Partnership Profiles Equity Distributing No Debt

The aroma of freshly brewed coffee hung heavy in the air, a comforting blanket against the crisp morning chill. Sunlight streamed through the expansive windows of the co-working space, illuminating a cluster of individuals huddled around a large table, their faces animated with a mixture of excitement and focused determination. This wasn't just another Monday morning meeting; it was the genesis of a new kind of collaboration, a blueprint for a business model that dared to prioritize partnership and equity over traditional debt financing.

At its core, the "Partnership Profiles Equity Distributing No Debt" (PPEDND) model represents a radical shift in how startups and small businesses are funded and structured. Eschewing traditional loans and venture capital, this innovative approach centers on building a robust network of aligned partners, each contributing expertise, resources, and effort in exchange for equity and a share of the profits. It fosters a collaborative environment where success is a shared endeavor, and the burden of debt is entirely absent.

The Genesis of an Idea

The seeds of the PPEDND model were sown in the fertile ground of entrepreneurial frustration. Many founders, burdened by crippling debt and the constant pressure to meet investor expectations, found themselves losing sight of their original vision. They felt trapped in a system that prioritized short-term gains over long-term sustainability and genuine impact.

"The traditional funding landscape often forces startups to sacrifice their values and autonomy," explains Sarah Chen, a leading advocate for the PPEDND approach and founder of a consultancy specializing in collaborative business models. "Founders end up spending more time chasing funding than building their actual business, and the relentless pursuit of growth can lead to burnout and ultimately, failure."

Chen's own experiences mirrored these sentiments. She witnessed firsthand the struggles of numerous startups caught in the debt trap, their innovative ideas stifled by the weight of financial obligations. This spurred her to explore alternative models that prioritized partnership, shared risk, and long-term sustainability.

