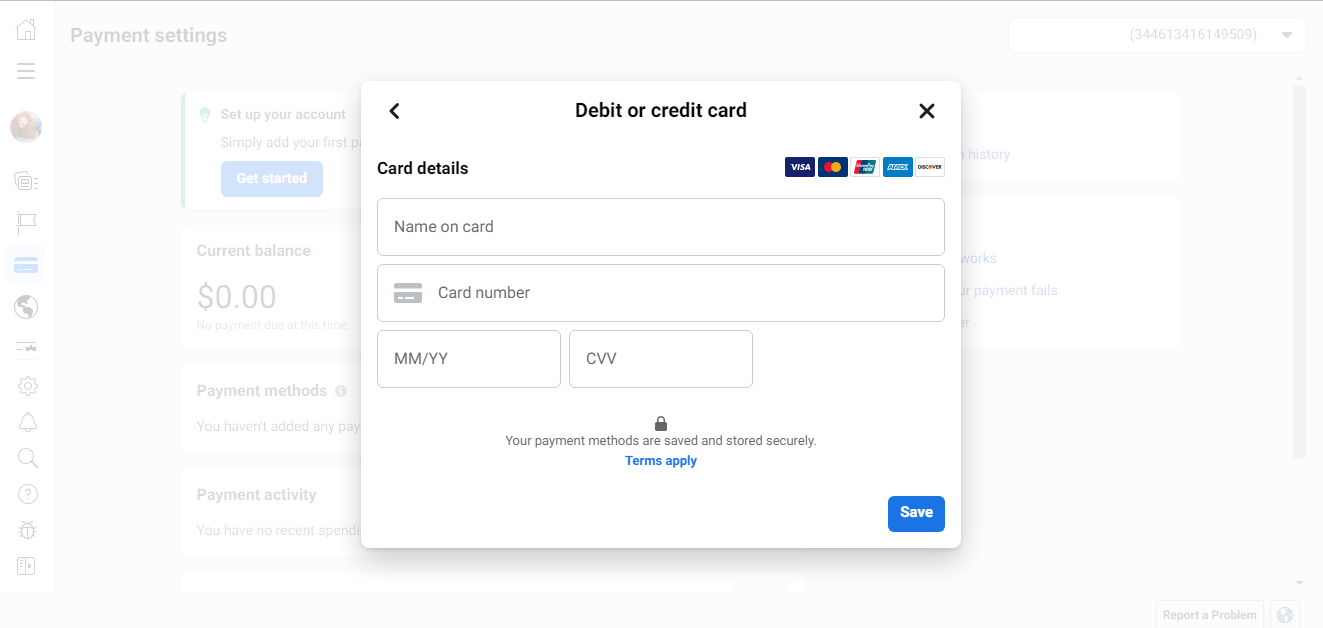

In the absence of clear guidance from Meta, users must take proactive steps to protect themselves. Regularly monitor your debit card statements for any suspicious activity, paying close attention to charges labeled "Meta Pay". Immediately report any unauthorized transactions to your bank or credit card company.

Consider setting up transaction alerts on your debit card to receive notifications for any activity. This allows you to quickly identify and report any fraudulent charges.

It is also advisable to review your Meta account security settings. Change your password to a strong, unique one, and enable two-factor authentication for an added layer of protection. Be wary of phishing attempts and avoid clicking on suspicious links or providing personal information to unverified sources.

Legal Implications and Future Outlook

If Meta fails to adequately address this issue and provide restitution to affected users, the company could face legal challenges. Class-action lawsuits could be filed on behalf of those who have suffered financial losses due to the unauthorized Meta Pay charges. Regulatory bodies, such as the Federal Trade Commission (FTC), may also launch investigations into Meta's data security practices.

The long-term impact of this situation on Meta's reputation remains to be seen. A swift and transparent response, coupled with concrete steps to prevent future incidents, is essential to restoring user trust and mitigating the potential damage. The future of Meta Pay as a trusted payment platform hinges on the company's ability to address these concerns effectively.

Moving forward, Meta should prioritize enhancing its payment security infrastructure. This includes implementing more robust fraud detection systems, strengthening authentication protocols, and providing clear and accessible customer support channels. Only through a concerted effort to address these issues can Meta hope to regain the confidence of its users and ensure the long-term viability of Meta Pay.