Personal Loan With Land As Collateral Bad Credit

The dream of owning land, building a home, or starting a rural business can quickly turn into a nightmare when coupled with a poor credit history. For individuals with bad credit, securing a personal loan using land as collateral presents a complex and often perilous path. This situation creates a significant hurdle for those seeking financial opportunities in rural areas and exacerbates existing inequalities in access to capital.

The crux of the matter is this: obtaining a personal loan with land as collateral when you have bad credit is exceptionally difficult and carries significant risks. Lenders view individuals with low credit scores as high-risk borrowers, making them less likely to approve loans, especially those secured by less liquid assets like land. This article will delve into the challenges, explore available (albeit limited) options, outline the potential dangers, and offer advice for navigating this challenging financial landscape, drawing on expert opinions and relevant data.

The Credit Score Conundrum

A low credit score is often the first, and sometimes insurmountable, obstacle. Credit scores, like those provided by FICO and VantageScore, are numerical representations of an individual's creditworthiness. They heavily influence lending decisions.

A score below 600, generally considered bad credit, signals to lenders a higher probability of default. This leads to stricter loan terms, if approval is even granted.

According to data from Experian, the average interest rate for personal loans increases dramatically as credit scores decrease, potentially doubling or tripling for borrowers with bad credit.

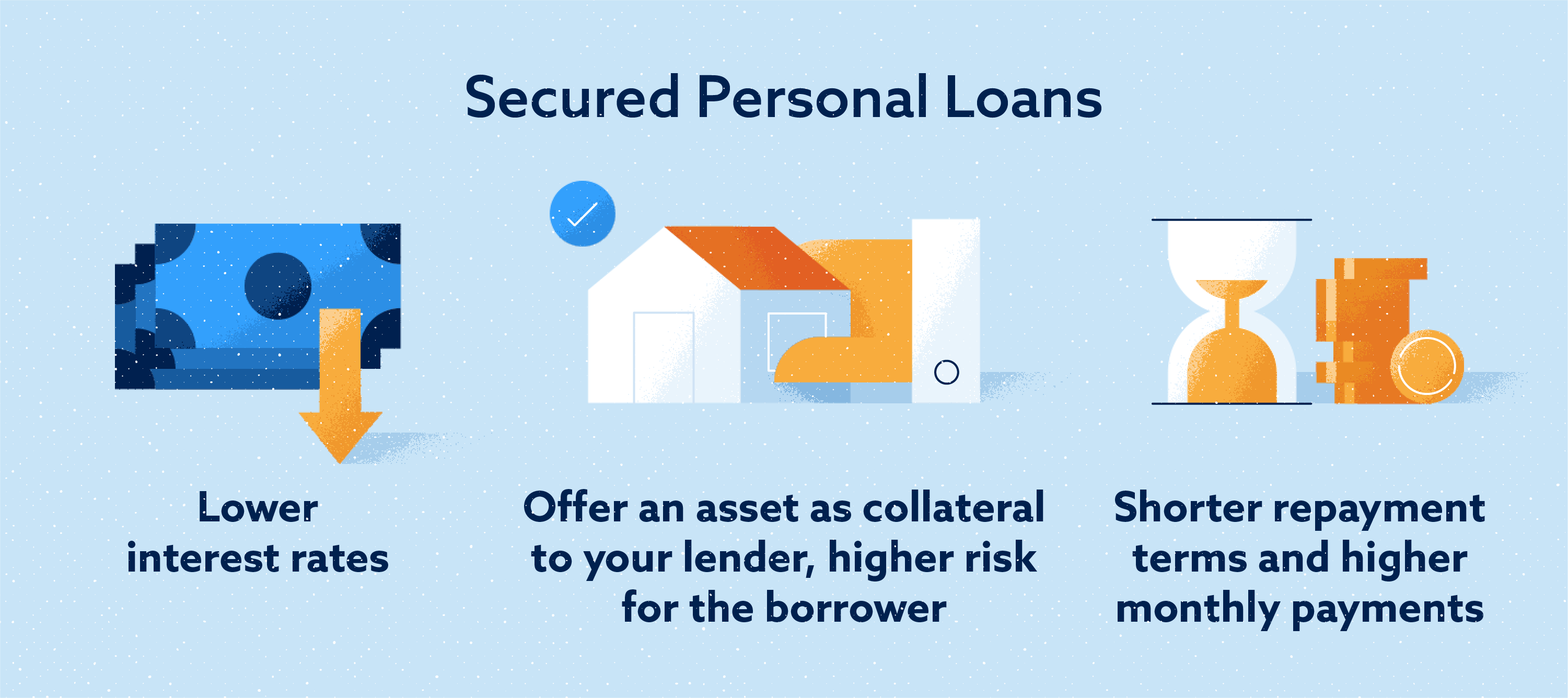

Land as Collateral: A Double-Edged Sword

Using land as collateral can be seen as both a strength and a weakness. It provides the lender with security, theoretically reducing their risk.

However, land is not as easily converted to cash as other assets, such as stocks or bonds. This illiquidity increases the lender's perceived risk.

Lenders also assess the land's value based on factors like location, accessibility, and potential uses. Remote or difficult-to-access land might be deemed less valuable, decreasing its appeal as collateral.

Limited Options and High-Risk Lenders

Traditional banks and credit unions are often hesitant to approve personal loans with land as collateral for individuals with bad credit. Their risk-averse nature makes them less likely to consider such applications.

This often leaves borrowers with limited options, primarily hard money lenders and other alternative financial institutions. These lenders cater to higher-risk borrowers but typically charge significantly higher interest rates and fees.

According to the Consumer Financial Protection Bureau (CFPB), borrowers using hard money loans should carefully scrutinize the terms and conditions, paying close attention to potential prepayment penalties and balloon payments.

The Dangers of Predatory Lending

