Primary Paid More Than Secondary Allowed Amount

A shocking revelation has surfaced: in numerous instances across several states, primary medical claims are being paid at rates exceeding the allowed amount for secondary claims under the same insurance policies.

This discrepancy, affecting both patients and healthcare providers, raises serious questions about the fairness and transparency of insurance reimbursement practices. It also puts a spotlight on the need for stricter regulatory oversight.

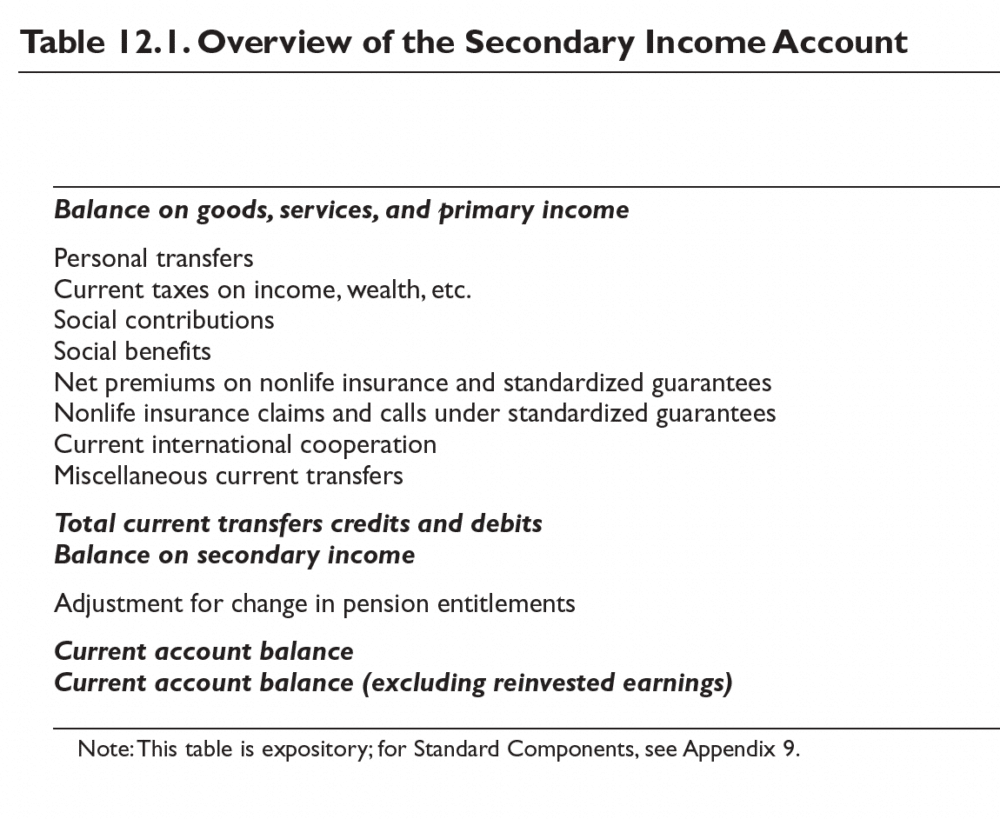

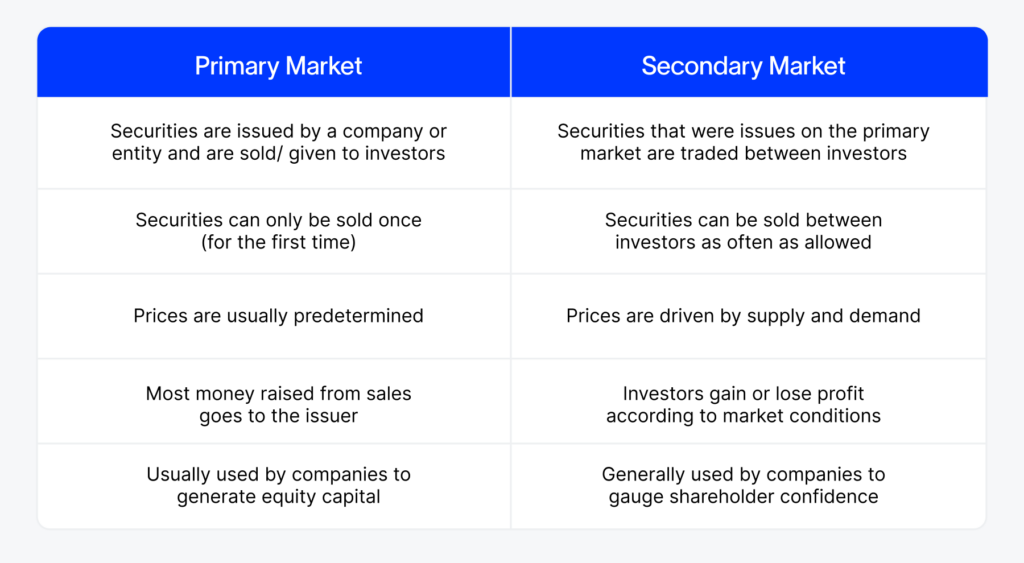

The Core Issue

The problem centers on the allowed amount, the maximum payment an insurer will reimburse for a particular service.

Ideally, the primary insurer pays a certain percentage of this allowed amount, and the secondary insurer then covers the remaining portion, up to the allowed amount. But that is not what is happening.

Reports indicate primary insurers are sometimes reimbursing *more* than what the secondary insurer deems as the total allowed amount, leaving the patient responsible for the difference or the provider absorbing the loss.

