Ontario Homeowners Struggle With Mortgage Defaults Due To Higher Rates

Across Ontario, a growing number of homeowners are facing the daunting reality of mortgage defaults as interest rates continue their upward climb. The increased financial strain is pushing families to the brink, forcing difficult decisions and raising concerns about the stability of the province's housing market.

This article examines the rising trend of mortgage defaults in Ontario, exploring the contributing factors, the segments of the population most affected, and the potential consequences for the broader economy. Data from the Canada Mortgage and Housing Corporation (CMHC) and insights from financial analysts paint a concerning picture of increasing financial vulnerability among homeowners.

The Rising Tide of Mortgage Defaults

Recent statistics reveal a noticeable uptick in mortgage delinquency rates across Ontario. While overall rates remain relatively low compared to historical peaks, the upward trajectory is causing alarm. The Canadian Bankers Association (CBA) reports a steady increase in missed mortgage payments, particularly in regions with high housing costs such as the Greater Toronto Area (GTA) and Southwestern Ontario.

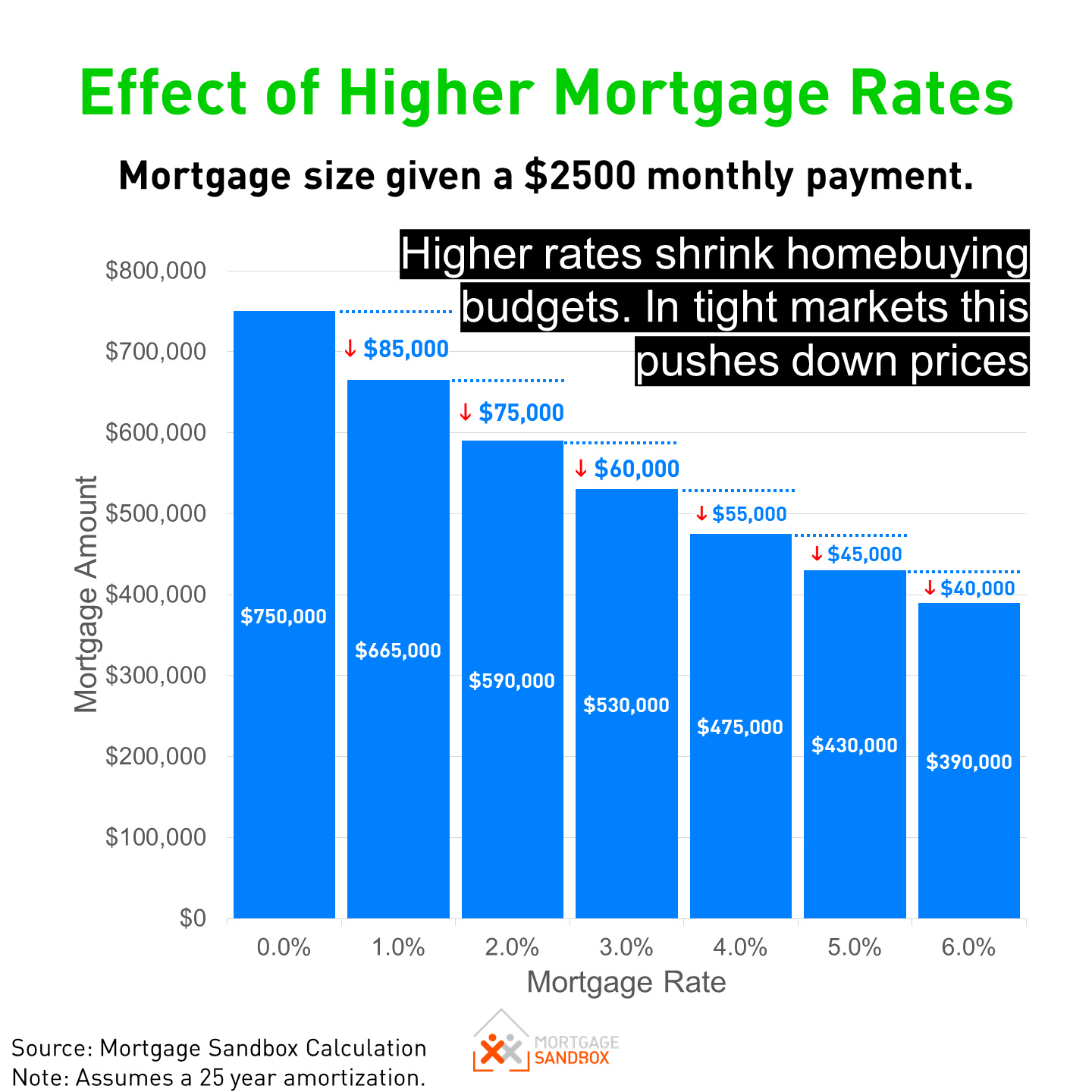

This trend is directly linked to the series of interest rate hikes implemented by the Bank of Canada in its effort to combat inflation. These rate increases have significantly increased the cost of borrowing, making mortgage payments increasingly unaffordable for many households.

Who is Most Affected?

First-time homebuyers who stretched their budgets to enter the market during the pandemic-fueled housing boom are particularly vulnerable. These individuals often secured mortgages at historically low interest rates, which have since been adjusted upwards during their mortgage renewal period. Now, they face dramatically higher monthly payments.

Fixed-income earners, such as retirees, and those with variable-rate mortgages are also disproportionately impacted. Variable-rate mortgages, once an attractive option due to their lower initial rates, have become a significant burden as interest rates have risen sharply.

Furthermore, homeowners who have experienced job loss or reduced income face even greater challenges in keeping up with their mortgage obligations.

The Human Cost

Beyond the statistics, the rising mortgage default rate represents real struggles for Ontario families. Many homeowners are facing the agonizing prospect of losing their homes, a devastating outcome that can have profound emotional and financial consequences.

One example is the story of *Sarah Miller*, a single mother from Hamilton, Ontario, who recently received a notice of power of sale from her lender. "I never thought I'd be in this position," she says. "I worked so hard to buy my home, and now I'm terrified of losing everything."

