Payday Loans That Accept Varo Bank No Credit Check

The intersection of fintech and short-term lending is becoming increasingly complex, with many consumers seeking accessible financial solutions. Among the options explored, the availability of payday loans that accept Varo Bank accounts without a credit check has generated significant interest and debate.

This article examines the landscape of these loan offerings, the implications for borrowers, and the regulatory environment surrounding them.

Payday Loans and Varo Bank: An Overview

Payday loans are short-term, high-interest loans typically designed to be repaid on the borrower's next payday. They are often marketed as a quick solution for unexpected expenses or cash flow shortages.

Varo Bank, a mobile-first bank, offers online banking services, including checking and savings accounts, without physical branches. The bank has gained popularity for its accessibility and user-friendly platform.

The core question is whether payday lenders readily accept Varo Bank accounts and whether credit checks are bypassed in the process. The answer is nuanced and requires careful consideration.

The Prevalence of No-Credit-Check Payday Loans

Many payday lenders advertise "no credit check" loans, implying that credit history is not a factor in the approval process. While this can be attractive to individuals with poor or limited credit, it's essential to understand what "no credit check" truly means.

In most cases, lenders conduct a soft credit check, which doesn't impact the borrower's credit score. This soft check is used to verify identity and assess the borrower's ability to repay the loan. Some lenders may forgo even a soft check, relying instead on other factors, such as bank account history and proof of income.

However, completely eliminating credit checks comes with increased risk for the lender, leading to higher interest rates and fees to compensate for the potential default.

Varo Bank Account Acceptance and Payday Loans

The acceptance of Varo Bank accounts by payday lenders varies. Some lenders may readily accept Varo Bank accounts, while others may not due to internal policies or concerns about verification. Because Varo Bank is an online-only bank, some lenders might be more cautious.

To determine acceptance, potential borrowers should directly contact the payday lender or check their website for accepted banking institutions. Online reviews and forums can also provide insights from other borrowers' experiences.

It is important to note that even if a lender accepts a Varo Bank account, this does not automatically guarantee loan approval or the absence of a credit check.

Potential Benefits and Risks

For some individuals, payday loans that accept Varo Bank accounts can offer a convenient source of funds during financial emergencies. The accessibility of online banking with Varo Bank combined with the speed of payday loans can be appealing.

However, these loans come with significant risks. High interest rates and fees can lead to a cycle of debt, making it difficult for borrowers to repay the loan and cover their regular expenses. Furthermore, the lack of a thorough credit check could mean that lenders are not adequately assessing the borrower's ability to repay.

The Consumer Financial Protection Bureau (CFPB) has cautioned consumers about the dangers of payday loans, highlighting the potential for debt traps and financial hardship.

Regulation and Consumer Protection

Payday loans are regulated at both the state and federal levels. Some states have strict limits on interest rates and fees, while others have effectively banned payday lending altogether.

The Truth in Lending Act (TILA) requires lenders to disclose the loan's terms, including the annual percentage rate (APR), fees, and repayment schedule. Borrowers should carefully review these disclosures before accepting a loan.

Consumers should also be aware of their rights under the Fair Debt Collection Practices Act (FDCPA), which protects them from abusive debt collection practices.

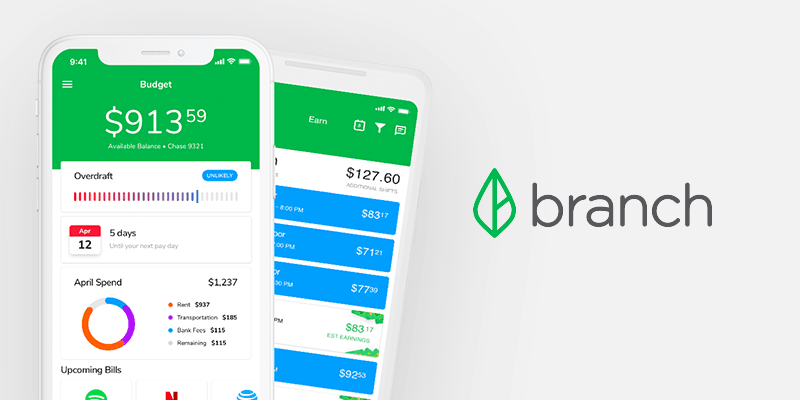

Alternatives to Payday Loans

Before resorting to payday loans, individuals should explore alternative options, such as personal loans from credit unions or banks. These loans typically have lower interest rates and more favorable repayment terms.

Borrowers can also consider options like borrowing from friends or family, negotiating payment plans with creditors, or seeking assistance from local charities or government programs.

Building an emergency fund can provide a financial cushion to avoid the need for short-term, high-interest loans.

Conclusion

Payday loans that accept Varo Bank accounts without a credit check offer potential accessibility but carry substantial risks. The high cost of borrowing and the potential for debt traps make it crucial for consumers to carefully weigh their options and explore alternatives.

Responsible borrowing practices, financial planning, and awareness of consumer protection laws are essential when considering any form of short-term lending.

Borrowers should prioritize building financial stability and exploring more sustainable financial solutions whenever possible.

![Payday Loans That Accept Varo Bank No Credit Check 1 Hour Payday Loans No Credit Check | [year] Guide](https://avocadoughtoast.com/wp-content/uploads/2022/02/1-Hour-Payday-Loans-No-Credit-Check.png)