Pros And Cons Of P2p Payments

Imagine you're splitting a dinner bill with friends. No more scrambling for exact change or waiting for someone to hit the ATM. Instead, a few taps on your phone, and the money magically zips across the digital divide, settling the score in seconds. This is the everyday reality of peer-to-peer (P2P) payments, a technology that has quietly revolutionized how we handle transactions, both big and small.

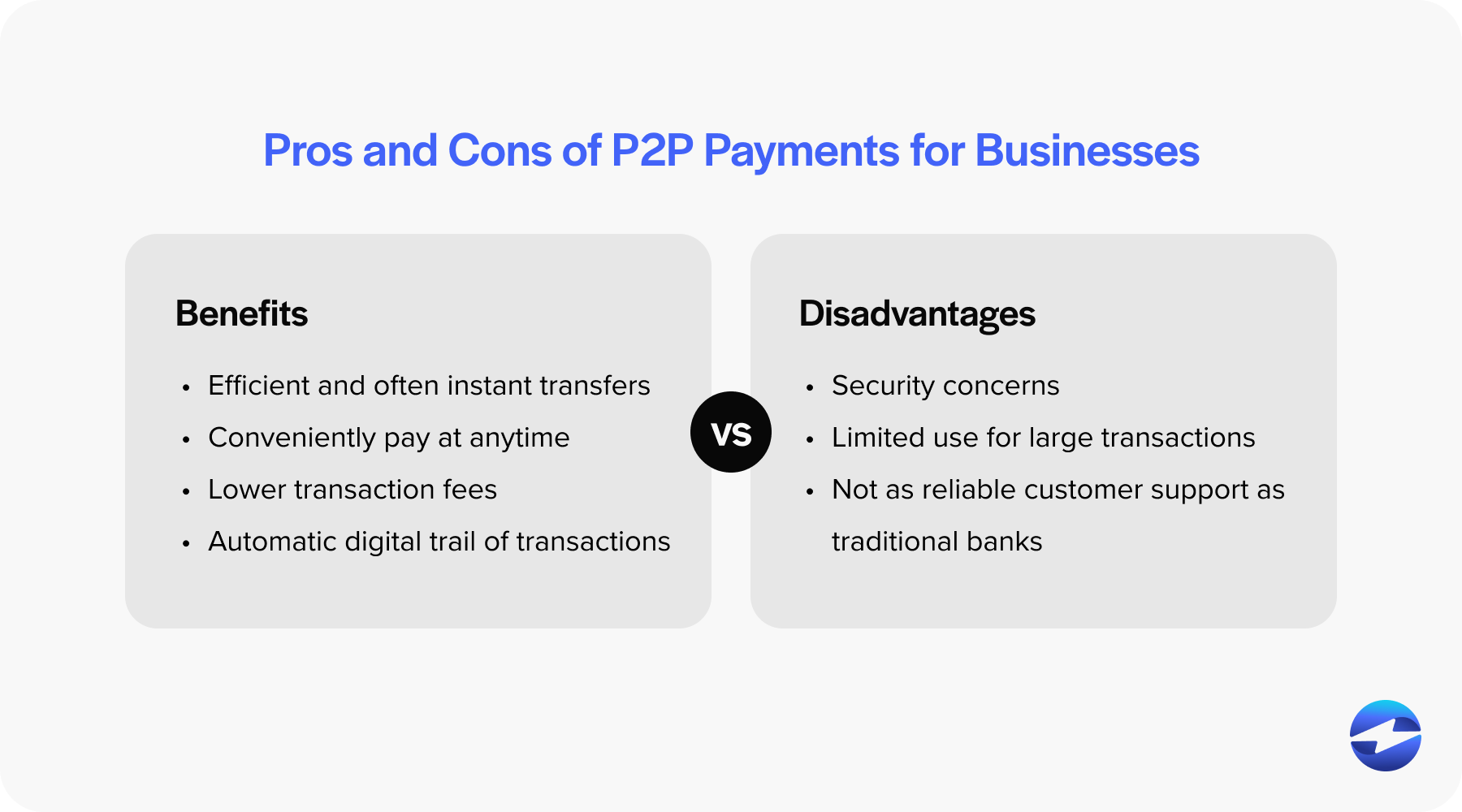

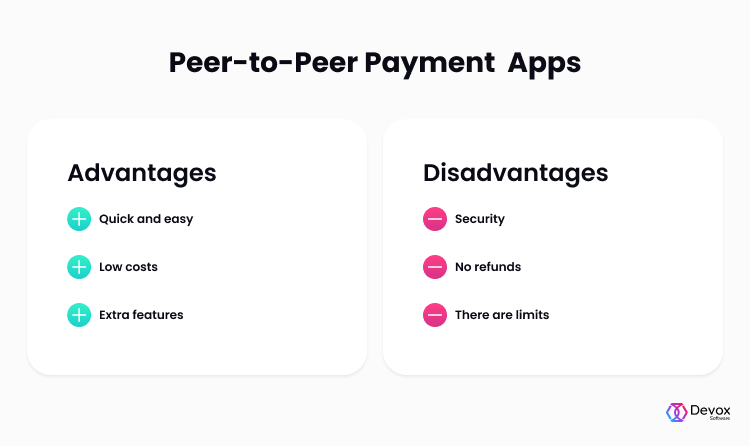

P2P payment systems offer undeniable convenience and speed, but this ease of use comes with its own set of considerations. From security vulnerabilities to potential fees and the erosion of privacy, it's crucial to weigh the pros and cons before fully embracing this digital shift.

The Rise of the P2P Revolution

The concept of P2P payments isn't entirely new, but its widespread adoption is a relatively recent phenomenon, fueled by the proliferation of smartphones and the increasing comfort level with mobile banking. Companies like PayPal, a pioneer in the online payment space, paved the way for the current ecosystem.

However, it was the arrival of services like Venmo, Cash App, and Zelle that truly democratized P2P payments. These user-friendly platforms, often integrated with social features, made sending money as easy as sending a text message.

The COVID-19 pandemic further accelerated the adoption of P2P payments, as people sought contactless and convenient ways to transact. According to a report by Statista, the transaction value of digital payments is projected to reach $1.53 trillion in 2024.

The Allure of Convenience: Pros of P2P Payments

Unparalleled Convenience

The most obvious advantage of P2P payments is the sheer convenience they offer. Splitting bills, paying back friends, or sending money to family becomes incredibly easy, eliminating the need for cash or checks.

Transactions are typically processed within seconds, providing instant gratification and peace of mind for both the sender and the recipient. This speed is especially valuable in situations where time is of the essence.

Accessibility and Inclusivity

P2P platforms have made financial transactions more accessible to a wider range of people, including those who may not have traditional bank accounts. These services can provide a viable alternative for individuals who are unbanked or underbanked.

Many P2P apps are designed to be user-friendly, making them accessible to people with varying levels of technological proficiency. This inclusivity is particularly important for bridging the digital divide.

Social Integration

Some P2P platforms, like Venmo, have integrated social features that allow users to share payment details with their friends, creating a sense of community around transactions. While some might find this feature intrusive, others enjoy the social aspect of seeing what their friends are spending their money on.

This social element can also make it easier to track shared expenses and remember who owes whom, reducing the awkwardness of chasing down payments.

