Can H & R Block File Taxes Without W2

Imagine this: Tax season is looming, the pressure is on, and suddenly, panic sets in – your W-2 form is nowhere to be found. Maybe it's buried under a pile of papers, accidentally shredded, or simply vanished into the digital abyss. The dread of facing the tax deadline without this crucial document can feel overwhelming.

But take a deep breath; all is not lost. This article explores whether you can file your taxes with H&R Block, a well-known tax preparation service, even if you don't have your physical W-2.

Filing Taxes Without a W-2: Is it Possible?

The short answer is yes, it's often possible to file your taxes without a physical W-2, especially with the help of services like H&R Block. However, there are specific steps and considerations involved. The IRS generally requires you to report all income accurately, and your W-2 is the primary document for doing so.

Understanding the Role of H&R Block

H&R Block is a leading provider of tax preparation services, offering both in-person and online options. Their experienced tax professionals are well-versed in navigating complex tax situations, including those involving missing W-2s. They aim to make the tax filing process as smooth and stress-free as possible.

How H&R Block Can Help Without a W-2

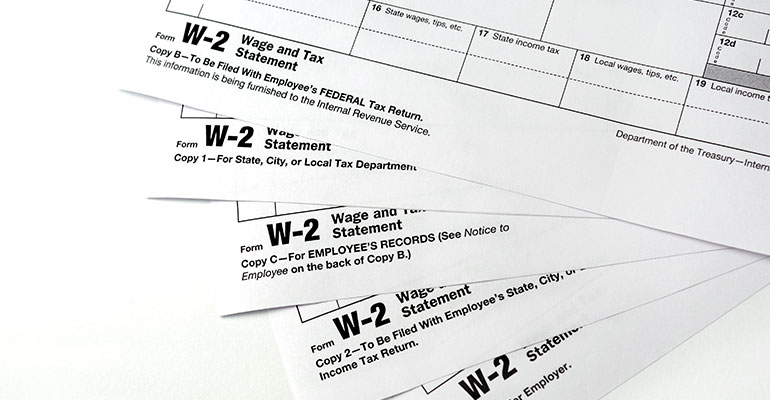

If you're missing your W-2, H&R Block can guide you through alternative methods of verifying your income. The first step is usually to contact your employer and request a duplicate W-2. This is the simplest and most direct solution.

If obtaining a duplicate W-2 isn't immediately feasible, H&R Block can help you use other documentation to estimate your income and taxes withheld. This might include pay stubs, bank statements showing direct deposits from your employer, or even a copy of last year's tax return.

