Personal Financial Statement For Business Owners

:max_bytes(150000):strip_icc()/Screenshot3-869320d427024c9aadf078b3bb224174.png)

Imagine Sarah, owner of a thriving local bakery, hands dusted with flour, a gentle smile playing on her lips as she greets her regulars. She pours her heart into every cake and pastry, but lately, a nagging question keeps her up at night: How healthy is her personal financial picture, truly? It's a common concern for entrepreneurs, often juggling business finances with their own.

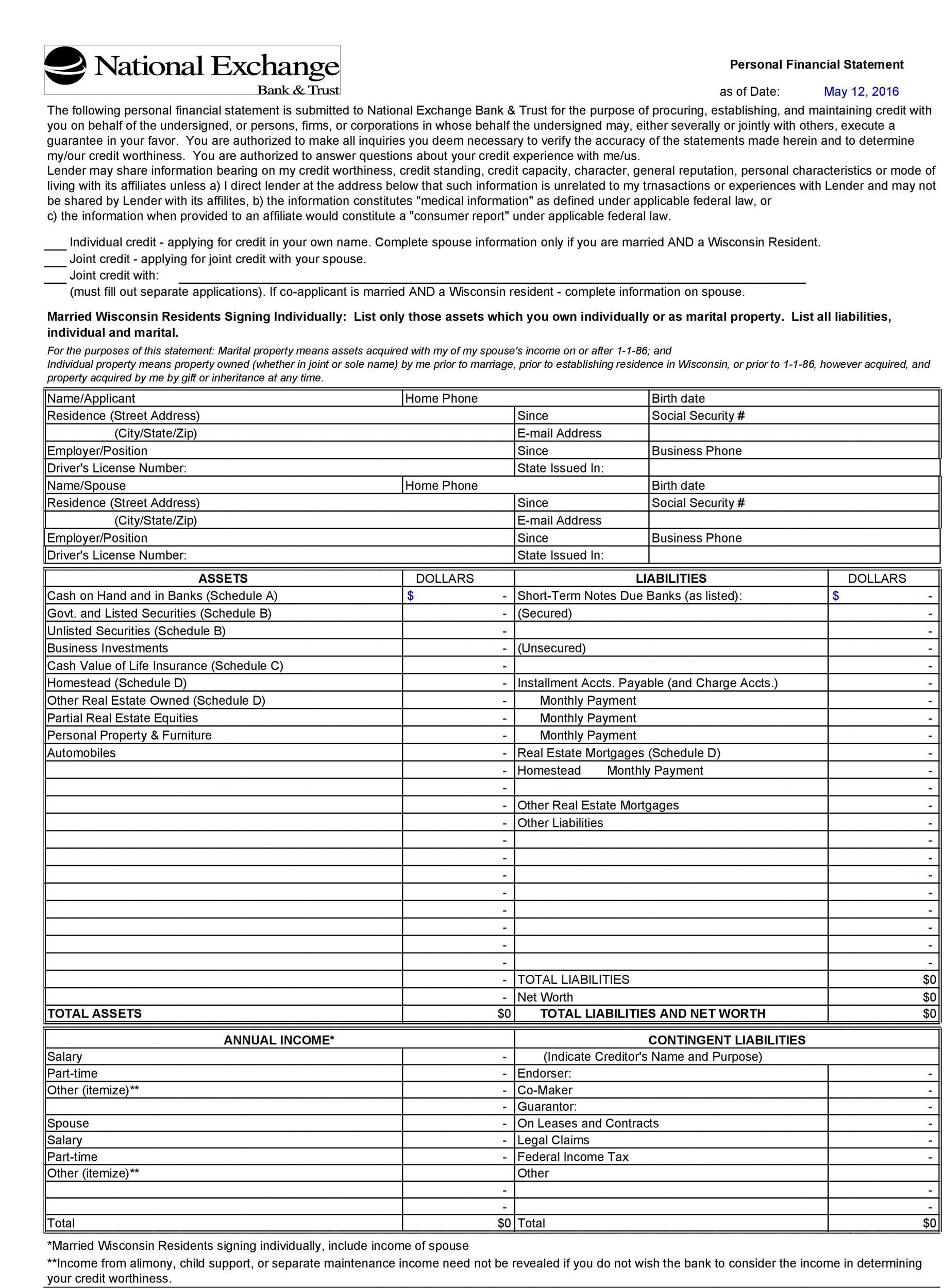

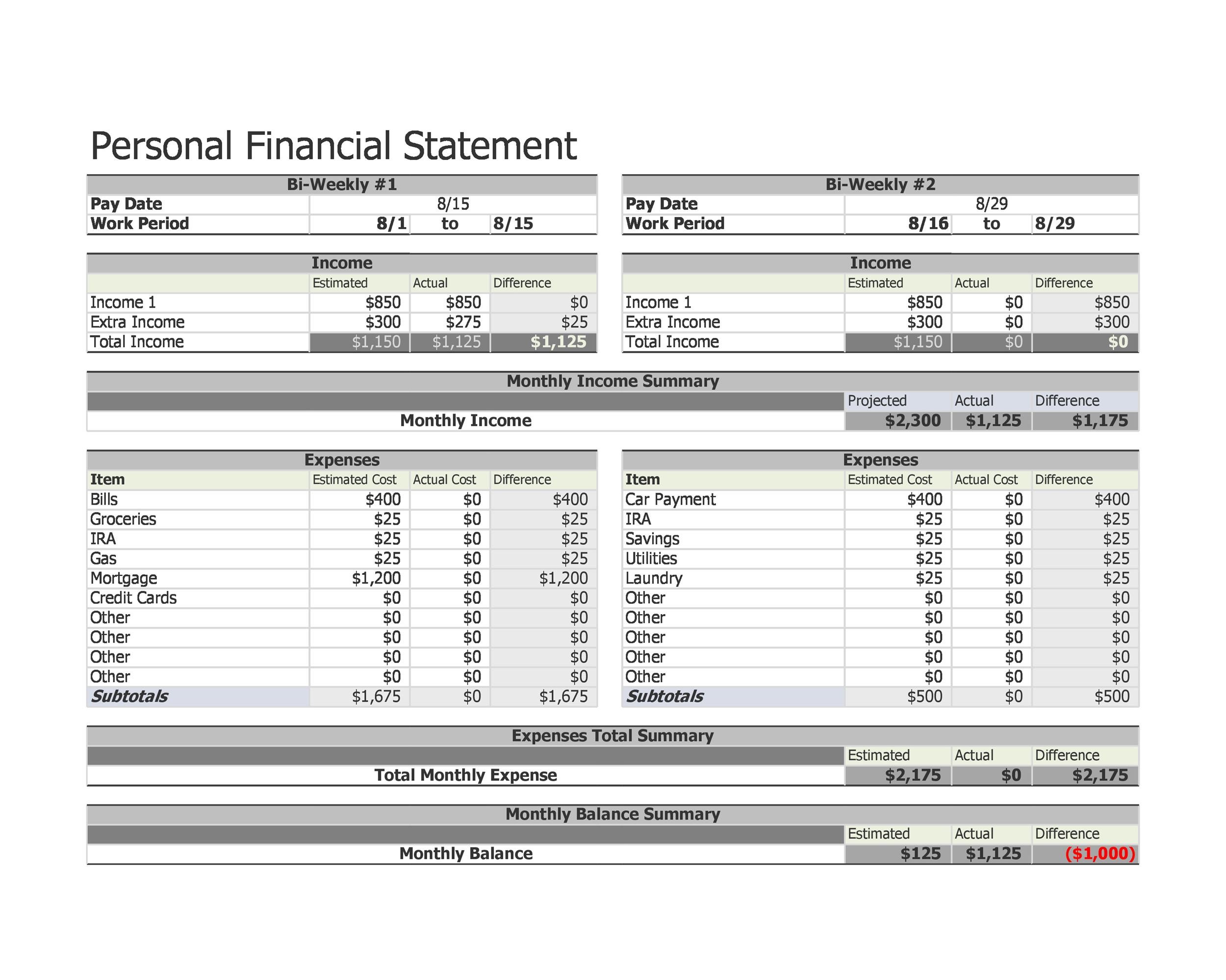

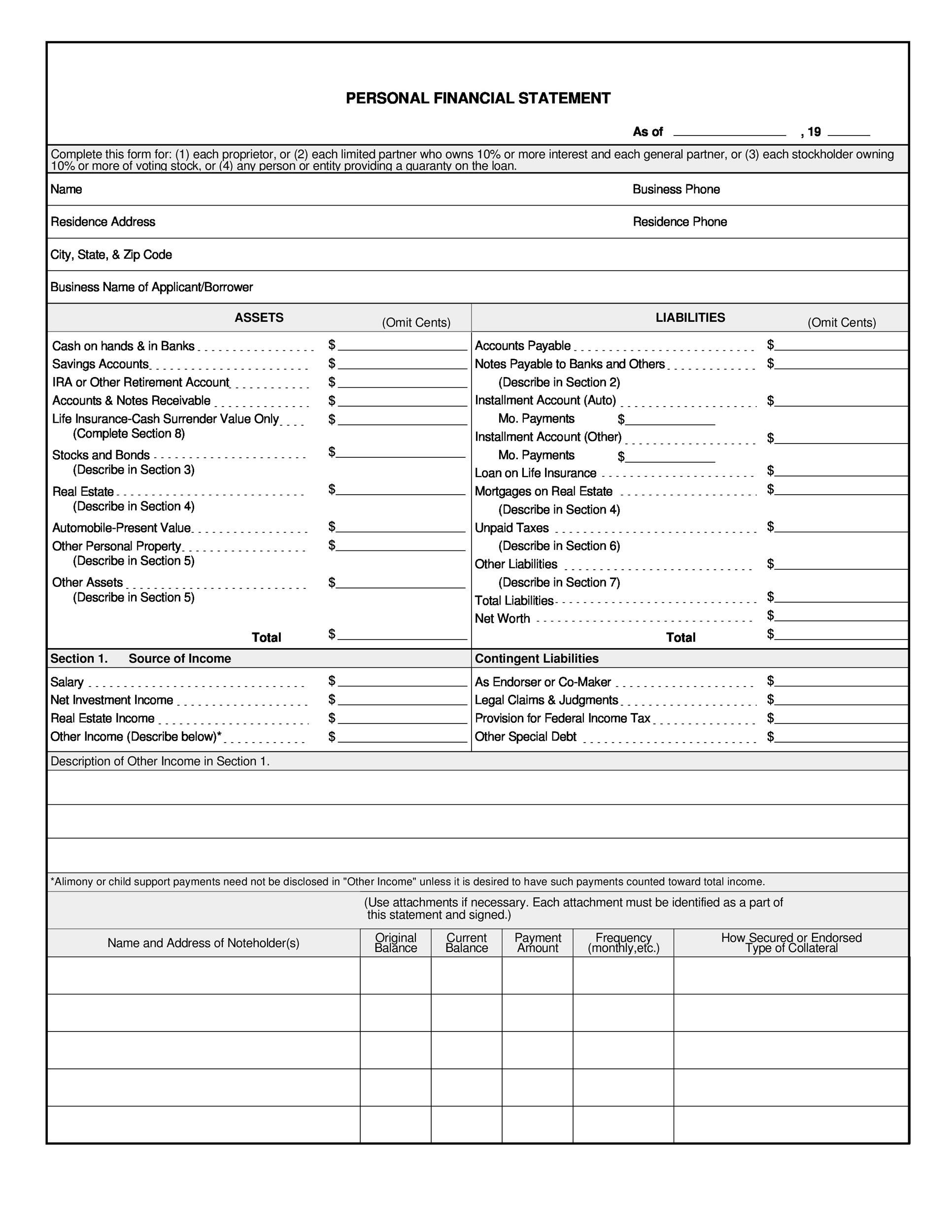

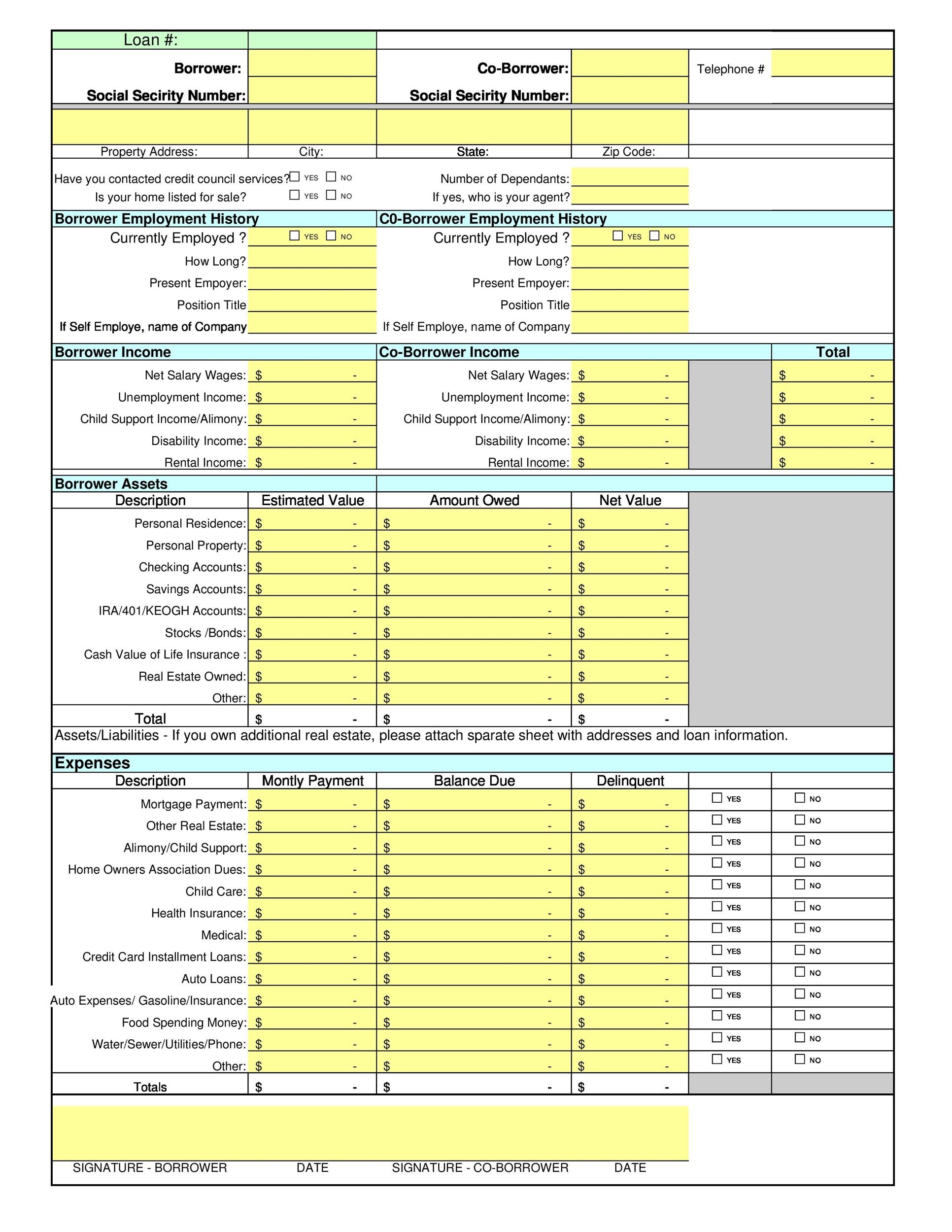

Understanding your personal financial statement as a business owner is crucial for making informed decisions, securing loans, and planning for the future. It offers a clear snapshot of your assets, liabilities, and net worth, separate from your business's financial health, providing a foundation for sound financial management.

Why a Personal Financial Statement Matters

Many business owners mistakenly believe their business’s financial success automatically translates into personal financial security. This isn't always the case. A personal financial statement provides a crucial reality check.

