Pros And Cons Of Funding Sources Quick Check

In the high-stakes world of business, access to capital can be the difference between explosive growth and crippling stagnation. Entrepreneurs and businesses frequently face a critical juncture: deciding which funding source aligns best with their long-term goals and risk tolerance. This pivotal decision demands a careful evaluation of the pros and cons associated with each available option.

Navigating the complex landscape of funding sources requires a deep understanding of the trade-offs inherent in each. This article provides an objective analysis of common funding sources, including venture capital, bank loans, angel investors, bootstrapping, and crowdfunding. The aim is to equip businesses with the knowledge needed to make informed decisions that maximize opportunities while mitigating potential risks. It will also consider less conventional avenues and government programs, offering a holistic overview of the funding ecosystem.

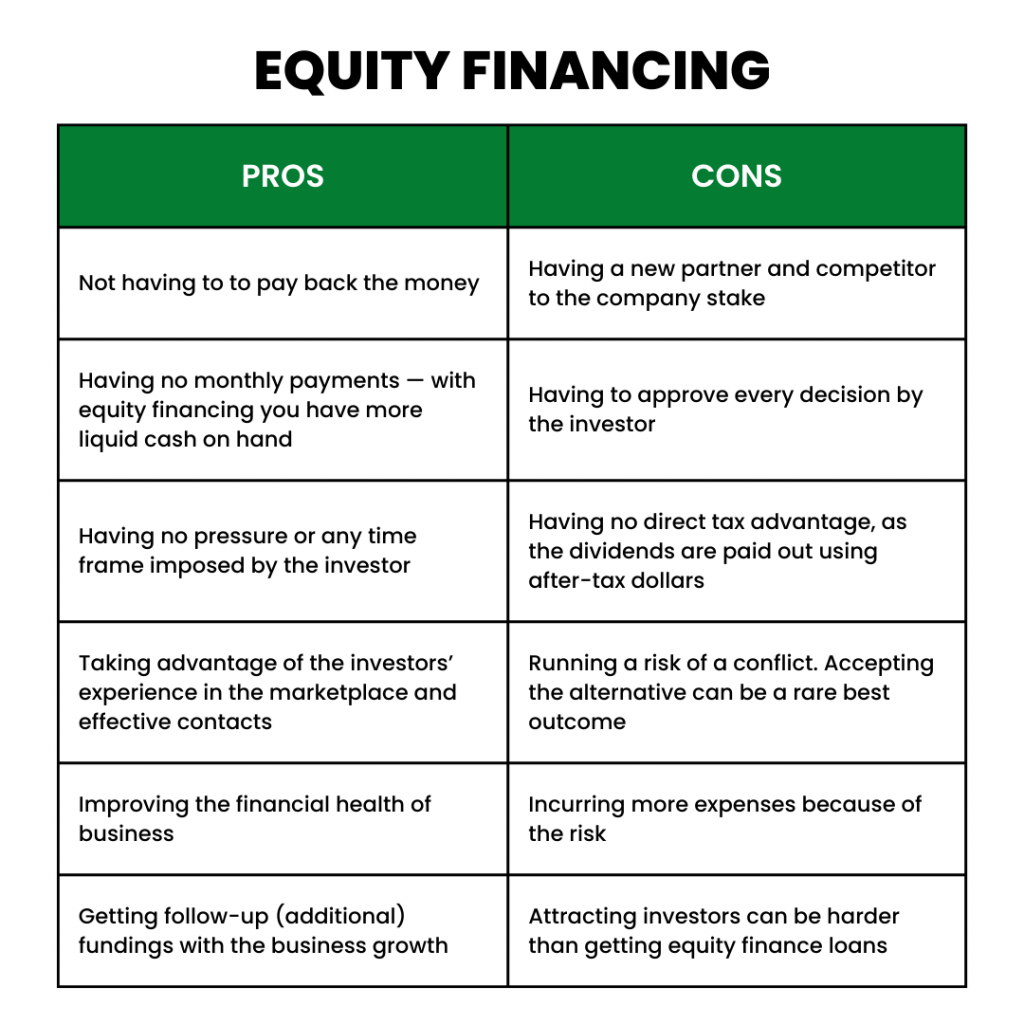

Venture Capital: High Risk, High Reward

Venture Capital (VC) is often seen as the holy grail for startups with high-growth potential. Securing VC funding can provide significant capital infusions, expert mentorship, and valuable networking opportunities. However, this comes at the cost of equity dilution and a loss of control over the company's strategic direction.

Pros: Large capital injections accelerate growth. Experienced VC firms offer strategic guidance and industry connections.

Cons: Significant equity dilution reduces founder ownership. VC firms often demand board seats and influence over key decisions.

VCs typically seek a high return on their investment within a relatively short timeframe, often putting pressure on companies to prioritize rapid scaling over sustainable growth. This relentless pursuit of growth can sometimes lead to burnout and increased risk-taking.

