Money Borrowing Apps Without Direct Deposit

Accessing quick cash in emergencies has become increasingly streamlined with the proliferation of mobile borrowing apps. However, a segment of the population faces a hurdle: many apps require direct deposit for loan disbursement, leaving those without it searching for alternatives. The availability and implications of money-borrowing apps that don't require direct deposit are under increased scrutiny as more individuals explore these options.

This article explores the landscape of these apps, examining their mechanics, associated risks and benefits, and their potential impact on financial inclusion for those traditionally excluded from mainstream financial services. It also investigates the importance of responsible borrowing and compares the apps with other options like payday loans.

Understanding the Landscape of Money Borrowing Apps

Money borrowing apps are designed to provide short-term financial assistance, often in the form of small loans or cash advances. They aim to offer a convenient and accessible solution for unexpected expenses or temporary cash flow gaps.

The typical model involves users downloading the app, linking their bank account (often for transaction history analysis), and applying for a small loan. Direct deposit has become a standard requirement for many of these apps, ensuring automatic repayment and reducing the risk of default for lenders.

The Challenge of Direct Deposit

However, not everyone has a direct deposit setup. Gig workers, those with unconventional employment arrangements, and individuals with limited access to traditional banking services might lack this feature. This creates a barrier to entry for these individuals when seeking quick financial relief through mainstream borrowing apps.

This situation has fueled the emergence of alternative apps and lending platforms that don't require direct deposit. These apps frequently rely on different methods for verifying identity and repayment ability, sometimes relying on alternative data sources or requiring collateral.