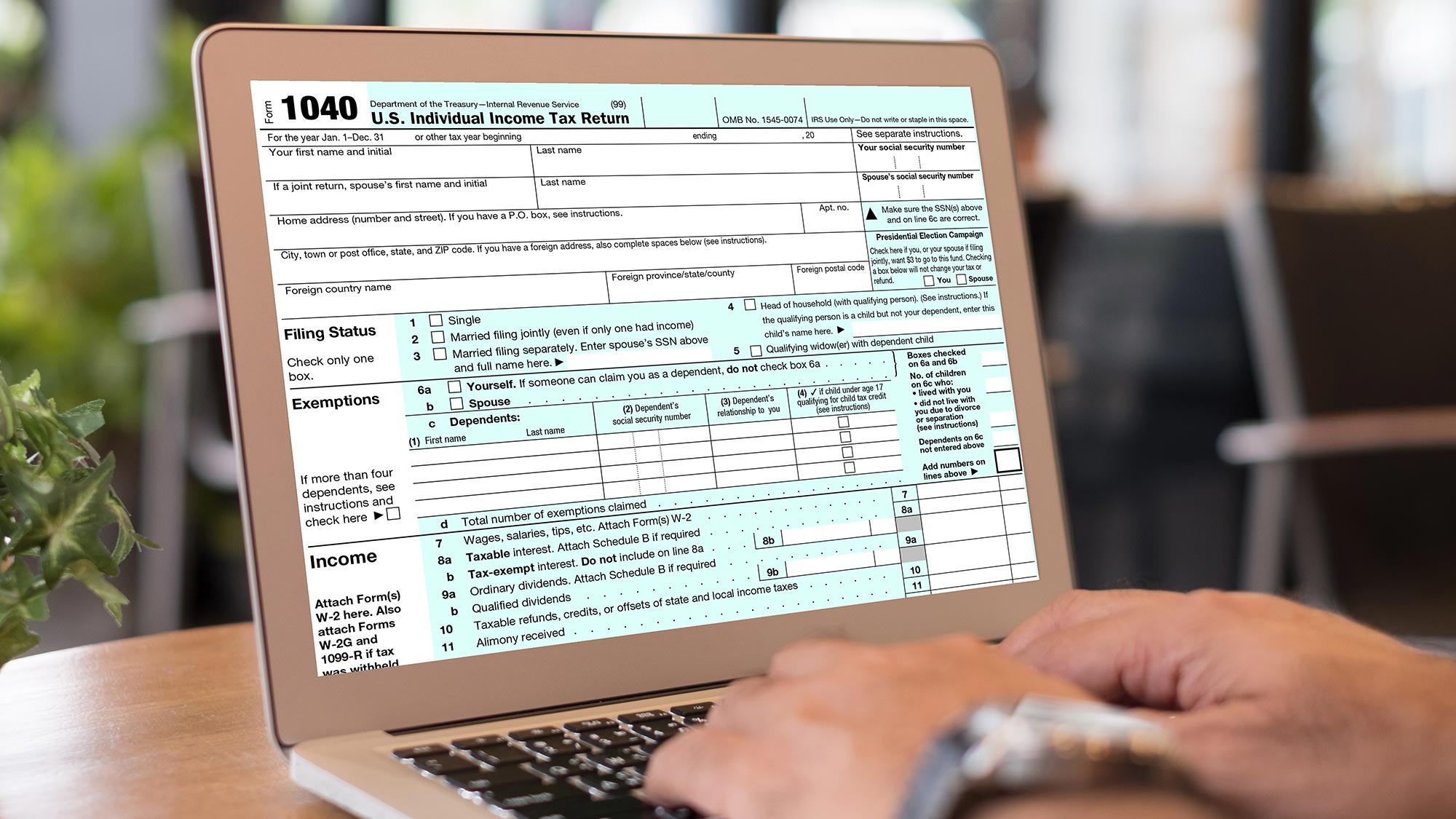

Using these alternative documents, H&R Block can help you file Form 4852, which is a substitute for Form W-2, Wage and Tax Statement. This form requires you to estimate your wages and taxes withheld based on the information you have available.

Important: You'll need to provide a detailed explanation on Form 4852 as to why you're unable to obtain your W-2 from your employer.

Potential Challenges and Considerations

Filing without a W-2, even with H&R Block's assistance, can present some challenges. Estimating your income and withholdings accurately is crucial. Any discrepancies between your estimates and the actual amounts reported by your employer to the IRS could lead to delays in processing your return or even an audit.

The IRS may also require additional documentation to verify your income and withholdings. It's always best to exhaust all efforts to obtain a duplicate W-2 from your employer before resorting to alternative methods.

While H&R Block can provide guidance and support, ultimately, you are responsible for the accuracy of the information reported on your tax return.

The Significance of Accurate Tax Filing

Accurate tax filing is essential for several reasons. It ensures you receive the correct refund amount, avoids penalties and interest charges, and helps maintain a good standing with the IRS. Consulting with a tax professional at H&R Block can provide peace of mind and help you navigate the complexities of tax law.

They stay updated on the latest tax regulations and can offer personalized advice based on your individual circumstances.

Remember, failing to file or filing inaccurately can have significant consequences. That is why professional assistance is crucial.

Conclusion

The missing W-2 doesn't have to derail your tax season. H&R Block can provide valuable assistance in navigating this situation. By gathering alternative documentation and working closely with their tax professionals, you can file your taxes accurately and confidently, even without the physical form in hand.

Remember, proactive communication with your employer and thorough record-keeping are always the best strategies for a smooth tax filing experience.