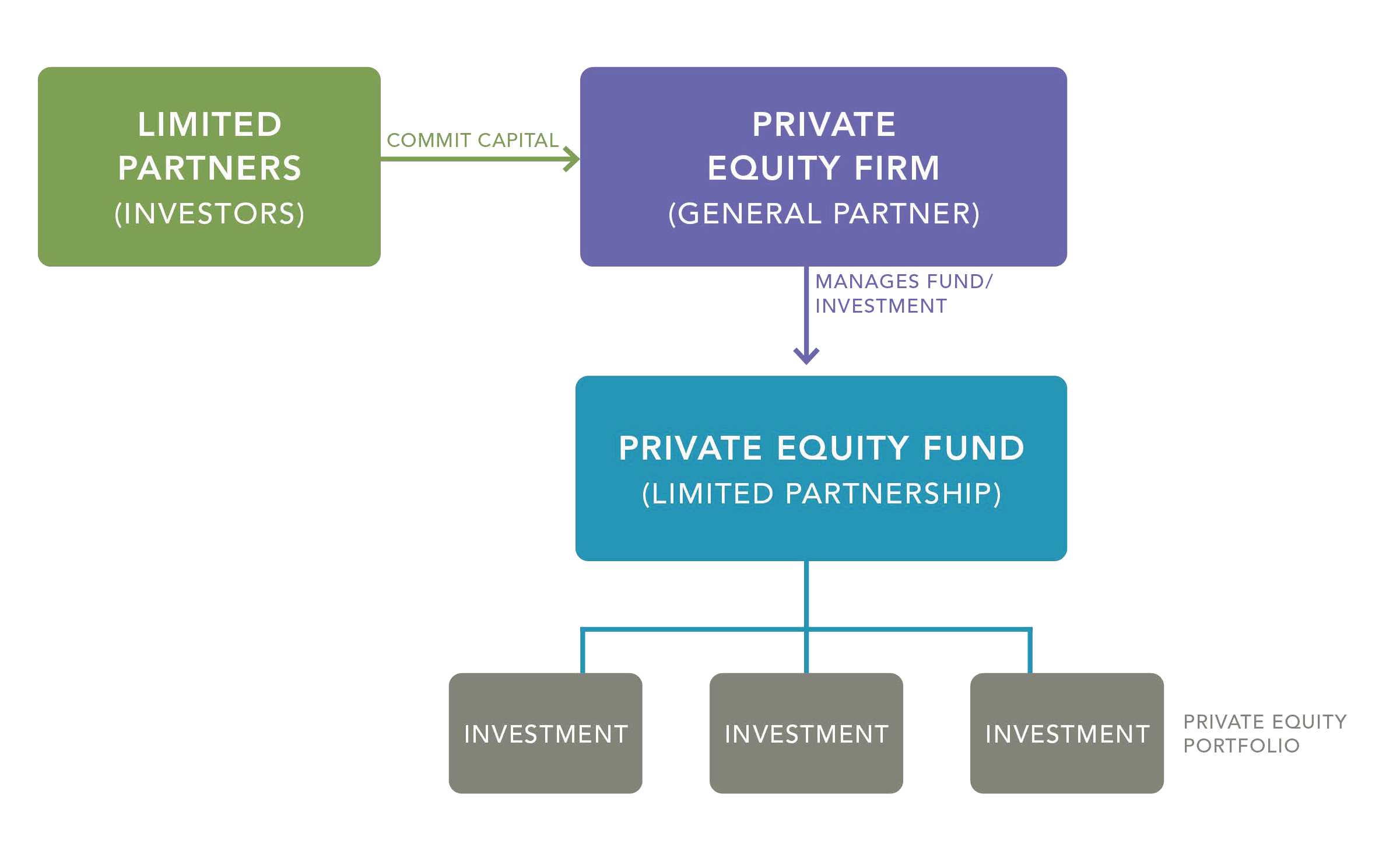

How PPEDND Works

The PPEDND model is not a one-size-fits-all solution, but rather a flexible framework that can be adapted to suit the specific needs of different businesses. However, certain key principles underpin the approach:

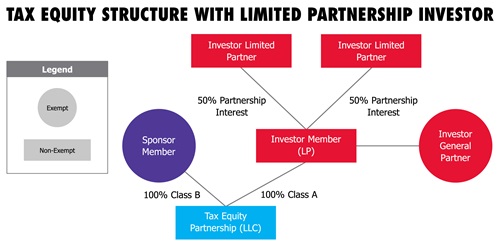

- Strategic Partnerships: Identifying and onboarding partners who bring complementary skills, resources, and networks to the table is paramount. These partners are not simply investors but active participants in the business.