Exploring Apps Without Direct Deposit

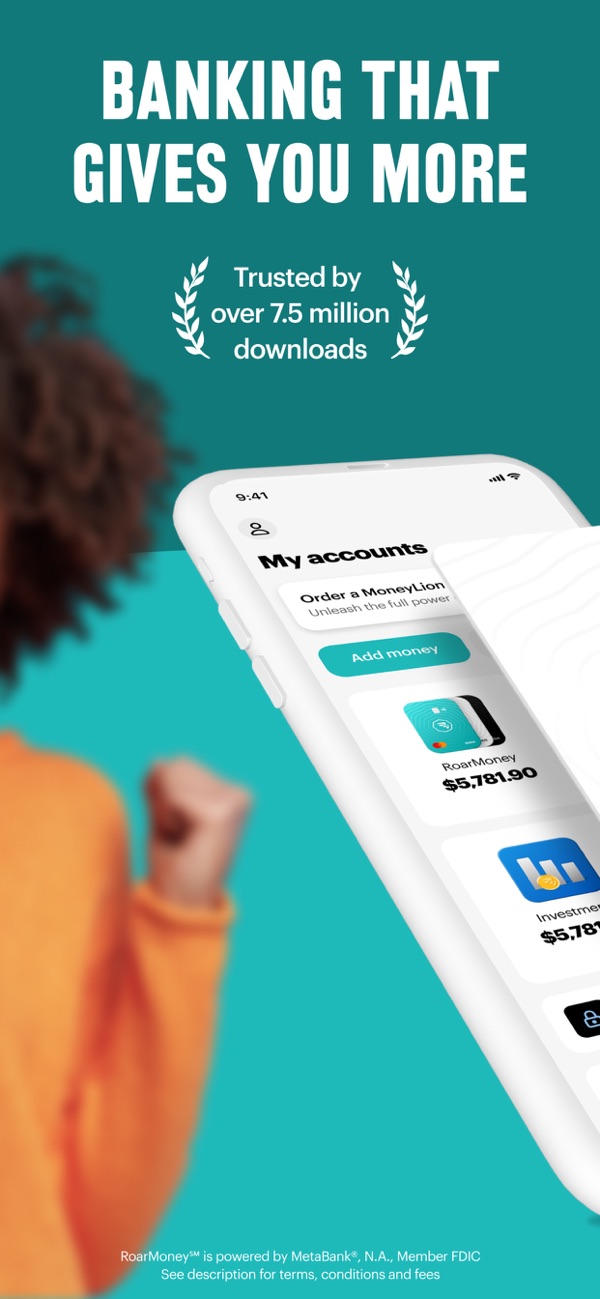

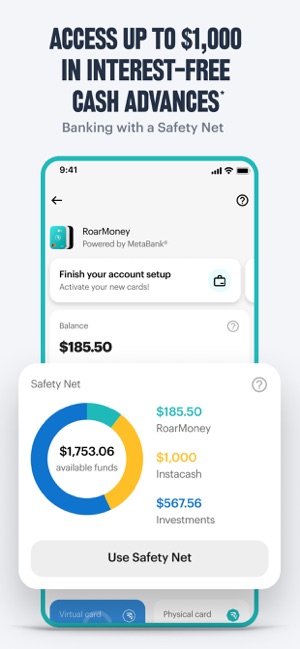

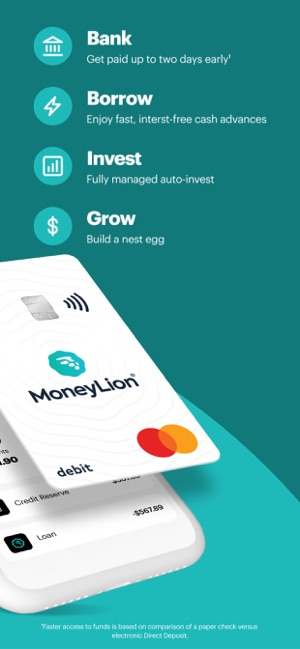

Several apps cater to individuals without direct deposit. These alternatives often utilize methods like prepaid debit cards, physical checks, or cash pickup locations for disbursement.

Some apps partner with retail locations, allowing borrowers to collect their funds in person. Others may accept alternative forms of income verification, such as pay stubs or bank statements, instead of relying solely on direct deposit history.

How They Work

The application process generally involves providing personal information, income details, and potentially linking a bank account for transaction analysis. Instead of requiring direct deposit, the app might ask for access to transaction history to assess repayment capacity.

Disbursement is usually facilitated through a prepaid debit card that is linked to the app. The user can then access the funds via ATM withdrawals or point-of-sale transactions.

Risks and Benefits of Apps Without Direct Deposit

While offering accessibility, apps without direct deposit can come with higher interest rates or fees. This reflects the increased risk associated with lending to individuals without a verified direct deposit history.

Benefits include convenience, speed, and access to funds for those who might otherwise be excluded. They can also assist building credit history for some consumers.

The Importance of Due Diligence

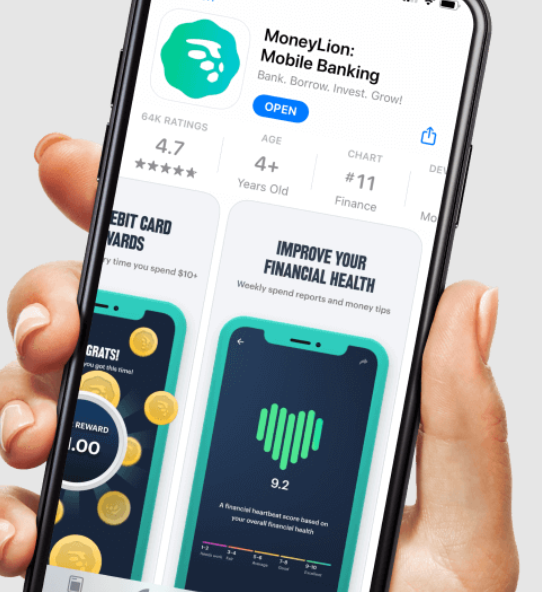

It's crucial for users to carefully review the terms and conditions of any borrowing app before committing. Pay close attention to the interest rates, fees, repayment schedule, and any potential penalties for late or missed payments.

Checking the app's reviews and ratings on reputable app stores can also offer valuable insights into the user experience and customer service. Also it is important to check whether the lending company is registered under regulatory laws.

Responsible Borrowing Practices

Regardless of the app used, responsible borrowing is key. Borrow only what you need and can comfortably repay within the agreed-upon timeframe.

Avoid using these apps as a long-term solution for financial difficulties. Seek financial counseling or explore other options, such as budgeting tools or government assistance programs, if you're struggling to manage your finances.

Alternatives to Borrowing Apps

Several alternatives to borrowing apps exist, including credit unions, community banks, and personal loans. These options may offer lower interest rates and more flexible repayment terms, although they may require a more rigorous application process.

Payday loans are another readily available option, however, they typically come with extremely high interest rates and should be approached with extreme caution. It is wise to consider other options before considering a payday loan.

The Future of Financial Inclusion

Money borrowing apps, both those requiring direct deposit and those without, are playing a growing role in the financial landscape. The demand for quick and accessible financial solutions is likely to continue, driving innovation and competition in the market.

As technology evolves, we can anticipate even more sophisticated methods for assessing creditworthiness and facilitating lending to individuals with diverse financial circumstances. The key is to prioritize responsible lending practices and to ensure that consumers have access to the information and resources they need to make informed decisions.

Ultimately, the goal is to promote financial inclusion and to empower individuals to manage their finances effectively and responsibly. Careful assessment of the terms, rates, and conditions is crucial when using any borrowing app. If you're facing persistent financial challenges, seeking guidance from a financial advisor is always recommended.