Paid In Capital Excess Of Par

The seemingly arcane accounting term, Paid-In Capital in Excess of Par, has become increasingly relevant in today's complex financial landscape. It represents a critical component of a company’s financial health, often signaling investor confidence and potentially influencing strategic decisions. However, understanding its nuances is vital for investors, analysts, and company management alike, particularly in an era of fluctuating market conditions and complex equity structures.

This article delves into the intricacies of Paid-In Capital in Excess of Par, often abbreviated as APIC. We aim to provide a comprehensive understanding of what it is, how it's calculated, why it matters, and what its implications are for various stakeholders. By examining its role in corporate finance, we hope to shed light on its importance for evaluating a company’s financial standing and future prospects.

Understanding Paid-In Capital in Excess of Par

Paid-In Capital in Excess of Par, also known as Additional Paid-In Capital, is the amount of money investors pay for stock above its par value. Par value is a nominal value assigned to a share of stock in a company's charter. It often bears little relationship to the actual market price of the stock.

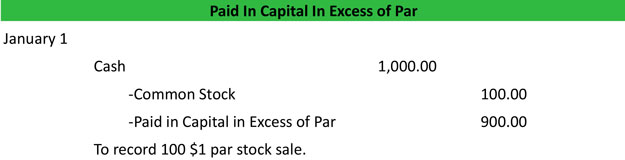

Consider a company issues shares with a par value of $1 per share but sells them to investors for $25 per share. The $1 represents the par value, while the $24 difference is the Paid-In Capital in Excess of Par.