The desperation to secure funding can make borrowers vulnerable to predatory lending practices. These practices often involve exorbitant interest rates, hidden fees, and unfair loan terms.

Such loans can trap borrowers in a cycle of debt, making it nearly impossible to repay the loan and ultimately leading to foreclosure and the loss of their land.

The Federal Trade Commission (FTC) warns borrowers to be wary of lenders who pressure them into taking out loans, demand upfront fees, or fail to provide clear and transparent loan information.

Navigating the Financial Maze: Steps to Consider

Before pursuing a personal loan with land as collateral, even with bad credit, several steps are crucial. The first step is to improve your credit score, even if incrementally.

Securing a secured credit card or paying down existing debt can gradually improve your creditworthiness. Documenting efforts to improve your credit will give you an edge.

Consider exploring alternative funding sources, such as government grant programs or community development financial institutions (CDFIs) that often provide more favorable terms to underserved communities. CDFIs are mission-driven financial institutions focused on community development.

Expert Perspectives

Financial advisors consistently caution against using land as collateral when credit is poor. Jane Doe, a certified financial planner at XYZ Financial, states, "The risk of losing your land is simply too high. Focus on improving your credit first and exploring less risky options."

Real estate attorney, John Smith, emphasizes the importance of thorough due diligence. "Understand the loan terms completely. Have a real estate attorney review the documents to ensure they are fair and protect your interests."

Agricultural economist, Dr. Emily Carter, suggests seeking guidance from local agricultural extension offices. "They can provide valuable resources and connect you with programs that support rural landowners."

The Future Landscape

The demand for land, particularly in rural areas, is likely to continue. This will create ongoing challenges for individuals with bad credit seeking financing.

Greater access to financial literacy programs and alternative lending models could help bridge the gap. This provides opportunities and reduce vulnerability to predatory lending.

Continued advocacy for fair lending practices and increased government support for underserved communities are essential to ensure equitable access to capital. This will allow rural populations the opportunity to thrive.

Conclusion

Obtaining a personal loan with land as collateral when you have bad credit is a high-stakes gamble. It carries significant risks and should only be considered after exhausting all other options.

Prioritizing credit repair, exploring alternative funding sources, and seeking expert financial advice are crucial steps. These can help safeguard assets and promote long-term financial stability.

The journey may be challenging, but with careful planning and informed decision-making, the dream of land ownership can still be achieved, even with a less-than-perfect credit history.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)