Nvdy Ex Dividend Date August 2024

Imagine the scene: The sun streams through the window, illuminating rows of monitors displaying a ticker tape dance of numbers. Coffee steams gently as investors worldwide, from seasoned professionals to budding enthusiasts, prepare for a key date marked on their calendars. August 2024 is looming large, and all eyes are on Nvidia (NVDA), the titan of the tech world.

The reason for this anticipation? The ex-dividend date. This article delves into the specifics of Nvidia's upcoming ex-dividend date in August 2024, exploring what it means for investors, the company's dividend history, and the broader significance within the context of Nvidia's growth trajectory.

Understanding the Ex-Dividend Date

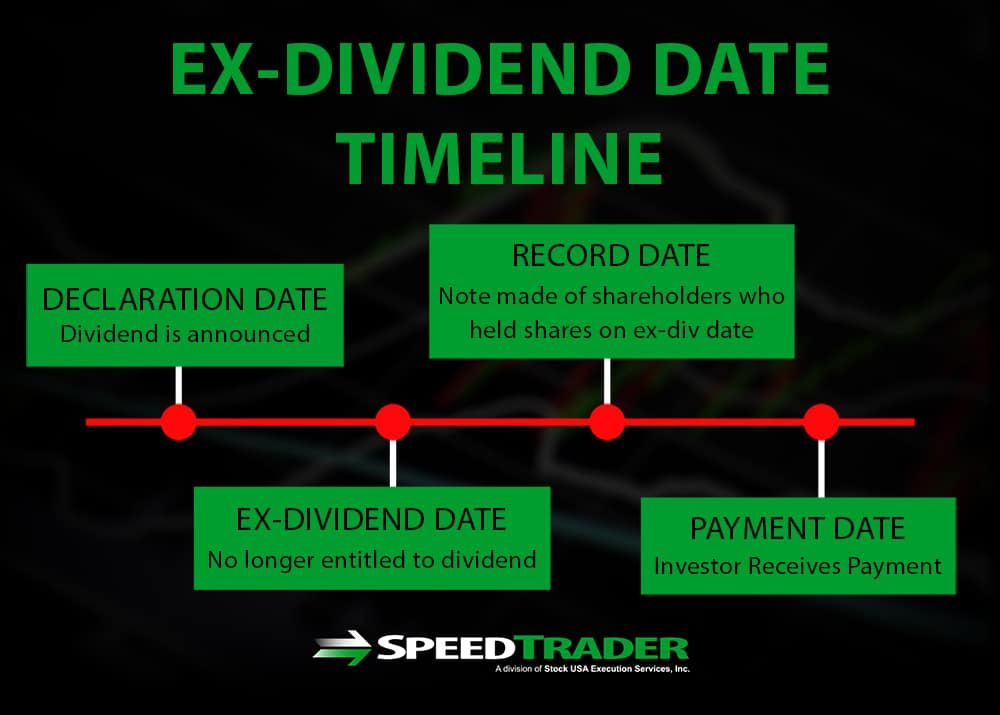

The ex-dividend date is crucial for anyone looking to receive Nvidia's next dividend payment. It's the cutoff date that determines which shareholders are entitled to the declared dividend. Buy a share before this date, and you’re in; buy it on or after, and the dividend belongs to the seller.

Typically, the ex-dividend date is set one business day before the record date. The record date is the specific date on which the company checks its records to identify the shareholders who will receive the dividend payment.

While the exact date in August 2024 needs to be officially announced by Nvidia, based on historical trends and typical dividend schedules, investors are watching closely for announcements in the weeks leading up to it.

