Personal Business Accounting Software

In an era defined by entrepreneurial spirit and the rise of freelance work, managing personal finances has transcended simple budgeting. Sophisticated personal business accounting software is now an indispensable tool, not just for individuals, but for the growing legions of self-employed professionals and small business owners. The stakes are high, with financial stability, tax compliance, and strategic growth all hanging in the balance.

At its core, personal business accounting software empowers users to track income and expenses, generate reports, and ultimately, make informed financial decisions. This article delves into the current landscape of these software solutions, exploring their features, benefits, challenges, and future trends. We will examine the diverse needs of users, the varying levels of complexity offered by different platforms, and the crucial role these tools play in fostering financial health and business success, drawing on industry data and expert insights.

The Rise of Personal Business Accounting Software

The demand for these solutions is soaring. According to a recent report by Grand View Research, the global accounting software market is projected to reach $20.4 billion by 2027, fueled by the increasing adoption of cloud-based solutions and the growing number of small businesses and freelancers. This surge highlights the need for accessible and user-friendly financial management tools.

Key Features and Benefits

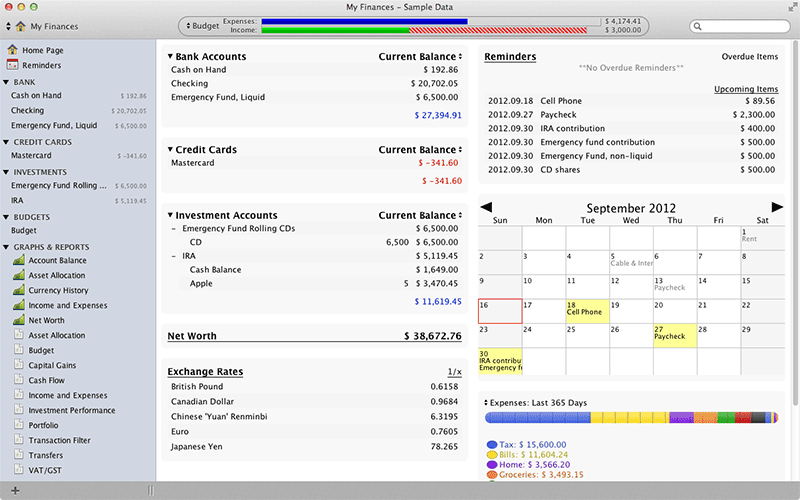

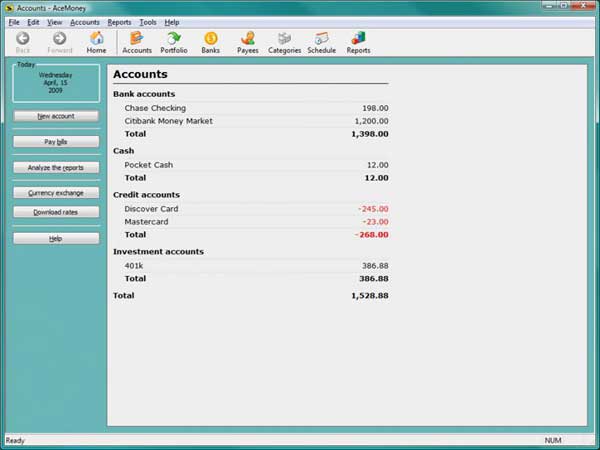

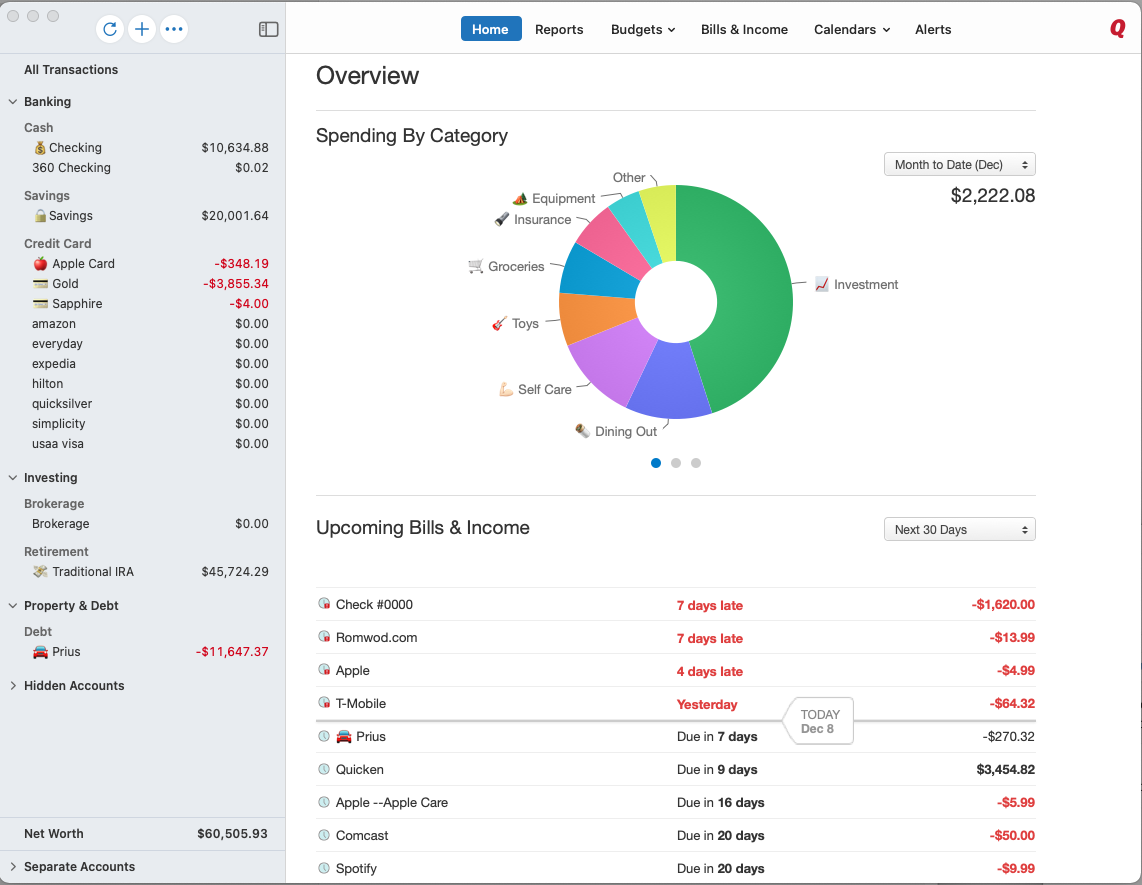

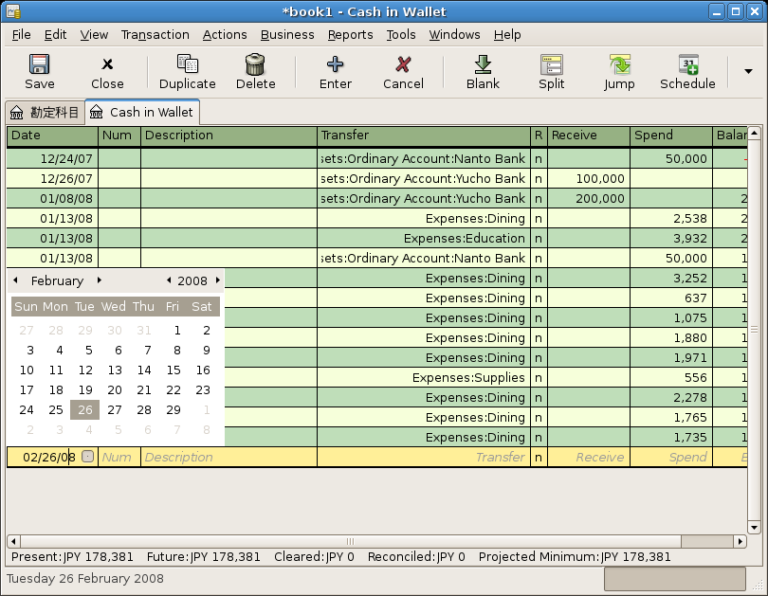

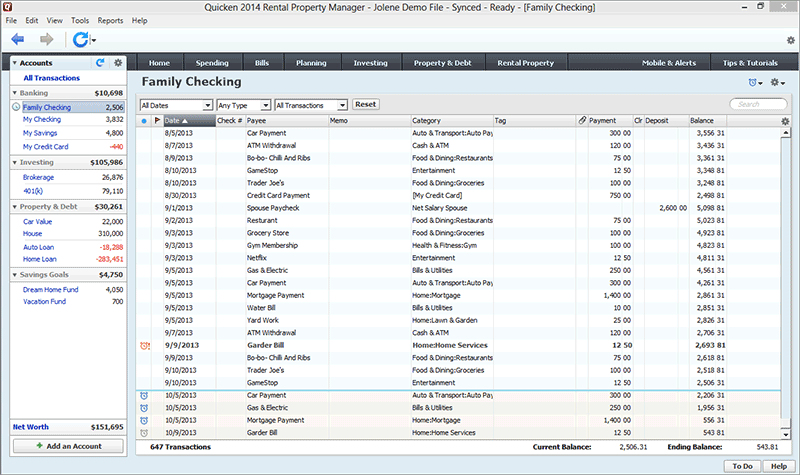

Modern personal business accounting software offers a wide array of functionalities. These typically include income and expense tracking, invoicing, budgeting, financial reporting, and tax preparation assistance. Many platforms also integrate with bank accounts and credit cards for automated transaction recording, minimizing manual data entry.

The benefits are numerous. Users gain a clear picture of their financial health, identify areas for cost savings, and optimize their tax strategies. These tools also streamline administrative tasks, freeing up valuable time for core business activities.

Navigating the Software Landscape

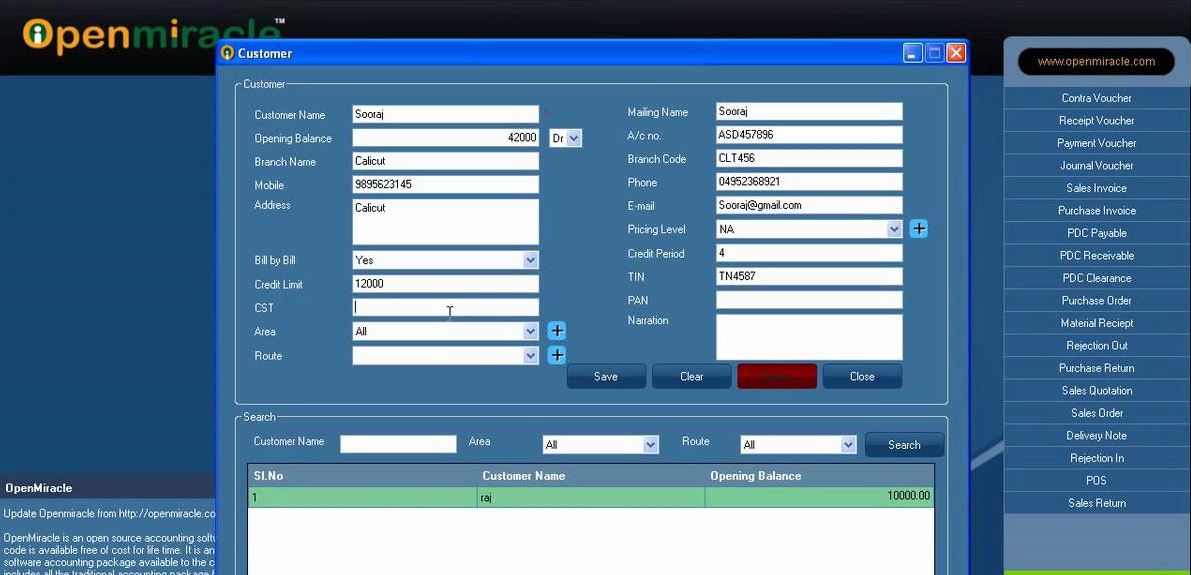

The market presents a diverse range of options, from basic budgeting apps to comprehensive accounting suites. Popular choices include QuickBooks Self-Employed, FreshBooks, and Zoho Books, each catering to different user needs and skill levels. Choosing the right software depends on factors such as business size, industry, and specific financial requirements.

For instance, freelancers with simple invoicing needs might find a user-friendly app like Wave Accounting sufficient. However, small business owners with more complex inventory management and payroll requirements may need a more robust solution like Xero.

Challenges and Considerations

Despite the advantages, challenges remain. Data security is a paramount concern, requiring users to carefully evaluate the security protocols of each platform. Integration with existing systems can also pose a hurdle, particularly for businesses with legacy software.

Furthermore, the learning curve can be steep for those unfamiliar with accounting principles. While most software vendors offer tutorials and support, some users may benefit from consulting with a professional accountant to ensure proper setup and usage. It is also crucial to stay updated with the latest tax laws and regulations, as these can significantly impact financial reporting.