Scope and Impact

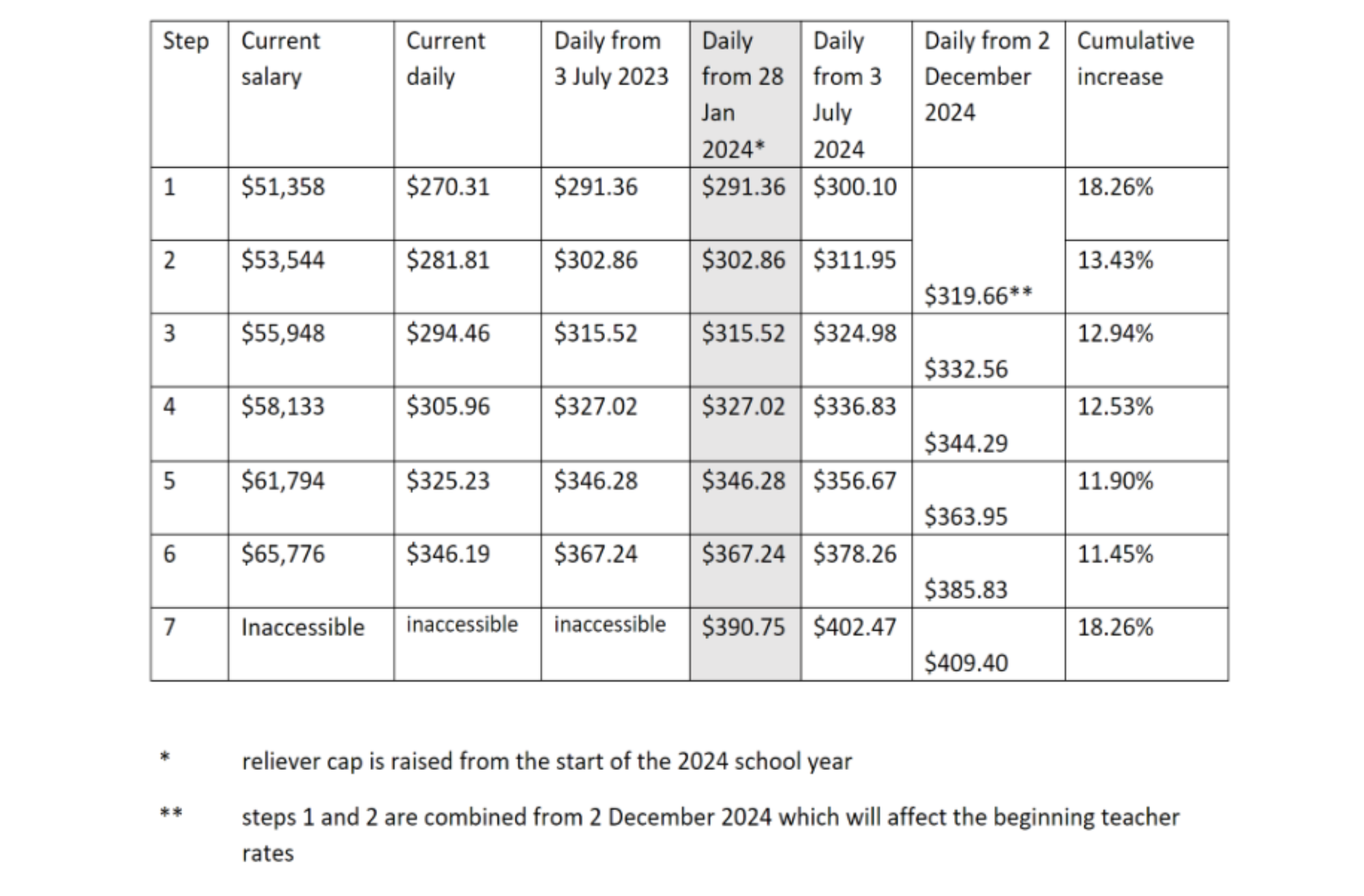

The issue isn’t isolated. Data compiled from a recent investigation by the National Association of Healthcare Advocacy (NAHA) reveals widespread inconsistencies.

NAHA found instances in at least 15 states, including California, Texas, Florida, and New York, demonstrating this payment anomaly. The findings cover the period from January 1, 2023, to October 26, 2024.

The number of affected claims is estimated to be in the tens of thousands, potentially impacting millions of dollars in healthcare costs.

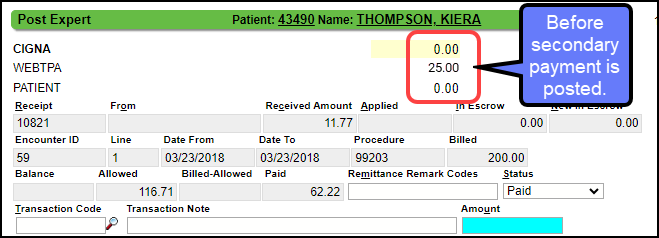

Specific Examples

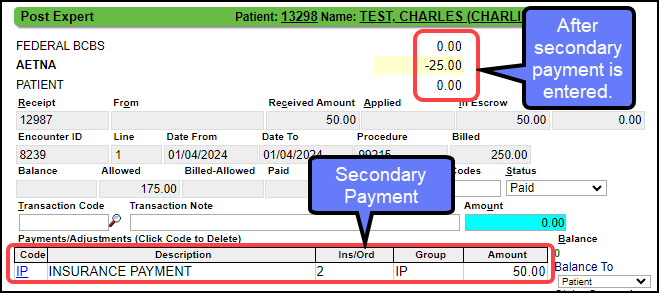

One case cited by NAHA involved a patient in Texas undergoing a common surgical procedure. The primary insurer, Blue Cross Blue Shield of Texas, paid $1,200 for the procedure.

However, the secondary insurer, UnitedHealthcare, determined the allowed amount for the same procedure to be only $1,000. The patient received a bill for $200, the difference between the primary payer's payment and the secondary payer's allowed amount.

Similar cases have emerged, revealing this is not a isolated incident.

Who is Affected?

The primary victims are patients with dual insurance coverage.

These are often individuals with Medicare and a supplemental insurance plan, or those covered by two employer-sponsored plans. The increased financial burden puts them at high risk.

Healthcare providers are also impacted. They face increased administrative costs trying to reconcile these discrepancies, and are often forced to write off the outstanding balances.

Possible Causes

Several factors may contribute to this problem.