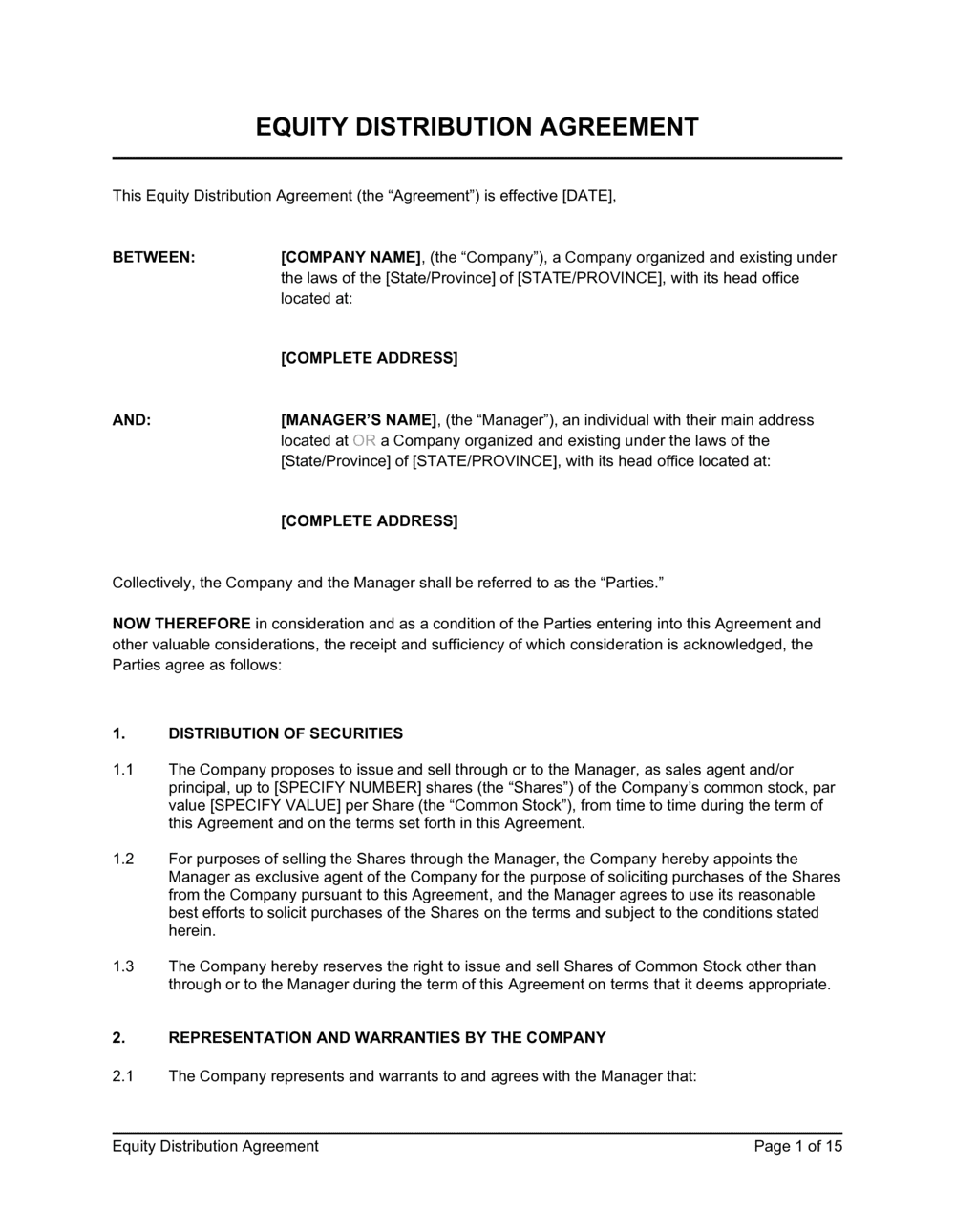

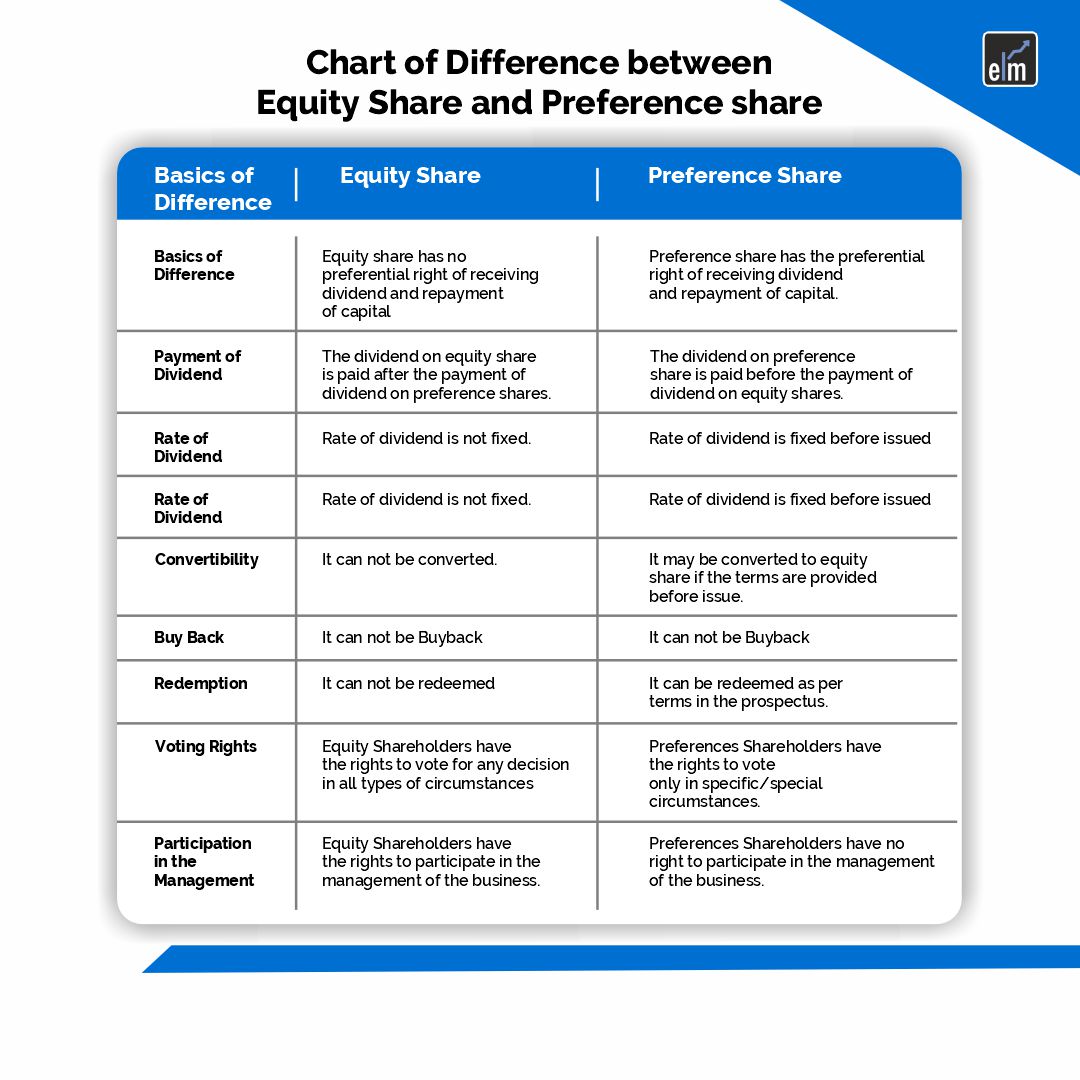

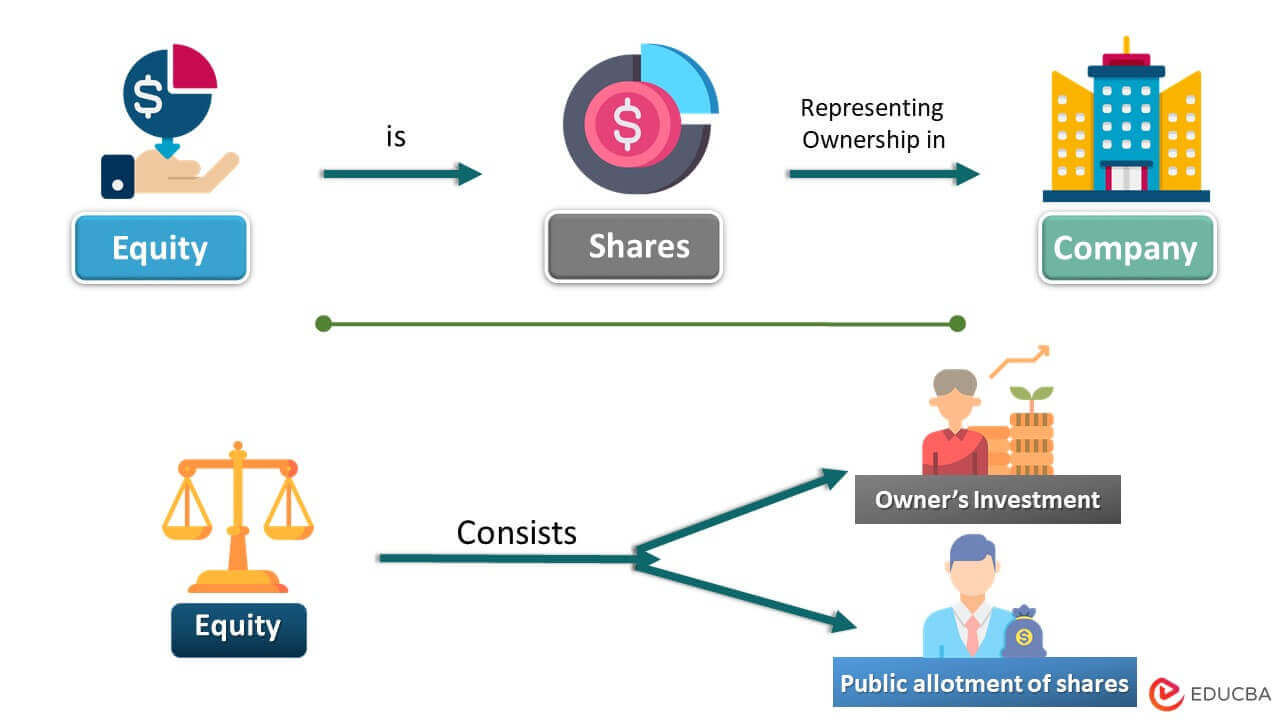

- Equity Distribution: Equity is distributed among the partners based on their contribution to the business, whether it's financial investment, expertise, or sweat equity. This ensures that everyone has a vested interest in the success of the venture.

- Profit Sharing: A pre-determined profit-sharing agreement outlines how profits will be distributed among the partners, providing a clear and transparent mechanism for rewarding contributions.