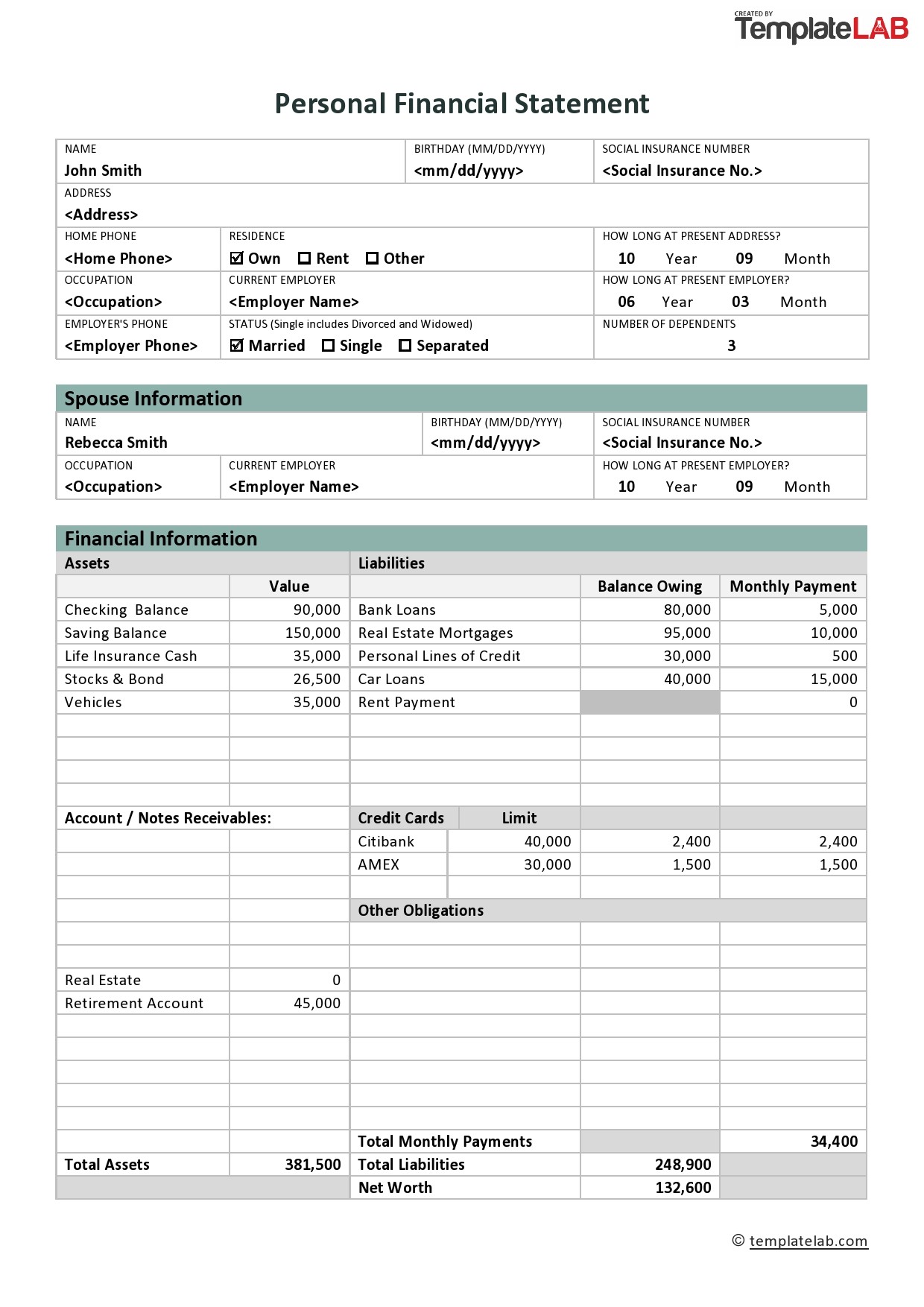

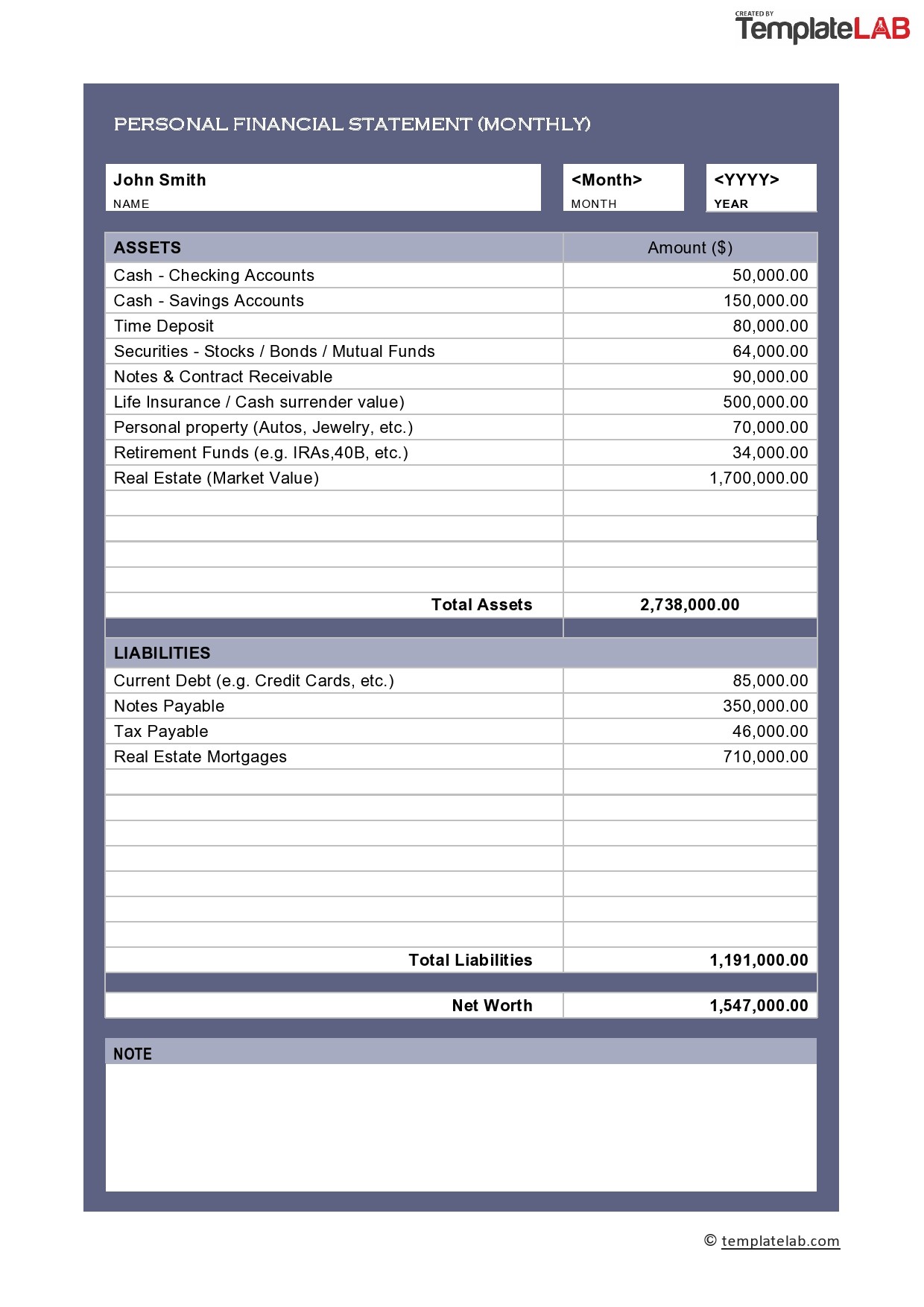

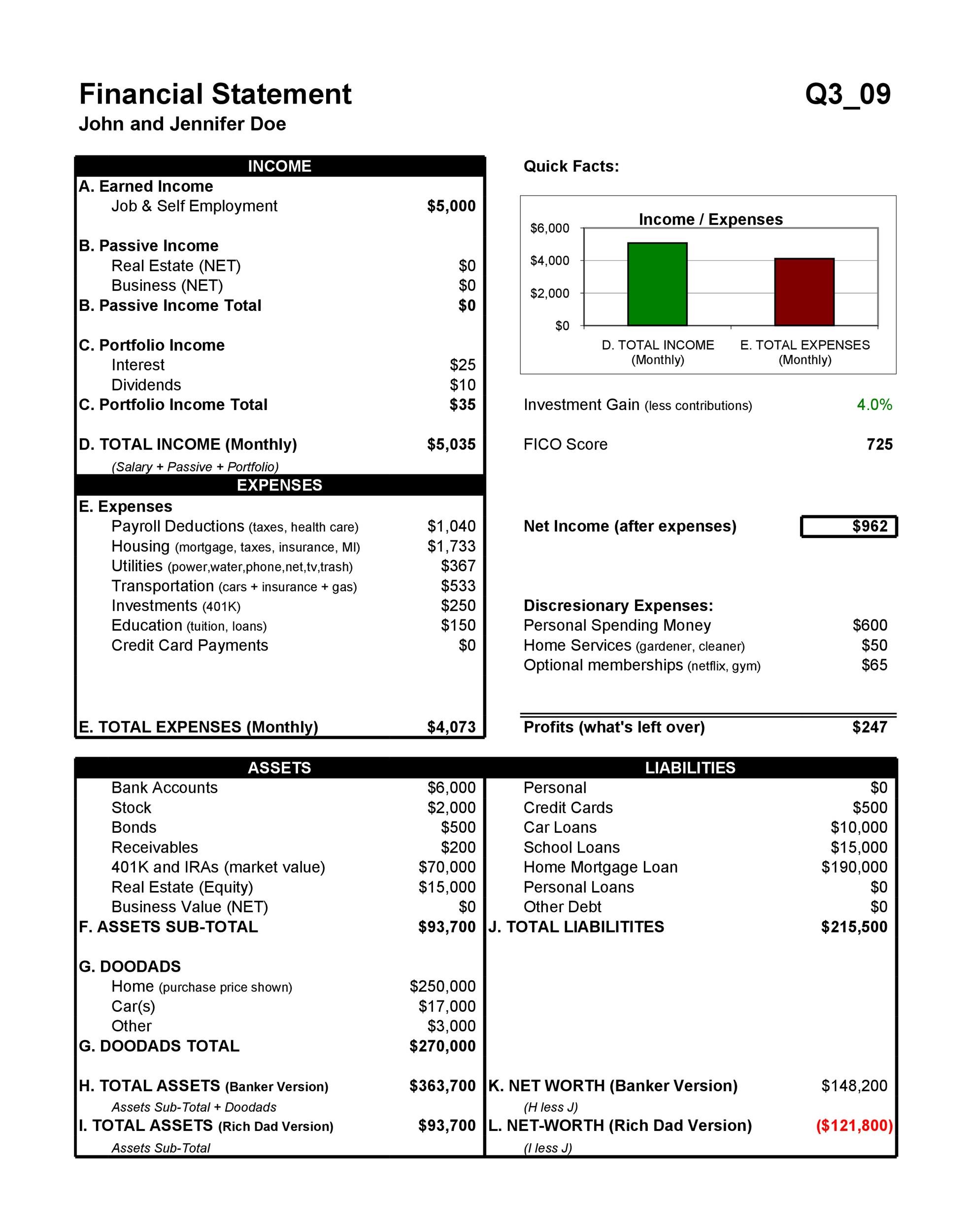

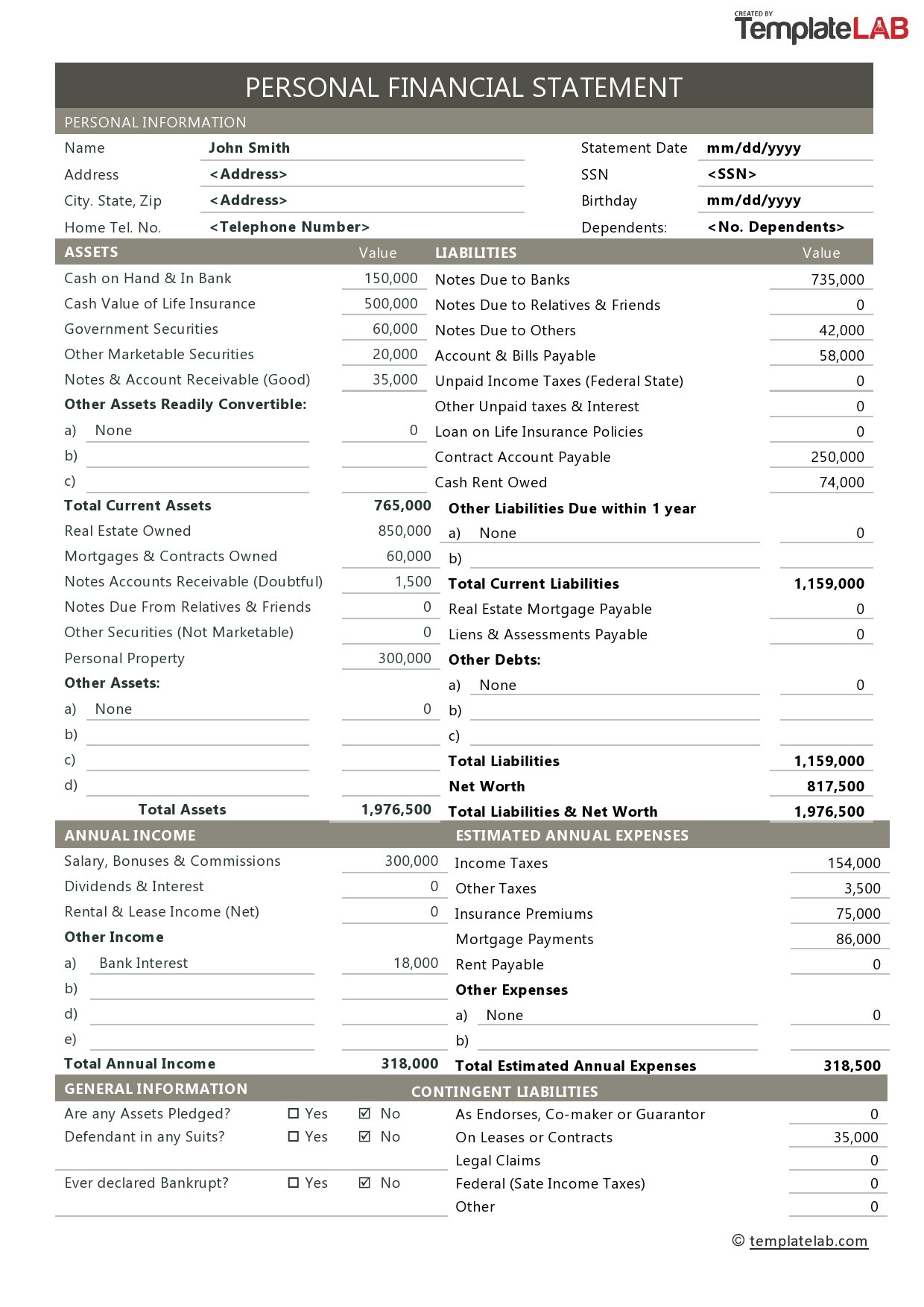

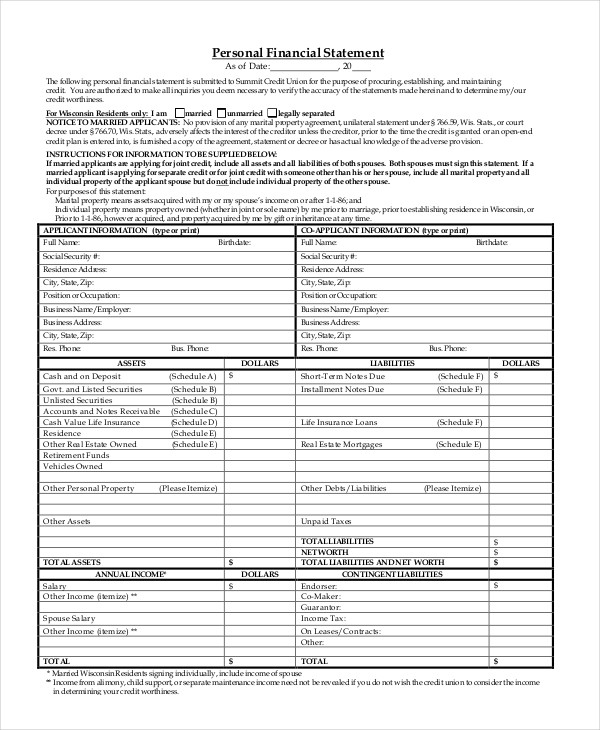

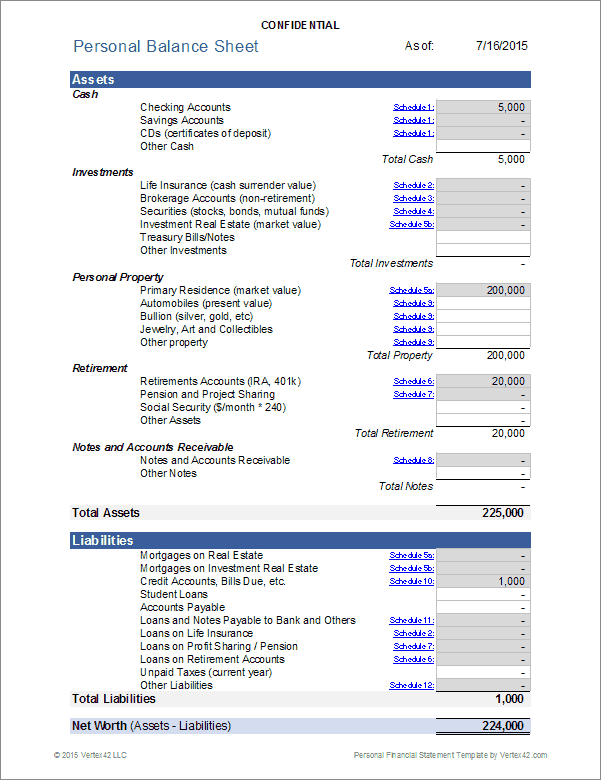

It's a detailed summary of your assets (what you own), liabilities (what you owe), and, most importantly, the difference between the two: your net worth. Think of it as a financial x-ray revealing your overall financial health.

This document is invaluable when applying for loans, both for your business and personal needs. Lenders often require it to assess your ability to repay debts. A strong personal financial statement can significantly improve your chances of securing funding.

