How Do I Transfer Money From Savings To Checking

In today's fast-paced financial landscape, efficiently managing your funds between savings and checking accounts is crucial. Whether you're preparing for upcoming expenses or simply consolidating your assets, knowing how to transfer money seamlessly can save you time and potential headaches.

Understanding the mechanics of transferring funds, the various methods available, and any associated fees or limitations is essential for sound financial management. This article provides a comprehensive guide to navigating the process of transferring money from savings to checking accounts, empowering you to make informed decisions and optimize your banking experience.

Understanding Transfer Methods

Several methods exist for transferring funds between your savings and checking accounts. Each option offers varying levels of convenience, speed, and associated costs.

Online Banking

Online banking is arguably the most popular and convenient method for transferring funds. Most banks offer user-friendly online portals or mobile apps that allow customers to initiate transfers with just a few clicks.

To transfer money online, simply log in to your bank's website or app, navigate to the transfer section, and select your savings and checking accounts.

Enter the amount you wish to transfer and confirm the transaction, noting that some banks may require two-factor authentication for added security.

Mobile Banking

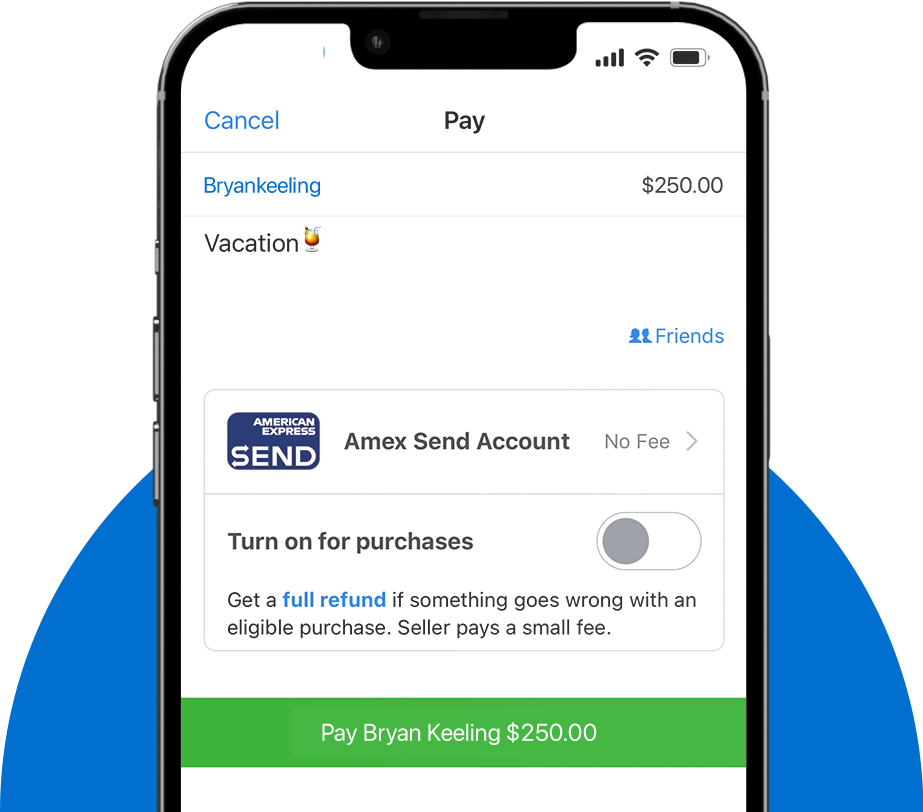

Mobile banking apps offer similar functionality to online banking, but with the added convenience of being accessible on your smartphone or tablet. Transfers can be initiated anytime, anywhere, making it an ideal option for those on the go.

The process is generally the same as online banking: log in, select accounts, enter the amount, and confirm. Mobile apps often include features like push notifications to alert you when a transfer is complete.

Automated Teller Machines (ATMs)

ATMs provide a physical way to transfer funds between your accounts, but with limitations. Not all ATMs offer transfer capabilities, and those that do may have daily transfer limits.

To transfer money at an ATM, insert your debit card, enter your PIN, and select the transfer option. Follow the on-screen prompts to choose your accounts and enter the transfer amount.

Phone Transfers

Contacting your bank's customer service line is another option for transferring funds. A bank representative can assist you with the transfer process, but be prepared to answer security questions to verify your identity.

This method can be useful if you need assistance or have questions about the transfer, but it may involve longer wait times compared to online or mobile banking.

In-Person Transfers

Visiting a bank branch in person allows you to transfer funds with the help of a teller. While this method may be the most time-consuming, it offers the opportunity for personalized assistance and immediate confirmation of the transfer.

Simply inform the teller of your request, provide your account information, and complete any necessary paperwork.

Factors to Consider Before Transferring

Before initiating a transfer, it's crucial to consider several factors to avoid potential complications or fees.

Transfer Limits

Banks often impose daily or monthly transfer limits to protect against fraud and ensure account security. These limits can vary depending on the bank and the type of account you have.

Check with your bank to understand your transfer limits and ensure the amount you wish to transfer is within those limits.

Fees and Charges

While many banks offer free transfers between linked accounts, some may charge fees for certain transfer methods or if you exceed your transfer limits. Always review your bank's fee schedule to avoid unexpected charges.

Processing Time

The time it takes for a transfer to complete can vary depending on the method used and the bank's policies. Online and mobile transfers are usually processed instantly or within one business day. Other methods, like phone or in-person transfers, may take longer.

Plan your transfers accordingly, especially if you need the funds in your checking account by a specific date.

Linked Accounts

Before you can transfer money between accounts, you need to ensure they are properly linked. This process usually involves verifying your ownership of both accounts. Contact your bank for instructions on linking accounts if they are not already connected.

Future Trends in Money Transfers

The landscape of money transfers is constantly evolving, with new technologies and innovations emerging regularly. One notable trend is the rise of real-time payments, which allow for immediate transfers between accounts, even across different banks.

As financial technology continues to advance, we can expect to see even faster, more secure, and more convenient methods for transferring money between savings and checking accounts. Keeping informed about these advancements will be key to optimizing your financial management strategies in the years to come.

In conclusion, mastering the art of transferring money from savings to checking accounts is essential for effective financial management. By understanding the available methods, considering potential fees and limitations, and staying abreast of future trends, you can ensure seamless and efficient transfers, empowering you to take control of your financial well-being.

Remember to always prioritize security and verify the accuracy of your transfer details before confirming any transaction.