Online Bookkeeping Software For Small Business

Small businesses are facing a critical need for efficient financial management amidst growing economic pressures. Online bookkeeping software is rapidly becoming the go-to solution, offering streamlined processes and real-time insights.

This digital shift is essential for survival. It empowers entrepreneurs to maintain control of their finances, reduce errors, and make data-driven decisions, all while saving valuable time and resources.

The Rise of Digital Bookkeeping

Online bookkeeping software is experiencing unprecedented adoption. According to a recent report by Grand View Research, the global bookkeeping software market is projected to reach $5.3 billion by 2030, growing at a CAGR of 8.6% from 2022 to 2030.

This surge is driven by the increasing need for automation and accessibility. Small business owners are recognizing the limitations of traditional methods and embracing cloud-based solutions for their accounting needs.

Key Benefits for Small Businesses

These software solutions offer a multitude of benefits.

Real-time Financial Data: Access up-to-date financial information anytime, anywhere.

Automation of Tasks: Automate repetitive tasks like invoice generation, bank reconciliation, and expense tracking, freeing up valuable time for core business activities.

Improved Accuracy: Reduce manual errors and ensure accurate financial reporting.

Enhanced Collaboration: Facilitate seamless collaboration between business owners, accountants, and other stakeholders.

Cost Savings: Reduce the need for expensive in-house bookkeepers and minimize accounting fees.

Simplified Tax Preparation: Streamline the tax preparation process with organized financial data and automated reporting.

Popular Software Options

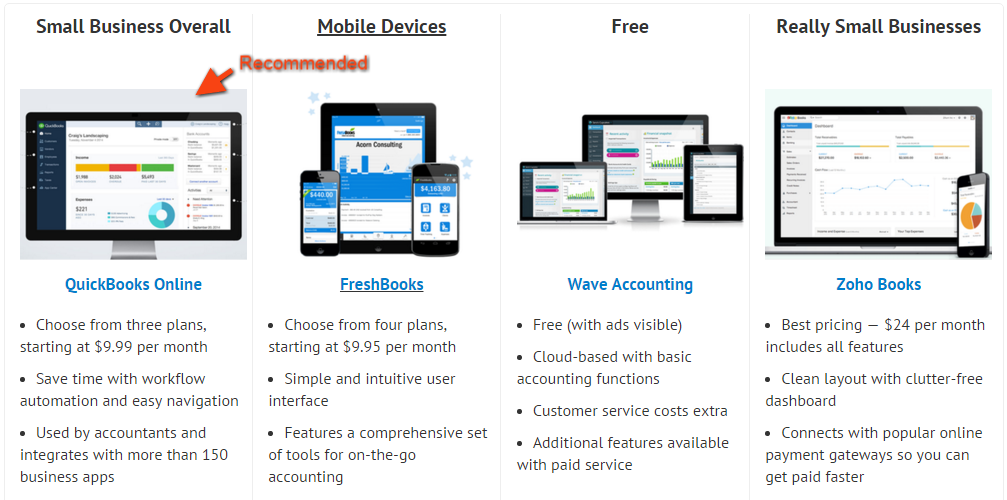

Several leading online bookkeeping software options are available.