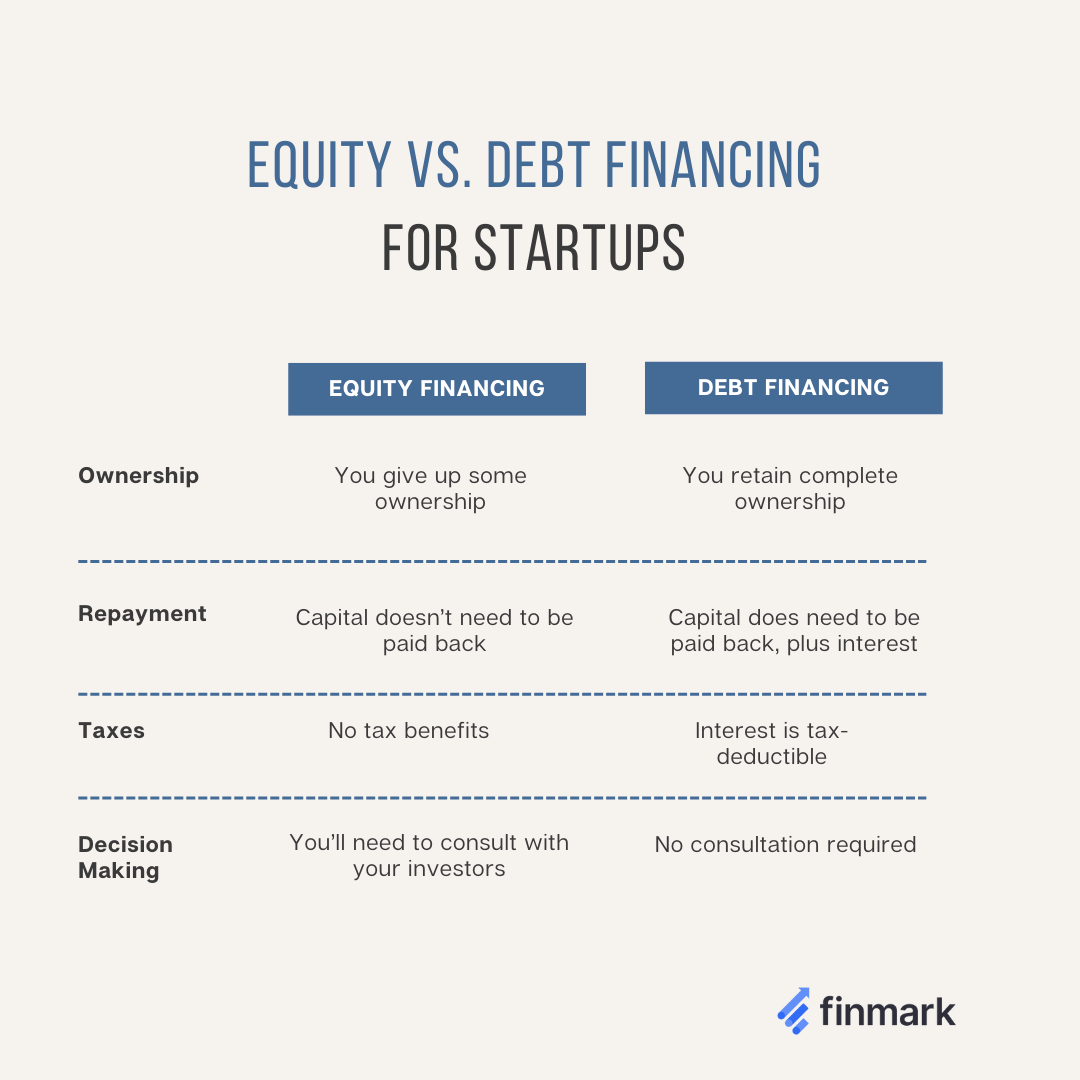

- No Debt Financing: The cornerstone of the PPEDND model is the avoidance of traditional debt financing. This eliminates the burden of interest payments and reduces the financial risk for all partners.

This framework allows for a more sustainable and collaborative business environment. It prioritizes the collective expertise and investment of its members above traditional means.

The Benefits of a Debt-Free Approach

The absence of debt is arguably the most significant advantage of the PPEDND model. This allows businesses to focus on innovation, growth, and long-term sustainability without the constant pressure of meeting loan repayments.

"Debt can be incredibly stifling," says David Lee, founder of a successful software startup that adopted the PPEDND model. "It forces you to make short-term decisions that may not be in the best interest of the business in the long run. By eliminating debt, we've been able to prioritize building a strong foundation and investing in our team."

Beyond financial stability, the PPEDND model fosters a stronger sense of shared ownership and accountability. Each partner is invested in the success of the business, not just financially, but also emotionally and intellectually. This leads to increased collaboration, innovation, and resilience.

Challenges and Considerations

While the PPEDND model offers numerous advantages, it also presents certain challenges. Finding the right partners, establishing clear roles and responsibilities, and navigating potential conflicts can be complex and time-consuming. It requires transparency, communication, and a strong commitment to shared values.

"Building a successful partnership requires a lot of upfront work," acknowledges Chen. "It's essential to have a clear agreement that outlines the roles, responsibilities, and expectations of each partner. You also need to establish a robust communication framework to ensure that everyone is aligned and informed."

Furthermore, the PPEDND model may not be suitable for all types of businesses. Companies requiring significant upfront capital investment may find it difficult to raise sufficient funds through partnerships alone. In such cases, a hybrid approach, combining PPEDND with other forms of financing, may be necessary.

