Missing One Payment May Cause Borrowers To

A single missed payment on a loan or credit card can trigger a cascade of negative consequences for borrowers, potentially leading to long-term financial hardship. Experts are raising concerns about the increasing number of individuals at risk, especially in the face of rising interest rates and persistent inflation.

The impact of a missed payment extends far beyond a late fee. It can significantly damage credit scores, limit access to future credit, and even result in debt collection actions. This article explores the various ramifications of missing just one payment and offers advice on how borrowers can mitigate these risks.

Understanding the Domino Effect

Missing a payment is a common occurrence, often due to oversight or temporary financial strain. However, its implications are more profound than many borrowers realize.

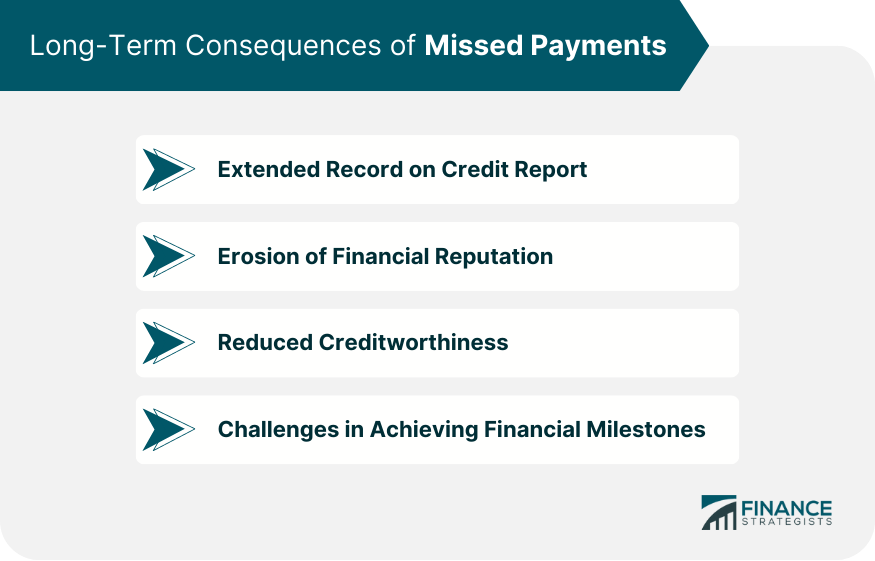

According to data from Experian, a missed payment can remain on a credit report for up to seven years. This can dramatically lower a credit score, a three-digit number that lenders use to assess creditworthiness.

A lower credit score translates to higher interest rates on future loans, including mortgages, auto loans, and personal loans. In some cases, it can even disqualify borrowers from obtaining credit altogether.

Who is Most Vulnerable?

Certain demographics are disproportionately affected by the consequences of missed payments. Lower-income individuals, those with limited financial literacy, and younger borrowers are particularly susceptible.

A report by the Consumer Financial Protection Bureau (CFPB) highlights that these groups often have thinner credit files and less access to financial resources, making them more vulnerable to the negative impacts of even a single missed payment.

Delinquency rates also tend to be higher among minority communities, further exacerbating existing inequalities.

The Ripple Effects on Financial Stability

The impact of a missed payment extends beyond credit scores. It can trigger a series of events that destabilize a borrower's financial well-being.

Late fees, which can range from $25 to $39 per missed payment, add to the financial burden. Over time, these fees can accumulate, making it even more difficult to catch up on payments.

Furthermore, many credit card companies and lenders will increase the interest rate on the account if a payment is missed, a practice known as penalty pricing. This can significantly increase the total amount owed and prolong the repayment period.

"The consequences of missing a payment can quickly spiral out of control," says Sarah Chen, a financial advisor at ClearPath Financial. "It's crucial for borrowers to take proactive steps to prevent this from happening."

Navigating the Challenges: Prevention and Solutions

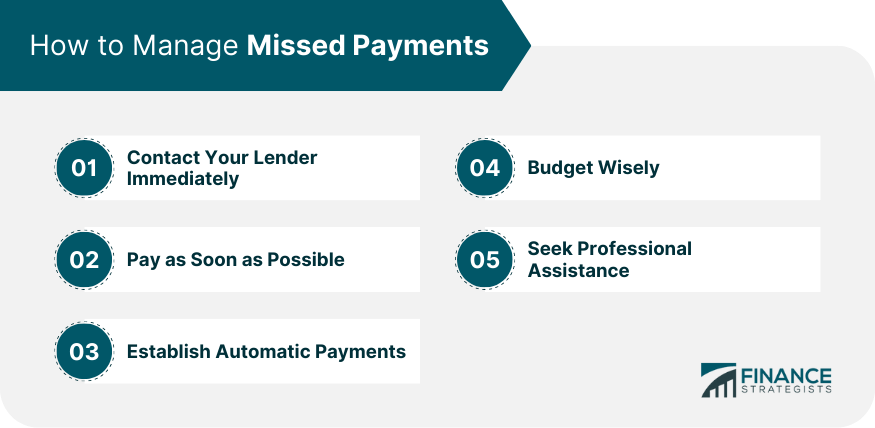

Preventing a missed payment is the best course of action. Borrowers can take several steps to minimize the risk.