Stories like Sarah's are becoming increasingly common, highlighting the human cost of the current economic climate. These situations underscore the need for support and resources for homeowners facing financial hardship.

Government and Lender Responses

The Ontario government and financial institutions are aware of the rising concerns and are taking steps to mitigate the impact. The government offers various programs and resources to assist homeowners facing financial difficulties. These programs include property tax assistance and access to financial counseling services.

Lenders are also offering options such as mortgage deferrals and extended amortization periods to help borrowers manage their payments. However, these measures may only provide temporary relief and could result in higher overall costs in the long run.

"We encourage homeowners who are struggling to contact their lender as soon as possible to explore available options," stated a spokesperson for the Ontario Ministry of Finance.

Potential Economic Impact

A significant increase in mortgage defaults could have wider implications for the Ontario economy. A surge in foreclosures could put downward pressure on house prices, potentially triggering a market correction.

This could also negatively impact the construction industry and related sectors, leading to job losses and reduced economic activity. Furthermore, a decline in consumer confidence could further dampen economic growth.

Financial analysts are closely monitoring the situation, assessing the potential risks and advising policymakers on appropriate measures to maintain financial stability. The Bank of Canada's future interest rate decisions will be crucial in determining the trajectory of the housing market and the financial well-being of Ontario homeowners.

Looking Ahead

The coming months will be critical in determining the long-term impact of rising interest rates on Ontario homeowners. Continued monitoring of mortgage default rates, housing prices, and economic indicators is essential.

Homeowners facing financial difficulties are encouraged to seek professional advice and explore all available options. Early intervention and proactive communication with lenders can help prevent the worst-case scenarios.

Ultimately, addressing the challenge of rising mortgage defaults requires a multifaceted approach involving government support, responsible lending practices, and proactive financial planning by homeowners. Only through collaborative efforts can Ontario mitigate the risks and protect the financial stability of its residents and the overall economy.