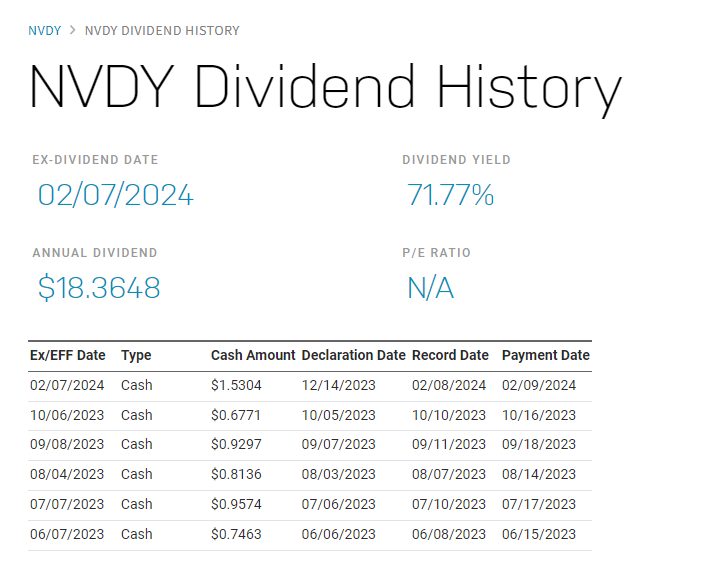

Nvidia's Dividend History: A Glimpse into Financial Strategy

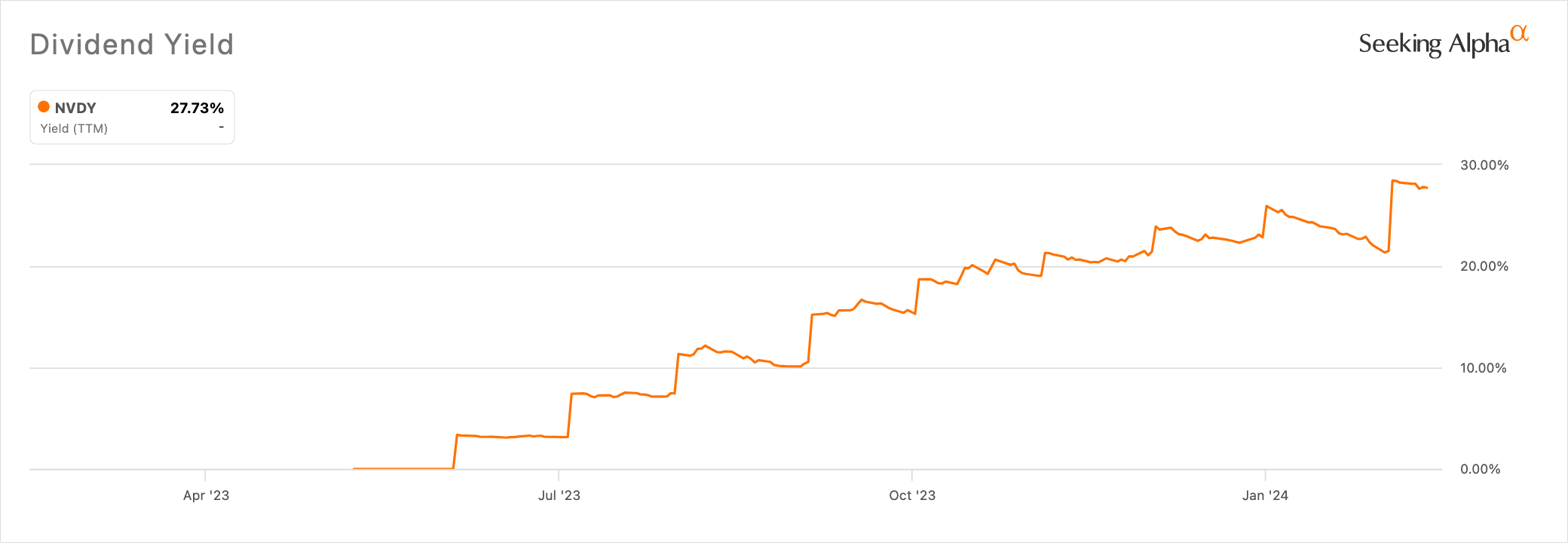

Nvidia, primarily known for its groundbreaking work in graphics processing units (GPUs) and artificial intelligence, has a history of rewarding its shareholders through dividends. While the dividend yield may not be as high as some other companies, it represents a tangible return for investors, demonstrating the company's financial health and commitment to shareholder value.

Examining Nvidia's dividend history reveals a pattern of consistent, albeit modest, payouts. The company strategically balances dividend distributions with reinvesting profits back into research and development, driving further innovation and growth.

This approach resonates with many investors who appreciate both the immediate return through dividends and the potential for long-term capital appreciation driven by Nvidia's technological advancements.