Setting up automatic payments is a simple and effective way to ensure that payments are made on time. Creating a budget and tracking expenses can help borrowers identify potential cash flow issues before they arise.

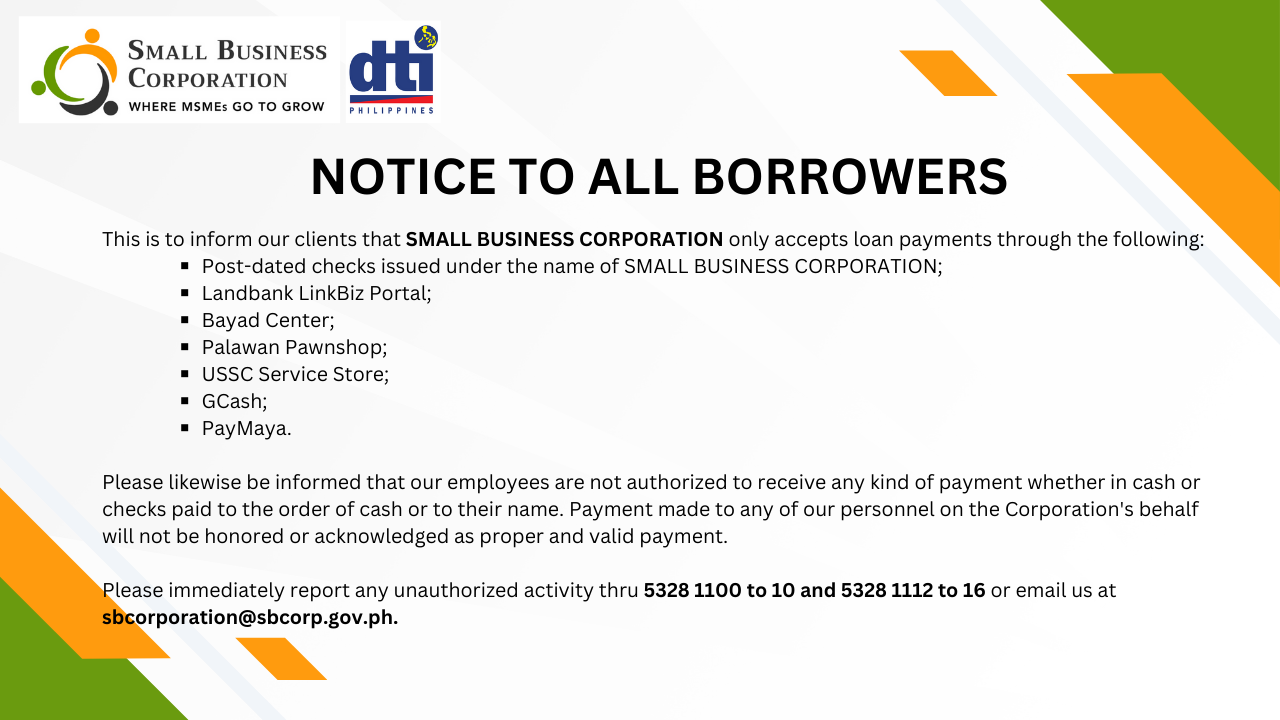

If a borrower anticipates difficulty making a payment, contacting the lender immediately is crucial. Many lenders offer hardship programs or temporary payment arrangements that can help borrowers stay on track.

"Communication is key," says Chen. "Lenders are often willing to work with borrowers who are proactive and transparent about their financial situation."

Consolidating debt, exploring balance transfer options, and seeking credit counseling are other potential solutions for borrowers struggling to manage their debt obligations.

A Personal Account

Michael Davis, a 32-year-old from Chicago, experienced firsthand the consequences of missing a single credit card payment.

Due to an unexpected medical bill, Davis missed a payment on his credit card. His credit score dropped significantly, and he was subsequently denied a loan for a new car.

"It was a wake-up call," says Davis. "I realized the importance of managing my finances responsibly and building a strong credit history."

Looking Ahead: Financial Literacy and Consumer Protection

Addressing the issue of missed payments requires a multi-faceted approach. Financial literacy programs can empower consumers to make informed decisions about credit and debt.

Stronger consumer protection regulations can help prevent predatory lending practices and ensure that borrowers are treated fairly.

Ultimately, promoting financial well-being requires a collaborative effort from individuals, lenders, policymakers, and educators. By understanding the potential consequences of missing even a single payment, borrowers can take proactive steps to protect their financial futures.