Success Stories and Emerging Trends

Despite the challenges, a growing number of businesses are embracing the PPEDND model, and their success stories are inspiring others to explore this alternative approach. From software startups to sustainable farming initiatives, the PPEDND model is proving its viability across a wide range of industries.

One notable example is a local organic farm that successfully launched using the PPEDND model. By partnering with local chefs, retailers, and community members, the farm was able to secure the necessary resources and expertise to get off the ground without incurring any debt. The farm's success has not only provided fresh, healthy food to the community but has also created a thriving ecosystem of collaborative partnerships.

The rise of the gig economy and the increasing demand for collaborative workspaces are further fueling the adoption of the PPEDND model. More and more individuals are seeking opportunities to work on projects that align with their values and contribute their skills to a shared vision. The PPEDND model provides a framework for harnessing this talent and creating a more equitable and sustainable business ecosystem.

The Future of Business

The PPEDND model represents a paradigm shift in how we think about funding and structuring businesses. It challenges the traditional notion that debt is a necessary evil and offers a compelling alternative that prioritizes partnership, equity, and long-term sustainability.

As more businesses embrace this collaborative approach, we can expect to see a more resilient, innovative, and equitable business landscape. One where success is not measured solely by financial metrics but also by the positive impact on the community and the well-being of all stakeholders. The future of business may well be rooted in the power of partnership, fueled by shared purpose, and unburdened by the weight of debt.

The quiet hum of the co-working space, still filled with the lingering scent of coffee, serves as a testament to the quiet revolution underway. It's a reminder that innovation isn't just about groundbreaking technology or disruptive ideas; it's about reimagining the very foundations upon which we build our businesses and our futures.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

_1.jpg)