One possibility is outdated or inconsistent databases used by different insurers to determine allowed amounts. Variations in negotiated rates between insurers and providers also play a role.

According to health policy expert Dr. Emily Carter, "The lack of transparency in insurance contracts and the complexity of billing codes make it difficult to identify and correct these discrepancies. It's often a black box."

Regulatory Response and Investigation

State insurance regulators are beginning to take notice. The California Department of Managed Health Care has launched an investigation into the issue.

The department is requesting data from major insurers operating in the state to determine the extent of the problem and identify potential violations of state insurance laws.

Other states are expected to follow suit, with NAHA actively lobbying for similar investigations nationwide.

What's Next?

The immediate next steps involve gathering more data to quantify the scope of the problem.

NAHA is encouraging patients and providers to report instances of this payment discrepancy to their organization. Advocacy groups are pushing for greater transparency in insurance billing practices.

The investigation by the California Department of Managed Health Care could serve as a model for other states, potentially leading to regulatory changes and greater consumer protection.

Call to Action

Individuals with dual insurance coverage should carefully review their Explanation of Benefits (EOB) statements. Check for discrepancies between what the primary insurer paid and the allowed amount determined by the secondary insurer.

If a discrepancy is found, contact both insurers to inquire about the billing practices. Report any suspected violations to the state insurance regulator.

Transparency is key in healthcare pricing and billing.