Calculation and Accounting Treatment

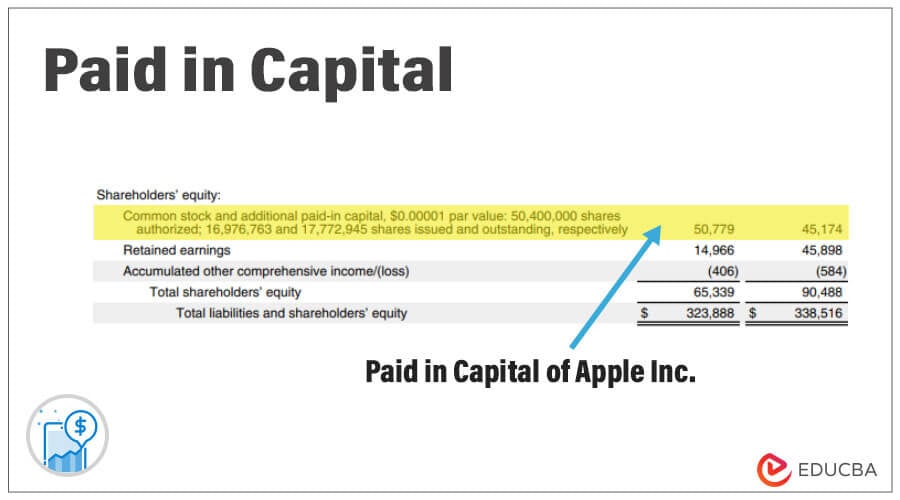

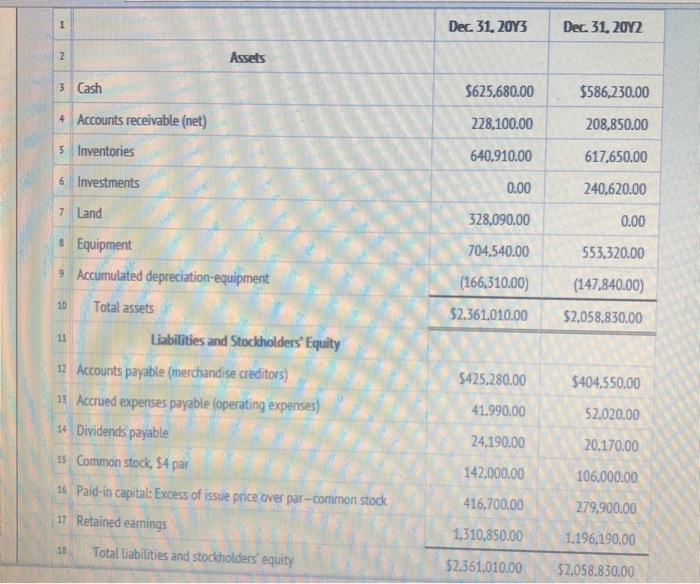

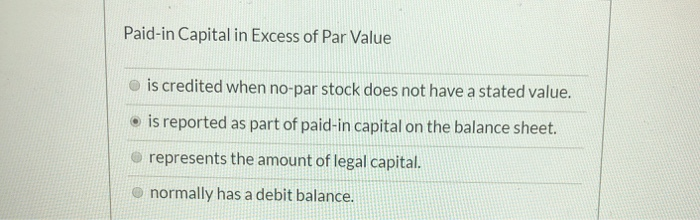

The formula for calculating Paid-In Capital in Excess of Par is relatively straightforward: (Issue Price per Share – Par Value per Share) x Number of Shares Issued. This amount is recorded as a separate line item within the shareholders' equity section of the balance sheet.

This separation is crucial for transparency, as it distinguishes the legally required par value from the additional capital contributed by investors. The distinction provides a clearer picture of the total investment received by the company.

Why Paid-In Capital in Excess of Par Matters

A substantial amount of Paid-In Capital in Excess of Par often indicates strong investor confidence in the company's prospects. It suggests that investors are willing to pay a premium for the company's stock, expecting future growth and profitability.

Companies can utilize this excess capital for various strategic initiatives, such as research and development, acquisitions, or debt reduction. Effectively managing this capital is vital for maximizing shareholder value.

Conversely, a lack of significant Paid-In Capital in Excess of Par may signal concerns among investors about the company's future potential. This could make it more challenging for the company to raise capital in the future.

Implications for Financial Analysis

Analysts often use Paid-In Capital in Excess of Par to assess a company's financial stability and growth potential. It helps in understanding the source of a company's equity and its ability to fund future investments.

A large Paid-In Capital in Excess of Par can provide a financial cushion, enabling the company to weather economic downturns or invest in risky but potentially high-reward projects. This is especially important in volatile markets.

It is also an important data point when calculating book value per share which is then used to perform company valuation.

Sources and Common Uses of Paid-In Capital

The primary source of Paid-In Capital in Excess of Par is the issuance of common or preferred stock at a price above its par value. Stock options and warrants exercises are also key.

Companies can use this capital for various purposes, including funding operations, acquiring other businesses, repurchasing shares, or paying down debt. The deployment strategies should be carefully evaluated to ensure they contribute to long-term value creation.

According to a report by Deloitte on equity trends, companies are increasingly using APIC funds for strategic acquisitions. This trend reflects the focus on inorganic growth.

Legal and Regulatory Considerations

The use of Paid-In Capital in Excess of Par is subject to legal and regulatory constraints. These constraints vary depending on the jurisdiction and the company's charter.

In many jurisdictions, companies are restricted from using Paid-In Capital in Excess of Par to pay dividends. Such restrictions protect creditors by ensuring that companies maintain a sufficient equity cushion.

Companies must also comply with securities laws when issuing stock and reporting Paid-In Capital in Excess of Par. These laws aim to ensure transparency and prevent fraudulent activities.

Criticisms and Potential Misinterpretations

While Paid-In Capital in Excess of Par can be a positive indicator, it is important to interpret it cautiously. A high APIC does not guarantee future success. It merely indicates that investors were willing to pay a premium in the past.

Some critics argue that focusing solely on Paid-In Capital in Excess of Par can be misleading, as it doesn't reflect the quality of earnings or the efficiency of capital allocation. A more comprehensive analysis of a company's financial statements is necessary.

There's also the risk of management manipulating earnings. Therefore a large APIC can also hide financial troubles.

The Future of Paid-In Capital in Excess of Par

In an increasingly volatile and complex financial world, understanding Paid-In Capital in Excess of Par remains essential. As companies continue to innovate and seek new funding sources, its relevance is likely to increase.

The rise of SPACs and other alternative investment vehicles has also impacted Paid-In Capital in Excess of Par dynamics, creating new challenges and opportunities for investors and companies alike. Thorough due diligence and a solid understanding of the intricacies are vital.

In conclusion, Paid-In Capital in Excess of Par provides valuable insights into a company's financial health and investor sentiment. By carefully analyzing this metric, stakeholders can make more informed decisions and navigate the complexities of the modern financial landscape with greater confidence.

:max_bytes(150000):strip_icc()/additionalpaidincapital-final-6c076433118e4b9bb699fa576696fb0e.png)

:max_bytes(150000):strip_icc()/Paidincapital_sketch_final-99d3b0711bc2421aa14b0bf5ecb6eeaf.png)