The Cloud Advantage and Emerging Trends

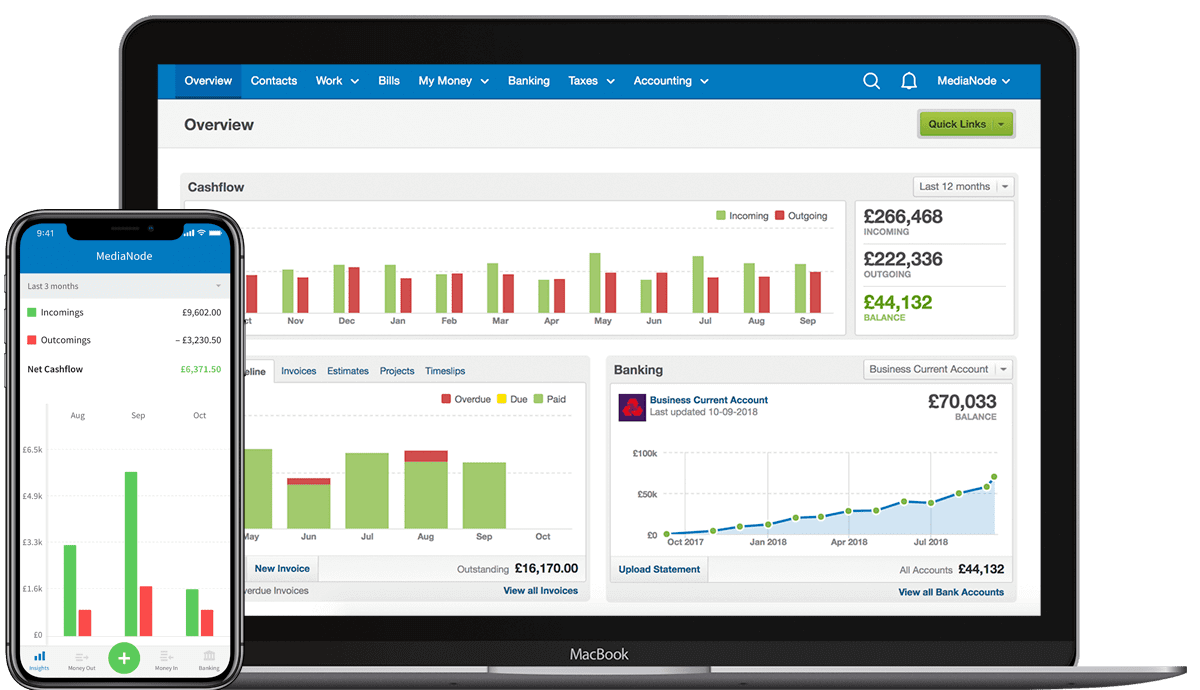

The shift towards cloud-based accounting software has revolutionized the industry. Cloud solutions offer greater accessibility, scalability, and collaboration capabilities compared to traditional desktop software. Real-time data visibility and automated updates are key benefits.

Artificial intelligence (AI) and machine learning are also playing an increasingly important role. AI-powered features can automate tasks such as invoice processing, expense categorization, and fraud detection. These technologies enhance efficiency and accuracy, freeing up users to focus on strategic decision-making.

Expert Perspectives

"Personal business accounting software has leveled the playing field for small businesses," says Sarah Johnson, a Certified Public Accountant (CPA) specializing in small business accounting. "These tools empower entrepreneurs to take control of their finances, make informed decisions, and ultimately, achieve their business goals."

However, Johnson cautions that "technology is only as good as the user. It's essential to understand the underlying accounting principles and to seek professional advice when needed." She suggests users invest in training and workshops to maximize the benefits of their chosen software.

Looking Ahead

The future of personal business accounting software is bright, with continued innovation and integration on the horizon. We can expect to see more sophisticated AI-powered features, improved mobile accessibility, and tighter integration with other business applications. These advancements will further empower individuals and small businesses to thrive in an increasingly competitive landscape.

In conclusion, personal business accounting software is no longer a luxury, but a necessity for anyone managing their own finances or running a small business. By carefully evaluating their needs, selecting the right software, and staying informed about industry trends, users can unlock the full potential of these powerful tools and achieve lasting financial success.