Payday Loans That Use Cash App

Urgent warnings are being issued regarding a surge in payday loans exploiting the Cash App platform. Vulnerable users are being targeted with predatory lending practices, often masked as quick financial assistance.

This article details the growing trend of payday loans facilitated through Cash App, outlining the risks, legal implications, and steps individuals can take to protect themselves from these exploitative schemes.

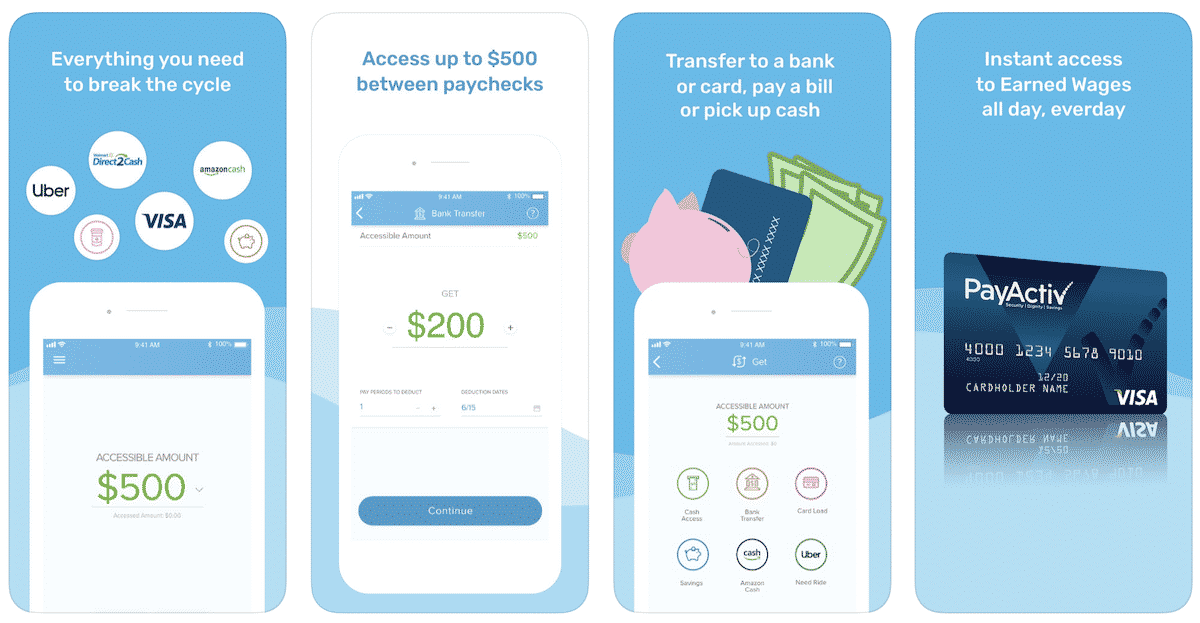

The Rise of Cash App Payday Loans

The convenience of Cash App has inadvertently created a breeding ground for unregulated payday lenders. These lenders often operate outside traditional regulatory frameworks, making it difficult to track and control their activities.

Reports indicate a significant increase in complaints related to excessively high interest rates and aggressive collection tactics associated with these loans. Many borrowers find themselves trapped in a cycle of debt, struggling to repay the initial loan amount plus exorbitant fees.

The Better Business Bureau (BBB) has issued alerts about the proliferation of such schemes. They advise users to exercise extreme caution when considering loans offered through Cash App or similar platforms.