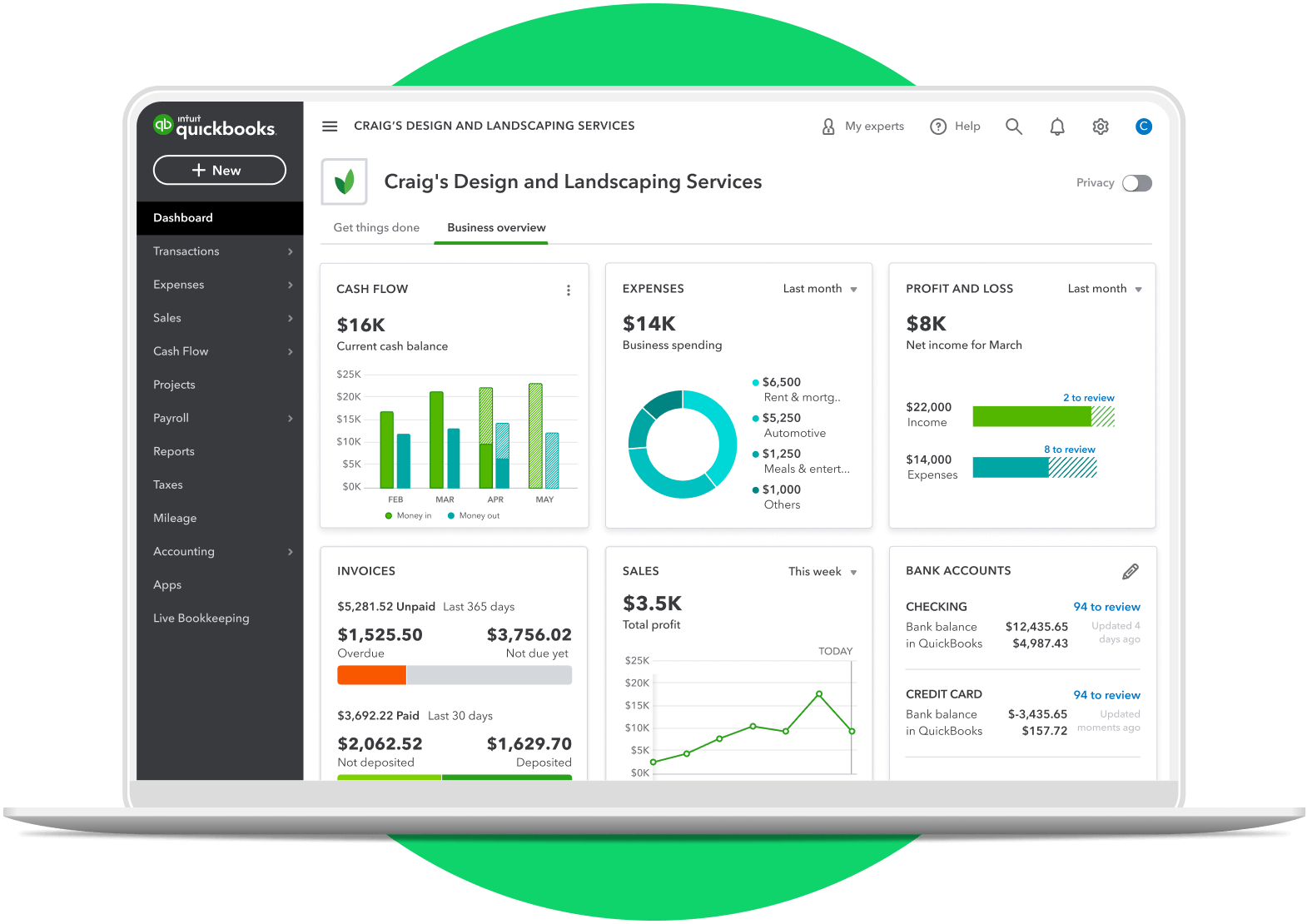

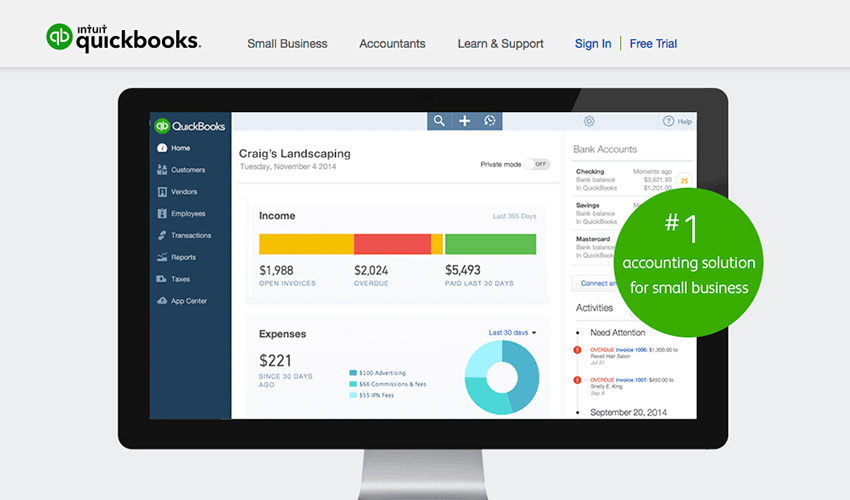

QuickBooks Online: A popular choice among small businesses, offering a range of features, including invoicing, expense tracking, and reporting.

Xero: Another widely used platform known for its user-friendly interface and strong integration capabilities.

Zoho Books: A comprehensive solution offering features like invoicing, expense management, and inventory tracking, all within the Zoho ecosystem.

FreshBooks: Specifically designed for freelancers and small businesses, FreshBooks focuses on invoicing and time tracking.

Sage Accounting: A robust solution offering advanced features for growing businesses, including inventory management and multi-currency support.

Challenges and Considerations

While the benefits are clear, small businesses must consider certain challenges.

Data Security: Ensure the software provider has robust security measures in place to protect sensitive financial data.

Integration: Verify that the software integrates seamlessly with other business systems, such as CRM and e-commerce platforms.

Training and Support: Choose a provider that offers adequate training and support to ensure smooth implementation and ongoing use.

Cost: Compare pricing plans and features to find a solution that fits your budget and business needs.

The Urgent Need for Action

Small businesses must act quickly to embrace online bookkeeping software. The competitive landscape demands efficiency and informed decision-making.

Delaying the transition could result in missed opportunities, increased errors, and ultimately, financial instability.

Next Steps for Small Businesses

Take the following steps to implement online bookkeeping software.

Assess your needs: Determine your specific bookkeeping requirements and identify the features that are most important to your business.

Research software options: Compare different software providers and choose a solution that aligns with your needs and budget.

Implement the software: Migrate your financial data and set up the software according to your business processes.

Train your staff: Provide adequate training to your staff to ensure they can effectively use the software.

Monitor your progress: Track your financial performance and make adjustments as needed.