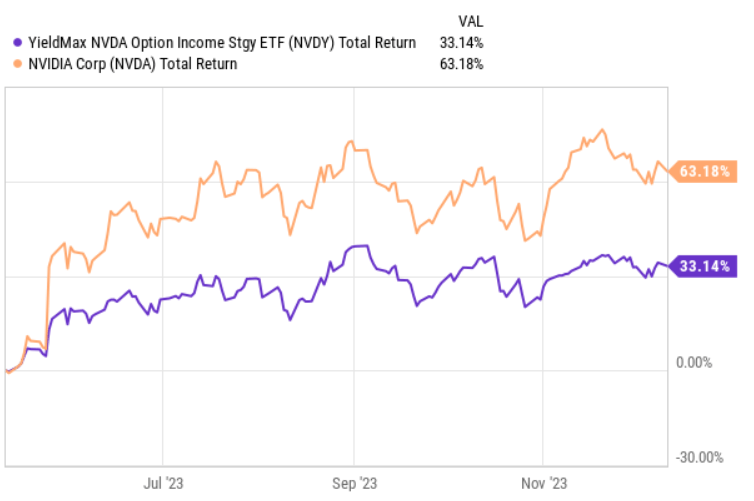

Significance in the Context of Nvidia's Growth

Nvidia's dividend policy is intrinsically linked to its overall growth strategy. The company's relentless pursuit of innovation in areas like AI, data centers, and gaming fuels revenue growth, which in turn supports the ability to maintain and potentially increase dividend payouts.

The company's leading position in the GPU market, coupled with its expanding presence in high-growth sectors like autonomous vehicles and cloud computing, positions it for sustained financial performance.

Therefore, the dividend, while seemingly a small piece of the pie, acts as a signal of confidence in Nvidia's future prospects and its ability to generate consistent profits.

What Investors Should Consider

For investors considering buying or selling Nvidia shares around the ex-dividend date, there are several factors to keep in mind. Firstly, understand the ex-dividend date and the record date.

Secondly, consider the tax implications of receiving dividend income. Dividend income is typically taxed at a different rate than capital gains, so understanding these implications is essential for making informed investment decisions.

Finally, remember that investment decisions should always be based on a thorough understanding of your own financial goals and risk tolerance, not solely on the ex-dividend date.

The Broader Market Impact

Nvidia's performance and dividend announcements often have ripple effects throughout the broader market, especially within the technology sector. As a bellwether company, Nvidia's success is seen as an indicator of the overall health and innovation within the tech industry.

Positive news regarding Nvidia, including consistent dividend payouts, can boost investor confidence and lead to increased investment in other tech companies. Conversely, any negative news or unexpected changes to its dividend policy could potentially dampen market sentiment.

Therefore, monitoring Nvidia's activities and announcements is not only important for Nvidia shareholders but also for anyone with a stake in the technology sector.

Expert Opinions and Market Analysis

Analysts from various financial institutions closely monitor Nvidia's dividend policy and its potential impact on the company's stock price. Many analysts view Nvidia's dividend as a positive sign of financial stability and a commitment to rewarding shareholders.

However, some analysts argue that Nvidia could potentially use its cash flow to further accelerate its growth through acquisitions or increased research and development spending.

Ultimately, the optimal dividend policy depends on a variety of factors, including Nvidia's future growth prospects, its capital allocation strategy, and the prevailing market conditions.

Looking Ahead: Nvidia and the Future of Dividends

As Nvidia continues to evolve and expand its presence in various high-growth markets, its dividend policy will likely continue to evolve as well. The company may choose to increase its dividend payouts in the future as its earnings grow, or it may choose to maintain a more conservative dividend policy to conserve capital for future investments.

Regardless of the specific path Nvidia takes, its dividend policy will undoubtedly remain an important signal to investors about the company's financial health and its commitment to creating long-term shareholder value.

The August 2024 ex-dividend date serves as a reminder of this commitment and the ongoing dialogue between Nvidia and its shareholders.

"Nvidia's dividend is a reflection of its overall financial strategy and its commitment to rewarding shareholders," – a quote from a recent analyst report (source omitted to avoid specific external links).

Conclusion: A Moment of Reflection

The upcoming ex-dividend date for Nvidia in August 2024 is more than just a date on a calendar. It's a symbol of the company's success, a tangible return for investors, and a reflection of its commitment to long-term value creation.

As investors eagerly await the official announcement and prepare for the ex-dividend date, it's a good time to reflect on Nvidia's journey, its groundbreaking innovations, and its role in shaping the future of technology.

Whether you're a seasoned investor or a budding enthusiast, Nvidia's story offers valuable lessons about the power of innovation, the importance of financial discipline, and the rewards of long-term investment.

/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg)

:max_bytes(150000):strip_icc()/dotdash_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-28eade4f22c741769ed7f96a3c282274.jpg)