Navigating the Risks: Cons of P2P Payments

Security Vulnerabilities

Despite the convenience, P2P payments are not without their risks. One of the biggest concerns is security, as these platforms can be vulnerable to fraud and scams.

Phishing attacks, account takeovers, and other malicious activities can result in unauthorized transactions and financial losses. Users must be vigilant about protecting their login credentials and being wary of suspicious requests.

The Federal Trade Commission (FTC) has issued warnings about scams involving P2P payments, urging consumers to exercise caution when sending money to strangers.

Irreversible Transactions

Unlike some traditional payment methods, P2P transactions are often irreversible. If you send money to the wrong person or fall victim to a scam, it can be difficult, if not impossible, to recover your funds.

This lack of recourse makes it crucial to double-check recipient information before confirming a payment. It also highlights the importance of using P2P platforms only with people you know and trust.

Fees and Limitations

While many P2P services offer free basic transactions, some may charge fees for certain features, such as instant transfers or sending money with a credit card. These fees can add up over time, eroding the cost savings associated with using P2P payments.

Additionally, some platforms may impose limits on the amount of money you can send or receive, which can be inconvenient for larger transactions. It is essential to understand the fee structure and limitations of each platform before using it.

Privacy Concerns

The social features of some P2P platforms raise privacy concerns, as transaction details may be visible to other users. Even if you choose to make your transactions private, the platform itself may still collect and analyze your data for marketing or other purposes.

Users should carefully review the privacy policies of P2P platforms to understand how their data is being used and take steps to protect their privacy. The Electronic Frontier Foundation advocates for strong privacy protections for users of digital payment systems.

The Future of P2P Payments

Despite the risks, P2P payments are likely to continue to grow in popularity, driven by their convenience and accessibility. As technology evolves, we can expect to see further innovations in this space, such as increased security measures, greater integration with other financial services, and the emergence of new platforms.

However, it is crucial for users to remain informed about the risks associated with P2P payments and to take steps to protect themselves from fraud and scams. By understanding the pros and cons of these systems, we can harness their benefits while mitigating their potential drawbacks.

Ultimately, the decision of whether or not to use P2P payments is a personal one. It depends on your individual needs, risk tolerance, and comfort level with technology. But by weighing the advantages and disadvantages, you can make an informed choice that aligns with your financial goals and security concerns.

.jpg)