Key Components of a Personal Financial Statement

Creating a personal financial statement might seem daunting, but breaking it down into manageable parts makes the process much easier. Start by listing all your assets.

This includes cash in bank accounts, investments (stocks, bonds, mutual funds), real estate (your home, rental properties), personal property (vehicles, jewelry, valuable collections), and even the value of your ownership stake in your business. Be realistic and use current market values whenever possible.

Next, list all your liabilities. This includes mortgages, car loans, student loans, credit card debt, and any other outstanding obligations. Be thorough and accurate in documenting the amounts owed and interest rates.

The difference between your total assets and total liabilities is your net worth. A positive net worth indicates you own more than you owe, while a negative net worth suggests the opposite. Tracking your net worth over time allows you to monitor your financial progress and identify areas for improvement.

According to a 2023 report by the Small Business Administration (SBA), entrepreneurs who regularly monitor their personal finances are more likely to make informed business decisions and achieve long-term financial stability. This highlights the significant impact of personal financial awareness on business success.

Building a Strong Financial Foundation

Once you've created your personal financial statement, use it as a tool for financial planning. Identify areas where you can improve your financial health.

Consider paying down high-interest debt, increasing your savings rate, or diversifying your investments. It is important to consult a financial advisor to create a personalized strategy tailored to your specific goals and circumstances.

Regularly review and update your personal financial statement, at least annually, to reflect changes in your assets, liabilities, and net worth. This ongoing process will keep you informed about your financial progress and help you stay on track toward your goals.

Thinking back to Sarah, understanding her personal financial statement allows her to confidently approach a bank for a small business loan to expand her bakery. It also empowers her to plan for her retirement, knowing that her hard work is building a secure future for herself and her family.

Ultimately, a personal financial statement is more than just a document; it’s a roadmap to financial well-being. It empowers business owners like Sarah to navigate the complexities of entrepreneurship with clarity and confidence, ensuring that their personal and business finances work together harmoniously.