Bank Loans: A Traditional Approach

Bank loans represent a more traditional funding route, offering a debt-based solution with predetermined repayment terms. This option allows businesses to retain full ownership and control but requires a strong credit history and collateral.

Pros: Maintain full ownership and control. Predictable repayment schedule with fixed interest rates.

Cons: Stringent eligibility requirements and collateral demands. Repayment obligations can strain cash flow, especially in the early stages.

While bank loans offer stability, the application process can be lengthy and demanding, requiring extensive documentation and financial projections. Moreover, the amount of funding available may be limited compared to other sources.

Angel Investors: A Bridge to Venture Capital

Angel Investors are high-net-worth individuals who provide capital to startups in exchange for equity or convertible debt. They often bring valuable experience and mentorship, serving as a bridge between bootstrapping and venture capital.

Pros: Access to capital and industry expertise. More flexible terms compared to venture capital firms.

Cons: Can be difficult to find the right angel investor. Potential for differing visions and conflicting advice.

Finding the right angel investor who aligns with the company's values and long-term goals is crucial. A mismatch in expectations can lead to friction and hinder decision-making.

Bootstrapping: Self-Reliance and Control

Bootstrapping involves funding a business through personal savings, revenue, and careful resource management. This approach allows founders to maintain complete control and avoid debt or equity dilution.

Pros: Full control and ownership. Forces resourcefulness and efficient spending.

Cons: Limited capital restricts growth potential. Personal financial risk and slower progress.

Bootstrapping requires significant self-discipline and a willingness to make sacrifices. While it fosters independence, it can also limit the company's ability to scale quickly and compete effectively.

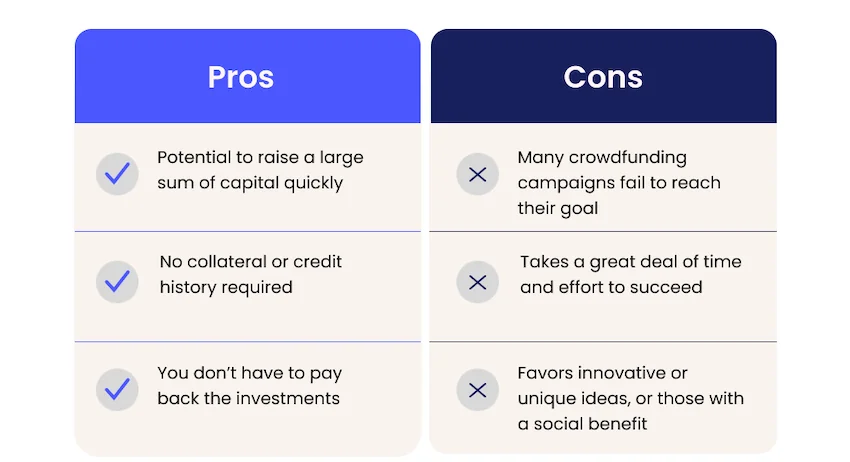

Crowdfunding: Tapping the Power of the Crowd

Crowdfunding leverages online platforms to solicit small investments from a large number of individuals. This option can be an effective way to raise capital, build brand awareness, and validate a product or service.

Pros: Access to a broad investor base and market validation. Builds brand awareness and community engagement.

Cons: Requires significant marketing and public relations efforts. Can be time-consuming and uncertain.

Successful crowdfunding campaigns demand compelling storytelling and a strong social media presence. Failure to meet funding goals can be demoralizing and damage a company's reputation.

