New America High Income Fund Inc

NEW YORK, NY - Shares of New America High Income Fund Inc. (NYSE: HYB) plunged sharply today following a disappointing earnings report and revised investment outlook, triggering investor concern and increased selling pressure.

The fund, known for its high-yield corporate bond investments, is now facing scrutiny over its ability to maintain current dividend payouts and navigate increasingly volatile market conditions.

Financial Performance Under Pressure

The fund reported a net investment income of $0.15 per share for the quarter, significantly below the $0.22 per share analysts had anticipated.

This shortfall is attributed to rising interest rates and widening credit spreads impacting the value of its fixed-income portfolio.

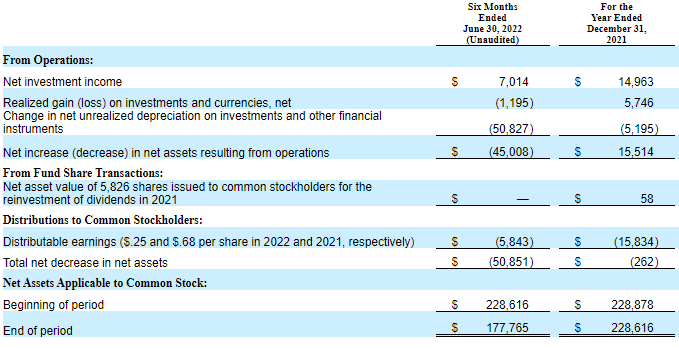

Net asset value (NAV) also declined, falling to $5.80 per share from $6.50 per share at the end of the previous quarter.

Dividend Sustainability Questioned

The current monthly distribution rate of $0.0615 per share is now under review by the fund's board of directors, raising fears of a potential dividend cut.

A statement released by the fund indicated that future distributions will be determined based on market conditions and portfolio performance, adding to investor uncertainty.

"We are closely monitoring the market environment and actively managing the portfolio to navigate these challenging times," stated a representative from New America High Income Fund in the report.

Market Reaction and Trading Activity

Shares of HYB experienced heavy selling pressure, closing down 15% at $4.93 per share on significantly higher than average trading volume.

The sell-off reflects growing apprehension about the fund's near-term prospects and its ability to sustain its historical payout levels.

Trading volume surged to over 500,000 shares, compared to its average daily volume of approximately 100,000 shares.

Portfolio Composition and Strategy

The New America High Income Fund primarily invests in a diversified portfolio of high-yield corporate bonds, also known as "junk bonds."

These bonds offer higher yields compared to investment-grade bonds but also carry greater credit risk, making the fund more vulnerable to economic downturns.

The fund's top holdings include bonds from companies in the energy, telecommunications, and healthcare sectors.

Expert Analysis and Outlook

Financial analysts are downgrading their ratings on HYB, citing concerns about increased credit risk and the potential for further NAV erosion.

"Given the current macroeconomic backdrop, we believe that New America High Income Fund faces significant headwinds," said a lead analyst from a major investment firm.

"We are revising our rating to 'Underperform' and lowering our price target to $4.50," they added.

Management's Response

The fund's management team is reportedly exploring various strategies to mitigate the impact of rising interest rates and credit spreads.

These include actively managing the portfolio's duration, increasing its allocation to higher-quality bonds, and hedging strategies to reduce interest rate risk.

However, the effectiveness of these measures remains to be seen.

What's Next for HYB?

Investors will be closely watching the fund's next earnings report and dividend announcement for further indications of its financial health.

The board of directors is expected to make a decision on the dividend policy in the coming weeks, which will have a significant impact on investor sentiment.

The future of New America High Income Fund hinges on its ability to successfully navigate the challenging market environment and deliver sustainable returns to its shareholders.