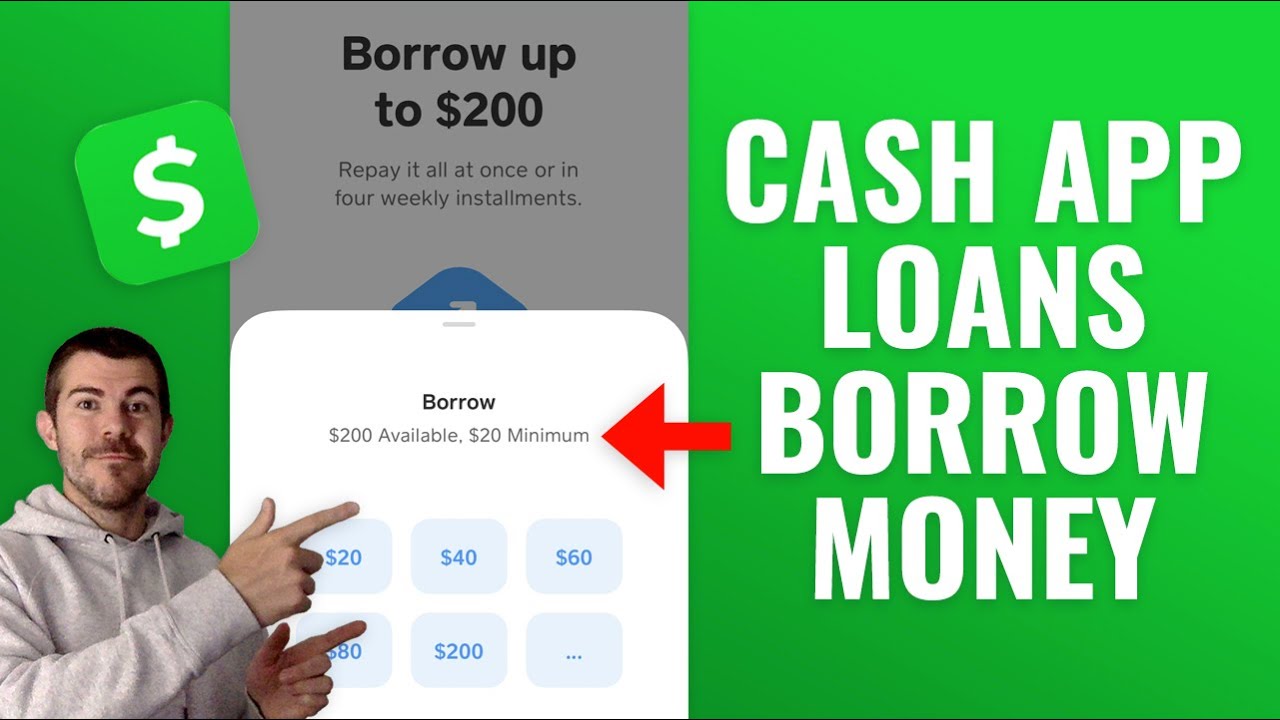

How the Scam Works

Scammers typically advertise "easy money" or "instant loans" on social media or through direct messages within Cash App. They lure users in with promises of quick approvals and minimal credit checks.

Once a user expresses interest, the lender requests personal information, including Cash App IDs and banking details. This information is then used to deposit the loan amount, often with hidden fees and interest rates attached.

The agreed-upon repayment terms are frequently vague, and lenders may impose penalties for late payments or rollovers. In many cases, the annual percentage rate (APR) can exceed 300%, far surpassing the legal limits in many states.

Legal and Financial Risks

Payday loans facilitated through Cash App often operate in a legal gray area. Because many lenders are unlicensed and unregulated, borrowers may have limited recourse if they encounter problems.

High interest rates can quickly lead to financial hardship, making it difficult for borrowers to meet their other financial obligations. Defaulting on these loans can negatively impact credit scores and lead to aggressive collection efforts.

Furthermore, sharing personal and financial information with unverified lenders poses a significant risk of identity theft. Scammers may use this information to access bank accounts, open fraudulent credit cards, or commit other forms of financial fraud.

Who is at Risk?

Individuals with limited access to traditional financial services, such as those with poor credit or low incomes, are particularly vulnerable. These individuals may turn to Cash App payday loans as a last resort, unaware of the potential risks.

Younger users who are new to personal finance and may not fully understand the terms and conditions of these loans are also at risk. Scammers often target this demographic through social media and other online platforms.

The Consumer Financial Protection Bureau (CFPB) has warned about the dangers of payday loans, regardless of the platform used. They encourage consumers to explore alternative options, such as credit counseling or borrowing from trusted sources.

Protecting Yourself

Exercise extreme caution when considering loans offered through Cash App or other online platforms. Avoid providing personal or financial information to unverified lenders.

Always read the fine print and understand the terms and conditions of any loan agreement before accepting funds. Be wary of loans with excessively high interest rates or vague repayment terms.

Report any suspicious activity to Cash App and the relevant regulatory authorities. You can also file a complaint with the Federal Trade Commission (FTC) if you believe you have been scammed.

Next Steps and Ongoing Developments

Law enforcement agencies are actively investigating these scams and working to identify and prosecute the perpetrators. Regulatory bodies are also exploring ways to better regulate payday lending practices on digital platforms.

Cash App is implementing measures to detect and prevent fraudulent activity on its platform. However, users must remain vigilant and take steps to protect themselves.

Consumer advocacy groups are pushing for stricter regulations on payday lenders and greater transparency in the lending industry. They urge consumers to educate themselves about the risks and to seek help if they are struggling with debt.