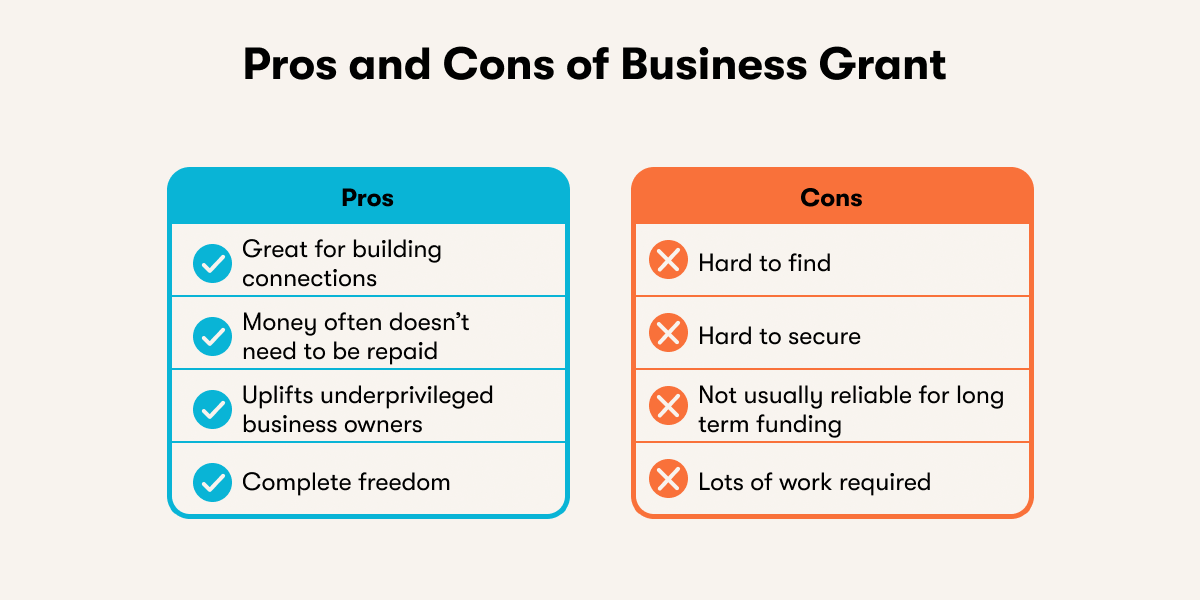

Government Grants and Programs

Numerous government grants and programs are designed to support small businesses and innovation. These opportunities often provide non-dilutive funding but require a rigorous application process.

Pros: Non-dilutive funding. Can enhance credibility and attract further investment.

Cons: Highly competitive and bureaucratic application process. Reporting requirements and potential compliance issues.

Navigating the complex landscape of government programs requires persistence and attention to detail. While the rewards can be substantial, the process can be time-consuming and require specialized expertise.

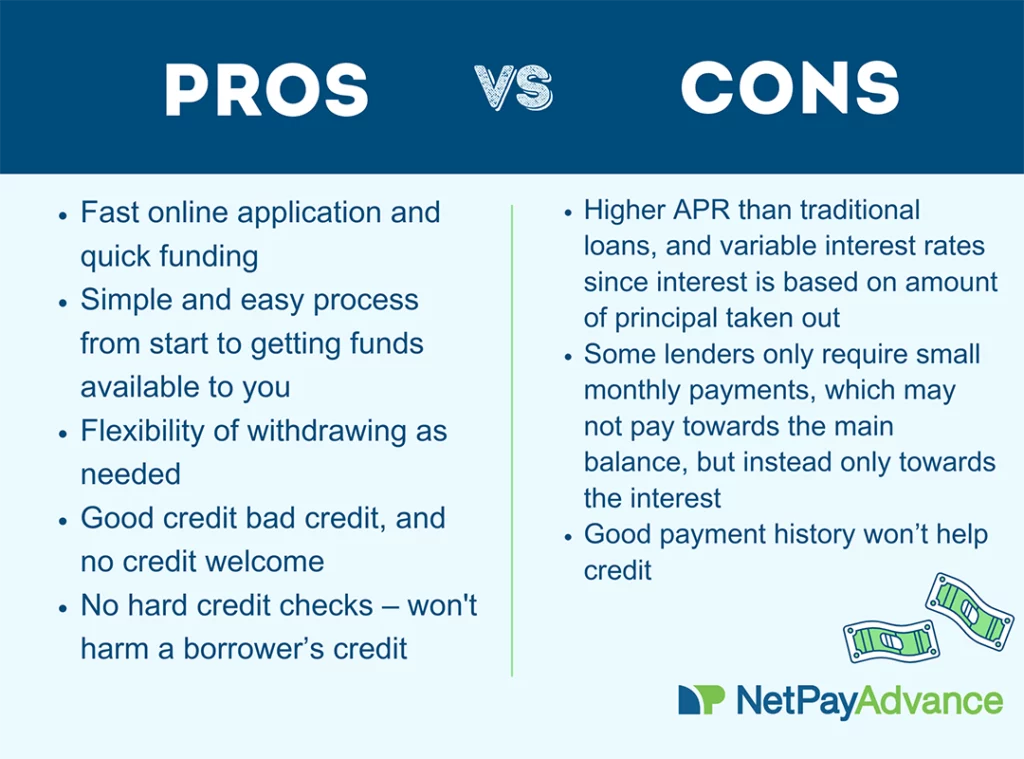

Alternative Funding Sources

Beyond the traditional options, businesses are increasingly exploring alternative funding sources such as revenue-based financing and invoice factoring. These methods offer flexible repayment terms tailored to a company's cash flow.

"The rise of fintech has created a plethora of innovative funding options that cater to specific business needs," notes financial analyst, Sarah Chen.

Pros: Flexible repayment terms aligned with revenue. Can provide quick access to capital.

Cons: Higher interest rates compared to traditional loans. May require sharing sensitive financial data.

These alternative solutions can be particularly appealing to businesses with predictable revenue streams and short-term financing needs.

Making the Right Choice

Choosing the right funding source is a strategic imperative that requires careful consideration of a company's specific circumstances, goals, and risk tolerance. A thorough assessment of the pros and cons of each option, coupled with expert advice, is essential for making informed decisions that pave the way for sustainable growth. Understanding the long-term implications of each option is vital.